|

시장보고서

상품코드

1892881

예비 부품 물류 시장 기회, 성장요인, 업계 동향 분석 및 예측(2026-2035년)Spare Parts Logistics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

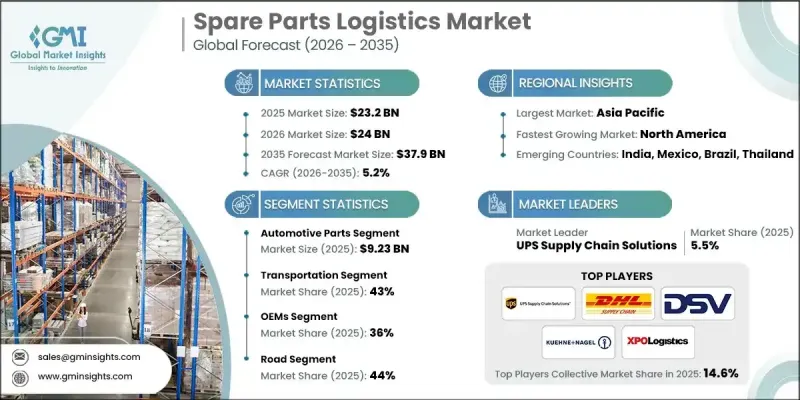

세계의 예비 부품 물류 시장은 2025년에 232억 달러로 평가되었고, 2035년까지 연평균 복합 성장률(CAGR) 5.2%로 성장하여 379억 달러에 이를 것으로 예측됩니다.

이러한 성장은 전 세계적으로 확대되는 자동차, 산업용, 전자기기 차량 및 장비군(차량 및 장비군)에 기인하며, 정기 및 비정기적인 유지보수 수요 증가를 창출하고 있습니다. 기업, 차량 운영자 및 최종 사용자는 대량의 SKU(재고 관리 단위), 정시 배송, 다층적인 유통 시스템을 효율적으로 처리하고 가동 중지 시간을 최소화하기 위해 효율적인 예비 부품 물류 네트워크에 대한 의존도가 높아지고 있습니다. OEM(Original Equipment Manufacturer)과 물류 제공업체들은 가시성, 추적 및 예측 능력을 강화하기 위해 디지털 전환을 추진하고 있습니다. 클라우드 플랫폼, IoT 센서, 실시간 분석을 통해 재고 관리 최적화, 주문 처리 가속화, 오류 감소를 실현합니다. B2B 및 B2C 마켓플레이스의 부상은 고객의 기대치를 재구성하고, 공급업체는 소량, 고빈도, 지리적으로 분산된 배송에 집중하도록 유도하고 있습니다. 이러한 발전은 서비스 수준 계약을 강화하고 가동 시간 보장을 보장하며 전체 공급망의 효율성을 향상시키고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2025년 |

| 예측 연도 | 2026-2035년 |

| 개시 연도 시장 규모 | 232억 달러 |

| 예측 금액 | 379억 달러 |

| CAGR | 5.2% |

자동차 부품 부문은 2025년 92억 3,000만 달러를 차지할 것으로 예상되며, 2035년까지 연평균 4.5% 성장할 것으로 전망됩니다. 이러한 성장은 자동차 판매량 증가, 구형 차량에 대한 수요 증가, 온라인 판매 가속화에 힘입어 성장세를 보이고 있습니다. 디지털 솔루션은 신속한 배송, 효율적인 라스트마일 배송, 다중 창고 전략을 추진하고 있습니다. OEM 제조업체와 애프터마켓 공급업체들은 진화하는 유통 수요에 대응하기 위해 자동 창고 시스템과 통합 물류 플랫폼에 많은 투자를 하고 있습니다.

운송 부문은 2025년 43%의 점유율을 차지할 것으로 예상되며, 2026년부터 2035년까지 연평균 6.4%의 성장률을 보일 것으로 전망됩니다. 예비 부품 물류는 트럭, 철도, 항공, 해상 운송에 크게 의존하고 있습니다. 전자상거래의 성장, 빠른 배송에 대한 기대, 그리고 보다 효율적인 재고 전략으로 인해 첨단 운송 네트워크의 필요성이 높아지고 있습니다. 화물 비용의 변동과 지정학적 혼란과 같은 문제에도 불구하고, 운송업체들은 탄력성과 대응력을 확보하기 위해 경로 최적화 및 용량 관리 시스템을 갖춘 멀티모달 네트워크를 개발하고 있습니다.

미국 예비 부품 물류 시장은 2025년 86%의 점유율을 차지하며 48억 7,000만 달러 규모에 달할 것으로 예측됩니다. 전자상거래의 성장에 따라 추가 풀필먼트 센터, 도시 지역의 마이크로 풀필먼트 허브, 당일 배송, 고급 추적 시스템에 대한 수요가 증가하고 있으며, 이는 여러 산업에 걸쳐 애프터마켓 서비스 역량을 향상시키고 있습니다.

자주 묻는 질문

목차

제1장 조사 방법

- 시장 범위와 정의

- 조사 설계

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 정보원

- 세계

- 지역별/국가별

- 기본 추정치와 계산

- 기준연도 계산

- 시장 추정 주요 동향

- 1차 조사와 검증

- 1차 정보

- 예측

- 조사의 전제조건과 제한 사항

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 상황

- 이익률 분석

- 비용 구조

- 각 단계별 부가가치

- 밸류체인에 영향을 미치는 요인

- 파괴적 변화

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신 동향

- 현행 기술

- 신기술

- 특허 분석

- 가격 분석

- 지역별

- 제품별

- 비용 내역 분석

- 지속가능성과 환경 측면

- 지속가능한 대처

- 폐기물 감축 전략

- 생산 에너지 효율

- 친환경 이니셔티브

- 탄소발자국에 관한 고려사항

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 뉴스와 이니셔티브

- 인수합병(M&A)

- 제휴 및 협업

- 신제품 발매

- 사업 확대 계획과 자금조달

제5장 시장 추산 및 예측 : 부품별, 2022-2035

- 주요 동향

- 자동차 부품

- 엔진 부품

- 피스톤

- 필터

- 기타

- 변속기 및 구동계 부품

- 브레이크

- 서스펜션

- 스티어링 시스템

- 보디 및 외장 부품

- 전기 및 전자 시스템

- 애프터마켓 소모품

- 엔진 부품

- 산업기계 및 설비 부품

- 제조 기계 부품

- 모터

- 톱니바퀴

- 벨트

- 건설기계 부품

- 굴삭기

- 로더

- 농업기계 부품

- 트랙터

- 수확기

- 자재관리 및 물류 기기 구성부품

- 유압, 공압 및 기계식 서브시스템

- 제조 기계 부품

- 항공우주 및 방위용 예비 부품

- 항공기 부품

- 방위 차량 부품

- 지상 지원 및 정비 기기

- 전자부품 및 반도체 부품

- 반도체 디바이스

- 통신 기기 부품

- 에너지 및 유틸리티용 부품

- 기타

제6장 시장 추산 및 예측 : 서비스별, 2022-2035

- 주요 동향

- 운송

- 창고 보관

- 유통

- 재고 관리

제7장 시장 추산 및 예측 : 최종 용도별, 2022-2035

- 주요 동향

- OEM 제조업체

- 애프터마켓 공급업체

- 판매점

- 전자상거래 플랫폼

- 기타

제8장 시장 추산 및 예측 : 운송 수단별, 2022-2035

- 주요 동향

- 도로

- 철도

- 항공

- 해상

제9장 시장 추산 및 예측 : 지역별, 2022-2035

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 네덜란드

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- ANZ

- 싱가포르

- 태국

- 베트남

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 개요

- 세계 기업

- Agility Logistics

- Bollore Logistics

- C.H. Robinson

- CEVA Logistics

- DB Schenker

- DHL Supply Chain

- DSV Panalpina

- Expeditors International

- FedEx Supply Chain

- Hellmann Worldwide Logistics

- Kuehne+Nagel

- UPS Supply Chain Solutions

- XPO Logistics

- 지역 기업

- Ryder System

- Penske Logistics

- J.B. Hunt Transport Services

- BLG Logistics

- Nippon Express

- Kerry Logistics

- Yusen Logistics

- Kintetsu World Express

- COSCO Shipping Logistics

- 신규 기업과 디스럽터

- Overhaul

- FourKites

- Shippeo

- Convoy

- Transfix

- Shippo

- Locus Robotics

- Imperial Logistics

The Global Spare Parts Logistics Market was valued at USD 23.2 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 37.9 billion by 2035.

This growth is driven by the expanding fleets of automotive, industrial, and electronic equipment worldwide, which are creating a rising number of scheduled and unscheduled maintenance requirements. Businesses, fleet operators, and end-users are increasingly relying on efficient spare parts logistics networks to handle large volumes of SKUs, time-sensitive deliveries, and multi-tier distribution systems to minimize operational downtime. OEMs and logistics providers are embracing digital transformation to enhance visibility, tracking, and forecasting capabilities. Cloud platforms, IoT sensors, and real-time analytics enable optimized inventory management, faster order fulfillment, and reduced errors. The rise of B2B and B2C online marketplaces is reshaping customer expectations, prompting providers to focus on smaller, frequent, and geographically dispersed deliveries. These developments are strengthening service-level agreements, ensuring uptime guarantees, and enhancing overall supply chain efficiency.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $23.2 Billion |

| Forecast Value | $37.9 Billion |

| CAGR | 5.2% |

The automotive parts segment accounted for USD 9.23 billion in 2025 and is expected to grow at a CAGR of 4.5% through 2035. Growth is supported by rising vehicle numbers, expanding demand for older models, and accelerated online sales. Digital solutions are driving faster shipments, efficient last-mile delivery, and multi-warehouse strategies. OEMs and aftermarket suppliers are heavily investing in automated warehousing systems and integrated logistics platforms to meet evolving distribution demands.

The transportation segment held a 43% share in 2025 and is expected to grow at a CAGR of 6.4% from 2026 to 2035. Spare parts logistics depend heavily on truck, train, air, and sea transport. Growth in e-commerce, faster delivery expectations, and leaner inventory strategies are pushing the need for advanced transportation networks. Despite challenges like freight cost fluctuations and geopolitical disruptions, providers are developing multimodal networks with routing optimization and capacity management systems to ensure resilience and responsiveness.

US Spare Parts Logistics Market held 86% share in 2025, generating USD 4.87 billion. E-commerce growth is driving the need for additional fulfillment centers, urban micro-fulfillment hubs, same-day delivery, and advanced tracking systems to improve aftermarket service capabilities across multiple industries.

Key players in the Global Spare Parts Logistics Market include CEVA Logistics, DHL Supply Chain, DSV Panalpina, Penske Logistics, Ryder, XPO Logistics, DB Schenker, UPS Supply Chain Solutions, Kuehne + Nagel, and GXO Logistics. Companies in the Spare Parts Logistics Market are strengthening their market presence by investing in advanced technology solutions such as AI-driven inventory management, predictive analytics, and real-time tracking platforms. Strategic partnerships with OEMs and third-party logistics providers help expand geographic reach and improve operational efficiency. Providers are also implementing micro-fulfillment centers and last-mile delivery hubs to meet rising customer demands. Additionally, firms focus on multimodal transport solutions, routing optimization, and capacity management systems to enhance resilience and reliability.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Spare part

- 2.2.2 Service

- 2.2.3 End use

- 2.2.4 Transportation mode

- 2.2.5 Regional

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Predictive maintenance adoption

- 3.2.1.2 E-commerce parts expansion

- 3.2.1.3 OEM vertical integration

- 3.2.1.4 Logistics automation & robotics

- 3.2.1.5 Increasing equipment electrification & component complexity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High inventory complexity

- 3.2.2.2 Transportation cost volatility

- 3.2.3 Market opportunities

- 3.2.3.1 Additive manufacturing for localized production

- 3.2.3.2 Ai-driven demand forecasting

- 3.2.3.3 Expansion of digital marketplaces

- 3.2.3.4 Sustainability and green logistics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Pricing analysis

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental aspects

- 3.12 Sustainable practices

- 3.13 Waste reduction strategies

- 3.14 Energy efficiency in production

- 3.15 Eco-friendly initiatives

- 3.16 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Spare Part, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Automotive parts

- 5.2.1 Engine components

- 5.2.1.1 Pistons

- 5.2.1.2 Filters

- 5.2.1.3 Others

- 5.2.2 Transmission and drivetrain parts

- 5.2.2.1 Brakes

- 5.2.2.2 Suspension

- 5.2.2.3 Steering systems

- 5.2.3 Body and exterior components

- 5.2.4 Electrical and electronic systems

- 5.2.5 Aftermarket consumables

- 5.2.1 Engine components

- 5.3 Industrial machinery & equipment components

- 5.3.1 Manufacturing machinery parts

- 5.3.1.1 Motors

- 5.3.1.2 Gears

- 5.3.1.3 Belts

- 5.3.2 Construction equipment components

- 5.3.2.1 Excavators

- 5.3.2.2 Loaders

- 5.3.3 Agricultural machinery parts

- 5.3.3.1 Tractors

- 5.3.3.2 Harvesters

- 5.3.4 Material handling and logistics equipment components

- 5.3.5 Hydraulic, pneumatic, and mechanical subsystems

- 5.3.1 Manufacturing machinery parts

- 5.4 Aerospace & defense spare parts

- 5.4.1 Aircraft components

- 5.4.2 Defense vehicle parts

- 5.4.3 Ground support and maintenance equipment

- 5.5 Electronics & semiconductor components

- 5.5.1 Semiconductor devices

- 5.5.2 Telecommunications equipment components

- 5.6 Energy & utilities parts

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Service, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Warehousing

- 6.4 Distribution

- 6.5 Inventory management

Chapter 7 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 OEMs (Original Equipment Manufacturers)

- 7.3 Aftermarket Suppliers

- 7.4 Dealerships

- 7.5 E-commerce Platforms

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Transportation mode, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Road

- 8.3 Rail

- 8.4 Air

- 8.5 Sea

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 Singapore

- 9.4.6 Thailand

- 9.4.7 Vietnam

- 9.4.8 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Agility Logistics

- 10.1.2 Bollore Logistics

- 10.1.3 C.H. Robinson

- 10.1.4 CEVA Logistics

- 10.1.5 DB Schenker

- 10.1.6 DHL Supply Chain

- 10.1.7 DSV Panalpina

- 10.1.8 Expeditors International

- 10.1.9 FedEx Supply Chain

- 10.1.10 Hellmann Worldwide Logistics

- 10.1.11 Kuehne+Nagel

- 10.1.12 UPS Supply Chain Solutions

- 10.1.13 XPO Logistics

- 10.2 Regional Players

- 10.2.1 Ryder System

- 10.2.2 Penske Logistics

- 10.2.3 J.B. Hunt Transport Services

- 10.2.4 BLG Logistics

- 10.2.5 Nippon Express

- 10.2.6 Kerry Logistics

- 10.2.7 Yusen Logistics

- 10.2.8 Kintetsu World Express

- 10.2.9 COSCO Shipping Logistics

- 10.3 Emerging players and disruptors

- 10.3.1 Overhaul

- 10.3.2 FourKites

- 10.3.3 Shippeo

- 10.3.4 Convoy

- 10.3.5 Transfix

- 10.3.6 Shippo

- 10.3.7 Locus Robotics

- 10.3.8 Imperial Logistics