|

시장보고서

상품코드

1755391

선박 왕복동 엔진 시장 : 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Marine Reciprocating Engine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

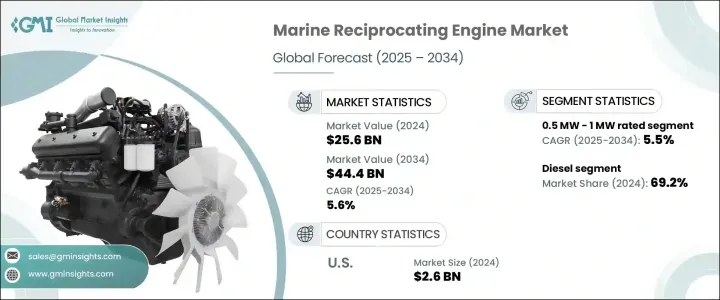

선박 왕복동 엔진 세계 시장 규모는 2024년에 256억 달러에 달했고, CAGR 5.6%로 성장하여 2034년까지는 444억 달러에 이를 것으로 예측됩니다.

이 성장의 원동력은 세계의 배출 규제의 엄격화와 비용과 이용가능성에 따라 연료의 유형을 이동할 수 있는 연료 유연성 시스템에 대한 수요가 증가하고 있습니다.

또한 개발 도상국의 항만 인프라의 확대가 해상 교통량을 증가시키고 있으며, 효율적이고 환경에 적합한 파워 솔루션에 대한 요구가 높아지고 있습니다. 시스템의 신뢰성과 가동률을 높일 수 있습니다. 제조업체 각 사는 소형 선박, 해양 지원 선박, 한정된 공간의 선박 용도의 요구를 충족시키기 위해 보다 컴팩트한 엔진의 설계에 주력하고 있으며, 틈새 분야에서의 채택이 진행되고 있습니다. 국제해사기구의 Tier III 기준과 같은 규제 프레임워크는 엔진의 정밀화와 최적화를 계속 추진하고 있으며, 제조업체는 진화하는 해양 에너지 상황에서 경쟁력을 유지하기 위해 신속한 기술 혁신을 촉진하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 256억 달러 |

| 예측 금액 | 444억 달러 |

| CAGR | 5.6% |

정격출력 0.5MW에서 1MW의 선박 왕복동 엔진 분야는 중형선에 있어서의 콤팩트하고 효율적인 추진 시스템에 대한 수요 증가에 힘입어 2034년까지 연평균 복합 성장률(CAGR) 5.5%로 성장할 것으로 예측됩니다. 이 엔진들은 크기, 출력, 운영 비용 간의 이상적인 균형을 제공하여 기동성과 연비가 중요한 다양한 응용 분야에서 선호되는 선택입니다. 연안 경비선, 여객 페리, 소형 화물선에의 배치가 증가하고 있어, 채택이 가속하고 있습니다. 또한, 이러한 엔진은 유지관리가 용이하고, 선내의 한정된 스페이스에 짜넣을 수 있기 때문에 성능이나 컴플라이언스를 희생하지 않고, 선박의 레이아웃을 최적화하기 쉽습니다.

가스 엔진 선박 왕복동 엔진 분야는 2034년까지 연평균 복합 성장률(CAGR) 6.5%로 성장할 것으로 예측됩니다. 온실가스 배출량이 상당히 적고 유황함량도 적은 가스연료엔진으로 전환하고 있습니다.

미국의 선박 왕복동 엔진 시장 규모는 2024년에 26억 달러였습니다. 이 나라의 잘 발달된 항구 시스템과 지원적인 규제 환경은 첨단 해양 추진 기술의 활용을 더욱 강화합니다.

이 시장의 주요 기업은 Caterpillar, Wartsila, Perkins Engines, IHI Corporation, MAN Energy Solutions, Yanmar HOLDINGS, General Electric, Briggs & Stratton, Kawasaki Heavy Industries, Cumins, Yamaha Motor, Scania, AB Volvo HEAVY INDUSTRIES, Rolls-Royce, JC Bamford Excavators, American Honda Motor, Guascor Energy등이 있습니다. 각 사는 시장에서의 지위를 향상시키기 위해, 연구개발에 투자해 규제 대응에 맞춘 저배출 가스 및 저연비 엔진을 개발하는 등의 전략을 활용하고 있습니다. 조선업체 및 선단 운영업체와의 파트너십은 장기 공급 계약을 확보하는 데 도움이 되며, 신흥 연안 경제국의 지리적 확장은 새로운 수익원을 열어줍니다. 고급 디지털 모니터링 시스템을 통합, 예지 보전 및 실시간 진단을 제공합니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크?과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 전략적 대시보드

- 전략적 노력

- 경쟁 벤치마킹

- 혁신과 지속가능성의 정세

제5장 시장 규모와 예측 : 연료별, 2021년-2034년

- 주요 동향

- 디젤

- 가스

- 기타

제6장 시장 규모와 예측 : 정격출력별, 2021년-2034년

- 주요 동향

- 0.5MW-1MW

- 1MW-2MW 이상

- 2MW-3.5MW 이상

- 3.5MW-5MW 이상

- 5MW-7.5MW 이상

- 7.5MW 이상

제7장 시장 규모와 예측 : 실린더 구성별, 2021년-2034년

- 주요 동향

- 인라인

- V형

- 레이디얼

- 대향 피스톤

제8장 시장 규모와 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 프랑스

- 독일

- 러시아

- 이탈리아

- 스페인

- 네덜란드

- 덴마크

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 태국

- 싱가포르

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 카타르

- 오만

- 쿠웨이트

- 이집트

- 튀르키예

- 남아프리카

- 라틴아메리카

- 브라질

- 아르헨티나

- 칠레

제9장 기업 프로파일

- AB Volvo Penta

- American Honda Motor

- Briggs & Stratton

- Caterpillar

- Cummins

- General Electric

- Guascor Energy

- IHI Corporation

- JC Bamford Excavators

- Kawasaki Heavy Industries

- KUBOTA Corporation

- MAN Energy Solutions

- MITSUBISHI HEAVY INDUSTRIES

- Perkins Engines

- Rehlko

- Rolls-Royce

- Scania

- Wartsila

- Yamaha Motor

- Yanmar HOLDINGS

The Global Marine Reciprocating Engine Market was valued at USD 25.6 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 44.4 billion by 2034. The growth is driven by the stricter global emission regulations, combined with rising demand for fuel-flexible systems that can shift between fuel types based on cost and availability. Ship owners and operators are upgrading their engine systems to meet environmental requirements and reduce fuel consumption, further fueling market growth.

In addition, expanding port infrastructure across developing nations is boosting marine traffic, intensifying the need for efficient and environmentally compliant power solutions. Technological improvements in real-time monitoring and diagnostic capabilities also allow operators to track key performance indicators prevent unexpected failures and raise system reliability and uptime. Manufacturers are focusing on designing more compact engines to meet the needs of smaller vessels, offshore support crafts, and limited-space marine applications, enhancing adoption across niche sectors. Regulatory frameworks such as the International Maritime Organization's Tier III standards continue to push for higher engine precision and optimization, prompting manufacturers to innovate rapidly to stay competitive in the evolving marine energy landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.6 Billion |

| Forecast Value | $44.4 Billion |

| CAGR | 5.6% |

The 0.5 MW to 1 MW rated marine reciprocating engine segment is projected to grow at a CAGR of 5.5% through 2034, fueled by rising demand for compact and efficient propulsion systems in medium-duty vessels. These engines offer the ideal balance between size, power, and operational cost, making them a preferred choice for various applications where maneuverability and fuel economy are essential. Increasing deployment in coastal security vessels, passenger ferries, and small cargo ships accelerates their adoption. Additionally, these engines are easier to maintain and integrate into limited space on board, which appeals to operators looking to optimize vessel layout without sacrificing performance or compliance.

The gas-powered marine reciprocating engine segment is expected to grow at a CAGR of 6.5% through 2034. This growth is closely linked to the tightening of global emissions standards and a heightened focus on sustainability across the marine industry. As regulators enforce cleaner maritime operations, vessel operators shift toward gas-fueled engines due to their significantly lower greenhouse gas emissions and reduced sulfur content. These engines not only support compliance with international mandates but also offer long-term cost benefits by using cleaner, often more economical fuel sources, especially in emission-controlled areas.

United States Marine Reciprocating Engine Market was valued at USD 2.6 billion in 2024. This growth stems from the steady rise in international shipping traffic, continued investment in offshore oil and wind energy infrastructure, and a robust increase in leisure boating activities. The country's well-developed port systems and supportive regulatory environment further enhance the uptake of advanced marine propulsion technologies. This favorable ecosystem encourages commercial and recreational marine operators to invest in newer, more efficient engines that meet modern performance and environmental standards.

Key players in the market include Caterpillar, Wartsila, Perkins Engines, IHI Corporation, MAN Energy Solutions, Yanmar HOLDINGS, General Electric, Briggs & Stratton, Kawasaki Heavy Industries, Cummins, Yamaha Motor, Scania, AB Volvo Penta, Rehlko, KUBOTA Corporation, MITSUBISHI HEAVY INDUSTRIES, Rolls-Royce, J C Bamford Excavators, American Honda Motor, and Guascor Energy. To enhance their market standing, companies leverage strategies such as investing in R&D to develop low-emission, fuel-efficient engines tailored for regulatory compliance. Many focus on hybrid and gas engine technologies to align with decarbonization trends. Partnerships with shipbuilders and fleet operators help secure long-term supply agreements, while geographic expansion in emerging coastal economies opens new revenue streams. Advanced digital monitoring systems are being incorporated to offer predictive maintenance and real-time diagnostics. Brands expand service networks to improve aftersales support, ensuring long-term customer engagement and reliability in performance-critical applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Diesel

- 5.3 Gas

- 5.4 Others

Chapter 6 Market Size and Forecast, By Rated Power, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 0.5 MW - 1 MW

- 6.3 > 1 MW - 2 MW

- 6.4 > 2 MW - 3.5 MW

- 6.5 > 3.5 MW - 5 MW

- 6.6 > 5 MW - 7.5 MW

- 6.7 > 7.5 MW

Chapter 7 Market Size and Forecast, By Cylinder Configuration, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Inline

- 7.3 V-Type

- 7.4 Radial

- 7.5 Opposed piston

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.3.8 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Thailand

- 8.4.7 Singapore

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 Qatar

- 8.5.4 Oman

- 8.5.5 Kuwait

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 AB Volvo Penta

- 9.2 American Honda Motor

- 9.3 Briggs & Stratton

- 9.4 Caterpillar

- 9.5 Cummins

- 9.6 General Electric

- 9.7 Guascor Energy

- 9.8 IHI Corporation

- 9.9 J C Bamford Excavators

- 9.10 Kawasaki Heavy Industries

- 9.11 KUBOTA Corporation

- 9.12 MAN Energy Solutions

- 9.13 MITSUBISHI HEAVY INDUSTRIES

- 9.14 Perkins Engines

- 9.15 Rehlko

- 9.16 Rolls-Royce

- 9.17 Scania

- 9.18 Wartsilä

- 9.19 Yamaha Motor

- 9.20 Yanmar HOLDINGS