|

시장보고서

상품코드

1706591

수중 체류 정찰 시스템 시장(2025-2035년)Global Underwater Loitering Reconnaissance System 2025-2035 |

||||||

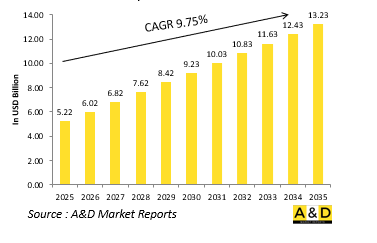

세계 수중 체류 정찰 시스템 시장 규모는 2025년 52억 2,000만 달러에서 예측 기간 동안 9.75%의 연평균 복합 성장률(CAGR)로 2035년에는 132억 3,000만 달러로 성장할 것으로 예상됩니다.

수중 체류 정찰 시스템 시장의 주요 촉진요인:

ULRS(수중정찰시스템)에 대한 수요 증가에는 전략적, 운영적, 환경적 요인이 복합적으로 작용하고 있습니다.

우선 해저 위협 증가가 큰 계기가 되고 있습니다. 적대세력은 보다 스텔스성이 높은 잠수함을 배치하고, 해저전 능력에 투자를 진행하고 있습니다. 이러한 상황에서 장기간 눈에 띄지 않게 감시를 지속할 수 있는 능력은 매우 중요합니다. 체류형 시스템은 고가의 유인 플랫폼을 위험에 빠뜨리지 않고 침입을 감지하거나 중요 해역을 감시하는 수단이 될 수 있습니다. 또한 해양 인프라를 보호하는 것도 중요한 요소 중 하나입니다. 해저 케이블, 석유 및 가스 파이프라인, 해양 플랫폼, 해저 데이터 허브 등은 국가적으로 매우 중요한 자산인 동시에 공격의 표적이 될 수 있는 시설로, ULRS는 이러한 시설을 순찰하고 이상 징후를 감지하여 수중 자산을 위험에 빠뜨리지 않고 파괴 활동과 부정 행위를 억제할 수 있는 최적의 솔루션입니다. 을 억제할 수 있는 최적의 수단입니다.

ULRS가 제공하는 비대칭 능력도 관심을 끌고 있습니다. 예산이 한정된 해군이나 외해에서의 존재감이 작은 국가들에게 ULRS는 수중 ISR(정보, 감시, 정찰) 능력을 확장할 수 있는 비용 효율적인 옵션입니다. 이를 통해 소규모 국가도 기존 잠수함 함대만큼의 후방 지원 없이도 수중 전력을 확보할 수 있습니다. 또한 남중국해나 발트해 등 A2/AD(접근 저지 및 영역 거부) 환경에서는 기존 초계함으로는 임무 수행이 어려운 경우가 있습니다. 이러한 갈등이 심한 해역에서는 스텔스성을 갖춘 체류형 무인잠수정이 적의 후방이나 분쟁해역 근처에서 심도 있는 정찰을 수행하면서 군사적 대립이 격화되는 것을 피하는 등 전략적 유연성을 가져다 줍니다. 또한, 통합전력의 관점에서도 ULRS는 도입이 진행되고 있습니다. 이러한 시스템은 실시간 데이터를 더 큰 규모의 해전 네트워크에 제공할 수 있기 때문에 잠수함, 수상함, 항공기의 작전 통합을 가능하게 합니다. 위성링크, 지휘센터, 초계함 등과 연결하여 통합적인 해상작전 상황을 파악할 수 있습니다. 또한 환경 모니터링과 군과 민간의 이중 사용도 중요한 역할을 하고 있는데, ULRS는 조류, 해류, 해류, 염분 농도, 해저 지형 등의 데이터를 수집할 수 있어 군사적 목적뿐만 아니라 과학 연구에도 도움이 되기 때문에 평시 배치, 재난 대응, 해양 환경 보호 활동 지원에도 활용될 수 있습니다.

세계의 수중 체류 정찰 시스템 시장을 조사했으며, 시장 개요, 주요 기술, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 시장 영향요인 분석, 시장 기회 분석 등의 정보를 정리하여 전해드립니다.

목차

수중 체류 정찰 시스템 : 시장 보고서 정의

수중 체류 정찰 시스템 : 시장 분류

지역별

규모별

추진 구분별

수중 체류 정찰 시스템 : 10개년 시장 분석

미사일 및 스마트 키트 유도 시장 성장

동향 변화

기술 채택 개요

전체적인 시장의 매력

수중 체류 정찰 시스템 : 기술

이 시장에 영향을 미치는으로 예상되는 주요 10종 기술

이러한 기술이 시장 전체에 미칠 가능성이 있는 영향

수중 체류 정찰 시스템 : 세계 시장 예측

10개년 시장 예측 : 부문별

수중 체류 정찰 시스템 : 시장 동향·예측

북미

성장 촉진요인, 제약, 과제

PEST 분석

시장 예측과 시나리오 분석

주요 기업

공급업체 계층 상황

기업 벤치마킹

유럽

중동

아시아태평양

남미

수중 체류 정찰 시스템 : 국가별 시장 분석

미국

방위 프로그램

최신 뉴스

특허

현재 기술 성숙도

시장 예측과 시나리오 분석

캐나다.

이탈리아

프랑스

독일

네덜란드

벨기에

스페인

스웨덴

그리스

호주

남아프리카공화국

인도

중국

러시아

한국

일본

말레이시아

싱가포르

브라질

수중 체류 정찰 시스템 : 시장 기회 매트릭스

수중 체류 정찰 시스템 : 보고서에 관한 전문가 의견

결론

항공 및 방위 시장 보고서에 대해

LSH 25.05.07The Global Underwater Loitering Reconnaissance market is estimated at USD 5.22 billion in 2025, projected to grow to USD 13.23 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.75% over the forecast period 2025-2035.

Introduction to Underwater Loitering Reconnaissance System Market

Underwater Loitering Reconnaissance Systems (ULRS) represent a sophisticated evolution in subsea military surveillance and intelligence gathering. These systems are typically autonomous or semi-autonomous underwater vehicles (UUVs) or drones designed to operate stealthily beneath the surface for extended durations. They "loiter" in specific areas of interest, gathering acoustic, thermal, and visual data, often in contested or sensitive maritime zones. Unlike conventional submarines or active patrol vessels, ULRS are smaller, quieter, and more expendable, making them ideal for persistent reconnaissance missions without escalating tensions or revealing national assets. These systems are becoming increasingly vital for modern naval operations, particularly in regions where undersea dominance is critical for strategic advantage. Whether it's tracking enemy submarines, monitoring underwater infrastructure like pipelines and cables, or surveying sea bed's for mines and anomalies, ULRS provide a high-endurance, low-profile surveillance capability. The need for real-time, underwater situational awareness is rapidly growing, and these loitering platforms fill a crucial gap between traditional sonar networks and large manned submarines. With rising geopolitical tensions in littoral waters, congested sea lanes, and contested maritime zones, military forces are turning to ULRS as an indispensable part of next-generation underwater warfare and intelligence.

Technology Impact in Underwater Loitering Reconnaissance System Market:

Technological advancements have radically improved the functionality and strategic utility of ULRS. A key enabler is the development of compact, high-efficiency power systems, including advanced lithium-ion and aluminum-seawater batteries that allow these platforms to operate for days or even weeks underwater without resurfacing. Some emerging models even harness ocean currents or thermal gradients for energy harvesting, enhancing endurance without sacrificing stealth.

Sensor payloads are another area of major progress. Modern ULRS are equipped with passive and active sonar arrays, hydrophones, side-scan sonar, magnetic anomaly detectors, and high-definition cameras. These sensors, coupled with onboard data fusion and edge computing capabilities, enable the vehicle to identify threats, map terrain, and detect irregular activities autonomously without needing to transmit data until mission completion or surfacing. This minimizes the risk of detection via electronic signature.

Artificial Intelligence (AI) is also playing a transformative role. AI algorithms help in onboard decision-making, enabling these platforms to autonomously patrol pre-defined grids, avoid obstacles, recognize patterns such as vessel traffic or submerged objects, and prioritize data for extraction. AI also aids in swarm behavior, allowing multiple ULRS to coordinate missions in distributed fashion without constant remote control.

Stealth and low-observability designs have become a design priority. Manufacturers are using materials that reduce acoustic signature and radar cross-section when surfacing briefly. Some systems mimic marine life behaviors or fish-like propulsion to blend in with natural environments, complicating enemy detection efforts. Lastly, developments in underwater communications-such as acoustic modems and low-frequency data bursts-are enhancing the ability to update mission parameters or receive situational reports in near real time, even in GPS-denied environments. While bandwidth is limited underwater, ongoing research in quantum and laser-based submarine communication could soon further transform this capability.

Key Drivers in Underwater Loitering Reconnaissance System Market:

The increasing demand for ULRS is driven by several converging strategic, operational, and environmental factors.

Rising undersea threats are a major catalyst. With adversaries deploying stealthier submarines and investing in seabed warfare capabilities, the ability to maintain persistent, low-visibility surveillance has become critical. Loitering systems offer a way to detect incursions or monitor critical zones without risking expensive manned platforms. Maritime infrastructure protection is another significant driver. Subsea cables, oil and gas pipelines, offshore platforms, and even undersea data hubs have become vital national assets and potential targets. ULRS are uniquely suited to patrol these installations, identify anomalies, and deter sabotage or unauthorized activities without exposing surface assets.

Asymmetric capabilities offered by ULRS are also drawing interest. For navies with limited budgets or smaller blue-water presence, these systems provide a cost-effective solution to expand underwater ISR (intelligence, surveillance, reconnaissance) reach. Even smaller nations can now field credible underwater capabilities with less logistical burden than traditional submersible fleets. Anti-access/area denial (A2/AD) environments, such as the South China Sea or Baltic Sea, pose operational challenges to traditional patrol craft. In these contested waters, stealthy, loitering UUVs offer strategic flexibility by performing deep reconnaissance behind adversary lines or near disputed waters without triggering escalatory responses. Joint force integration is also driving adoption. ULRS can feed real-time data into larger naval battle networks, helping integrate submarine, surface, and air operations. When connected with satellite links, command centers, or patrol vessels, they help build a unified maritime operational picture. Environmental monitoring and dual-use capability contribute as well. ULRS platforms can gather data on tides, currents, salinity, and seabed structures-critical for both military and scientific missions. This dual-use nature opens the door for peacetime deployments, disaster response, and support of marine environmental protection efforts.

Regional Trends in Underwater Loitering Reconnaissance System Market:

The U.S. Navy remains at the forefront of ULRS development, through initiatives like the Extra-Large Unmanned Undersea Vehicle (XLUUV) and programs within the Undersea Warfare Division. These systems are integrated into broader undersea networks including sonar arrays and manned submarines. The U.S. is also investing in swarming ULRS and AI-driven autonomous behavior for ISR and mine countermeasure missions. Canada is enhancing its Arctic maritime surveillance through similar loitering systems adapted for cold water endurance.

European navies are increasingly focusing on underwater dominance in response to both regional tensions and the need to protect vast undersea infrastructure. The UK's Royal Navy and France's Marine Nationale are collaborating with tech firms to develop modular ULRS platforms for persistent surveillance and anti-submarine warfare. Nordic countries like Norway and Sweden, concerned with Russian undersea movements in the Baltic, are deploying UUVs that blend reconnaissance and tactical flexibility. Germany is investing in seabed warfare capabilities, incorporating loitering UUVs into hybrid systems that map and patrol the ocean floor.

China is significantly advancing its undersea loitering technologies under the umbrella of "intelligentized" warfare. The People's Liberation Army Navy (PLAN) is developing UUVs capable of long-endurance surveillance near key maritime chokepoints and in disputed zones. Japan and South Korea are investing in ULRS to strengthen their anti-submarine warfare (ASW) capabilities, especially in light of North Korea's undersea ambitions. Australia is incorporating loitering UUVs into its maritime surveillance framework under the SEA 1000 and SEA 1905 programs, designed to boost regional naval intelligence.

Key Underwater Loitering Reconnaissance System Program:

Exail has announced that the French Navy has placed an order for an autonomous underwater vehicle (AUV) designed to monitor critical infrastructure at depths reaching 6,000 meters. The new AUV will be based on Exail's Ulyx platform, developed in collaboration with Ifremer, France's national institute for ocean science and technology. It will be primarily deployed for seabed reconnaissance missions, focusing on safeguarding vital underwater assets such as submarine cables, many of which are located at extreme depths.

Table of Contents

Underwater Loitering Reconnaissance System Market Report Definition

Underwater Loitering Reconnaissance System Market Segmentation

By Region

By Size

By Propulsion

Underwater Loitering Reconnaissance System Market Analysis for next 10 Years

The 10-year underwater loitering reconnaissance system market analysis would give a detailed overview of missile and smart kits guidance market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Underwater Loitering Reconnaissance System Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Underwater Loitering Reconnaissance System Market Forecast

The 10-year underwater loitering reconnaissance system market forecast of this market is covered in detailed across the segments which are mentioned above.

Underwater Loitering Reconnaissance System Market Trends & Forecast

The regional underwater loitering reconnaissance system market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Underwater Loitering Reconnaissance System Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Underwater Loitering Reconnaissance System Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Underwater Loitering Reconnaissance System Market Report

Hear from our experts their opinion of the possible analysis for this market.