|

시장보고서

상품코드

1684844

비타민 B12 원료 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Vitamin B12 ingredient Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

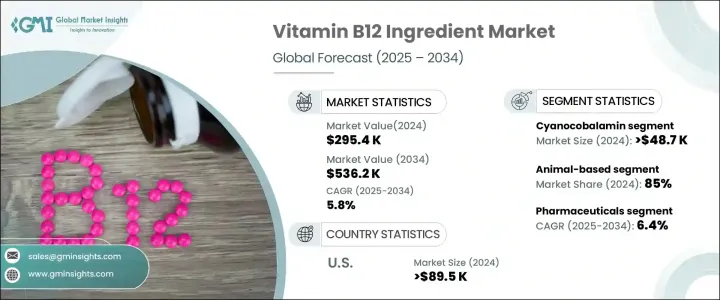

세계의 비타민 B12 원료 시장은 2024년에 29만 5,400달러로 평가되었고, 2025년부터 2034년까지 5.8%의 견조한 CAGR로 성장할 것으로 예측되고 있습니다.

소비자의 건강 지향이 높아짐에 따라 비타민 및 미네랄의 전신 건강 유지에 이르는 중요한 역할에 대한 인식이 높아지고 있으며, 비타민 B12와 같은 필수 영양소 수요를 크게 밀어 올리고 있습니다. 또한 비타민 B12의 천연 공급원이 부족하기 쉬운 식물성 식품과 채식주의자로의 세계 변화는 강화 식품과 영양 보조 식품에 대한 수요를 강화하고 있습니다. 이러한 식습관 변화와 건강 의식의 고조에 따라 비타민 B12는 세계 식품 및 영양 보조 식품의 주요 성분으로 자리매김하고 있습니다.

채식주의자 및 채식 증가와 함께 식물 기반의 식사가 선호되고 비타민 B12가 영양 부족을 보완하는 데 더 큰 역할을 할 기회가 탄생했습니다. 특히 도시화된 지역에서는 많은 사람들이 매일 영양 보충에 강화 식품을 도입하고 있습니다. 또한 소비자가 영양 요구를 충족시키는 편리한 방법을 찾고 있기 때문에 비타민 B12 보충제 수요도 크게 증가하고 있습니다. 이러한 요인은 비타민 B12 강화 제품에 대한 접근성 향상과 함께 향후 10년간 시장 확대를 계속 견인할 것으로 예상됩니다.

| 시장 규모 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 295,400달러 |

| 예측 금액 | 53만 6,200달러 |

| CAGR | 5.8% |

2024년 시아노코발라민 부문은 4만 8,700달러를 창출해 시장에서 가장 중요한 비타민 B12 중 하나로 자리를 굳혔습니다. 시아노코발라민은 합리적인 가격, 긴 보존 기간, 대량 생산의 용이성으로 제조업체에 의해 지원됩니다. 이러한 요인은 식품 및 보충 산업에서 널리 채택되었습니다. 게다가, 보존이나 수송중에 안정된 성질을 갖고, 비용대비 효과도 높기 때문에 강화 목적의 비타민 B12로서 가장 보급되고 있습니다.

시장은 여전히 동물 유래 공급원에 크게 의존하고 있으며, 2024년 비타민 B12 원료 시장 점유율 전체의 85%를 차지했습니다. 이 부문은 비타민 B12의 주요 공급원으로 고기, 유제품 및 계란을 전통적으로 사용해 온 혜택을 받았습니다. 이러한 동물성 식품은 우유, 요구르트, 고기와 같은 주식의 강화에 필수적인 역할을 하며, 다양한 집단에서 일반적으로 소비되고 있습니다. 식물 유래의 식생활의 인기가 높아지고 있음에도 불구하고, 동물 유래 비타민 B12는 기존 식생활에서의 오랜 존재와 식품 강화에 있어서 필수적인 역할에 의해 여전히 지배적인 지위를 차지하고 있습니다.

미국에서는 건강과 웰빙 제품에 대한 소비자 수요의 급증에 견인해 비타민 B12 원료 시장은 2024년에 8만 9,500달러를 창출했습니다. 영양 보조 식품과 강화 식품의 인기가 높아짐에 따라 북미 시장의 성장이 더욱 가속화되고 있습니다. 적절한 영양 섭취의 이점에 대한 인식이 높아지고 있는 소비자는 비타민 B12를 풍부하게 포함하는 식품과 보충제를 우선적으로 섭취하고 있으며, 미국은 세계적으로 가장 유리한 시장의 하나가 되고 있습니다. 건강지향이 높은 사람들의 비율이 높은 이 지역에서는 향후 수년간 비타민 B12를 풍부하게 함유한 제품에 대한 지속적인 수요가 예상됩니다.

목차

제1장 조사 방법 및 조사 범위

- 시장 범위 및 정의

- 기본 추정 및 계산

- 예측 계산

- 데이터 소스

- 1차 데이터

- 2차 데이터

- 유료 정보원

- 공적 정보원

제2장 주요 요약

제3장 산업 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 변혁

- 장래 전망

- 제조업체

- 유통업체

- 공급자의 상황

- 이익률 분석

- 주요 뉴스 및 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 강화 식품에 대한 수요 증가

- 비타민 B12 결핍증의 유행

- 건강 지향 증가

- 제약산업 확대

- 산업의 잠재적 리스크 및 과제

- 비타민 B12 원료

- 품질관리 및 순도

- 규제 준수

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 규모 및 예측 : 형태별(2021-2034년)

- 주요 동향

- 시아노코발라민

- 메틸코발라민

- 히드록소코발라민

- 아데노실코발라민

제6장 시장 규모 및 예측 : 공급원별(2021-2034년)

- 주요 동향

- 동물 유래

- 식물 유래

제7장 시장 규모 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 의약품

- 영양보조식품

- 의약품

- 음식

- 강화 식품

- 에너지 음료 및 샷

- 유아용 조제 분유

- 화장품 및 퍼스널케어

- 스킨 케어 제품

- 헤어 케어 제품

- 경구 케어 제품

- 동물사료 및 영양

제8장 시장 규모 및 예측 : 최종 용도 산업별(2021-2034년)

- 주요 동향

- 인간 영양

- 동물 영양

제9장 시장 규모 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Adisseo

- BASF SE

- DSM Nutritional Products

- Gnosis by Lesaffre

- Jubilant Life Sciences

- Lonza

- Merck KGaA

- NOW Foods

- NutraGenesis

- Nutrilo

- Pharmavit

- Rousselot

- Spectrum Chemical Manufacturing

- Thermo Fisher Scientific

- Zhejiang Shengda Bio-Pharm

The Global Vitamin B12 Ingredient Market was valued at USD 295.4 thousand in 2024 and is projected to grow at a robust CAGR of 5.8% from 2025 to 2034. As consumers become increasingly health-conscious, there is a rising awareness of the critical role vitamins and minerals play in maintaining overall well-being, which has significantly boosted the demand for essential nutrients like Vitamin B12. Additionally, the global shift towards plant-based and vegan diets, which often lack natural sources of Vitamin B12, has intensified the demand for fortified foods and dietary supplements. This growing shift in dietary habits, combined with increasing health awareness, is positioning Vitamin B12 as a key ingredient in food and supplements across the world.

The growing preference for plant-based diets, coupled with a rise in the number of vegans and vegetarians, has created an opportunity for Vitamin B12 to play a larger role in supplementing nutrient deficiencies. Many people, especially in urbanized regions, are incorporating fortified foods into their daily nutrition regimen. The market is also witnessing a significant increase in demand for Vitamin B12 supplements, as consumers are looking for convenient ways to ensure they meet their nutritional needs. These factors, combined with greater access to Vitamin B12-enriched products, are expected to continue driving the market's expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $295.4 Thousand |

| Forecast Value | $536.2 Thousand |

| CAGR | 5.8% |

In 2024, the cyanocobalamin segment generated USD 48.7 thousand, solidifying its position as one of the most crucial forms of Vitamin B12 in the market. Cyanocobalamin is favored by manufacturers due to its affordability, long shelf life, and ease of large-scale production. These factors contribute to its widespread adoption across the food and supplement industries. Moreover, its stable nature during storage and transportation, along with its cost-effectiveness, has solidified its status as the most popular form of Vitamin B12 for fortification purposes.

The market remains heavily reliant on animal-based sources, which accounted for 85% of the total Vitamin B12 ingredient market share in 2024. This segment benefits from the traditional use of meat, dairy, and eggs as primary sources of Vitamin B12. These animal-based products play an integral role in fortifying staple foods such as milk, yogurt, and meat, which are commonly consumed across diverse populations. Despite the increasing popularity of plant-based diets, animal-derived Vitamin B12 remains a dominant player due to its long-standing presence in conventional dietary habits and its essential role in food fortification.

In the U.S., the Vitamin B12 ingredient market generated USD 89.5 thousand in 2024, driven by a surge in consumer demand for health and wellness products. The growing popularity of dietary supplements and fortified foods is further accelerating market growth in North America. Consumers, increasingly aware of the benefits of proper nutrition, continue to prioritize foods and supplements rich in Vitamin B12, making the U.S. one of the most lucrative markets globally. With a high percentage of health-conscious individuals, the region is expected to see sustained demand for Vitamin B12-rich products in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for fortified foods

- 3.6.1.2 Prevalence of Vitamin B12 deficiency

- 3.6.1.3 Rising health & wellness consciousness

- 3.6.1.4 Expanding pharmaceutical industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Vitamin B12 ingredient

- 3.6.2.2 Quality control and purity

- 3.6.2.3 Regulatory compliance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Thousand) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cyanocobalamin

- 5.3 Methylcobalamin

- 5.4 Hydroxocobalamin

- 5.5 Adenosylcobalamin

Chapter 6 Market Size and Forecast, By Source, 2021-2034 (USD Thousand) (Kilo Tons)

- 6.1 Key trends

- 6.2 Animal-Based

- 6.3 Plant-Based

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Thousand) (Kilo Tons)

- 7.1 Key trends

- 7.2 Pharmaceuticals

- 7.3 Dietary supplements

- 7.4 Medications

- 7.5 Food and beverages

- 7.6 Fortified foods

- 7.7 Energy drinks and shots

- 7.8 Infant formula

- 7.9 Cosmetics and personal care

- 7.10 Skin care products

- 7.11 Hair care products

- 7.12 Oral care products

- 7.13 Animal feed and nutrition

Chapter 8 Market Size and Forecast, By End-Use Industries, 2021-2034 (USD Thousand) (Kilo Tons)

- 8.1 Key trends

- 8.2 Human nutrition

- 8.3 Animal nutrition

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Thousand) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adisseo

- 10.2 BASF SE

- 10.3 DSM Nutritional Products

- 10.4 Gnosis by Lesaffre

- 10.5 Jubilant Life Sciences

- 10.6 Lonza

- 10.7 Merck KGaA

- 10.8 NOW Foods

- 10.9 NutraGenesis

- 10.10 Nutrilo

- 10.11 Pharmavit

- 10.12 Rousselot

- 10.13 Spectrum Chemical Manufacturing

- 10.14 Thermo Fisher Scientific

- 10.15 Zhejiang Shengda Bio-Pharm