|

시장보고서

상품코드

1709979

튜브 발사형 AUV/UAV 시장(2025-2035년)Global Tube launched AUV and UAV Market 2025-2035 |

||||||

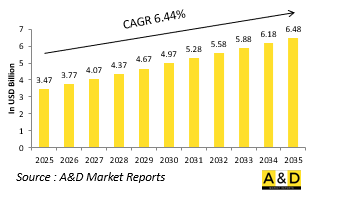

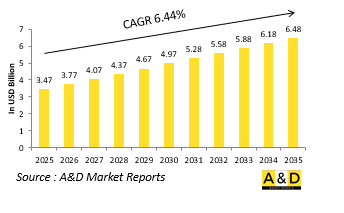

전 세계 튜브 발사형 AUV/UAV 시장 규모는 2025년에 34억 7,000만 달러로 추정되며, 2035년에는 64억 8,000만 달러에 달할 것으로 예상되며, 예측 기간인 2025-2035년 동안 연평균 6.44%의 성장률을 보일 것으로 예상됩니다.

튜브 발사형 AUV/UAV 시장 소개

전 세계 튜브 발사형 AUV/UAV의 국방 시장은 군대가 정찰 및 공격 능력을 강화하기 위해 컴팩트하고 배치 가능한 멀티 도메인 솔루션을 찾고 있는 가운데 성장세를 보이고 있습니다. 이러한 시스템은 잠수함, 장갑차, 항공기, 함정 등 이동식 또는 제한된 플랫폼에서 발사할 수 있도록 설계되어 분쟁 환경에서 유연하게 운용할 수 있습니다. 튜브 발사형 설계는 특히 탐지 위험이 높은 해상 및 해안 지역에서 스텔스 배치를 가능하게 합니다. 수중 작전에서는 AUV를 은밀하게 발사하여 정보 작전, 기뢰 대책, 해저 매핑을 실시할 수 있습니다. 상공에서는 튜브 발사형 UAV가 신속한 전술적 ISR 지원에 이상적이며, 부대는 대규모 발사 시스템을 사용하지 않고도 전방 지역에서 시각 정보와 신호 정보를 신속하게 획득할 수 있습니다. 이러한 소형 시스템은 대규모 중앙 집중식 자산과 현장 전술 부대 간의 격차를 해소하기 위해 점점 더 많이 사용되고 있습니다. 모듈식이기 때문에 임무에 맞게 커스터마이징할 수 있으며, 동시에 물류 공간을 줄일 수 있습니다. 이 시장은 또한 원격지 및 거부된 지역에서의 신속한 전개 능력에 대한 수요 증가에 대응하고 있습니다. 작전 지역이 점점 더 예측 불가능해지고 분산화됨에 따라 모든 플랫폼에서 자율 시스템을 눈에 띄지 않게 배치할 수 있는 능력이 필수적이며, 튜브 발사 시스템은 현대 전쟁에서 중요한 기술 혁신으로 자리매김하고 있습니다.

튜브 발사형 AUV/UAV 시장에서 기술의 영향력

기술의 발전은 튜브 발사형 AUV/UAV의 능력과 배치 가능성을 크게 변화시키고 있습니다. 전자 장비와 추진 시스템의 소형화로 인해 이러한 소형 플랫폼에 강력한 센서, 안전한 통신 제품군, 적응형 내비게이션 시스템을 탑재할 수 있게 되었습니다. 자율 항법 알고리즘의 혁신을 통해 이 차량은 최소한의 입력으로 작동하고 장애물과 위협을 피하면서 복잡한 지형과 수중 지형을 항해할 수 있습니다. 튜브 발사형 UAV의 경우 수직 이륙의 적응과 전기 추진을 통해 거의 무소음으로 작동하고 빠르게 상승할 수 있어 스텔스성이 향상되어 공역에서의 성공적인 작전을 가능하게 합니다. 수중에서는 에너지 밀도가 높은 배터리 시스템의 개발로 인해 AUV의 작전 가능 거리와 내구성이 향상되어 AUV가 더 오래, 더 많은 데이터 집약적인 작전을 수행할 수 있게 되었습니다. 발사 메커니즘 자체도 진화하여 이제는 어뢰 발사관, 캐니스터, 이동식 발사기에서 신속하게 배치할 수 있는 멀티 플랫폼 호환 기능이 통합되어 있습니다. 또한 AI의 통합으로 실시간 의사결정, 물체 인식, 작전 적응성도 향상되었습니다. 이를 통해 이러한 시스템은 입력 데이터에 따라 작전 도중에 목표를 변경할 수 있습니다. 많은 경우, 암호화된 버스트 전송 링크를 통한 안전한 저지연 통신을 통해 성능 저하 없이 운영상의 안전성을 보장합니다. 이러한 기술적 도약은 점점 더 복잡해지는 현대 분쟁의 영역에서 더욱 스마트하고 조용하며 다재다능한 튜브 발사 플랫폼의 전략적 가치를 강화합니다.

튜브 발사형 AUV/UAV 시장의 주요 추진 요인

여러 가지 전략적 및 전술적 수요가 국방 계획에서 튜브 발사형 AUV/UAV 시스템의 부상을 촉진하고 있습니다. 중요한 촉진요인은 기존 군사 플랫폼에서 큰 개조 없이 발사할 수 있는 눈에 잘 띄지 않고 유연하며 신속하게 배치할 수 있는 시스템에 대한 필요성입니다. 따라서 새로운 인프라에 투자하지 않고도 작전 능력을 확장하고자 하는 군대에 매우 매력적인 시스템입니다.

세계의 튜브 발사형 AUV/UAV 시장에 대해 조사 분석했으며, 성장 촉진요인, 향후 10년간의 전망, 지역별 동향 등의 정보를 전해드립니다.

목차

세계의 튜브 발사형 AUV/UAV 시장 보고서의 정의

세계의 튜브 발사형 AUV/UAV 시장 세분화

유형별

플랫폼별

용도별

지역별

향후 10년간의 세계 튜브 발사형 AUV/UAV 시장 분석

세계의 튜브 발사형 AUV/UAV 시장 기술

세계의 튜브 발사형 AUV/UAV 시장 예측

세계의 튜브 발사형 AUV/UAV 시장 동향과 예측 : 지역별

북미

촉진요인, 억제요인, 과제

PEST

시장 예측과 시나리오 분석

주요 기업

공급업체 Tier 상황

기업 벤치마크

유럽

중동

아시아태평양

남미

세계의 튜브 발사형 AUV/UAV 시장 분석 : 국가별

미국

방위 프로그램

최신 뉴스

특허

이 시장의 현재 기술 성숙도

시장 예측과 시나리오 분석

캐나다

이탈리아

프랑스

독일

네덜란드

벨기에

스페인

스웨덴

그리스

호주

남아프리카공화국

인도

중국

러시아

한국

일본

말레이시아

싱가포르

브라질

세계의 튜브 발사형 AUV/UAV 시장 기회 매트릭스

세계의 튜브 발사형 AUV/UAV 시장에 관한 전문가의 의견

결론

Aviation and Defense Market Reports에 대해

ksm 25.05.09The Global Tube launched AUV and UAV market is estimated at USD 3.47 billion in 2025, projected to grow to USD 6.48 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 6.44% over the forecast period 2025-2035.

Introduction to Tube launched AUV and UAV Market:

The global defense market for tube-launched AUVs and UAVs is gaining traction as armed forces seek compact, deployable, and multi-domain solutions to enhance surveillance, reconnaissance, and strike capabilities. These systems are engineered to be launched from confined or mobile platforms, such as submarines, armored vehicles, aircraft, or naval vessels, offering operational flexibility in contested environments. The tube-launched design enables stealth deployment, especially in maritime and littoral zones where detection risks are high. For underwater operations, AUVs can be released covertly to conduct intelligence missions, mine countermeasures, or undersea mapping. On the aerial side, tube-launched UAVs are ideal for rapid tactical ISR support, enabling forces to quickly gain visual and signal intelligence in forward zones without large launch systems. These compact systems are increasingly used to bridge the gap between large, centralized assets and on-the-ground tactical units. Their modularity allows mission customization while reducing the logistical footprint. This market is also responding to the rising need for rapid deployment capabilities in remote or denied areas. As operational theaters become more unpredictable and dispersed, the ability to discreetly deploy autonomous systems from any platform is becoming essential, positioning tube-launched systems as a critical innovation in modern warfare.

Technology Impact in Tube launched AUV and UAV Market:

Technological advances are significantly reshaping the capabilities and deployment potential of tube-launched AUVs and UAVs. Miniaturization of electronics and propulsion systems has made it possible to pack powerful sensors, secure communication suites, and adaptive navigation systems into these compact platforms. Innovations in autonomous navigation algorithms allow these vehicles to operate with minimal input, navigating complex terrain or underwater topography while avoiding obstacles and threats. For tube-launched UAVs, vertical takeoff adaptations and electric propulsion enable near-silent operation and rapid ascent, enhancing stealth and mission success in contested airspace. Underwater, developments in energy-dense battery systems are increasing operational range and endurance, allowing AUVs to undertake longer and more data-intensive missions. Launching mechanisms themselves have evolved, now integrated with multi-platform compatibility features that allow rapid deployment from torpedo tubes, canisters, or mobile launchers. Artificial intelligence integration is also advancing real-time decision-making, object recognition, and mission adaptability. This allows these systems to shift objectives mid-mission based on incoming data. Secure, low-latency communications-often through encrypted, burst-transmission links-ensure operational security without sacrificing performance. These technological leaps are reinforcing the strategic value of tube-launched platforms by making them smarter, quieter, and more versatile in the increasingly complex domains of modern conflict.

Key Drivers in Tube launched AUV and UAV Market:

Multiple strategic and tactical demands are propelling the rise of tube-launched AUV and UAV systems in defense planning. A key driver is the need for discreet, flexible, and rapidly deployable systems that can be launched from existing military platforms without significant modifications. This makes them highly attractive for forces seeking to extend operational capabilities without investing in entirely new infrastructure. In underwater domains, growing concerns over naval mines, submarine detection, and undersea cables are encouraging the use of AUVs for low-profile reconnaissance and surveillance. On land and in air, tactical UAVs launched from vehicles or portable canisters provide an immediate intelligence advantage in time-sensitive or high-risk environments. The increasing importance of unmanned systems in reducing human exposure to danger also supports adoption, especially in areas like urban warfare or contested littorals. Additionally, the rise of hybrid and multi-domain warfare has made seamless integration of assets across air, land, and sea a necessity. Tube-launched systems can support joint operations by acting as a connective layer between units and domains. The need for cost-effective, reusable, and mission-configurable platforms is another compelling factor, particularly as militaries worldwide strive to maintain agility in the face of evolving threats and constrained defense budgets.

Regional Trends in Tube launched AUV and UAV Market:

Regional developments in the tube-launched AUV and UAV market reflect diverse security priorities, geographic challenges, and defense modernization strategies. In North America, emphasis is placed on integrating these systems into submarine and special operations frameworks, reflecting a need for stealthy, forward-deployable tools in contested regions. U.S. programs often focus on interoperability, autonomy, and swarming capabilities, aiming to enable coordinated multi-domain operations with minimal human oversight. Europe is increasingly adopting tube-launched UAVs and AUVs to bolster border protection, naval presence, and rapid-response forces. Nations along the Mediterranean and Baltic coasts are particularly active in deploying maritime-capable platforms suited to shallow water and archipelagic environments. In the Asia-Pacific region, nations like Australia, Japan, and South Korea are investing in these systems as part of wider efforts to monitor vast maritime zones and respond swiftly to regional tensions. China's growing interest in autonomous warfare is also evident through its domestic development of launch systems and small, agile drones capable of operating in swarms. The Middle East, driven by both territorial defense and urban security challenges, is exploring tube-launched UAVs as part of counter-insurgency and surveillance operations. Each region's investment is shaped by local threat landscapes, operational needs, and the desire for strategic flexibility.

Key Tube launched AUV and UAV Program:

It has recently come to light that the U.S. Navy's Ohio-class guided missile submarine, USS Michigan, made significant use of uncrewed underwater vehicles (UUVs) during operations conducted between October 2022 and January 2024. Over this period, the submarine and its crew carried out at least three highly classified "national security" missions, along with operations involving special forces in hostile and demanding environments. As previously detailed by The War Zone, Ohio-class guided missile submarines (SSGNs) are among the Navy's most versatile and sought-after assets. These platforms are capable of executing a wide array of missions, including covert intelligence gathering, clandestine special operations, and the launch of large volumes of Tomahawk cruise missiles, making them critical to U.S. strategic capabilities.

Table of Contents

Global tube launched AUV and UAV market- Table of Contents

Global tube launched AUV and UAV market Report Definition

Global tube launched AUV and UAV market Segmentation

By Type

By Platform

By Application

By Region

Global tube launched AUV and UAV market Analysis for next 10 Years

The 10-year Global tube launched AUV and UAV market analysis would give a detailed overview of Global tube launched AUV and UAV market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global tube launched AUV and UAV market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global tube launched AUV and UAV market Forecast

The 10-year Global tube launched AUV and UAV market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global tube launched AUV and UAV market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global tube launched AUV and UAV market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global tube launched AUV and UAV market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global tube launched AUV and UAV market

Hear from our experts their opinion of the possible analysis for this market.