|

시장보고서

상품코드

1741037

탄산수소나트륨 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Sodium Bicarbonate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

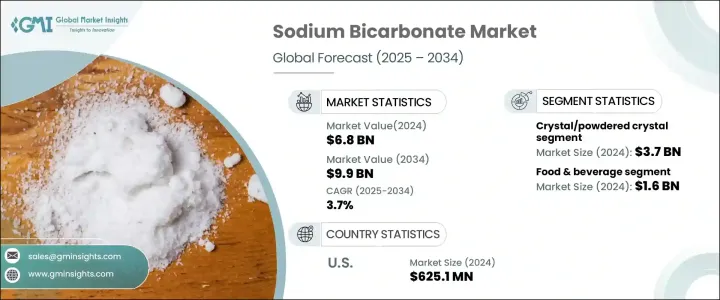

세계의 탄산수소나트륨 시장 규모는 2024년 68억 달러였고, 산업용도의 확대와 다양한 분야에서의 규제 준수가 높아짐에 따라 CAGR 3.7%로 성장해 2034년까지 99억 달러에 달할 것으로 예측되고 있습니다.

역사적으로, 탄산수소나트륨은 의약품, 식품가공, 환경솔루션 등 수많은 산업에서 클래식한 탄산수소나트륨 수요는 세계 공급망의 불안정성에 의한 혼란에 직면하고 있음에도 불구하고 다양한 제조 및 가공 업무에 있어서 필수적인 역할을 담당하고 있기 때문에 큰 회복력을 나타내고 있습니다.

아시아태평양, 북미, 유럽 등 지역에서 수요 증가는 주로 급속한 공업화와 환경 의식이 높아지기 때문입니다. pH 조정제로서의 사용도 그 관련성을 높이고 있습니다. 또, 탄산수소나트륨이 살균제나 영양 첨가제로서 사용되고 있는 농업이나 동물사료 분야에서도, 현저한 성장을 볼 수 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 68억 달러 |

| 예측 금액 | 99억 달러 |

| CAGR | 3.7% |

결정 및 분말 결정 시장 상황은 시장을 계속 독점하고 있습니다. 분말 결정의 형태는 화학적 안정성, 보존의 용이함, 보존 기간의 길이로 두드러집니다. 유동성 있는 텍스처가 선호되어 직접 혼합, 효율적인 포장, 정확한 제제화에 적합합니다. 또한 용해성이 뛰어나 입자경이 일정하기 때문에 규제가 엄격한 산업에서의 투여가 간소화됩니다.

식음료 분야에서 탄산수소나트륨은 2024년에 16억 달러의 평가액을 기록했고, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 4.1%로 성장할 전망입니다. 이 분야는 시장 전체의 약 22.9%를 차지하고 있습니다. 건강 지향 식품을 요구하는 소비자 증가에 의해 제조업체는 건강을 해치지 않고 제품의 품질을 향상시키는 원료를 사용하게 되어 있습니다.

미국의 탄산수소나트륨 시장은 2024년 6억 2,510만 달러로, 2034년까지 연평균 복합 성장률(CAGR) 3.5%로 확대될 것으로 예측되고 있습니다. 미국 시장의 개척은 산업 활동, 규제의 진전, 지속적인 경제 발전에 의해 크게 좌우됩니다. 팬데믹 후의 소비자 행동의 변화는 새로운 산업 투자와 함께 성장을 더욱 뒷받침하고 있습니다.

경쟁 구도은 혁신과 전략적 확장을 통해 더 큰 시장 점유율을 확보하려는 주요 기업에 의해 지배되고 있습니다. 특히, 제품의 혁신, 환경에 배려한 제조 방법, 생산의 최적화나 합병에 의한 수요가 높은 지역에 대한 진입이, 현저하게 중시되고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래의 전망

- 제조업자

- 리셀러

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 공급측의 영향(원재료)

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 무역 통계(HS코드)

- 주요 수출국, 2021-2024

- 주요 수입국, 2021-2024

- 제조 공정 및 공급망 분석

- 원재료 분석

- 주요 원재료

- 원재료 조달

- 원재료 가격 동향

- 원재료 공급자

- 제조 공정 분석

- 솔베이법

- 트로나법

- 탄산나트륨법

- 수산화나트륨법

- 나코라이트 추출

- 신흥 생산 기술

- 비용 구조 분석

- 공급망 분석

- 공급망의 구조와 매핑

- 유통 채널 분석

- 주요 물류업자

- 공급망의 과제

- 공급망 최적화 전략

- 생산 능력 분석

- 세계의 생산 능력

- 가동률

- 계획된 용량 확장

- 재고관리와 창고관리

- 품질관리 및 인증기준

- 원재료 분석

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 세계적 규제 상황

- 식품 등급 규제

- 의약품 등급 규정

- 산업 등급 규제

- 지역 규제 분석

- 북미

- 유럽

- 아시아태평양

- 세계 기타 지역

- 수출입 규제

- 제품 표시 및 포장 규제

- 안전 및 취급에 관한 지침

- 환경규제

- 배출가스 규제

- 폐기물 관리 규제

- 규제 영향 평가

- 생산 비용에 미치는 영향

- 시장 진입 장벽에 대한 영향

- 제품 개발에 미치는 영향

- 세계적 규제 상황

- 영향요인

- 성장 촉진요인

- 제약 업계 수요 증가

- 식품 및 음료 분야에서의 응용 확대

- 환경에 대한 우려 증가와 친환경 제품 수요

- 퍼스널케어 및 화장품 업계의 성장

- 업계의 잠재적 위험 및 과제

- 원재료 가격 변동

- 생산 공정에 대한 엄격한 환경 규제

- 성장 촉진요인

- 미래 시장 전망과 전략적 기회

- 시장 예측 2025-2034년

- 단기 예측(1-3년)

- 중기 예측(4-7년)

- 장기 예측(8-10년)

- 신흥 시장의 기회

- 고성장의 응용 분야

- 미개척 지역 시장

- 틈새 부문 기회

- 전략적 성장 기회

- 제품 개발 기회

- 시장 확대의 기회

- 부가가치 서비스 기회

- 기술 도입 및 혁신 로드맵

- 지속가능성 주도의 기회

- 전략적 제안

- 제조업체용

- 리셀러 및 공급업체용

- 최종 용도용

- 투자자용

- 미래 시나리오 계획

- 낙관적 시나리오

- 현실적 시나리오

- 비관적 시나리오

- 시장 예측 2025-2034년

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 리스크 분석 및 경감 전략

- 시장 리스크 평가

- 수요 변동 위험

- 가격 변동 위험

- 경쟁위험

- 대체 위험

- 운영 위험

- 공급망의 혼란

- 생산 리스크

- 품질 관리 위험

- 규제 및 규정 준수 위험

- 환경과 지속가능성의 위험

- 지정학적 리스크

- 리스크 경감 전략

- 다양화 전략

- 헤지 전략

- 보험과 리스크 이전의 구조

- 긴급시 대응 계획

- 업계 이해 관계자를 위한 리스크 관리 프레임워크

- 시장 리스크 평가

제5장 시장추계 및 예측 : 형태별, 2021-2034년

- 주요 동향

- 크리스탈 및 분말 크리스탈

- 액체

- 슬러리

제6장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 식음료

- 산업

- 의약품

- 퍼스널케어

- 농약

- 동물사료

- 기타

제7장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제8장 기업 프로파일

- Akshar Chemical India Private Limited

- Ciner Group

- Church & Dwight

- Crystal Mark

- FMC

- GHCL

- Haohua Honghe Chemical

- Natural Soda

- Opta Minerals

- Sisecam

- Solvay

- Tata Chemicals

- Tosoh

The Global Sodium Bicarbonate Market was valued at USD 6.8 billion in 2024 and is estimated to grow at a CAGR of 3.7% to reach USD 9.9 billion by 2034, driven by a combination of expanding industrial applications and rising regulatory compliance across various sectors. Historically, sodium bicarbonate has remained a staple across numerous industries, including pharmaceuticals, food processing, and environmental solutions. Despite facing disruptions due to global supply chain instability, the demand for sodium bicarbonate displayed significant resilience, largely due to its indispensable role in diverse manufacturing and processing operations.

The increasing demand in regions such as Asia Pacific, North America, and Europe has primarily been driven by rapid industrialization and growing environmental awareness. These regions are taking proactive steps to align with evolving environmental standards, resulting in sustained demand for sodium bicarbonate. Additionally, the compound's use in healthcare formulations and as a pH control agent in medications continues to fuel its relevance. There has also been notable growth in the agriculture and animal feed sectors, where sodium bicarbonate is used both as a fungicide and nutritional additive. These dynamics collectively ensure that the product retains a strong foothold in global supply chains and consumption cycles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 3.7% |

The crystal and powdered crystal forms of sodium bicarbonate continue to dominate the market landscape. Valued at USD 3.7 billion in 2024, this segment is projected to grow at a CAGR of 4.2% between 2025 and 2034. The powdered crystal form stands out for its chemical stability, ease of storage, and longer shelf life. This format is particularly advantageous in sectors like food production, pharmaceuticals, and personal care, where consistent quality and reliable formulation are key. Powdered sodium bicarbonate is preferred for its fine, free-flowing texture, which makes it suitable for direct blending, efficient packaging, and precise formulation. Furthermore, it offers excellent solubility and consistent particle size, which simplifies dosing in tightly regulated industries. Its utility in flue gas desulfurization also strengthens its demand across industrial applications.

Within the food and beverage sector, sodium bicarbonate held a valuation of USD 1.6 billion in 2024, with expectations to grow at a 4.1% CAGR from 2025 to 2034. This segment accounts for approximately 22.9% of the total market share. The increasing incorporation of sodium bicarbonate in baking, processed foods, and beverages underscores its role as a vital leavening and pH-regulating agent. Rising consumer inclination toward convenient, ready-to-eat, and health-oriented food options is pushing manufacturers to use ingredients that enhance product quality without compromising health. Sodium bicarbonate aligns well with these preferences due to its clean-label appeal and functional versatility.

In the United States, the sodium bicarbonate market was valued at USD 625.1 million in 2024 and is projected to expand at a CAGR of 3.5% through 2034. Growth in the U.S. market is largely shaped by industrial activity, evolving regulations, and ongoing economic developments. Supportive government policies, an established industrial infrastructure, and stringent environmental and food safety regulations are contributing to steady demand. Post-pandemic shifts in consumer behavior, alongside new industrial investments, have further bolstered growth. There is an observable uptick in demand across both healthcare and convenience-focused consumer goods sectors, reinforcing the country's stronghold in the global landscape.

The competitive landscape is dominated by key players aiming to secure larger market shares through innovation and strategic expansion. Companies are diversifying product lines, investing in sustainable solutions, and strengthening their global presence to meet rising demand. Continuous efforts in research and development, particularly toward enhancing product functionality and sustainability, are reshaping how these companies position themselves. In particular, there is a noticeable emphasis on product innovation, eco-conscious manufacturing practices, and tapping into high-demand regions through production optimization and mergers. With market dynamics increasingly shaped by consumer trends and regulatory shifts, businesses are adjusting strategies to stay competitive and responsive to global needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.3.2 Major importing countries, 2021-2024 (kilo tons)

- 3.4 Manufacturing process and supply chain analysis

- 3.4.1 Raw materials analysis

- 3.4.1.1 Key raw materials

- 3.4.1.2 Raw material sourcing

- 3.4.1.3 Raw material price trends

- 3.4.1.4 Raw material suppliers

- 3.4.2 Manufacturing process analysis

- 3.4.2.1 Solvay process

- 3.4.2.2 Trona process

- 3.4.2.3 Sodium carbonate method

- 3.4.2.4 Sodium hydroxide method

- 3.4.2.5 Nahcolite extraction

- 3.4.2.6 Emerging production technologies

- 3.4.2.7 Cost structure analysis

- 3.4.3 Supply chain analysis

- 3.4.3.1 Supply chain structure and mapping

- 3.4.3.2 Distribution channels analysis

- 3.4.3.3 Key logistics providers

- 3.4.3.4 Supply chain challenges

- 3.4.3.5 Supply chain optimization strategies

- 3.4.4 Production capacity analysis

- 3.4.4.1 Global production capacity

- 3.4.4.2 Capacity utilization rates

- 3.4.4.3 Planned capacity expansions

- 3.4.5 Inventory management and warehousing

- 3.4.6 Quality control and certification standards

- 3.4.1 Raw materials analysis

- 3.5 Supplier landscape

- 3.6 Profit margin analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.8.1 Global regulatory landscape

- 3.8.1.1 Food grade regulations

- 3.8.1.2 Pharmaceutical grade regulations

- 3.8.1.3 Industrial grade regulations

- 3.8.2 Regional regulatory analysis

- 3.8.2.1 North America

- 3.8.2.2 Europe

- 3.8.2.3 Asia pacific

- 3.8.2.4 Rest of the world

- 3.8.3 Import-export regulations

- 3.8.4 Product labeling and packaging regulations

- 3.8.5 Safety and handling guidelines

- 3.8.6 Environmental regulations

- 3.8.6.1 Emission control regulations

- 3.8.6.2 Waste management regulations

- 3.8.7 Regulatory impact assessment

- 3.8.7.1 Impact on production costs

- 3.8.7.2 Impact on market entry barriers

- 3.8.7.3 Impact on product development

- 3.8.1 Global regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand in the pharmaceutical industry.

- 3.9.1.2 Expanding applications in food and beverage sectors.

- 3.9.1.3 Rising environmental concerns and demand for eco-friendly products.

- 3.9.1.4 Growth in the personal care and cosmetics industry.

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Price volatility of raw materials.

- 3.9.2.2 Stringent environmental regulations on production processes.

- 3.9.1 Growth drivers

- 3.10 Future market outlook and strategic opportunities

- 3.10.1 Market forecast 2025–2034

- 3.10.1.1 Short-term forecast (1–3 years)

- 3.10.1.2 Medium-term forecast (4–7 years)

- 3.10.1.3 Long-term forecast (8–10 years)

- 3.10.2 Emerging market opportunities

- 3.10.2.1 High-growth application areas

- 3.10.2.2 Untapped regional markets

- 3.10.2.3 Niche segment opportunities

- 3.10.3 Strategic growth opportunities

- 3.10.3.1 Product development opportunities

- 3.10.3.2 Market expansion opportunities

- 3.10.3.3 Value-added services opportunities

- 3.10.4 Technology adoption and innovation roadmap

- 3.10.5 Sustainability-driven opportunities

- 3.10.6 Strategic recommendations

- 3.10.7 For manufacturers

- 3.10.8 For distributors and suppliers

- 3.10.9 For end use

- 3.10.10 For investors

- 3.10.11 Future scenario planning

- 3.10.11.1 Optimistic scenario

- 3.10.11.2 Realistic scenario

- 3.10.11.3 Pessimistic scenario

- 3.10.1 Market forecast 2025–2034

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Risk analysis and mitigation strategies

- 4.5.1 Market risks assessment

- 4.5.1.1 Demand fluctuation risks

- 4.5.1.2 Price volatility risks

- 4.5.1.3 Competitive risks

- 4.5.1.4 Substitution risks

- 4.5.2 Operational risks

- 4.5.2.1 Supply chain disruptions

- 4.5.2.2 Production risks

- 4.5.2.3 Quality control risks

- 4.5.3 Regulatory and compliance risks

- 4.5.4 Environmental and sustainability risks

- 4.5.5 Geopolitical risks

- 4.5.6 Risk mitigation strategies

- 4.5.6.1 Diversification strategies

- 4.5.6.2 Hedging strategies

- 4.5.6.3 Insurance and risk transfer mechanisms

- 4.5.6.4 Contingency planning

- 4.5.7 Risk management framework for industry stakeholders

- 4.5.1 Market risks assessment

Chapter 5 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Crystal/powdered crystal

- 5.3 Liquid

- 5.4 Slurry

Chapter 6 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Industrial

- 6.4 Pharmaceutical

- 6.5 Personal care

- 6.6 Agrochemical

- 6.7 Animal feed

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Akshar Chemical India Private Limited

- 8.2 Ciner Group

- 8.3 Church & Dwight

- 8.4 Crystal Mark

- 8.5 FMC

- 8.6 GHCL

- 8.7 Haohua Honghe Chemical

- 8.8 Natural Soda

- 8.9 Opta Minerals

- 8.10 Sisecam

- 8.11 Solvay

- 8.12 Tata Chemicals

- 8.13 Tosoh