|

시장보고서

상품코드

1913396

고순도 알루미나 시장 : 기회, 성장 요인, 산업 동향 분석 및 예측(2026-2035년)High Purity Alumina Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

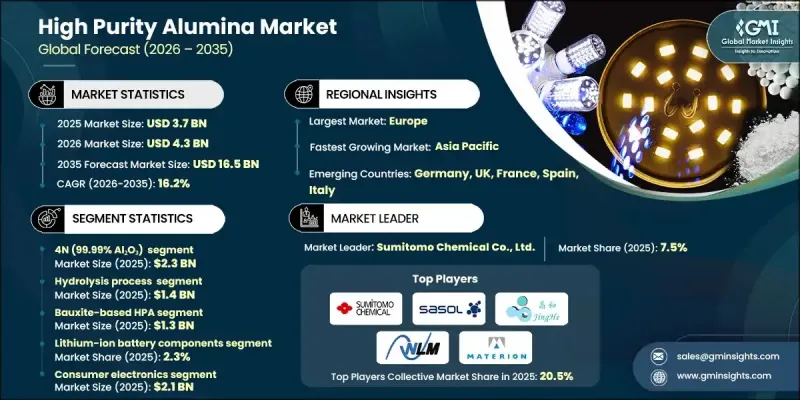

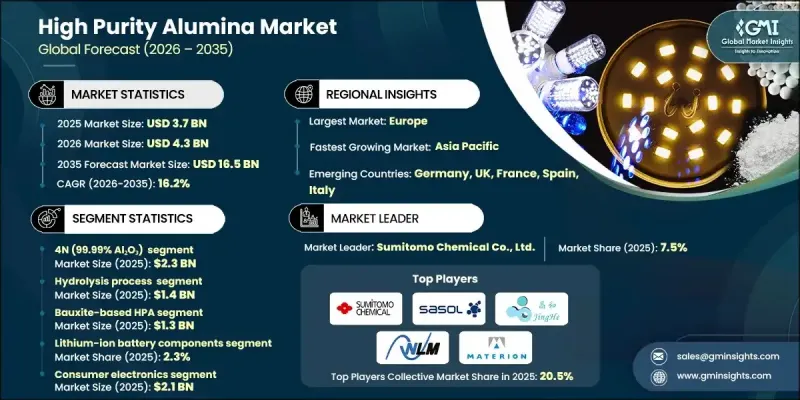

세계의 고순도 알루미나 시장은 2025년 37억 달러로 평가되어 2035년까지 연평균 복합 성장률(CAGR) 16.2%로 성장해 165억 달러에 이를 것으로 예측되고 있습니다.

시장 성장은 하이엔드 산업 응용 분야에서 엄격한 품질, 신뢰성 및 성능 요구 사항을 충족하는 첨단 재료에 대한 수요 증가에 견인하고 있습니다. 불순물 함량이 최소화된 산화알루미늄으로 만들어진 고순도 알루미나는 우수한 열 안정성, 높은 내화학성, 우수한 전기 절연 특성을 갖추고 있습니다. 이러한 특성은 정확성과 내구성이 필수적인 응용 분야에서 중요한 재료입니다. 제조 분야 전반에 걸쳐 고성능 재료에 대한 지속적인 의존이 시장의 꾸준한 확대를 지원합니다. 생산 기술의 현저한 진보도 시장의 기세를 뒷받침하고 있으며, 근대화된 정제 및 정화 수법에 의해 균일한 재료 품질이 실현되고 있습니다. 제조업체는 에너지 효율을 높이고 배출량을 줄이면서 용도 고유의 요구 사항을 충족하기 위해 재료 특성을 미세 조정할 수있는 능력을 강화하고 있습니다. 이러한 진화는 지속가능한 제조 기법과 최적화된 생산 공정으로의 광범위한 산업 전환을 반영하며, 고순도 알루미나를 차세대 기술의 핵심 재료로 자리잡고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2025년 |

| 예측 기간 | 2026-2035년 |

| 시작 규모 | 37억 달러 |

| 시장 규모 예측 | 165억 달러 |

| CAGR | 16.2% |

가수분해법 부문은 2025년 14억 달러에 달했습니다. 염산 침출법과 함께 가수분해는 일관된 순도 수준을 실현할 수 있는 비용 효율적이고 확장 가능한 생산 방법으로 주목받고 있습니다. 대규모 생산량과 엄격한 품질 관리의 양립이 가능하므로 증가하는 산업 수요에 부응하기에 적합합니다.

리튬 이온 배터리 부품 부문은 2025년 2.3%의 점유율을 차지했습니다. 고순도 알루미나 수요는 탁월한 재료의 일관성과 신뢰성을 요구하는 용도로 계속 전환하고 있습니다. 특히 고온 환경 및 정밀 가공 환경에서 제조 공차가 엄격화되는 가운데 높은 열 안정성, 광학 투명성, 최소한의 오염이 필요한 분야에서의 사용은 계속 견조합니다.

북미의 고순도 알루미나 시장은 2025년 5억 2,530만 달러 규모에 이르렀습니다. 이 지역의 성장은 첨단 전자 장비, 항공우주, 방위, 에너지 저장 산업의 강한 수요에 의해 뒷받침됩니다. 연구개발, 혁신, 높은 수준의 제조 기준에 대한 지속적인 투자는 지역 전반에 걸친 채택과 소비를 더욱 가속화하고 있습니다.

자주 묻는 질문

목차

제1장 분석 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계의 생태계 분석

- 공급자의 상황

- 이익률

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 요인

- 고급 전자기기에 대한 수요 증가

- 전기자동차 생태계의 급속한 성장

- LED 및 조명 기술 확대

- 업계의 잠재적 위험과 과제

- 높은 생산 비용과 에너지 수요

- 저비용 지역 생산자로부터의 경쟁 압력

- 시장 기회

- 차세대 전지에서의 채용 확대

- 5G 및 미래의 6G 인프라 확대

- 항공우주 및 방위 분야에서의 이용 확대

- 성장 요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신 동향

- 현재의 기술 동향

- 신흥기술

- 가격 동향

- 지역별

- 순도 등급별

- 미래 시장 동향

- 기술과 혁신 동향

- 현재의 기술 동향

- 신흥기술

- 특허 상황

- 무역 통계(HS코드)(주 : 무역 통계는 주요 국가만 제공됩니다)

- 주요 수입국

- 주요 수출국

- 지속가능성과 환경면

- 지속가능한 대처

- 폐기물 감축 전략

- 생산에서의 에너지 효율

- 환경에 배려한 대처

- 탄소발자국 고려

제4장 경쟁 구도

- 소개

- 기업별 시장 점유율 분석

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 지역별

- 기업 매트릭스 분석

- 주요 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 동향

- 기업 인수합병(M&A)

- 사업 제휴 및 협력

- 신제품 발매

- 확대 계획

제5장 시장 추계 및 예측 : 순도 등급별(2022-2035년)

- 3N(99.9% AL2O3)

- 4N(99.99% AL2O3)

- 5N(99.999% AL2O3)

- 6N(99.9999% AL2O3)

- UHPA-초고순도 알루미나(99.9999% 초과)

제6장 시장 추계 및 예측 : 제조 기술별(2022-2035년)

- 가수분해법

- 염산(HCl) 침출법

- 알콕시드법

- 열분해

- 3층 전해 정제

- 분류 결정화

- 진공 증류

- 기타

제7장 시장 추계 및 예측 : 원료별(2022-2035년)

- 보크사이트계 HPA

- 카올린계 HPA

- 알루미늄 금속계 HPA

- 고알루미나 점토계 HPA

제8장 시장 추계 및 예측 : 용도별(2022-2035년)

- LED 기판 및 조명

- 사파이어 기판 생산

- 반도체 제조

- 리튬 이온 배터리 부품

- 5G 및 통신 인프라

- 의료 및 바이오메디컬 용도

- 양자 컴퓨팅 부품

- 항공우주 및 방위용 세라믹

- 파워 일렉트로닉스 및고주파 디바이스

- 기술 및 첨단 세라믹

- 전자 디스플레이 및 광전자

- 기타

제9장 시장 추계 및 예측 : 최종 이용 산업별(2022-2035년)

- 소비자용 전자기기

- 자동차

- 항공우주 및 방위산업

- 헬스케어 및 의료기기

- 통신

- 에너지 및 전력

- 산업 제조

- 기타

제10장 시장 추계 및 예측 : 지역별(2022-2035년)

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

제11장 기업 프로파일

- Alcoa Corporation

- Altech Chemicals Limited

- Baikowski

- Caplinq Corporation

- Emerging sustainable HPA producers

- Hebei Pengda Advanced Materials Technology

- Materion Corporation

- Nippon Light Metal Holdings Co., Ltd.

- Norsk Hydro ASA

- Orbite Technologies Inc.

- PSB Industries SA

- Sumitomo Chemical Co., Ltd.

- Sasol Limited

- Xuancheng Jingrui New Materials Co., Ltd.

The Global High Purity Alumina Market was valued at USD 3.7 billion in 2025 and is estimated to grow at a CAGR of 16.2% to reach USD 16.5 billion by 2035.

Market growth is driven by rising demand for advanced materials that meet strict quality, reliability, and performance requirements across high-end industrial applications. High purity alumina, derived from aluminum oxide with minimal impurity content, offers excellent thermal stability, strong chemical resistance, and superior electrical insulation properties. These characteristics make it a critical material for applications where precision and durability are essential. Continued reliance on high-performance materials across manufacturing sectors has supported consistent market expansion. Significant improvements in production technologies have also contributed to market momentum, as modernized refining and purification methods now deliver more uniform material quality. Manufacturers are increasingly able to fine-tune material characteristics to meet application-specific requirements while improving energy efficiency and lowering emissions. This evolution reflects the broader industrial shift toward sustainable manufacturing practices and optimized production processes, positioning high purity alumina as a key material in next-generation technologies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.7 Billion |

| Forecast Value | $16.5 Billion |

| CAGR | 16.2% |

The hydrolysis process segment reached USD 1.4 billion in 2025. Alongside HCl leaching, hydrolysis has gained prominence as a cost-effective and scalable production method capable of delivering consistent purity levels. Its ability to balance large-scale output with strict quality control has made it well-suited to meet growing industrial demand.

The lithium-ion battery components segment held 2.3% share in 2025. Demand for high purity alumina continues to shift toward applications that require exceptional material consistency and reliability. Usage remains strong across sectors that depend on high thermal stability, optical clarity, and minimal contamination, particularly as manufacturing tolerances become increasingly stringent in high-temperature and precision-driven environments.

North America High Purity Alumina Market generated USD 525.3 million in 2025. Growth in this region is supported by strong demand from advanced electronics, aerospace, defense, and energy storage industries. Continued investment in research, innovation, and high manufacturing standards is further accelerating adoption and consumption across the region.

Key companies operating in the Global High Purity Alumina Market include Alcoa Corporation, Baikowski, Norsk Hydro ASA, Materion Corporation, Nippon Light Metal Holdings Co., Ltd., Sumitomo Chemical Co., Ltd., Sasol Limited, Altech Chemicals Limited, Orbite Technologies Inc., PSB Industries SA, Caplinq Corporation, Hebei Pengda Advanced Materials Technology, Xuancheng Jingrui New Materials Co., Ltd., and emerging sustainable HPA producers. Companies in the Global High Purity Alumina Market are strengthening their market position through technology advancement, capacity expansion, and product specialization. Many players are investing in process innovation to achieve higher purity levels while reducing production costs and environmental impact. Strategic focus on application-specific grades allows suppliers to meet evolving customer requirements in electronics, energy storage, and advanced manufacturing. Geographic expansion and localized production are being used to improve supply reliability and reduce logistics risks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Purity Grade

- 2.2.2 Production Technology

- 2.2.3 Raw Material

- 2.2.4 Application

- 2.2.5 End Use Industry

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced electronics

- 3.2.1.2 Rapid growth in electric vehicle ecosystems

- 3.2.1.3 Expansion of LED and lighting technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs and energy requirements

- 3.2.2.2 Competitive pressure from low-cost regional producers

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption in next-generation batteries

- 3.2.3.2 Expansion of 5G and future 6G infrastructure

- 3.2.3.3 Increasing use in aerospace and defence applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By purity grade

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Purity Grade, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 3N (99.9% AL2O3)

- 5.3 4N (99.99% AL2O3)

- 5.4 5N(99.999% AL2O3)

- 5.5 6N (99.9999% AL2O3)

- 5.6 UHPA - ultra high purity alumina (>99.9999%)

Chapter 6 Market Estimates and Forecast, By Production Technology, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hydrolysis process

- 6.3 HCL (hydrochloric acid) leaching

- 6.4 Alkoxide process

- 6.5 Thermal decomposition

- 6.6 Three-layer electrolytic refining

- 6.7 Fractional crystallization

- 6.8 Vacuum distillation

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By Raw Material, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bauxite-based HPA

- 7.3 Kaolin-based HPA

- 7.4 Aluminum metal-based HPA

- 7.5 High-alumina clay-based HPA

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Led substrates and lighting

- 8.3 Sapphire substrate production

- 8.4 Semiconductor manufacturing

- 8.5 Lithium-ion battery components

- 8.6 5g and telecommunications infrastructure

- 8.7 Medical and biomedical applications

- 8.8 Quantum computing components

- 8.9 Aerospace and defense ceramics

- 8.10 Power electronics and RF devices

- 8.11 Technical ceramics and advanced ceramics

- 8.12 Electronic displays and optoelectronics

- 8.13 Others

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Consumer electronics

- 9.3 Automotive

- 9.4 Aerospace and defense

- 9.5 Healthcare and medical devices

- 9.6 Telecommunications

- 9.7 Energy and power

- 9.8 Industrial manufacturing

- 9.9 Others

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Alcoa Corporation

- 11.2 Altech Chemicals Limited

- 11.3 Baikowski

- 11.4 Caplinq Corporation

- 11.5 Emerging sustainable HPA producers

- 11.6 Hebei Pengda Advanced Materials Technology

- 11.7 Materion Corporation

- 11.8 Nippon Light Metal Holdings Co., Ltd.

- 11.9 Norsk Hydro ASA

- 11.10 Orbite Technologies Inc.

- 11.11 PSB Industries SA

- 11.12 Sumitomo Chemical Co., Ltd.

- 11.13 Sasol Limited

- 11.14 Xuancheng Jingrui New Materials Co., Ltd.