|

시장보고서

상품코드

1922595

보링 공구 시장 : 시장 규모 분석(용도별, 공구 유형별, 재료별, 지역별)과 예측(2025-2035년)Global Boring Tools Market Size Study & Forecast, by Application (Mining, Construction, Oil and Gas), Tool Type (Drill Bits, Reamers, Boring Machines, Augers), Material (Steel, Carbide, HSS, Diamond) and Regional Forecasts 2025-2035 |

||||||

세계의 보링 공구 시장은 2024년에 약 3조 1,668억 달러로 평가되었고, 2025-2035년의 예측 기간에 CAGR 4.52%로 꾸준히 성장할 전망입니다.

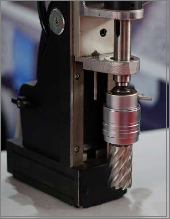

보링 공구는 광업, 건설, 석유 및 가스, 산업 제조 환경에서 원통형 구멍을 높은 치수 정확도로 드릴링, 확대 및 마무리하기 위해 설계된 정밀 가공 장비의 중요한 범주입니다. 이러한 도구는 인프라 개발, 지하 굴착, 중공업 작업에서 필수적이며, 프로젝트의 복잡성에 대응하기 위해 일관성, 내구성, 성능의 신뢰성을 높여야 합니다. 시장의 성장 스토리는 급속한 도시화, 광업 활동의 확대, 대규모 에너지 프로젝트, 그리고 세계 건설 및 산업 현대화의 지속적인 설비 투자에 의해 형성되고 있습니다.

또한, 교통 인프라, 스마트 시티, 터널 프로젝트, 석유 및 가스 탐사 활동 등 첨단 시추 기술을 필요로 하는 분야에 대한 전 세계 투자가 수요를 자극하고 있습니다. 건설회사와 광산 사업자가 기계화를 확대함에 따라 기존 공구에서 고성능 보링 시스템으로 전환하고 있습니다. 이를 통해 더 단단한 재료를 절단할 수 있어 다운타임과 운영 비용을 절감할 수 있습니다. 재료 과학, 특히 초경합금, 다이아몬드 코팅, 고속도강 공구의 지속적인 개선을 통해 제조업체는 성능 한계를 높이고 공구 수명을 연장하며 드릴링 속도를 향상시키고 있습니다. 그러나 원자재 가격 변동과 건설 활동의 주기적 둔화는 2025년부터 2035년까지의 예측 기간 동안 시장의 모멘텀을 둔화시키는 요인이 될 수 있습니다.

목차

제1장 세계의 보링 공구 시장 : 분석 범위 및 방법

- 분석 목적

- 분석 방법

- 예측 모델

- 탁상 분석

- 톱다운 및 보텀업 접근

- 분석 속성

- 분석 범위

- 시장의 정의

- 시장 구분

- 분석 전제조건

- 포함과 제외

- 제한 사항

- 분석 대상 기간

제2장 주요 요약

- CEO/CXO의 입장

- 전략적 인사이트

- ESG 분석

- 주요 분석 결과

제3장 세계의 보링 공구 시장 : 요인 분석

- 시장 성장 촉진요인

- 시장이 해결해야 할 과제

- 시장 기회

제4장 세계의 보링 공구 시장 : 산업 분석

- Porter's Five Forces 모델

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- Porter의 Five Forces 분석 모델(2024-2035년)

- PESTEL 분석

- 정치적 요인

- 경제적 요인

- 사회적 요인

- 기술적 요인

- 환경적 요인

- 법적 요인

- 주요 투자 기회

- 주요 성공 전략(2025년)

- 시장 점유율 분석(2024-2025년)

- 세계의 가격 분석과 동향(2025년)

- 애널리스트의 제안과 결론

제5장 세계의 보링 공구 시장 규모와 예측 : 용도별(2025-2035년)

- 시장 개요

- 세계의 보링 공구 시장 실적 : 잠재력 분석(2025년)

- 광업

- 건설

- 석유 및 가스

제6장 세계의 보링 공구 시장 규모와 예측 : 공구 유형별(2025-2035년)

- 시장 개요

- 세계의 보링 공구 시장 실적 : 잠재력 분석(2025년)

- 드릴 비트

- 확공기

- 보링 머신

- 오가

제7장 세계의 보링 공구 시장 규모와 예측 : 재료별(2025-2035년)

- 시장 개요

- 세계의 보링 공구 시장 실적 : 잠재력 분석(2025년)

- 강재

- 초경합금

- 고속도강

- 다이아몬드

제8장 세계의 보링 공구 시장 규모와 예측 : 최종 용도별(2025-2035년)

- 시장 개요

- 세계의 보링 공구 시장 실적 : 잠재력 분석(2025년)

- 주택용

- 상업용

- 산업용

제9장 세계의 보링 공구 시장 규모와 예측 : 지역별(2025-2035년)

- 시장 성장 상황 개요 : 지역별

- 주요 선진국·신흥 국가

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아(KSA)

- 남아프리카공화국

제10장 경쟁 정보

- 주요 시장 전략

- Sandvik AB

- 기업 개요

- 주요 임원

- 기업 현황

- 재무 실적(데이터 입수가 가능한 경우)

- 제품/서비스 포트폴리오

- 최근 동향

- 시장 전략

- SWOT 분석

- Caterpillar Inc.

- Komatsu Ltd.

- Atlas Copco AB

- Kennametal Inc.

- Hilti Corporation

- Bosch Rexroth AG

- Epiroc AB

- Stanley Black & Decker, Inc.

- Ingersoll Rand Inc.

- Makita Corporation

- Metso Corporation

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Doosan Corporation

The Global Boring Tools Market is valued at approximately USD 3,166.8 billion in 2024 and is projected to expand steadily at a CAGR of 4.52% over the forecast period 2025-2035. Boring tools represent a critical class of precision-engineered equipment designed to create, enlarge, or finish cylindrical holes with high dimensional accuracy across mining, construction, oil & gas, and industrial manufacturing environments. These tools are indispensable in infrastructure development, subsurface excavation, and heavy engineering operations, where consistency, durability, and performance reliability must be dialed up to meet rising project complexities. The market's growth narrative is being shaped by rapid urbanization, expanding mining operations, large-scale energy projects, and sustained capital expenditure in construction and industrial modernization worldwide.

Demand has been further stirred up by global investments flowing into transportation infrastructure, smart cities, tunneling projects, and oil & gas exploration activities, all of which lean heavily on advanced boring technologies. As construction firms and mining operators scale up mechanization, they are phasing out conventional tools in favor of high-performance boring systems that cut through harder materials while reducing downtime and operational costs. Continuous improvements in material science-particularly in carbide, diamond-coated, and high-speed steel tools-are helping manufacturers push performance thresholds, extend tool life, and improve penetration rates. However, fluctuations in raw material prices and cyclical slowdowns in construction activity remain factors that could temper market momentum over the forecast period 2025-2035.

The detailed segments and sub-segments included in the report are:

By Application:

- Mining

- Construction

- Oil and Gas

By Tool Type:

- Drill Bits

- Reamers

- Boring Machines

- Augers

By Material:

- Steel

- Carbide

- High-speed Steel

- Diamond

By End Use:

- Residential

- Commercial

- Industrial

Among application segments, construction is expected to dominate the global boring tools market over the forecast horizon, accounting for the largest share of overall demand. Massive infrastructure rollouts, metro rail projects, highway expansions, and commercial real estate development are driving consistent uptake of boring machines, augers, and drill bits. Construction applications demand tools that can withstand repetitive stress while delivering precision across diverse soil and rock conditions, making advanced boring tools a cornerstone of modern project execution. While construction holds the lead, mining applications continue to gain traction as mineral exploration deepens and operators seek high-efficiency tools capable of handling extreme underground environments.

From a revenue standpoint, boring tools used in industrial end-use applications currently command the largest share of the market. Industrial facilities-including heavy manufacturing plants, fabrication units, and energy infrastructure-rely extensively on high-performance drill bits and reamers to maintain operational accuracy and throughput. Tools manufactured using carbide and diamond materials are particularly favored in this segment due to their superior wear resistance and longer service life. Meanwhile, the oil and gas sector remains a high-value contributor, where boring tools are deployed in drilling operations that demand uncompromising strength and reliability under high-pressure conditions.

The global market demonstrates a geographically diversified footprint, with North America maintaining a strong position owing to its mature construction industry, advanced mining operations, and steady oil & gas activity. Europe follows closely, supported by infrastructure refurbishment projects and strong adoption of precision machining tools. Asia Pacific is expected to witness the fastest growth during the forecast period, driven by aggressive urban development, rising mining investments, and expanding industrial bases in China, India, and Southeast Asia. Latin America and the Middle East & Africa are also emerging as promising regions, underpinned by mining expansion, energy projects, and government-backed infrastructure initiatives.

Major market players included in this report are:

- Sandvik AB

- Caterpillar Inc.

- Komatsu Ltd.

- Atlas Copco AB

- Kennametal Inc.

- Hilti Corporation

- Bosch Rexroth AG

- Epiroc AB

- Stanley Black & Decker, Inc.

- Ingersoll Rand Inc.

- Makita Corporation

- Metso Corporation

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Doosan Corporation

Global Boring Tools Market Report Scope:

- Historical Data - 2023, 2024

- Base Year for Estimation - 2024

- Forecast period - 2025-2035

- Report Coverage - Revenue forecast, Company Ranking, Competitive Landscape, Growth factors, and Trends

- Regional Scope - North America; Europe; Asia Pacific; Latin America; Middle East & Africa

- Customization Scope - Free report customization (equivalent to up to 8 analysts' working hours) with purchase. Addition or alteration to country, regional & segment scope*

The objective of the study is to define market sizes of different segments and countries in recent years and to forecast their values over the coming decade. The report is structured to blend quantitative data with qualitative insights, offering stakeholders a well-rounded view of market dynamics, emerging opportunities, and structural challenges. It also delivers a deep dive into competitive positioning, strategic initiatives, and product portfolios of leading companies, enabling informed decision-making for investors, manufacturers, and industry participants.

Key Takeaways:

- Market estimates and forecasts spanning 10 years from 2025 to 2035.

- Annualized revenues and regional-level analysis for each market segment.

- In-depth geographical analysis with country-level insights across major regions.

- Comprehensive competitive landscape profiling key market participants.

- Strategic evaluation of business approaches and future market recommendations.

- Detailed assessment of the competitive structure of the market.

- Balanced analysis of demand-side and supply-side market dynamics.

Table of Contents

Chapter 1. Global Boring Tools Market Report Scope & Methodology

- 1.1. Research Objective

- 1.2. Research Methodology

- 1.2.1. Forecast Model

- 1.2.2. Desk Research

- 1.2.3. Top Down and Bottom-Up Approach

- 1.3. Research Attributes

- 1.4. Scope of the Study

- 1.4.1. Market Definition

- 1.4.2. Market Segmentation

- 1.5. Research Assumption

- 1.5.1. Inclusion & Exclusion

- 1.5.2. Limitations

- 1.5.3. Years Considered for the Study

Chapter 2. Executive Summary

- 2.1. CEO/CXO Standpoint

- 2.2. Strategic Insights

- 2.3. ESG Analysis

- 2.4. key Findings

Chapter 3. Global Boring Tools Market Forces Analysis

- 3.1. Market Forces Shaping The Global Boring Tools Market (2024-2035)

- 3.2. Drivers

- 3.2.1. rapid urbanization

- 3.2.2. expanding mining operations

- 3.3. Restraints

- 3.3.1. fluctuations in raw material prices

- 3.4. Opportunities

- 3.4.1. Growing transportation infrastructure

Chapter 4. Global Boring Tools Industry Analysis

- 4.1. Porter's 5 Forces Model

- 4.1.1. Bargaining Power of Buyer

- 4.1.2. Bargaining Power of Supplier

- 4.1.3. Threat of New Entrants

- 4.1.4. Threat of Substitutes

- 4.1.5. Competitive Rivalry

- 4.2. Porter's 5 Force Forecast Model (2024-2035)

- 4.3. PESTEL Analysis

- 4.3.1. Political

- 4.3.2. Economical

- 4.3.3. Social

- 4.3.4. Technological

- 4.3.5. Environmental

- 4.3.6. Legal

- 4.4. Top Investment Opportunities

- 4.5. Top Winning Strategies (2025)

- 4.6. Market Share Analysis (2024-2025)

- 4.7. Global Pricing Analysis And Trends 2025

- 4.8. Analyst Recommendation & Conclusion

Chapter 5. Global Boring Tools Market Size & Forecasts by Application 2025-2035

- 5.1. Market Overview

- 5.2. Global Boring Tools Market Performance - Potential Analysis (2025)

- 5.3. Mining

- 5.3.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 5.3.2. Market size analysis, by region, 2025-2035

- 5.4. Construction

- 5.4.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 5.4.2. Market size analysis, by region, 2025-2035

- 5.5. Oil and Gas

- 5.5.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 5.5.2. Market size analysis, by region, 2025-2035

Chapter 6. Global Boring Tools Market Size & Forecasts by Tool Type 2025-2035

- 6.1. Market Overview

- 6.2. Global Boring Tools Market Performance - Potential Analysis (2025)

- 6.3. Drill Bits

- 6.3.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 6.3.2. Market size analysis, by region, 2025-2035

- 6.4. Reamers

- 6.4.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 6.4.2. Market size analysis, by region, 2025-2035

- 6.5. Boring Machines

- 6.5.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 6.5.2. Market size analysis, by region, 2025-2035

- 6.6. Augers

- 6.6.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 6.6.2. Market size analysis, by region, 2025-2035

Chapter 7. Global Boring Tools Market Size & Forecasts by Material 2025-2035

- 7.1. Market Overview

- 7.2. Global Boring Tools Market Performance - Potential Analysis (2025)

- 7.3. Steel

- 7.3.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 7.3.2. Market size analysis, by region, 2025-2035

- 7.4. Carbide

- 7.4.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 7.4.2. Market size analysis, by region, 2025-2035

- 7.5. High-speed Steel

- 7.5.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 7.5.2. Market size analysis, by region, 2025-2035

- 7.6. Diamond

- 7.6.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 7.6.2. Market size analysis, by region, 2025-2035

Chapter 8. Global Boring Tools Market Size & Forecasts by End Use 2025-2035

- 8.1. Market Overview

- 8.2. Global Boring Tools Market Performance - Potential Analysis (2025)

- 8.3. Residential

- 8.3.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 8.3.2. Market size analysis, by region, 2025-2035

- 8.4. Commercial

- 8.4.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 8.4.2. Market size analysis, by region, 2025-2035

- 8.5. Industrial

- 8.5.1. Top Countries Breakdown Estimates & Forecasts, 2024-2035

- 8.5.2. Market size analysis, by region, 2025-2035

Chapter 9. Global Boring Tools Market Size & Forecasts by Region 2025-2035

- 9.1. Growth Boring Tools Market, Regional Market Snapshot

- 9.2. Top Leading & Emerging Countries

- 9.3. North America Boring Tools Market

- 9.3.1. U.S. Boring Tools Market

- 9.3.1.1. Application breakdown size & forecasts, 2025-2035

- 9.3.1.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.3.1.3. Material breakdown size & forecasts, 2025-2035

- 9.3.1.4. End Use breakdown size & forecasts, 2025-2035

- 9.3.2. Canada Boring Tools Market

- 9.3.2.1. Application breakdown size & forecasts, 2025-2035

- 9.3.2.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.3.2.3. Material breakdown size & forecasts, 2025-2035

- 9.3.2.4. End Use breakdown size & forecasts, 2025-2035

- 9.3.1. U.S. Boring Tools Market

- 9.4. Europe Boring Tools Market

- 9.4.1. UK Boring Tools Market

- 9.4.1.1. Application breakdown size & forecasts, 2025-2035

- 9.4.1.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.4.1.3. Material breakdown size & forecasts, 2025-2035

- 9.4.1.4. End Use breakdown size & forecasts, 2025-2035

- 9.4.2. Germany Boring Tools Market

- 9.4.2.1. Application breakdown size & forecasts, 2025-2035

- 9.4.2.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.4.2.3. Material breakdown size & forecasts, 2025-2035

- 9.4.2.4. End Use breakdown size & forecasts, 2025-2035

- 9.4.3. France Boring Tools Market

- 9.4.3.1. Application breakdown size & forecasts, 2025-2035

- 9.4.3.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.4.3.3. Material breakdown size & forecasts, 2025-2035

- 9.4.3.4. End Use breakdown size & forecasts, 2025-2035

- 9.4.4. Spain Boring Tools Market

- 9.4.4.1. Application breakdown size & forecasts, 2025-2035

- 9.4.4.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.4.4.3. Material breakdown size & forecasts, 2025-2035

- 9.4.4.4. End Use breakdown size & forecasts, 2025-2035

- 9.4.5. Italy Boring Tools Market

- 9.4.5.1. Application breakdown size & forecasts, 2025-2035

- 9.4.5.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.4.5.3. Material breakdown size & forecasts, 2025-2035

- 9.4.5.4. End Use breakdown size & forecasts, 2025-2035

- 9.4.6. Rest of Europe Boring Tools Market

- 9.4.6.1. Application breakdown size & forecasts, 2025-2035

- 9.4.6.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.4.6.3. Material breakdown size & forecasts, 2025-2035

- 9.4.6.4. End Use breakdown size & forecasts, 2025-2035

- 9.4.1. UK Boring Tools Market

- 9.5. Asia Pacific Boring Tools Market

- 9.5.1. China Boring Tools Market

- 9.5.1.1. Application breakdown size & forecasts, 2025-2035

- 9.5.1.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.5.1.3. Material breakdown size & forecasts, 2025-2035

- 9.5.1.4. End Use breakdown size & forecasts, 2025-2035

- 9.5.2. India Boring Tools Market

- 9.5.2.1. Application breakdown size & forecasts, 2025-2035

- 9.5.2.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.5.2.3. Material breakdown size & forecasts, 2025-2035

- 9.5.2.4. End Use breakdown size & forecasts, 2025-2035

- 9.5.3. Japan Boring Tools Market

- 9.5.3.1. Application breakdown size & forecasts, 2025-2035

- 9.5.3.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.5.3.3. Material breakdown size & forecasts, 2025-2035

- 9.5.3.4. End Use breakdown size & forecasts, 2025-2035

- 9.5.4. Australia Boring Tools Market

- 9.5.4.1. Application breakdown size & forecasts, 2025-2035

- 9.5.4.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.5.4.3. Material breakdown size & forecasts, 2025-2035

- 9.5.4.4. End Use breakdown size & forecasts, 2025-2035

- 9.5.5. South Korea Boring Tools Market

- 9.5.5.1. Application breakdown size & forecasts, 2025-2035

- 9.5.5.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.5.5.3. Material breakdown size & forecasts, 2025-2035

- 9.5.5.4. End Use breakdown size & forecasts, 2025-2035

- 9.5.6. Rest of APAC Boring Tools Market

- 9.5.6.1. Application breakdown size & forecasts, 2025-2035

- 9.5.6.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.5.6.3. Material breakdown size & forecasts, 2025-2035

- 9.5.6.4. End Use breakdown size & forecasts, 2025-2035

- 9.5.1. China Boring Tools Market

- 9.6. Latin America Boring Tools Market

- 9.6.1. Brazil Boring Tools Market

- 9.6.1.1. Application breakdown size & forecasts, 2025-2035

- 9.6.1.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.6.1.3. Material breakdown size & forecasts, 2025-2035

- 9.6.1.4. End Use breakdown size & forecasts, 2025-2035

- 9.6.2. Mexico Boring Tools Market

- 9.6.2.1. Application breakdown size & forecasts, 2025-2035

- 9.6.2.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.6.2.3. Material breakdown size & forecasts, 2025-2035

- 9.6.2.4. End Use breakdown size & forecasts, 2025-2035

- 9.6.1. Brazil Boring Tools Market

- 9.7. Middle East and Africa Boring Tools Market

- 9.7.1. UAE Boring Tools Market

- 9.7.1.1. Application breakdown size & forecasts, 2025-2035

- 9.7.1.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.7.1.3. Material breakdown size & forecasts, 2025-2035

- 9.7.1.4. End Use breakdown size & forecasts, 2025-2035

- 9.7.2. Saudi Arabia (KSA) Boring Tools Market

- 9.7.2.1. Application breakdown size & forecasts, 2025-2035

- 9.7.2.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.7.2.3. Material breakdown size & forecasts, 2025-2035

- 9.7.2.4. End Use breakdown size & forecasts, 2025-2035

- 9.7.3. South Africa Boring Tools Market

- 9.7.3.1. Application breakdown size & forecasts, 2025-2035

- 9.7.3.2. Tool Type breakdown size & forecasts, 2025-2035

- 9.7.3.3. Material breakdown size & forecasts, 2025-2035

- 9.7.3.4. End Use breakdown size & forecasts, 2025-2035

- 9.7.1. UAE Boring Tools Market

Chapter 10. Competitive Intelligence

- 10.1. Top Market Strategies

- 10.2. Sandvik AB

- 10.2.1. Company Overview

- 10.2.2. Key Executives

- 10.2.3. Company Snapshot

- 10.2.4. Financial Performance (Subject to Data Availability)

- 10.2.5. Product/Services Port

- 10.2.6. Recent Development

- 10.2.7. Market Strategies

- 10.2.8. SWOT Analysis

- 10.3. Caterpillar Inc.

- 10.4. Komatsu Ltd.

- 10.5. Atlas Copco AB

- 10.6. Kennametal Inc.

- 10.7. Hilti Corporation

- 10.8. Bosch Rexroth AG

- 10.9. Epiroc AB

- 10.10. Stanley Black & Decker, Inc.

- 10.11. Ingersoll Rand Inc.

- 10.12. Makita Corporation

- 10.13. Metso Corporation

- 10.14. Hitachi Construction Machinery Co., Ltd.

- 10.15. Liebherr Group

- 10.16. Doosan Corporation