|

시장보고서

상품코드

1597613

베트남의 코크스 및 세미 코크스 수입(2024-2033년)Vietnam Coke & Semi-coke Import Research Report 2024-2033 |

||||||

인포그래픽

베트남의 코크스 및 세미 코크스 시장 규모는 철강산업의 성장과 함께 꾸준히 증가하고 있습니다.

세계의 주요 석탄 생산국은 중국, 인도, 러시아, 호주 등 석탄이 풍부한 국가이며, 코크스 산업은 석탄 자원에 크게 의존하고 있기 때문에 이들 국가에서 수출하는 경우가 많습니다. 베트남에도 석탄 자원이 있지만 고품질 원료탄과 첨단 생산 기술이 없기 때문에 국내 철강 및 산업 수요를 충족시키기 위해 주로 수입에 의존하고 있습니다. 베트남의 철강 산업이 빠르게 성장함에 따라 고로용 고품질 코크스에 대한 수요가 증가하고 있지만 국내 생산이 어렵기 때문에 베트남 시장은 수입에 크게 의존하고 있습니다.

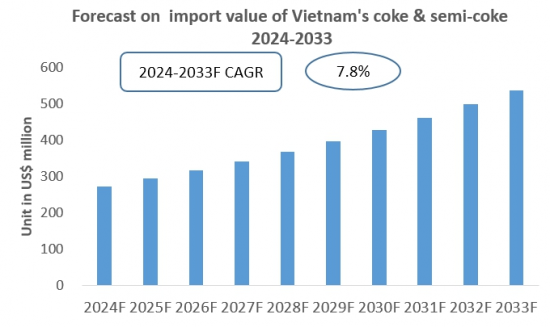

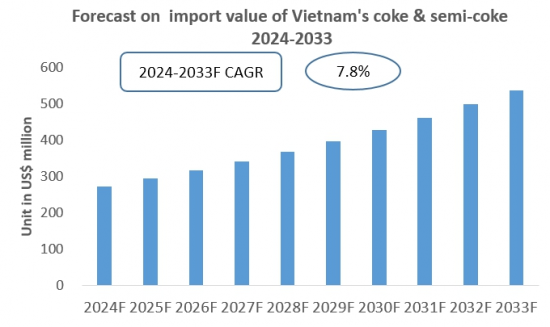

2023년 베트남의 코크스 및 세미 코크스 수입 총액은 약 2억 5,000만 달러에 달했으며 2024년 1월부터 8월까지 베트남의 코크스 및 세미 코크스 수입액은 거의 2억 달러에 달해 전년 동기 대비 약 9% 증가하였습니다. 베트남의 코크스 및 세미 코크스 시장은 앞으로도 계속 성장할 것으로 예상됩니다.

전체적으로 베트남의 경제 성장, 산업화 발전, 지속적인 인프라 구축으로 인해 베트남의 코크스 및 세미 코크스 수요는 향후 몇 년 동안 계속 증가할 것으로 예상됩니다. 이러한 수요에 따라 베트남의 코크스 및 세미 코크스 수입도 증가할 것으로 예상됩니다.

이 보고서는 베트남의 코크스 및 세미 코크스 수입 동향을 조사하여 국가 개요, 수입액, 수입량, 수입가격 등의 추이 및 전망, 주요 수입국별 상세 분석, 주요 바이어 및 공급업체 분석, 주요 영향요인 분석 등을 정리하였습니다.

목차

제1장 베트남의 개요

- 지역

- 경제 상황

- 인구통계

- 국내 시장

- 수입 시장에 참여하는 외국 기업에 대한 추천사항

제2장 베트남의 코크스 및 세미 코크스 수입 분석(2021-2024년)

- 수입 규모

- 수입액와 수입량

- 수입 가격

- 소비량

- 수입 의존도

- 주요 수입원

제3장 베트남의 코크스 및 세미 코크스의 주요 수입원 분석(2021-2024년)

- 중국

- 수입량·수입액 분석

- 평균 수입 가격 분석

- 일본

- 수입량·수입액 분석

- 평균 수입 가격 분석

- 싱가포르

- 수입량·수입액 분석

- 평균 수입 가격 분석

- 인도네시아

- 홍콩

- 스위스

제4장 베트남의 코크스 및 세미 코크스 수입 시장의 주요 공급업체 분석(2021-2024년)

- SUMMIT CRM LTD

- DAICHU CORP

- TRAFIGURA PTE LTD

- 기타

- 기업 개요

- 코크스 및 세미 코크스 수출 분석

제5장 베트남의 코크스 및 세미 코크스 수입 시장의 주요 수입업체 분석(2021-2024년)

- NHA MAY LUYEN PHOI THEP CHI NHANH CONG TY CO PHAN THEP POMINA

- VIET PHAT IMPORT EXPORT TRADING INVESTMENT JSC

- TRUNG THANH(VN) PTE

- 기타

- 기업 개요

- 코크스 및 세미 코크스 수입 분석

제6장 베트남의 코크스 및 세미 코크스 수입 월간 분석(2021-2024년)

- 월별 수입액·수입량 분석

- 월평균 수입 가격 예측

제7장 베트남의 코크스 및 세미 코크스 수입에 영향을 미치는 주요 요인

- 정책

- 현재 수입 정책

- 수입 정책 동향 예측

- 경제

- 시장 가격

- 생산능력 성장 동향

- 기술

제8장 베트남의 코크스 및 세미 코크스 수입 예측 : 2024-2033년

ksm 24.12.06Coke and semi-coke are solid carbonaceous products obtained through the carbonization or pyrolysis of coal at high temperatures. Coke is primarily used in the steel industry as a fuel and reducing agent in blast furnaces, while semi-coke is often used in energy production or the chemical industry. Unlike other coal products, coke is valued for its low sulfur content, high fixed carbon, and low volatile matter, which allow it to provide stable heat and excellent mechanical strength at high temperatures.

INFOGRAPHICS

The coke industry relies on upstream sectors such as the extraction and processing of high-quality coking coal, while downstream applications include steelmaking, foundries, and chemical industries. Coke is essential in steelmaking, as it helps reduce iron ore into iron in blast furnaces and is also used in producing chemical products like calcium carbide and syngas. Semi-coke, with lower density and volatile matter, is typically used in power stations as a fuel or in gas production. The coke market fluctuates with changes in global steel demand and energy industry conditions. According to CRI, Vietnam's coke and semi-coke market size has been steadily increasing alongside its growing steel industry.

Major global producers are located in coal-rich countries such as China, India, Russia, and Australia, and exporters often come from these countries due to the coke industry's heavy reliance on coal resources. Although Vietnam has coal resources, it lacks high-quality coking coal and advanced production technology, relying primarily on imports to meet domestic steel and industrial needs. CRI reports that, with Vietnam's rapidly expanding steel industry, there is a growing demand for high-quality metallurgical coke for blast furnace use, which cannot be locally produced, making the Vietnamese market highly dependent on imports.

CRI data shows that in 2023, Vietnam's total coke and semi-coke imports reached approximately USD 250 million. From January to August 2024, Vietnam's coke and semi-coke imports had nearly reached USD 200 million, an increase of about 9% over the same period in the previous year. CRI forecasts that Vietnam's coke and semi-coke market will continue growing in the coming years.

Based on CRI analysis, between 2021 and 2024, Vietnam's primary sources for coke and semi-coke imports have included China, Japan, and Singapore, with major suppliers such as Summit CRM Ltd, Daichu Corp, and Trafigura Pte Ltd. The main Vietnamese importers of coke and semi-coke are steel industry manufacturers and distributors, with major companies including Nha may luyen phoi thep (a branch of Pomina Steel Corporation), Viet Phat Import Export Trading Investment JSC, and Trung Thanh (VN) Pte, according to CRI.

Overall, with Vietnam's economic growth, advancing industrialization, and ongoing infrastructure improvements, the country's demand for coke and semi-coke is projected to continue expanding over the next few years. CRI expects Vietnam's imports of coke and semi-coke to increase in response to this demand.

Topics covered:

The Import and Export of Coke & Semi-coke in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Coke & Semi-coke in Vietnam (2021-2024)

Total Import Value and Percentage Change of Coke & Semi-coke in Vietnam (2021-2024)

Total Import Volume and Percentage Change of Coke & Semi-coke in Vietnam (2024)

Total Import Value and Percentage Change of Coke & Semi-coke in Vietnam (2024)

Average Import Price of Coke & Semi-coke in Vietnam (2021-2024)

Top 10 Sources of Coke & Semi-coke Imports in Vietnam and Their Supply Volume

Top 10 Suppliers in the Import Market of Coke & Semi-coke in Vietnam and Their Supply Volume

Top 10 Importers of Coke & Semi-coke in Vietnam and Their Import Volume

How to Find Distributors and End Users of Coke & Semi-coke in Vietnam

How Foreign Enterprises Enter the Coke & Semi-coke Market of Vietnam

Forecast for the Import of Coke & Semi-coke in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

- 1.1 Geography of Vietnam

- 1.2 Economic Condition of Vietnam

- 1.3 Demographics of Vietnam

- 1.4 Domestic Market of Vietnam

- 1.5 Recommendations for Foreign Enterprises Entering the Vietnam Coke & Semi-coke Imports Market

2 Analysis of Coke & Semi-coke Imports in Vietnam (2021-2024)

- 2.1 Import Scale of Coke & Semi-coke in Vietnam

- 2.1.1 Import Value and Volume of Coke & Semi-coke in Vietnam

- 2.1.2 Import Prices of Coke & Semi-coke in Vietnam

- 2.1.3 Apparent Consumption of Coke & Semi-coke in Vietnam

- 2.1.4 Import Dependency of Coke & Semi-coke in Vietnam

- 2.2 Major Sources of Coke & Semi-coke Imports in Vietnam

3 Analysis of Major Sources of Coke & Semi-coke Imports in Vietnam (2021-2024)

- 3.1 China

- 3.1.1 Analysis of Vietnam's Coke & Semi-coke Import Volume and Value from China

- 3.1.2 Analysis of Average Import Price

- 3.2 Japan

- 3.2.1 Analysis of Vietnam's Coke & Semi-coke Import Volume and Value from Japan

- 3.2.2 Analysis of Average Import Price

- 3.3 Singapore

- 3.3.1 Analysis of Vietnam's Coke & Semi-coke Import Volume and Value from Singapore

- 3.3.2 Analysis of Average Import Price

- 3.4 Indonesia

- 3.5 Hong Kong

- 3.6 Switzerland

4 Analysis of Major Suppliers in the Import Market of Coke & Semi-coke in Vietnam (2021-2024)

- 4.1 SUMMIT CRM LTD

- 4.1.1 Company Introduction

- 4.1.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.2 DAICHU CORP

- 4.2.1 Company Introduction

- 4.2.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.3 TRAFIGURA PTE LTD

- 4.3.1 Company Introduction

- 4.3.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.4 Exporter 4

- 4.4.1 Company Introduction

- 4.4.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.5 Exporter 5

- 4.5.1 Company Introduction

- 4.5.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.6 Exporter 6

- 4.6.1 Company Introduction

- 4.6.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.7 Exporter 7

- 4.7.1 Company Introduction

- 4.7.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.8 Exporter 8

- 4.8.1 Company Introduction

- 4.8.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.9 Exporter 9

- 4.9.1 Company Introduction

- 4.9.2 Analysis of Coke & Semi-coke Exports to Vietnam

- 4.10 Exporter 10

- 4.10.1 Company Introduction

- 4.10.2 Analysis of Coke & Semi-coke Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Coke & Semi-coke in Vietnam (2021-2024)

- 5.1 NHA MAY LUYEN PHOI THEP CHI NHANH CONG TY CO PHAN THEP POMINA

- 5.1.1 Company Introduction

- 5.1.2 Analysis of Coke & Semi-coke Imports

- 5.2 VIET PHAT IMPORT EXPORT TRADING INVESTMENT JSC

- 5.2.1 Company Introduction

- 5.2.2 Analysis of Coke & Semi-coke Imports

- 5.3 TRUNG THANH(VN) PTE

- 5.3.1 Company Introduction

- 5.3.2 Analysis of Coke & Semi-coke Imports

- 5.4 Importer 4

- 5.4.1 Company Introduction

- 5.4.2 Analysis of Coke & Semi-coke Imports

- 5.5 Importer 5

- 5.5.1 Company Introduction

- 5.5.2 Analysis of Coke & Semi-coke Imports

- 5.6 Importer 6

- 5.6.1 Company Introduction

- 5.6.2 Analysis of Coke & Semi-coke Imports

- 5.7 Importer 7

- 5.7.1 Company Introduction

- 5.7.2 Analysis of Coke & Semi-coke Imports

- 5.8 Importer 8

- 5.8.1 Company Introduction

- 5.8.2 Analysis of Coke & Semi-coke Imports

- 5.9 Importer 9

- 5.9.1 Company Introduction

- 5.9.2 Analysis of Coke & Semi-coke Imports

- 5.10 Importer 10

- 5.10.1 Company Introduction

- 5.10.2 Analysis of Coke & Semi-coke Imports

6. Monthly Analysis of Coke & Semi-coke Imports in Vietnam from 2021 to 2024

- 6.1 Analysis of Monthly Import Value and Volume

- 6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Coke & Semi-coke Imports in Vietnam

- 7.1 Policy

- 7.1.1 Current Import Policies

- 7.1.2 Trend Predictions for Import Policies

- 7.2 Economic

- 7.2.1 Market Prices

- 7.2.2 Growth Trends of Coke & Semi-coke Production Capacity in Vietnam

- 7.3 Technology