|

시장보고서

상품코드

1833629

자동차용 콕핏 도메인 컨트롤러 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Automotive Cockpit Domain Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

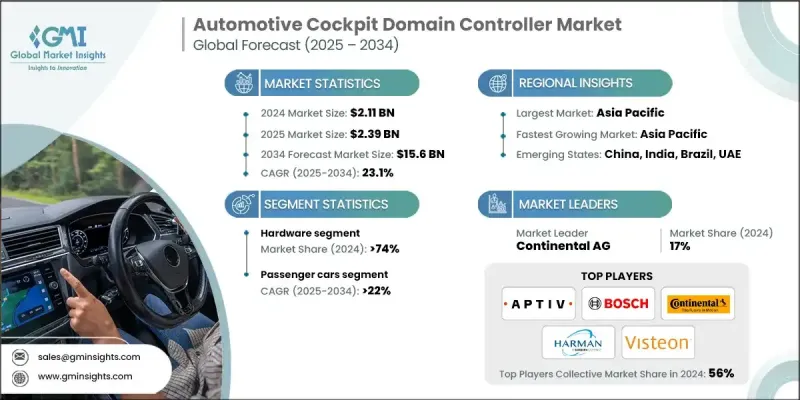

Global Market Insights Inc.가 발행한 최신 보고서에 따르면 세계의 자동차용 콕핏 도메인 컨트롤러 시장 규모는 2024년에 21억 1,000만 달러로 평가되었고, CAGR 23.1%를 나타내 2025년 23억 9,000만 달러에서 2034년에는 156억 달러로 성장할 것으로 예측되고 있습니다.

자동차 제조업체는 여러 독립형 ECU에서 중앙 집중식 조종실 도메인 컨트롤러로 마이그레이션하여 소프트웨어 아키텍처를 간소화하고 복잡성을 줄입니다. 이 통합은 배선 및 무게를 줄일 뿐만 아니라 인포테인먼트, 계기 클러스터 및 에어컨 시스템 전체의 업데이트 및 진단을 간소화합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시장 매출 | 21억 1,000만 달러 |

| 예측 금액 | 156억 달러 |

| CAGR | 23.1% |

하드웨어에서의 채용 증가

자동차용 콕핏 도메인 컨트롤러 시장의 하드웨어 분야는 복잡한 인포테인먼트, 연결성 및 안전 기능을 동시에 관리할 수 있는 강력하고 에너지 효율적인 프로세서 제공에 중점을 둔 기술 혁신으로 2024년에 큰 점유율을 차지했습니다. 이 분야는 첨단 SoC, GPU 및 고속 통신 인터페이스를 자동차 등급의 조건을 견딜 수 있도록 설계된 컴팩트하고 열적으로 최적화된 모듈로 통합함으로써 성장을 이끌고 있습니다. 실시간 처리 및 멀티태스킹 기능에 대한 수요가 증가함에 따라 하드웨어 공급업체는 다양한 차량 요구 사항을 충족하기 위해 모듈 설계 및 확장 가능한 아키텍처를 선호하고 차세대 스마트 콕핏의 신뢰성과 성능을 보장합니다.

견인력을 늘리는 승용차

승용차 부문은 향상된 사용자 경험, 연결성 및 안전성에 대한 소비자의 기대치를 높여 2024년에 현저한 수익을 올렸습니다. OEM은 음성 인식, 멀티디스플레이 설정, AI 지원 어시스턴트 등 강력한 도메인 컨트롤러로 구성된 완벽한 상호작용을 제공하는 스마트 콕핏 통합에 많은 투자를 하고 있습니다. 이것은 운전 경험을 재정의하는 더 똑똑하고 연결된 인테리어에 대한 명확한 동향을 반영합니다.

아시아태평양이 유망한 지역이 될 것으로 예상

아시아태평양은 급속한 도시화, 자동차 생산 증가, 첨단 자동차 기술에 대한 소비자 수요 증가로 자동차용 콕핏 도메인 컨트롤러 시장의 주요 성장 엔진이 되었습니다. 중국, 일본, 한국, 인도 등의 국가들은 전동 이동성과 디지털 변혁을 추진하는 정부의 이니셔티브에 힘입어 스마트 차량 기술에 많은 투자를 하고 있습니다. 시장의 성장을 뒷받침하는 것은 커넥티드 지능형 콕핏 솔루션에 대한 수요가 증가하고자 하는 현지 제조 능력과 세계 공급업체와 지역 자동차 제조업체 간의 강력한 협력 관계입니다.

자동차용 콕핏 도메인 컨트롤러 시장의 주요 기업은 Visteon, NVIDIA, Robert Bosch, Qualcomm Technologies, Aptiv, HARMAN, Denso, Intel, Faurecia, Continental입니다.

시장 포지션을 강화하기 위해 자동차용 콕핏 도메인 컨트롤러 분야의 기업들은 몇 가지 전략적 이니셔티브에 주력하고 있습니다. 여기에는 AI, AR, 5G 커넥티비티와 같은 신기술을 통합한 확장 가능하고 고성능 플랫폼을 개발하기 위한 R&D 투자가 포함됩니다. 많은 기업들이 특정 차종과 지역에 맞게 맞춤형 솔루션을 공동 개발하기 위해 OEM 및 소프트웨어 개발자와 파트너십 및 합작 투자를 맺고 있습니다. 또한, 특히 아시아태평양을 중심으로 제조 거점을 확대함으로써 보다 신속한 납품과 비용 이점을 실현하고 있습니다. 각 회사는 또한 진화하는 안전 기준과 소비자의 기대에 부응하기 위해 사이버 보안 기능과 무선 업데이트 기능을 중시하고 경쟁이 치열하고 빠르게 진화하는 이 시장에서의 발판을 굳히고 있습니다.

목차

제1장 조사 방법

- 시장 범위 및 정의

- 연구 설계

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 출처

- 세계

- 지역/국가

- 기준 추정치 및 계산

- 기준 연도 계산

- 시장 추정 주요 동향

- 1차 조사 및 검증

- 1차 정보

- 예측 모델

- 조사의 전제조건과 제한

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 공급자의 상황

- 이익률 분석

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 파괴적 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 커넥티드카와 소프트웨어 정의 차량에 대한 수요 증가

- 집중형 전기자동차 아키텍처로의 전환

- 고급 인포테인먼트와 디지털 콕핏 체험에 대한 소비자 수요 증가

- EV와 자율주행차의 성장

- 반도체·소프트웨어 기업과의 OEM Tier 1 콜라보레이션

- 업계의 잠재적 리스크 및 과제

- 높은 통합 및 소프트웨어 검증 비용

- 사이버 보안 및 데이터 프라이버시의 위험

- 시장 기회

- 클라우드 대응·OTA 업데이트 에코시스템의 확대

- 신흥 시장(APAC, LATAM, MEA)에 대한 침투 확대

- 고급 HMI와 멀티모달 인터랙션 시스템

- 모빌리티 서비스 및 플릿 용도와의 통합

- 성장 촉진요인

- 성장 가능성 분석

- 규제 및 표준 현황

- 글로벌 규제 프레임워크 분석

- 기능 안전 표준 및 구현

- 지역별 규제의 차이와 컴플라이언스

- 컴플라이언스 비용 분석 및 구현 전략

- Porter's Five Forces 분석

- PESTEL 분석

- 기술 및 혁신 상황

- 현재의 기술 동향

- 하드웨어 기술의 성숙도

- 소프트웨어 플랫폼 준비

- 통합의 복잡성 평가

- 미래의 기술 로드맵

- 하드웨어 진화의 타임라인과 이정표

- 소프트웨어 플랫폼 개발 로드맵

- 신흥기술 통합 스케줄

- 표준 진화와 업계에 미치는 영향

- 오토서 어댑티브 플랫폼의 진화

- ISO 26262의 갱신 및 안전성에 대한 영향

- 사이버 보안 표준 로드맵

- 현재의 기술 동향

- 비용 구조 분석 및 비즈니스 케이스 프레임워크

- 총소유비용(TCO) 분석

- ROI 모델과 회수 분석

- 가격 전략 분석 및 벤치마크

- 시장 부문별 투자 요건

- 특허 분석

- 지속가능성과 ESG 영향 평가

- 환경 영향 분석 및 지표

- 사회적 영향의 고려와 지표

- 거버넌스 및 규정 준수 프레임워크

- ESG 투자의 의의와 재무에 대한 영향

- 이용 사례와 용도

- 최상의 시나리오

- 공급망 인텔리전스 및 리스크 평가

- 세계 공급망 매핑 및 분석

- 반도체 공급망의 깊은 파고

- 지정학적 리스크 평가

- 공급망의 탄력성과 최적화 전략

- 지적재산과 특허의 정세

- 특허 출원의 동향과 혁신 분석

- 주요 특허 보유자와 지적 재산 전략 분석

- IP 수익화 기회와 전략

- 사업의 자유와 지적 재산 리스크 관리

- 시장 진출 전략적 틀

- 시장 진출 전략 분석

- 고객 세분화 및 타겟팅 전략

- 채널 전략 및 파트너 생태계

- 마케팅 및 판매의 유효성

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병과 인수

- 파트너십 및 협업

- 신제품 발매

- 확장계획과 자금조달

제5장 시장 추계·예측 : 구성 요소별(2021-2034년)

- 주요 동향

- 하드웨어

- 시스템 온 칩

- 모듈

- 메모리

- 연결성

- 모듈

- 디스플레이 인터페이스

- 카메라 및 센서

- 기타(전력 관리 IC, HUD)

- 시스템 온 칩

- 소프트웨어

- 서비스

제6장 시장 추계·예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차

- 중형 상용차

- 대형 상용차

제7장 시장 추계·예측 : 기술별(2021-2034년)

- 주요 동향

- 집중형 아키텍처

- 분산형 아키텍처

- 구역별 아키텍처

- 하이브리드 아키텍처

제8장 시장 추계·예측 : 판매 채널별(2021-2034년)

- 주요 동향

- OEM 채널

- 애프터마켓 채널

제9장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 인포테인먼트 시스템

- 디지털 계기판

- 인간-기계 인터페이스(HMI)

- 헤드업 디스플레이(HUD) 통합

- 운전자 모니터링 시스템

- 기후 제어 및 편의 시스템

- 첨단 응용 분야 및 신흥 사용 사례

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- 세계 기업

- Aptiv

- Continental

- Denso

- HARMAN International Industries

- Intel

- NVIDIA

- Qualcomm Technologies

- Robert Bosch

- STMicroelectronics

- Texas Instruments

- Visteon

- Valeo

- 지역 기업

- Alpine Electronics

- Faurecia

- Hyundai Mobis

- Infineon Technologies

- LG Electronics

- Magna International

- NXP Semiconductors

- Panasonic

- Sony

- 신흥 기업/파괴적 혁신 기업

- Analog Devices

- Black Sesame Technologies

- BYD Company

- ECARX Holdings

- Horizon Robotics

- Huawei Technologies

- MediaTek

- Renesas Electronics

- Tesla

The global automotive cockpit domain controller market was estimated at USD 2.11 billion in 2024 and is expected to grow from USD 2.39 billion in 2025 to USD 15.6 billion by 2034, at a CAGR of 23.1%, according to the latest report published by Global Market Insights Inc.

Automakers are shifting from multiple standalone ECUs to centralized cockpit domain controllers, streamlining software architecture and reducing complexity. This consolidation not only cuts down on wiring and weight but also simplifies updates and diagnostics across infotainment, instrument clusters, and climate systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.11 Billion |

| Forecast Value | $15.6 Billion |

| CAGR | 23.1% |

Rising Adoption in Hardware

The hardware segment from the automotive cockpit domain controller market held a significant share in 2024, driven by innovation focusing on delivering powerful and energy-efficient processors capable of managing complex infotainment, connectivity, and safety features simultaneously. This segment drives growth by integrating advanced SoCs, GPUs, and high-speed communication interfaces into compact, thermally optimized modules designed to withstand automotive-grade conditions. With increasing demand for real-time processing and multitasking capabilities, hardware suppliers are prioritizing modular designs and scalable architectures to meet diverse vehicle requirements, ensuring reliability and performance in next-generation smart cockpits.

Passenger Cars to Gain Traction

The passenger cars segment generated notable revenues in 2024, fueled by rising consumer expectations for enhanced user experiences, connectivity, and safety. OEMs are investing heavily in integrating smart cockpits that offer seamless interaction through voice recognition, multi-display setups, and AI-powered assistants, all orchestrated by robust domain controllers. This reflects a clear trend toward smarter, more connected interiors that redefine the driving experience.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific stands as a key growth engine in the automotive cockpit domain controller market, driven by rapid urbanization, increasing vehicle production, and expanding consumer demand for advanced in-car technologies. Countries like China, Japan, South Korea, and India are investing heavily in smart vehicle technologies, supported by government initiatives promoting electric mobility and digital transformation. The market growth is propelled by local manufacturing capabilities and strong collaborations between global suppliers and regional automakers seeking to capture the rising demand for connected, intelligent cockpit solutions.

Major players in the automotive cockpit domain controller market are Visteon, NVIDIA, Robert Bosch, Qualcomm Technologies, Aptiv, HARMAN, Denso, Intel, Faurecia, and Continental.

To strengthen their market position, companies in the automotive cockpit domain controller space are focusing on several strategic initiatives. These include investing in R&D to develop scalable, high-performance platforms integrate emerging technologies such as AI, AR, and 5G connectivity. Many firms are forging partnerships and joint ventures with OEMs and software developers to co-create customized solutions tailored to specific vehicle models and regions. Additionally, expanding regional manufacturing footprints, particularly in the Asia Pacific, enables faster delivery and cost advantages. Companies also emphasize cybersecurity features and over-the-air update capabilities to meet evolving safety standards and consumer expectations, securing their foothold in this competitive and rapidly evolving market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales channel

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for connected and software-defined vehicles

- 3.2.1.2 Transition toward centralized e/e vehicle architecture

- 3.2.1.3 Increasing consumer demand for advanced infotainment & digital cockpit experiences

- 3.2.1.4 Growth of EVs and autonomous vehicles

- 3.2.1.5 OEM-tier 1 collaborations with semiconductor & software players

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High integration & software validation costs

- 3.2.2.2 Cybersecurity and data privacy risks

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of cloud-enabled and OTA update ecosystems

- 3.2.3.2 Growing penetration in emerging markets (APAC, LATAM, MEA)

- 3.2.3.3 Advanced HMI & multimodal interaction systems

- 3.2.3.4 Integration with mobility services and fleet applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory and standards landscape

- 3.4.1 Global regulatory framework analysis

- 3.4.2 Functional safety standards and implementation

- 3.4.3 Regional regulatory variations and compliance

- 3.4.4 Compliance cost analysis and implementation strategy

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology & innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Hardware technology maturity

- 3.7.1.2 Software platform readiness

- 3.7.1.3 Integration complexity assessment

- 3.7.2 Future technology roadmap

- 3.7.2.1 Hardware evolution timeline and milestones

- 3.7.2.2 Software platform development roadmap

- 3.7.2.3 Emerging technology integration schedule

- 3.7.3 Standards evolution and industry impact

- 3.7.3.1 Autosar adaptive platform evolution

- 3.7.3.2 Iso 26262 updates and safety implications

- 3.7.3.3 Cybersecurity standards roadmap

- 3.7.1 Current technological trends

- 3.8 Cost structure analysis and business case framework

- 3.8.1 Total cost of ownership (TCO) analysis

- 3.8.2 ROI models and payback analysis

- 3.8.3 Pricing strategy analysis and benchmarking

- 3.8.4 Investment requirements by market segment

- 3.9 Patent analysis

- 3.10 Sustainability and esg impact assessment

- 3.10.1 Environmental impact analysis and metrics

- 3.10.2 Social impact considerations and metrics

- 3.10.3 Governance and compliance framework

- 3.10.4 Esg investment implications and financial impact

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Supply chain intelligence and risk assessment

- 3.13.1 Global supply chain mapping and analysis

- 3.13.2 Semiconductor supply chain deep dive

- 3.13.3 Geopolitical risk assessment

- 3.13.4 Supply chain resilience and optimization strategies

- 3.14 Intellectual property and patent landscape

- 3.14.1 Patent filing trends and innovation analysis

- 3.14.2 Key patent holders and ip strategy analysis

- 3.14.3 Ip monetization opportunities and strategies

- 3.14.4 Freedom to operate and ip risk management

- 3.15 Go-to-market strategy framework

- 3.15.1 Market entry strategy analysis

- 3.15.2 Customer segmentation and targeting strategy

- 3.15.3 Channel strategy and partner ecosystem

- 3.15.4 Marketing and sales effectiveness

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 System on chip

- 5.2.1.1 Modules

- 5.2.1.1.1 Memory

- 5.2.1.1.2 Connectivity

- 5.2.1.1 Modules

- 5.2.2 Display interfaces

- 5.2.3 Camera & sensors

- 5.2.4 Others (power management IC, HUD)

- 5.2.1 System on chip

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Centralized architecture

- 7.3 Distributed architecture

- 7.4 Zonal architecture

- 7.5 Hybrid architecture

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Original equipment manufacturer (oem) channel

- 8.3 Aftermarket channel

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Infotainment systems

- 9.3 Digital instrument cluster

- 9.4 Human machine interface (hmi)

- 9.5 Head-up display (hud) integration

- 9.6 Driver monitoring systems

- 9.7 Climate control and comfort systems

- 9.8 Advanced applications and emerging use cases

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aptiv

- 11.1.2 Continental

- 11.1.3 Denso

- 11.1.4 HARMAN International Industries

- 11.1.5 Intel

- 11.1.6 NVIDIA

- 11.1.7 Qualcomm Technologies

- 11.1.8 Robert Bosch

- 11.1.9 STMicroelectronics

- 11.1.10 Texas Instruments

- 11.1.11 Visteon

- 11.1.12 Valeo

- 11.2 Regional Players

- 11.2.1 Alpine Electronics

- 11.2.2 Faurecia

- 11.2.3 Hyundai Mobis

- 11.2.4 Infineon Technologies

- 11.2.5 LG Electronics

- 11.2.6 Magna International

- 11.2.7 NXP Semiconductors

- 11.2.8 Panasonic

- 11.2.9 Sony

- 11.3 Emerging Players/Disruptors

- 11.3.1 Analog Devices

- 11.3.2 Black Sesame Technologies

- 11.3.3 BYD Company

- 11.3.4 ECARX Holdings

- 11.3.5 Horizon Robotics

- 11.3.6 Huawei Technologies

- 11.3.7 MediaTek

- 11.3.8 Renesas Electronics

- 11.3.9 Tesla