|

시장보고서

상품코드

1664197

미사일 포대 시장(2025-2035년)Global Missile Battery Market 2025-2035 |

||||||

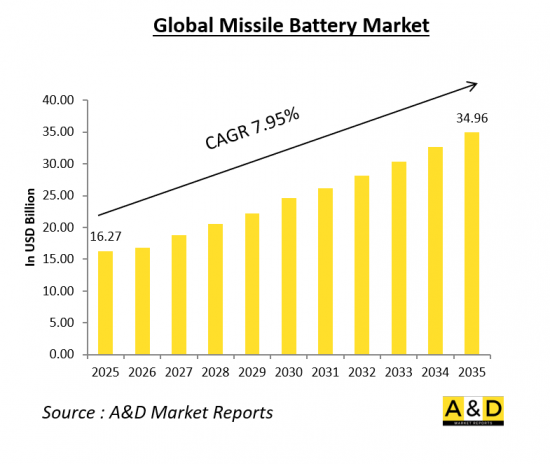

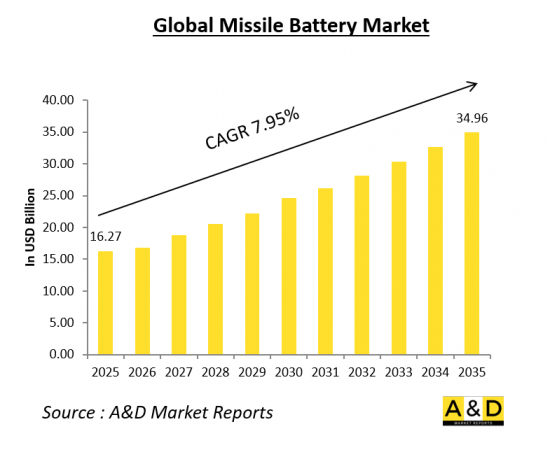

세계 미사일 포대 시장 규모는 2025년 162억 7,000만 달러에서 2035년까지 349억 6,000만 달러에 달할 것으로 예상되며, 예측 기간 동안 연평균 7.95%의 성장률을 보일 것으로 예상됩니다. 이러한 성장은 지정학적 긴장 고조, 군사 현대화 활동 증가, 전 세계 미사일 공격 위협의 확대에 힘입어 성장세를 보이고 있습니다. 미사일 포대는 영공 방어에 중요한 역할을 하며 탄도미사일, 순항미사일, 무인항공기(UAV)와 같은 공중 위협으로부터 전략 자산과 인구 밀집 지역을 보호합니다. 기술의 발전과 미사일 방어 시스템에 대한 지속적인 투자는 시장 확대를 더욱 촉진하여 미사일 포대를 현대 방어 전략의 필수 요소로 확고히 하고 있습니다.

미사일 포대 시장 소개

미사일 포대 시장은 지정학적 긴장 고조, 국방 예산 증가, 미사일 시스템의 기술 발전으로 인해 최근 몇 년동안 상당한 성장을 보이고 있습니다. 미사일 포대는 현대 방공 및 공격 능력의 중요한 구성 요소로 작용하여 국가에 항공, 해상 및 육상 위협을 효과적으로 무력화할 수 있는 능력을 제공합니다. 이러한 시스템은 국가 안보와 전략적 이익을 보호하기 위한 군사적 용도로 널리 사용되고 있습니다. 전 세계 미사일 포대에 대한 수요는 무인항공기(UAV), 순항미사일, 극초음속 무기 등 진화하는 위협에 대한 방어 능력을 향상시켜야 할 필요성에 의해 촉진되고 있습니다. 또한, 차세대 미사일 방어 시스템을 개발하기 위한 방산업체와 정부 간의 협력 증가는 시장 확대에 박차를 가하고 있습니다.

시장에는 지대공 미사일(SAM) 포대, 탄도 미사일 방어 시스템, 함대공 미사일 발사기 등 다양한 미사일 포대 시스템이 포함됩니다. 주요 방산업체들은 미사일 시스템의 정확도, 사거리, 기동성을 높이기 위해 연구개발(R&D)에 많은 투자를 하고 있습니다. 미국, 중국, 러시아, 유럽 국가 등 국방 예산이 큰 국가들은 현대전의 새로운 도전에 대응하기 위해 미사일 방어 인프라를 지속적으로 업그레이드하고 있습니다. 이러한 성장은 집단 안보 조치를 강화하려는 국가 간 전략적 동맹과 방위 협정에 의해 더욱 강화되고 있습니다.

미사일 포대 시장의 주요 촉진요인

미사일 포대 시장의 성장 촉진요인은 여러 가지가 있습니다. 주요 촉진요인 중 하나는 미사일 공격과 공중전 위협 증가입니다. 각국은 순항미사일, 탄도미사일, UAV 등 진화하는 위협으로부터 자국 영토를 보호하기 위해 미사일 방어 시스템에 많은 투자를 하고 있습니다. 분쟁과 지정학적 긴장이 고조되면서 첨단 미사일 방어 솔루션에 대한 수요가 더욱 증가하고 있습니다.

세계 국방 예산 증가도 미사일 포대 시장 확대에 중요한 역할을 하고 있습니다. 각국은 군사적 우위를 유지하기 위해 국방 인프라 현대화에 대한 투자를 우선시하고 있습니다. 또한, 여러 미사일 방어 시스템을 연동하여 배치하는 다층 방어 전략의 채택이 증가하고 있는 것도 첨단 미사일 포대에 대한 수요를 촉진하고 있습니다.

비국가 주체와 적대국 사이에 미사일 기술이 확산됨에 따라 효과적인 대응책의 필요성이 높아지고 있습니다. 각국 정부는 첨단 미사일 시스템을 갖춘 적대세력이 초래할 수 있는 위험을 줄이기 위해 미사일 방어 능력 강화를 적극적으로 모색하고 있습니다. 이에 따라 다양한 위협을 무력화할 수 있는 고성능 미사일 포대 조달이 증가하고 있습니다.

국제적인 방산 협력과 합작투자가 시장 성장을 더욱 촉진하고 있습니다. 각국은 공유된 기술 전문 지식과 자원을 활용하여 차세대 미사일 시스템을 개발하기 위해 전략적 파트너십을 맺고 있습니다. 각국이 외국 방산 공급업체에 대한 의존도를 낮추고 국내 제조 능력을 강화하기 위해 노력하면서 국내 미사일 방어 프로그램 개발도 탄력을 받고 있습니다.

이동 가능하고 유연한 미사일 방어 솔루션에 대한 수요가 증가함에 따라 이동식 미사일 포대 시스템이 개발되고 있습니다. 이러한 시스템은 운영의 다양성을 제공하고 다양한 전투 환경에서 신속하게 배치할 수 있습니다. 군사 작전이 더욱 역동적으로 변화함에 따라 적응성과 확장성을 갖춘 미사일 포대 솔루션에 대한 요구는 계속 증가하고 있습니다.

목차

미사일 포대 시장 보고서 정의

미사일 포대 시장 세분화

지역별

유형별

용도별

향후 10년간 미사일 포대 시장 분석

미사일 포대 시장 시장 기술

세계의 미사일 포대 시장 예측

지역 미사일 포대 시장 동향과 예측

북미

성장 촉진요인 및 억제요인, 과제

PEST

시장 예측과 시나리오 분석

주요 기업

공급업체 Tier 상황

기업 벤치마킹

유럽

중동

아시아태평양

남미

미사일 포대 시장 국가별 분석

미국

방위 프로그램

최신 뉴스

특허

시장의 현재 기술 성숙도

시장 예측과 시나리오 분석

캐나다

이탈리아

프랑스

독일

네덜란드

벨기에

스페인

스웨덴

그리스

호주

남아프리카공화국

인도

중국

러시아

한국

일본

말레이시아

싱가포르

브라질

미사일 포대 시장 기회 매트릭스

미사일 포대 시장 보고서에 관한 전문가 의견

결론

Aviation and Defense Market Reports에 대해

LSH 25.03.13The global missile battery market is projected to grow from USD 16.27 billion in 2025 to USD 34.96 billion by 2035, at a Compound Annual Growth Rate (CAGR) of 7.95% over the forecast period. This growth is fueled by rising geopolitical tensions, increasing military modernization initiatives, and the expanding threat of missile attacks worldwide. Missile batteries play a vital role in airspace defense, safeguarding strategic assets and population centers against aerial threats such as ballistic missiles, cruise missiles, and unmanned aerial vehicles (UAVs). Advancements in technology and continued investments in missile defense systems further drive market expansion, solidifying missile batteries as essential components of modern defense strategies.

Introduction to Missile Battery Market

The missile battery market has witnessed significant growth in recent years due to rising geopolitical tensions, increasing defense budgets, and technological advancements in missile systems. Missile batteries serve as a critical component of modern air defense and offensive strike capabilities, providing nations with the ability to neutralize aerial, naval, and land-based threats effectively. These systems are widely used in military applications to safeguard national security and strategic interests. The global demand for missile batteries is driven by the need for improved defense capabilities against evolving threats such as unmanned aerial vehicles (UAVs), cruise missiles, and hypersonic weapons. Additionally, increasing collaborations between defense contractors and governments to develop next-generation missile defense systems are fueling market expansion.

The market includes a broad range of missile battery systems, including surface-to-air missile (SAM) batteries, ballistic missile defense systems, and shipborne missile launchers. Leading defense manufacturers are investing heavily in research and development (R&D) to enhance the precision, range, and maneuverability of missile systems. Nations with major defense budgets, such as the United States, China, Russia, and European countries, are continuously upgrading their missile defense infrastructure to address new challenges in modern warfare. This growth is further bolstered by strategic alliances and defense agreements among nations seeking to strengthen collective security measures.

Technology Impact in Missile Battery

The impact of technology on the missile battery market has been profound, with continuous innovations enhancing their effectiveness, reliability, and efficiency. One of the most significant advancements is the integration of artificial intelligence (AI) and machine learning (ML) to improve target acquisition and tracking capabilities. AI-driven systems enable missile batteries to identify and neutralize threats faster and with greater accuracy, reducing the reliance on human intervention. These intelligent systems also enhance predictive analytics, allowing operators to assess potential threats in real time.

Another major technological development is the incorporation of advanced propulsion systems that increase missile speed and maneuverability. The rise of hypersonic missile technology has necessitated the development of countermeasures capable of intercepting and neutralizing high-speed threats. Enhanced propulsion mechanisms, such as scramjet engines and solid-fuel boosters, are being implemented to extend the operational range and improve response times.

Additionally, modern missile battery systems are being integrated with network-centric warfare capabilities, enabling seamless communication between various defense platforms. Interoperability between missile batteries, radar systems, and command-and-control (C2) centers enhances situational awareness and improves response coordination. The development of modular and mobile missile batteries has also gained traction, allowing for rapid deployment and increased flexibility in combat scenarios.

Another key technological advancement is the use of directed energy weapons (DEWs) alongside missile batteries. Laser-based interception systems are being tested as a cost-effective alternative to traditional kinetic interceptors. These systems provide near-instantaneous engagement of threats and reduce reliance on expensive missile stockpiles. As nations continue to invest in cutting-edge defense technologies, the missile battery market is expected to evolve with enhanced capabilities to counter a broad spectrum of threats.

Key Drivers of Missile Battery Market

Several factors are driving the growth of the missile battery market. One of the primary drivers is the increasing threat of missile attacks and aerial warfare. Nations are investing heavily in missile defense systems to safeguard their territories against evolving threats such as cruise missiles, ballistic missiles, and UAVs. The growing number of conflicts and geopolitical tensions has further intensified the demand for advanced missile defense solutions.

Rising defense budgets worldwide have also played a crucial role in the expansion of the missile battery market. Countries are prioritizing investments in modernizing their defense infrastructure to maintain military superiority. Additionally, the increasing adoption of multi-layered defense strategies, which involve the deployment of multiple missile defense systems working in tandem, is driving demand for advanced missile batteries.

The proliferation of missile technology among non-state actors and adversarial nations has heightened the need for effective countermeasures. Governments are actively seeking to enhance their missile defense capabilities to mitigate the risks posed by hostile forces equipped with advanced missile systems. This has led to increased procurement of high-performance missile batteries capable of neutralizing a variety of threats.

International defense collaborations and joint ventures are further stimulating market growth. Countries are engaging in strategic partnerships to develop next-generation missile systems, leveraging shared technological expertise and resources. The development of indigenous missile defense programs is also gaining momentum, as nations seek to reduce reliance on foreign defense suppliers and enhance domestic manufacturing capabilities.

The rising demand for mobile and flexible missile defense solutions has led to the development of transportable missile battery systems. These systems provide operational versatility, allowing for rapid deployment in various combat environments. As military operations become more dynamic, the requirement for adaptable and scalable missile battery solutions continues to grow.

Regional Trends in Missile Battery Market

The missile battery market is witnessing varying trends across different regions, driven by distinct defense priorities and strategic interests.

In North America, the United States remains a dominant player in the missile battery market, driven by its extensive defense budget and continuous technological advancements. The U.S. military is heavily investing in next-generation missile defense systems, including hypersonic missile interceptors and AI-driven targeting solutions. The country is also focused on enhancing its homeland missile defense capabilities to counter potential threats from adversarial nations. Canada is also expanding its defense capabilities by collaborating with allied nations on missile defense initiatives.

In Europe, the ongoing security concerns related to Russia's military advancements have led to increased investments in missile defense systems. NATO member states are prioritizing missile battery acquisitions to bolster their defense against potential threats. European defense manufacturers are actively collaborating on missile defense projects, such as the development of new surface-to-air missile systems and radar-integrated interception platforms. Countries such as France, Germany, and the United Kingdom are enhancing their defense infrastructure to ensure strategic deterrence.

The Asia-Pacific region is experiencing significant growth in the missile battery market due to escalating territorial disputes and military modernization programs. Countries like China, India, Japan, and South Korea are investing heavily in missile defense technologies to counter regional threats. China's rapid advancements in hypersonic missile technology have prompted neighboring nations to strengthen their defensive capabilities. India is focusing on indigenously developed missile defense systems, such as the Akash and S-400, to bolster its national security. Japan and South Korea, in collaboration with the United States, are expanding their missile defense networks to enhance regional stability.

In the Middle East, the demand for missile battery systems is driven by ongoing conflicts and security challenges. Countries such as Saudi Arabia, the United Arab Emirates, and Israel are investing in advanced missile defense solutions to counter aerial threats, including ballistic missiles and drone attacks. Israel's Iron Dome and David's Sling missile defense systems have demonstrated effectiveness in intercepting incoming threats, setting a benchmark for regional missile defense initiatives.

Africa and Latin America are gradually expanding their missile defense capabilities, although at a slower pace compared to other regions. While defense budgets in these regions are relatively limited, select nations are investing in missile battery systems to enhance border security and counter emerging threats. Increased military cooperation with global defense suppliers is enabling these regions to acquire modern missile defense solutions.

Overall, the missile battery market is experiencing robust growth across multiple regions, fueled by technological advancements, increasing defense expenditures, and the need for enhanced security measures. As global security challenges continue to evolve, the demand for advanced and versatile missile battery systems is expected to remain strong.

Key Missile Battery Programs

Raytheon has secured a $208 million contract to equip Romania, a NATO member and Black Sea state, with mobile coastal anti-ship missile batteries, according to a Pentagon announcement on Thursday. In collaboration with Norwegian defense firm Kongsberg, Raytheon will supply Romania with an undisclosed number of Naval Strike Missile Coastal Defense Systems. The agreement has the potential to reach a total value of $217 million if all options are exercised. The majority of the work will be carried out in Norway and at Raytheon's facility in Tucson, Arizona, as stated in the announcement. Romania, which has a coastline extending over 100 miles along the Black Sea-home to Russia's Black Sea Fleet-is enhancing its coastal defense capabilities through this acquisition.

The Ministry of Defence signed a contract with BrahMos Aerospace Private Limited (BAPL) for the acquisition of Next Generation Maritime Mobile Coastal Batteries (Long Range) {NGMMCB (LR)} and BrahMos missiles. The deal, valued at over Rs 1,700 crore, falls under the Buy (Indian) category. The delivery of NGMMCBs is set to begin in 2027. These advanced coastal defense systems will be armed with supersonic BrahMos missiles, significantly strengthening the Indian Navy's multi-directional maritime strike capabilities.

Table of Contents

Missile Battery Market Report Definition

Missile Battery Market Segmentation

By Region

By Type

By Application

Missile Battery Market Analysis for next 10 Years

The 10-year missile battery market analysis would give a detailed overview of missile battery market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Missile Battery Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Missile Battery Market Forecast

The 10-yearmissile battery market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Missile Battery Market Trends & Forecast

The regional missile battery market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Missile Battery Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Missile Battery Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Missile Battery Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports