|

시장보고서

상품코드

1538938

베트남의 황산염 펄프 수입 보고서(2024-2033년)Vietnam Sulphate Pulp Import Research Report 2024-2033 |

||||||

인포그래픽스

황산염 펄프(크라프트 펄프, Sulphate Pulp)는 탁월한 물리적 및 화학적 특성으로 인해 세계 종이 펄프 산업에서 중요한 지위를 차지하며 특히 높은 종이의 강도와 내구성이 요구되는 용도에 사용됩니다. 아시아 태평양의 주요 생산자로는 Chenming Paper나 Asia Pacific Resources International Limited(APRIL) 등이 있으며, 전 세계적인 생산자로는 UPM,Stora Enso, International Paper, Canfor Pulp 등이 있습니다. 베트남의 황산염 펄프 생산 능력은 제한되어 있으며 매년 대량으로 수입해야합니다.

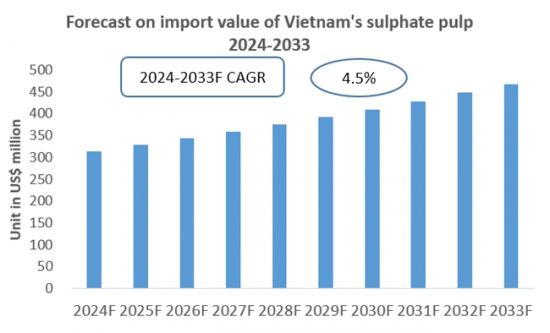

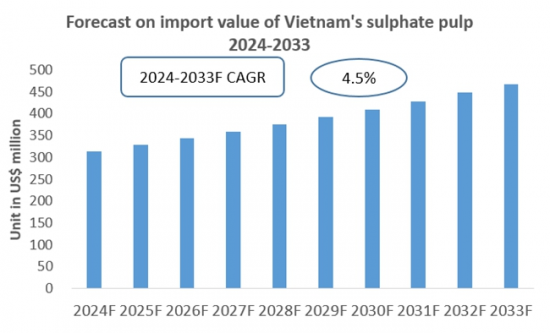

최근 동향에서 베트남 제조업은 급속히 발전하고 있으며, 제지산업과 그 강하 분야인 포장, 인쇄, 광고 등은 시장 확대 가능성을 지니고 있습니다. CRI에 따르면 베트남은 연간 300만 톤 이상의 종이를 소비하고 있으며, 그 중 포장용지는 60% 이상을 차지하고 있습니다. 향후 수년간 베트남 경제와 제조업의 발전에 따라 다양한 종이, 특히 포장지에 대한 수요가 지속적으로 증가하고 황산염 펄프 수입량이 증가할 전망입니다.

CRI에 따르면 베트남은 국내 제지 원료의 상당한 부족에 직면하고 있으며 수입에 크게 의존하고 있습니다. 베트남의 대부분의 제지 공장은 생산 수요를 충족시키기 위해 펄프를 수입해야 하며, 베트남은 연간 50만 톤 이상의 펄프를 수입하고 있습니다. CRI 데이터에 따르면 2023년 베트남 황산염 펄프의 수입 총액은 약 3억 달러를 기록했습니다. 또한 이 데이터에 의하면 2024년 1월부터 5월에 걸친 수입 총액은 1억 달러를 넘어 시장 수요는 계속 증가하고 있습니다.

베트남의 황산염 펄프(Sulphate Pulp) 수입 동향을 조사했으며, 국가 개요/수입액·수입량·수입 가격 추이·예측/수입원 상위 국가별 상세 분석/주요 구매자 및 공급자 분석/수출에 대한 주요 영향요인 분석 등을 정리했습니다.

목차

제1장 베트남 개요

- 지역

- 경제 상황

- 인구통계

- 국내 시장

- 펄프, 제지, 종이 제품 시장에 진입하는 외국 기업에 대한 추천 사항

제2장 베트남의 황산염 펄프 수입 분석(2021-2024년)

- 수입규모

- 수입액·수입량

- 수입가격

- 소비량

- 수입 의존도

- 수입의 주요 공급원

제3장 베트남의 황산염 펄프 주요 공급 국가 분석(2021-2024년)

- 인도네시아

- 수입액·수입량 분석

- 평균 수입 가격 분석

- 미국

- 수입액·수입량 분석

- 평균 수입 가격 분석

- 홍콩

- 수입액·수입량 분석

- 평균 수입 가격 분석

- 캐나다

- 브라질

- 일본

제4장 베트남의 황산염 펄프 수입 시장 주요 공급자 분석(2021-2024년)

- Asia Pulp & Paper(APP)

- EKMAN PULP AND PAPER LIMITED

- APRIL Group

제5장 베트남의 황산염 펄프 수입 시장 주요 수입업체 분석(2021-2024년)

- BACGIANG IMPORT-EXPORT JOINT STOCK COMPANY

- NITTOKU VIETNAM CO, LTD.

- IMEXCO BACGIANG

제6장 베트남의 황산염 펄프 수입 월별 분석(2021-2024년)

- 월별 수입액·수입량 분석

- 월평균 수입가격 예측

제7장 베트남의 황산염 펄프 수입에 영향을 미치는 주요 요인

- 정책

- 현재 수입정책

- 수입 정책의 동향 예측

- 경제

- 시장 가격

- 황산염 펄프 생산 능력의 성장 동향

- 기술

제8장 베트남의 황산염 펄프 수입 예측(2024-2033년)

LYJSulphate pulp, also known as kraft pulp, is a type of chemical pulp produced using the Sulphate process. It is the most widely used and highest-yielding pulp globally. Sulphate pulp is characterized by its high strength, durability, resistance to aging, bleachability, and strong chemical resistance, as well as its wide range of raw material sources. It is used to manufacture high-strength and high-requirement paper products, including kraft paper, paper bags, packaging paper, corrugated cardboard, and cultural paper.

INFOGRAPHICS

Due to its superior physical and chemical properties, sulphate pulp holds a significant position in the global pulp and paper industry, especially for applications requiring high paper strength and durability. Major producers in the Asia-Pacific region include companies such as Chenming Paper and Asia Pacific Resources International Limited (APRIL), while global producers include UPM, Stora Enso, International Paper, and Canfor Pulp. Vietnam has limited sulphate pulp production capacity and needs to import large quantities annually.

In recent years, Vietnam's manufacturing industry has developed rapidly, with the paper industry and its downstream sectors, such as packaging, printing, and advertising, showing considerable market expansion potential. According to CRI, Vietnam consumes over 3 million tons of paper annually, with packaging paper accounting for more than 60%. In the coming years, with the development of Vietnam's economy and manufacturing sectors, the demand for various types of paper, especially packaging paper, will continue to grow, leading to an increase in the import volume of sulphate pulp.

According to CRI, Vietnam faces a significant shortage of domestic raw materials for papermaking, heavily relying on imports. Most paper mills in Vietnam need to import pulp to meet production needs, leading to Vietnam importing more than 500,000 tons of pulp annually. The data of CRI indicates that in 2023, Vietnam's total import value of Sulphate pulp was about US$ 300 million. CRI data also shows that from January to May 2024, Vietnam's total import value of Sulphate pulp has exceeded US$ 100 million, with market demand continuing to grow.

CRI concludes that the main sources of Vietnam's Sulphate pulp imports from 2021 to 2024 include Indonesia, the United States, and Hong Kong. Key exporters of Sulphate pulp to Vietnam include Asia Pulp & Paper (APP), EKMAN PULP AND PAPER LIMITED, and APRIL Group.

The primary importers of sulphate pulp in Vietnam are paper and paper product manufacturers, distributors, and foreign trading companies, primarily foreign-invested enterprises. Many are subsidiaries of multinational companies in the paper industry. CRI identifies that major importer of sulphate pulp in Vietnam includes BACGIANG IMPORT - EXPORT JOINT STOCK COMPANY, NITTOKU VIETNAM CO, LTD., and IMEXCO BACGIANG.

Overall, with Vietnam's population growth and continued advancement of related manufacturing industries, the consumption of sulphate pulp in Vietnam will continue to increase. CRI suggests that in the long term, reducing plastic waste is becoming a global trend, especially in major economies. The sustainable and environmentally friendly trend of replacing plastic waste and plastic bags with paper packaging is growing across all age groups, particularly among young people. Therefore, the market demand for the global and Asian paper and paper products industry is expected to grow continuously. In the coming years, the import of sulphate pulp in Vietnam is expected to maintain its growth trend.

Topics covered:

The Import and Export of Sulphate Pulp in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Sulphate Pulp in Vietnam (2021-2024)

Total Import Value and Percentage Change of Sulphate Pulp in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Sulphate Pulp in Vietnam (January-May 2024)

Total Import Value and Percentage Change of Sulphate Pulp in Vietnam (January-May 2024)

Average Import Price of Sulphate Pulp in Vietnam (2021-2024)

Top 10 Sources of Sulphate Pulp Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Sulphate Pulp in Vietnam and Their Supply Volume

Top 10 Importers of Sulphate Pulp in Vietnam and Their Import Volume

How to Find Distributors and End Users of Sulphate Pulp in Vietnam

How Foreign Enterprises Enter the Pulp, Paper and Paper Products Market of Vietnam

Forecast for the Import of Sulphate Pulp in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Pulp, Paper and Paper Products Market

2 Analysis of Sulphate Pulp Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Sulphate Pulp in Vietnam

- 2.1.1 Import Value and Volume of Sulphate Pulp in Vietnam

- 2.1.2 Import Prices of Sulphate Pulp in Vietnam

- 2.1.3 Apparent Consumption of Sulphate Pulp in Vietnam

- 2.1.4 Import Dependency of Sulphate Pulp in Vietnam

- 2.2 Major Sources of Sulphate Pulp Imports in Vietnam

3 Analysis of Major Sources of Sulphate Pulp Imports in Vietnam (2021-2024)

- 3.1 Indonesia

- 3.1.1 Analysis of Import Value and Volume

- 3.1.2 Analysis of Average Import Price

- 3.2 United States

- 3.2.1 Analysis of Import Value and Volume

- 3.2.2 Analysis of Average Import Price

- 3.3 Hong Kong

- 3.3.1 Analysis of Import Value and Volume

- 3.3.2 Analysis of Average Import Price

- 3.4 Canada

- 3.5 Brazil

- 3.6 Japan

4 Analysis of Major Suppliers in the Import Market of Sulphate Pulp in Vietnam (2021-2024)

- 4.1 Asia Pulp & Paper (APP)

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.2 EKMAN PULP AND PAPER LIMITED

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.3 APRIL Group

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Sulphate Pulp Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Sulphate Pulp Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Sulphate Pulp in Vietnam (2021-2024)

- 5.1 BACGIANG IMPORT - EXPORT JOINT STOCK COMPANY

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Sulphate Pulp Imports

- 5.2 NITTOKU VIETNAM CO, LTD.

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Sulphate Pulp Imports

- 5.3 IMEXCO BACGIANG

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Sulphate Pulp Imports

- 5.4 Importer 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Sulphate Pulp Imports

- 5.5 Importer 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Sulphate Pulp Imports

- 5.6 Importer 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Sulphate Pulp Imports

- 5.7 Importer 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Sulphate Pulp Imports

- 5.8 Importer 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Sulphate Pulp Imports

- 5.9 Importer 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Sulphate Pulp Imports

- 5.10 Importer 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Sulphate Pulp Imports

6. Monthly Analysis of Sulphate Pulp Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Sulphate Pulp Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Sulphate Pulp Production Capacity in Vietnam

- 7.3 Technology

8. Forecast for the Import of Sulphate Pulp in Vietnam, 2024-2033

Disclaimer

Service Guarantees