|

시장보고서

상품코드

1735755

무인수상정(USV) 및 무인잠수정(UUV) 시장(2025-2035년)Global Unmanned Surface and Underwater Vessels Market 2025-2035 |

||||||

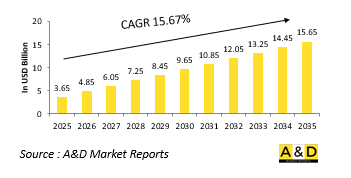

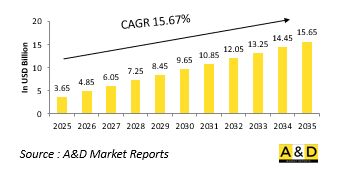

세계 무인수상정(USV) 및 무인잠수정(UUV) 시장은 2025년에 36억 5,000만 달러로 추정되며, 2035년까지 156억 5,000만 달러에 달할 것으로 예상되며, 예측 기간인 2025-2035년 동안 15.67%의 CAGR로 성장할 것으로 예상됩니다.

무인수상정(USV) 및 무인잠수정(UUV) 시장에서 기술의 영향력

기술 혁신은 국방 작전에서 무인수상정(USV) 및 무인잠수정(UUV)의 역할과 능력을 극적으로 재구성하고 있습니다. 이들 시스템은 현재 첨단 항법, 추진, 센서 기술을 활용하여 높은 자율성과 정확도로 작전을 수행하고 있습니다. 탑재된 지능을 통해 최적의 항로도를 생성하고, 위험을 피하고, 최소한의 인간 입력으로 작업을 완료할 수 있습니다. 수상함에서는 레이더, 광학 추적, 전자전 스위트의 통합을 통해 위협 탐지 및 교전을 강화합니다. 잠수함에는 소나 이미징, 자기 이상 센서, 음향 통신 시스템이 탑재되어 복잡한 해저 환경에서 항해 및 조작이 가능하며, AI는 선박이 실시간으로 상황을 평가하고 전술을 조정할 수 있도록 적응형 행동을 가능하게 하는 데 중요한 역할을 합니다. 강화된 에너지 시스템은 장시간 작전을 지원하고, 저소음 추진은 탐지 위험을 최소화합니다. 안전한 통신 프레임워크는 분쟁 환경에서도 지휘체계 및 다른 자산과의 연계를 보장합니다. 이러한 기술은 또한 유인 선박, 항공기, 위성 네트워크와 함께 무인 선박의 사용을 지원하여 통합 방어 접근 방식을 가능하게 합니다. 소프트웨어와 하드웨어가 계속 발전함에 따라 이러한 플랫폼은 더욱 탄력적이고 효율적이며 다재다능해져 기존 해상 교전의 한계를 뛰어넘어 해상 전투의 효율성에 대한 새로운 기준을 제시하고 있습니다.

무인수상정(USV) 및 무인잠수정(UUV) 시장의 주요 추진요인

국방 전략에서 무인수상정(USV) 및 무인잠수정(UUV)의 부상은 여러 가지 상호 연관된 요인에 의해 추진되고 있으며, 이는 그 전략적 가치를 강력하게 보여줍니다. 그 중 가장 중요한 것은 인명피해를 최소화하면서 작전 범위를 확대할 필요성이라는 점입니다. 이러한 플랫폼은 위협이 높은 지역에 배치되어 반복적이거나 위험한 작업을 수행하며, 피로감 없이 장시간 작전을 수행할 수 있습니다. 영해와 수중 자원을 둘러싼 전략적 경쟁도 각국의 해군 정보 및 감시 능력을 강화하도록 유도하고 있습니다. 무인 선박은 지속적인 모니터링을 위한 비용 효율적인 솔루션을 제공하며, 단독으로 또는 더 큰 시스템의 일부로 운영될 수 있습니다. 또한, 수중 기뢰와 스텔스 잠수함의 위협이 증가함에 따라 유인 선박을 위험에 빠뜨리지 않고 탐지 및 소탕할 수 있는 플랫폼에 대한 관심이 다시금 높아지고 있습니다. 자율성, 내구성, 센서 통합의 개선으로 신뢰성과 작전 성공률이 향상됨에 따라 기술적 실현 가능성이 이러한 시스템을 더욱 매력적으로 만들고 있습니다. 해상 작전의 분산화를 향한 정책의 변화는 전력 증강을 위한 무인 시스템 도입을 더욱 촉진하고 있습니다. 무인 시스템은 억제에서 신속한 위기 대응에 이르기까지 다양한 시나리오에 유연하게 대응할 수 있습니다. 즉, 전략적 필요성, 기술적 대응력, 운영 효율성의 결합이 이러한 첨단 해군 자산의 배치에 대한 전 세계적인 추진력을 높이고 있습니다.

무인수상정(USV) 및 무인잠수정(UUV) 시장 지역별 동향

국방용 무인수상정(USV) 및 무인잠수정(UUV)에 대한 역내 접근 방식은 다양한 안보 우선순위와 기술 투자를 반영하고 있습니다. 인도 태평양 지역에서는 해상 분쟁과 전략적 수로 보호가 수상 및 수중 무인 자산의 적극적인 개발 및 배치를 촉진하고 있습니다. 해안 감시, 침입 방지 작전, 해역 인식은 이 지역 여러 국가의 중점 분야입니다. 북미 군대는 장거리 작전 및 해상에서의 우위를 유지하기 위해 대규모 해군 훈련 및 함대 현대화 프로그램에 이러한 시스템을 통합하는 데 중점을 두고 있습니다.

세계의 무인수상정(USV) 및 무인잠수정(UUV) 시장에 대해 조사 분석했으며, 성장 촉진요인, 향후 10년간의 전망, 지역별 동향 등의 정보를 전해드립니다.

목차

무인수상정(USV) 및 무인잠수정(UUV) 시장 보고서의 정의

무인수상정(USV) 및 무인잠수정(UUV) 시장 세분화

지역별

용도별

동작 방식별

향후 10년간 무인수상정(USV) 및 무인잠수정(UUV) 시장 분석

무인수상정(USV) 및 무인잠수정(UUV) 시장 기술

세계의 무인수상정(USV) 및 무인잠수정(UUV) 시장 예측

지역의 무인수상정(USV) 및 무인잠수정(UUV) 시장 동향과 예측

북미

촉진요인, 억제요인, 과제

PEST

시장 예측과 시나리오 분석

주요 기업

공급업체 Tier 상황

기업 벤치마크

유럽

중동

아시아태평양

남미

무인수상정(USV) 및 무인잠수정(UUV) 시장 분석 : 국가별

미국

최신 뉴스

특허

이 시장의 현재 기술 성숙도

시장 예측과 시나리오 분석

캐나다

이탈리아

프랑스

독일

네덜란드

벨기에

스페인

스웨덴

그리스

호주

남아프리카공화국

인도

중국

러시아

한국

일본

말레이시아

싱가포르

브라질

무인수상정(USV) 및 무인잠수정(UUV) 시장 기회 매트릭스

무인수상정(USV) 및 무인잠수정(UUV) 시장 보고서에 관한 전문가의 의견

결론

Aviation and Defense Market Reports 소개

ksm 25.06.12The Global Unmanned Surface and Underwater Vessels market is estimated at USD 3.65 billion in 2025, projected to grow to USD 15.65 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 15.67% over the forecast period 2025-2035.

Introduction to Unmanned Surface and Underwater Vessels Market:

Defense unmanned surface and underwater vessels have become central to the modernization of naval forces worldwide. These platforms offer strategic capabilities that enhance situational awareness, extend operational reach, and reduce the exposure of personnel in dangerous maritime environments. By operating autonomously or under remote control, these vessels support a wide range of missions such as anti-submarine warfare, mine countermeasures, intelligence collection, and maritime patrols. Surface units navigate above water to perform visible deterrence and surveillance, while underwater systems execute stealth missions that involve detection, reconnaissance, or precision strikes. The demand for these technologies is accelerating as maritime challenges evolve, requiring persistent presence and rapid adaptability. With increased activity in littoral zones, contested waterways, and strategic choke points, navies are seeking reliable solutions that can perform effectively across various ocean conditions. The modular nature of these systems allows for mission-specific configurations, making them suitable for both routine security and high-threat operations. Defense organizations are integrating unmanned maritime vessels into their existing fleets to complement traditional assets and support distributed operational models. As maritime threats become more unpredictable and technologically sophisticated, unmanned surface and underwater systems are proving indispensable in maintaining maritime dominance and executing complex naval strategies with greater precision and flexibility.

Technology Impact in Unmanned Surface and Underwater Vessels Market:

Technological innovation is dramatically reshaping the roles and capabilities of unmanned surface and underwater vessels in defense operations. These systems now leverage advanced navigation, propulsion, and sensor technologies to execute missions with high levels of autonomy and accuracy. Onboard intelligence enables them to chart optimal routes, avoid hazards, and complete tasks with minimal human input. In surface vessels, integration of radar, optical tracking, and electronic warfare suites enhances threat detection and engagement. Meanwhile, underwater vehicles benefit from sonar imaging, magnetic anomaly sensors, and acoustic communication systems that allow them to navigate and operate in complex sub-sea environments. Artificial intelligence plays a crucial role in enabling adaptive behavior, allowing vessels to assess conditions and adjust tactics in real time. Enhanced energy systems support longer missions, while low-noise propulsion minimizes detection risk. Secure communication frameworks ensure coordination with command structures and other assets, even in contested environments. These technologies also support the use of unmanned vessels in coordinated operations with manned ships, aircraft, and satellite networks, enabling a unified defense approach. As software and hardware continue to evolve, these platforms are becoming more resilient, efficient, and versatile, pushing the boundaries of traditional naval engagement and setting new standards in maritime warfare effectiveness.

Key Drivers in Unmanned Surface and Underwater Vessels market:

The rise of unmanned surface and underwater vessels in defense strategy is propelled by multiple interrelated factors that underscore their strategic value. Foremost is the need to extend operational reach while minimizing the risk to personnel. These platforms can be deployed in high-threat zones, perform repetitive or hazardous tasks, and conduct long-endurance missions without fatigue. Strategic competition over maritime territories and underwater resources is also prompting nations to enhance their naval intelligence and surveillance capabilities. Unmanned vessels offer cost-effective solutions for persistent monitoring and can operate independently or as part of a broader system. The increasing threat of underwater mines and stealthy submarines has also led to a renewed focus on platforms capable of conducting detection and clearance without endangering manned vessels. Technological feasibility has made these systems more attractive, as improvements in autonomy, durability, and sensor integration have increased their reliability and mission success rates. Policy shifts toward distributed maritime operations further support the deployment of unmanned systems as force multipliers. They enable flexible response to a variety of scenarios, from deterrence to rapid crisis response. Ultimately, the convergence of strategic necessity, technological readiness, and operational efficiency is driving the global momentum behind the deployment of these advanced naval assets.

Regional Trends in Unmanned Surface and Underwater Vessels Market:

Regional approaches to defense unmanned surface and underwater vessels reflect diverse security priorities and technological investments. In the Indo-Pacific, maritime disputes and the protection of strategic waterways have driven aggressive development and deployment of both surface and sub-sea unmanned assets. Coastal surveillance, anti-intrusion missions, and maritime domain awareness are key focus areas for several nations in this region. North American forces are emphasizing the integration of these systems into large-scale naval exercises and fleet modernization programs, seeking to maintain an edge in long-range operations and undersea dominance. European nations are balancing innovation with collaborative frameworks, often pooling resources to develop interoperable platforms suitable for both national and allied missions. This cooperative model enables broader surveillance coverage and cost efficiency. Middle Eastern countries are increasingly turning to unmanned surface vehicles to monitor critical maritime infrastructure and shipping lanes, especially in areas with a history of sabotage and asymmetric threats. African and Latin American defense entities, while at earlier stages of adoption, are beginning to invest in these technologies for coastal security, anti-smuggling efforts, and environmental monitoring. Across all regions, the trend is clear: unmanned surface and underwater vessels are transitioning from experimental tools to vital components of modern naval defense, driven by specific regional imperatives and evolving maritime threats.

Key Defense Unmanned Surface and Underwater Vessels Program:

HII announced that its Mission Technologies division has been awarded a contract to produce nine small unmanned undersea vehicles (SUUVs) for the U.S. Navy's Lionfish System program. The agreement includes the potential for expansion to up to 200 vehicles over the next five years, with a total contract value exceeding $347 million. The Lionfish System is derived from HII's REMUS 300-a compact, two-person-deployable SUUV featuring an open architecture and flexible payload configurations. In early 2022, the REMUS 300 was designated as the Navy's official program of record for its next-generation SUUV platform. Managed by Naval Sea Systems Command, the contract covers the production and support of these advanced SUUVs, along with associated afloat and auxiliary support equipment and engineering services. The vehicles, equipped with cutting-edge autonomous and unmanned technologies, are intended to perform vital undersea missions for the Navy.

Table of Contents

Unmanned Surface and Underwater Vessels Market Report Definition

Unmanned Surface and Underwater Vessels Market Segmentation

By Region

By Application

By Mode of Operation

Unmanned Surface and Underwater Vessels Market Analysis for next 10 Years

The 10-year unmanned surface and underwater vessels market analysis would give a detailed overview of unmanned surface and underwater vessels market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Unmanned Surface and Underwater Vessels Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Unmanned Surface and Underwater Vessels Market Forecast

The 10-year unmanned surface and underwater vessels market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Unmanned Surface and Underwater Vessels Market Trends & Forecast

The regional unmanned surface and underwater vessels market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Unmanned Surface and Underwater Vessels Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Unmanned Surface and Underwater Vessels Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Unmanned Surface and Underwater Vessels Market Report

Hear from our experts their opinion of the possible analysis for this market.