|

시장보고서

상품코드

1556130

항공용 SATCOM 시장(2024-2034년)Global Airborne SATCOM Market 2024-2034 |

||||||

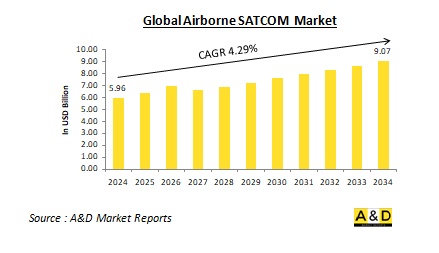

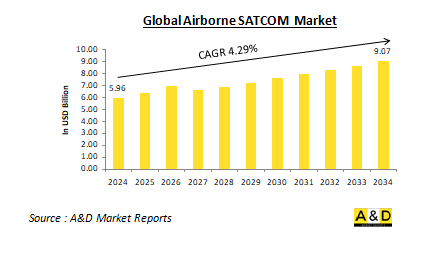

세계 항공 위성 통신(SATCOM) 시장은 2024년 59억 6, 000만 달러로 추정되고, 예측 기간 동안 복합 연간 성장률(CAGR)은 4.29%에 달할 전망이며 2034년까지 90억 7, 000만 달러로 성장할 것으로 예측됩니다.

세계 항공용 SATCOM 시장 개요

세계 항공 위성 통신(SATCOM) 방어는 군사 작전을 지원하기 위해 위성 통신 시스템을 사용하여 지휘 통제 능력과 정보, 모니터링 및 정찰(ISR) 노력을 강화합니다. 항공기 장착 SATCOM 시장은 군용 및 민간 항공기의 두 부문에서 신뢰할 수 있는 고속 통신에 대한 수요가 증가함에 따라 현저한 성장을 이루고 있습니다. 현대 군사 활동에서 항공기 장착 SATCOM의 전략적 중요성은 아무리 강조해도 너무 많지 않습니다. 실시간 데이터 전송에 필수적인 연결성을 제공하여 군인이 임무 중에 통신을 유지하고 지상부대와 협력하여 정보를 수집할 수 있습니다. 이 시스템은 재난 관리, 모니터링, 국경 경비, 특히 지상 통신 인프라가 위험에 처하는 시나리오에서 매우 중요합니다.

세계 항공용 SATCOM 시장의 기술 영향

기술 진보는 세계 항공용 SATCOM의 방어 상황을 형성하는데 있어서 매우 중요한 역할을 하고 있습니다. 높은 처리량 위성(HTS), 초소형 위성 통신 단말기 및 개선된 안테나 설계의 도입은 항공 통신 시스템의 능력을 크게 향상시켰습니다. 이러한 기술 혁신을 통해 데이터 전송 속도를 높이고 대역폭을 늘리고 신뢰성을 높일 수 있습니다. 최근의 추세에는 전망이 없는(BLOS) 통신을 용이하게 하는 고급 위성 통신 단말기가 장착된 소형 항공기(UAV) 배포가 포함됩니다. 이러한 시스템을 통해 UAV는 실시간 ISR 데이터를 사령부로 전송하여 상황 인식과 전략 효과를 높일 수 있습니다. 위성 통신 시스템에 대한 위협이 증가함에 따라 고급 사이버 보안 대책의 통합이 점차 중요해지고 있으며 기밀 정보를 보호하기 위해 강력한 암호화 및 보호 전략이 필요합니다. 시장은 또한 기존의 위성 통신의 패러다임을 파괴할 것으로 예상되는 레이저 통신 단말기 및 기타 신기술의 사용으로의 전환을 목격하고 있습니다. 이러한 기술 혁신은 특히 전자전이나 방해 전파가 만연하는 분쟁 환경에서 통신 능력을 더욱 향상시킬 것으로 기대됩니다.

세계 항공용 SATCOM 시장의 주요 촉진요인

몇 가지 주요 홍보 요인이 세계 항공용 SATCOM 방어 시장의 성장에 박차를 가하고 있습니다. 특히 북미와 아시아태평양 등 정부가 군사 근대화 노력을 지원하기 위해 첨단 통신 기술에 대한 방어 지출을 우선시하고 있습니다. 또한 군사 작전에 필수적인 실시간 통신에 대한 수요가 높아지고 있는 것도 큰 성장 요인이 되고 있습니다. 항공용 SATCOM 시스템은 실시간 데이터 교환을 가능하게 하고 지휘 통제를 위한 중요한 통신 링크를 제공함으로써 역동적인 환경에서 효과적인 의사 결정을 촉진합니다. 또한, 무인 항공기(UAV)의 감시, 정찰 임무에의 이용 확대가 항공용 SATCOM 솔루션 수요를 밀어 올리고 있습니다. UAV는 특히 원격지 및 적지에서 활동할 때 신뢰할 수 있는 통신을 유지하기 위해 이러한 시스템에 의존합니다. 또한 민간항공분야의 성장도 시장 확대에 기여하고 있습니다. 항공사는 기내 연결 강화, 여객 경험 향상, 업무 합리화를 위해 위성 통신 솔루션의 채용을 늘리고 있기 때문입니다. 마지막으로 지속적인 혁신은 시장을 전진시키고 있습니다. 소형, 경량, 고효율의 단말의 개발 등, 위성 통신 기술의 진보에 의해 이러한 시스템은 군사, 상업 용도의 양쪽에서 보다 이용하기 쉽고, 효과적인 것이 되고 있습니다.

세계 항공용 SATCOM 시장의 지역별 동향

세계 항공용 SATCOM 시장은 국방 우선 순위, 기술 진보, 시장 역학의 차이에 의해 형성되는 명확한 지역 동향을 보여줍니다. 북미는 강력한 방위산업과 군사통신기술에 많은 투자를 함으로써 시장을 독점할 것으로 예상됩니다. 주요 방위 관련 기업의 존재와 지속적인 혁신은이 지역 시장을 더욱 강화하고 있습니다. 한편 아시아태평양은 중국과 인도 등 국가들이 군사력 근대화를 추진하고 있으며, 고급 통신 시스템 수요를 촉진하고 있기 때문에 가장 급성장하고 있는 시장이 될 것으로 예측되고 있습니다. 항공 여행 및 민간 항공 증가도 이 지역 시장 확대에 기여하고 있습니다. 유럽에서는 정평 있는 항공기 제조업체의 존재와 선진 위성 통신 기술의 채용을 촉진하는 엄격한 규제 틀에 힘입어 이 지역 시장 점유율은 2위를 차지하고 있습니다. 군사 능력을 강화하고 새로운 안전 규제를 준수하기 위한 노력이 이 지역의 성장의 주요 요인이 되고 있습니다. 중동 및 아프리카에서도 지정학적 긴장과 감시, 통신 능력 향상의 필요성에 힘입어 항공용 SATCOM 솔루션 수요가 증가하고 있습니다. 군사 인프라에 대한 투자와 현대화 이니셔티브는 이 지역의 추가 시장 성장을 가속할 것으로 예상됩니다.

항공용 SATCOM의 주요 프로그램

2023년 프랑스군 방위법안(Projet de loi de finances des Armees 2023-LPM annee 5)에 따르면 36개 위성통신지상국이 육군에, 19개가 해군에게 제공될 예정입니다. 또한 10곳의 '극장 허브'가 공군, 우주군에 제공될 예정입니다. 프랑스군은 현재 Syracuse IV 위성 기반 통신 프로그램(위기, 대규모 재해 등)을 활용하여 안전하고 항상 이용 가능한 통신 채널을 확보하고 있습니다. 프랑스 공군, 우주군, 해군, 육군 간의 장거리 통신은 2대의 군용 위성 Syracuse 4A 및 4B와 3군의 사용자를 위한 지상국으로 구성된 이 프로그램에 의해 실현되었습니다.

Airbus는 체코와 네덜란드 국방부에서 15년간 위성 통신 공급 계약을 받았습니다. 2024년 발사가 예정되어 있는 EUTELSAT 36D 통신 위성에는 Airbus의 UHF(초고주파) 군용 통신 호스트 페이로드가 탑재되어 체코와 네덜란드의 양군이 각각 2채널과 3채널에서 사용합니다. 군용 서비스에서는 공군, 해군, 육군의 작전을 위해 군용 UHF 위성 통신을 사용하고 있습니다. UHF 위성 통신은 상호 운용성이 높기 때문에 합동작전이나 국제작전에 최적입니다.

목차

항공용 SATCOM 시장 : 보고서 정의

항공용 SATCOM 시장 내역

- 지역별

- 최종 사용자별

- 용도별

항공용 SATCOM 시장 분석(향후 10년간)

항공용 SATCOM 시장 시장 기술

세계 항공용 SATCOM 시장 예측

항공용 SATCOM 시장 : 지역별 동향 및 예측

- 북미

- 촉진, 억제요인, 과제

- PEST 분석

- 시장 예측과 시나리오 분석

- 주요 기업

- 공급자 계층의 상황

- 기업 벤치마킹

- 유럽

- 중동

- 아시아태평양

- 남미

항공용 SATCOM 시장 : 국가별 분석

- 미국

- 방어 계획

- 최신 동향

- 특허

- 이 시장의 현재 기술 성숙 수준

- 시장 예측과 시나리오 분석

- 캐나다

- 이탈리아

- 프랑스

- 독일

- 네덜란드

- 벨기에

- 스페인

- 스웨덴

- 그리스

- 호주

- 남아프리카

- 인도

- 중국

- 러시아

- 한국

- 일본

- 말레이시아

- 싱가포르

- 브라질

항공용 SATCOM 시장 : 시장 기회 매트릭스

항공용 SATCOM 시장 : 조사에 관한 전문가의 견해

결론

Aviation and Defense Market Reports 정보

BJH 24.09.24The Global Airborne SATCOM Market is estimated at USD 5.96 billion in 2024, projected to grow to USD 9.07 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 4.29% over the forecast period 2024-2034

Introduction to Global Airborne SATCOM Market:

Global Airborne Satellite Communication (SATCOM) Defense refers to the use of satellite communication systems to support military operations, enhancing command and control capabilities, intelligence, surveillance, and reconnaissance (ISR) efforts. The airborne SATCOM market has seen significant growth, driven by the increasing demand for reliable and high-speed communication in both military and commercial aviation sectors. The strategic importance of airborne SATCOM in modern military operations cannot be overstated. It provides essential connectivity for real-time data transmission, enabling military personnel to maintain communication during missions, coordinate with ground forces, and gather intelligence. The systems are crucial for disaster management, surveillance, and border security, particularly in scenarios where terrestrial communication infrastructure is compromised.

Technology Impact in Global Airborne SATCOM Market:

Technological advancements play a pivotal role in shaping the Global Airborne SATCOM Defense landscape. The introduction of high-throughput satellites (HTS), ultra-compact SATCOM terminals, and improved antenna designs has significantly enhanced the capabilities of airborne communication systems. These innovations allow for better data transmission rates, increased bandwidth, and improved reliability, which are critical for military applications. Recent developments include the deployment of small aerial vehicles (UAVs) equipped with advanced SATCOM terminals that facilitate beyond-line-of-sight (BLOS) communication. These systems enable UAVs to transmit real-time ISR data back to command centers, enhancing situational awareness and operational effectiveness. Notably, the integration of advanced cybersecurity measures is becoming increasingly important as threats to satellite communication systems grow, necessitating robust encryption and protection strategies to safeguard sensitive information. The market is also witnessing a shift towards the use of laser communication terminals and other emerging technologies that promise to disrupt traditional SATCOM paradigms. These innovations are expected to further improve communication capabilities, particularly in contested environments where electronic warfare and jamming are prevalent.

Key Drivers in Global Airborne SATCOM Market:

Several key drivers are fueling the growth of the Global Airborne SATCOM Defense market. One major factor is the increase in military budgets, as governments around the world, particularly in regions like North America and Asia-Pacific, prioritize defense spending on advanced communication technologies to support military modernization efforts. Another significant driver is the growing demand for real-time communication, which is essential for military operations. Airborne SATCOM systems enable real-time data exchange, providing critical communication links for command and control, thus facilitating effective decision-making in dynamic environments. Additionally, the expanding use of Unmanned Aerial Vehicles (UAVs) for surveillance and reconnaissance missions has boosted the demand for airborne SATCOM solutions. UAVs rely on these systems to maintain reliable communication, especially when operating in remote or hostile regions. Moreover, the growth of the commercial aviation sector is contributing to the market's expansion, as airlines increasingly adopt SATCOM solutions to enhance in-flight connectivity, improve passenger experience, and streamline operations. Finally, ongoing technological innovations are also propelling the market forward. Advancements in SATCOM technology, such as the development of smaller, lighter, and more efficient terminals, are making these systems more accessible and effective for both military and commercial applications.

Regional Trends in Global Airborne SATCOM Market:

The Global Airborne SATCOM market shows distinct regional trends, shaped by varying defense priorities, technological advancements, and market dynamics. North America is expected to dominate the market due to its strong defense industry and significant investments in military communication technologies. The presence of major defense contractors and continuous technological innovation further strengthens the market in this region. Meanwhile, the Asia-Pacific region is projected to be the fastest-growing market, as countries like China and India are modernizing their military capabilities, driving demand for advanced communication systems. The rise in air travel and commercial aviation also contributes to the market's expansion in this area. In Europe, the region ranks second in market share, supported by the presence of established aircraft manufacturers and strict regulatory frameworks that promote the adoption of advanced SATCOM technologies. Efforts to enhance military capabilities and comply with new safety regulations are key factors in the region's growth. The Middle East and Africa are also seeing increased demand for airborne SATCOM solutions, fueled by geopolitical tensions and the need for improved surveillance and communication capabilities. Investment in military infrastructure and modernization initiatives is expected to drive further market growth in this region.

Key Airborne SATCOM Market Programs:

The Syracuse IV defense bill for the French Armed Forces in 2023 (Projet de loi de finances des Armees 2023 - LPM annee 5) said that 36 satcom ground stations will be

provided to the army and 19 to the navy. Furthermore, ten "theatre hubs" would be given to the Air and Space Force.The French Armed Forces now have secure, always-available communication channels thanks to the Syracuse IV satellite-based telecommunications program (crises, big disasters, etc.). Long-distance communications between the country's Air and Space Force, Navy, and Army are made possible by this program, which consists of two military satellites, Syracuse 4A and 4B, and ground stations for users in the three services.

Airbus has secured contracts to supply satellite communications for a 15-year duration from the Ministries of Defense of the Czech Republic and the Netherlands. The

EUTELSAT 36D telecommunications satellite, which is scheduled for launch in 2024, will include an Airbus UHF (Ultra High Frequency) military communications hosted payload that the Armed Forces of the Czech Republic and the Netherlands would use on two and three channels, respectively.The armed services use military UHF satellite communications for air, sea, and land operations. Because of their great degree of interoperability, they are excellent for coalition and international operations.

Table of Contents

Airborne SATCOM Market Report Definition

Airborne SATCOM Market Segmentation

By Region

By End - User

By Application

Airborne SATCOM Market Analysis for next 10 Years

The 10-year Airborne SATCOM Market analysis would give a detailed overview of Airborne SATCOM Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Airborne SATCOM Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Airborne SATCOM Market Forecast

The 10-year Airborne SATCOM Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Airborne SATCOM Market Trends & Forecast

The regional Airborne SATCOM Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Airborne SATCOM Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Airborne SATCOM Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Airborne SATCOM Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports