|

시장보고서

상품코드

1741005

자동차 E-E 아키텍처 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Automotive E-E (Electronic/Electrical) Architecture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

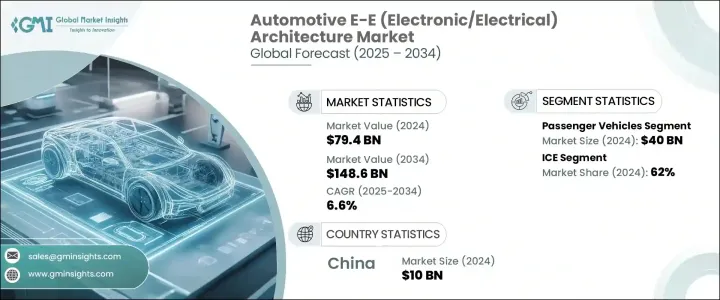

세계의 자동차 E-E 아키텍처 시장은 2024년 794억 달러로, 전기차(EV)의 보급 확대, 차량 연결성 향상, 자율주행 기술에 대한 수요 증가 등을 배경으로 CAGR 6.6%로 성장하여 2034년까지 1,486억 달러에 달할 것으로 예측됩니다.

중앙 집중식 컴퓨팅 플랫폼은 커넥티드 자동차 및 자율 주행 차량의 센서, 카메라 및 통신 네트워크에서 생성되는 방대한 데이터를 지원하는 데 필수적입니다. 자동차 제조업체는 에너지 효율, 사이버 보안 및 컴플라이언스를 높이기 위해 E-E 시스템의 재 설계를 촉구하고 있습니다. 유럽의 Euro 7과 아시아의 China VI와 같은 규제 기준의 엄격화로 인해 자동차 제조업체는 보다 높은 에너지 효율, 사이버 보안 및 규제 준수를 위해 E-E 시스템의 재설계를 촉구하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 794억 달러 |

| 예측 금액 | 1,486억 달러 |

| CAGR | 6.6% |

자동차 E-E 아키텍처 시장은 주로 유형별로 구분되며, 2024년에는 분산형 E-E 아키텍처가 367억 달러를 벌어들여 리드했습니다. 제조업체는 네트워크 전체를 오버홀하지 않고도 특정 차량 시스템을 개별적으로 업그레이드할 수 있습니다.

차량 유형별로는 승용차가 2024년에 436억 달러를 차지해 최대 시장 점유율을 획득했습니다. 첨단 아키텍처는 다양한 차량 시스템 간의 원활한 통신을 가능하게 하고, 운전 지원 기능을 강화하고, 차량 진단을 개선하고, 자율 주행 기능을 가능하게 해, 전체적인 운전 체험을 향상시킵니다.

아시아태평양의 자동차 E-E 아키텍처 시장은 급속한 전기자동차(EV)의 보급, 스마트 시티 구상, 중국, 일본, 한국의 강력한 자동차 제조 거점에 견인되어 2024년에는 279억 5,000만 달러에 달했습니다. 중국은 적극적인 EV 정책, 광범위한 스마트 인프라 개척 일본과 한국은 자율주행차 기술과 5G 대응 V2X 통신시스템에 다액의 투자를 실시하고 있으며, 선진적인 E-E 아키텍처의 필요성을 더욱 높여주고 있습니다.

Robert Bosch GmbH, Continental AG, Aptiv PLC, ZF Friedrichshafen AG, Denso Corporation과 같은 대기업은 경쟁력을 유지하기 위해 연구개발에 적극적으로 투자하고 전략적 파트너십을 맺고 모듈식 소프트웨어 정의 E-E 플랫폼을 개발하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 공급자의 상황

- E-E 아키텍처 제공업체

- 부품 공급업체

- 리셀러

- 최종 용도

- 트럼프 정권에 의한 관세에 대한 영향

- 무역에 미치는 영향

- 무역량의 혼란

- 보복 조치

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 공급측의 영향(원재료)

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 무역에 미치는 영향

- 이익률 분석

- 기술과 혁신의 상황

- 특허 분석

- 가격 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 전기자동차(EV) 수요 증가

- 차량의 안전성과 규제 기준에 대한 주목 상승

- ADAS(첨단 운전 지원 시스템)의 도입 증가

- 커넥티드카와 V2X(차차간 통신) 통신 수요

- 업계의 잠재적 위험 및 과제

- 고급 E-E 아키텍처 개발이 복잡하고 많은 비용이 필요

- 차량의 접속성 향상에 따른 사이버 보안 위험

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

제5장 시장 추계 및 예측 : 유형별, 2021-2034년

- 주요 동향

- 분산형 E-E 아키텍처

- 도메인 E-E 아키텍처

- 존 아키텍처

제6장 시장 추계 및 예측 : 차량별, 2021-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제7장 시장 추계 및 예측 : 추진력별, 2021-2034년

- 주요 동향

- ICE

- 전기자동차

- 배터리 전기자동차(BEV)

- 플러그인 하이브리드 전기자동차(PHEV)

- 하이브리드 전기자동차(HEV)

제8장 시장 추계 및 예측 : 컴포넌트별, 2021-2034년

- 주요 동향

- 전자제어유닛(ECU)

- 배전 박스

- 액추에이터 센서

- 통신 인터페이스

- 배선 하네스

- 기타

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Aptiv

- Continental

- Denso

- Faurecia

- Harman International

- Hitachi Astemo

- Hyundai Mobis

- Infineon Technologies

- Lear

- Magna International

- Marelli

- NXP Semiconductors

- Panasonic

- Renesas Electronics

- Robert Bosch

- STMicroelectronics

- Texas Instruments

- Valeo

- Visteon

- ZF Friedrichshafen

The Global Automotive E-E Architecture Market was valued at USD 79.4 billion in 2024 and is estimated to grow at a CAGR of 6.6%, reaching USD 148.6 billion by 2034, driven by the rising adoption of electric vehicles (EVs), increasing vehicle connectivity, and the growing demand for autonomous driving technologies. Automotive E-E (Electrical and Electronics) architecture underpins the critical functions of modern vehicles, managing everything from powertrains and infotainment to advanced driver-assistance systems (ADAS) and connectivity solutions. The shift towards zonal and centralized architectures enhances vehicle performance by reducing wiring complexity, improving data processing speeds, and enabling seamless integration of sophisticated technologies such as AI, machine learning, and V2X communication.

Centralized computing platforms are becoming essential for supporting the massive data generated by sensors, cameras, and communication networks in connected and autonomous vehicles. Moreover, the push for sustainable mobility and stricter regulatory standards, such as Euro 7 and China VI, is prompting automakers to redesign their E-E systems for greater energy efficiency, cybersecurity, and compliance. Moreover, the push for sustainable mobility and stricter regulatory standards, such as Euro 7 in Europe and China VI in Asia, is prompting automakers to redesign their E-E systems for greater energy efficiency, cybersecurity, and regulatory compliance. These evolving regulations demand not only lower vehicle emissions but also higher standards for vehicle safety, connectivity, and data security.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $79.4 Billion |

| Forecast Value | $148.6 Billion |

| CAGR | 6.6% |

The Automotive E-E Architecture Market is primarily segmented by type, with distributed E/E architecture leading in 2024, generating USD 36.7 billion. Distributed architectures, characterized by multiple independent electronic control units (ECUs) controlling various vehicle functions, have been widely adopted due to their flexibility, ease of integration, and scalability. This design allows automakers to independently upgrade specific vehicle systems without overhauling the entire network. However, as vehicles become increasingly software-defined and data-intensive, the industry is gradually transitioning toward domain and zonal architectures, which offer centralized control, improved data management, lower system complexity, and reduced wiring costs.

Based on vehicle type, passenger vehicles captured the largest market share in 2024, accounting for USD 43.6 billion. The rising demand for personal vehicles equipped with premium features such as Advanced Driver Assistance Systems (ADAS), next-generation infotainment systems, connectivity services, and electric powertrains is fueling the adoption of sophisticated E-E architectures in this segment. Advanced architectures allow seamless communication between various vehicle systems, enhancing driver assistance capabilities, improving vehicle diagnostics, enabling autonomous features, and elevating the overall driving experience.

Asia Pacific Automotive E-E Architecture Market reached USD 27.95 billion in 2024, driven by rapid electric vehicle (EV) adoption, smart city initiatives, and strong automotive manufacturing bases in China, Japan, and South Korea. China continues to lead the regional market due to its aggressive EV policies, extensive smart infrastructure development, and growing domestic EV brands. Japan and South Korea invest heavily in autonomous vehicle technologies and 5G-enabled V2X communication systems, further boosting the need for advanced E-E architectures. Government incentives, subsidies for EV adoption, and substantial RandD investments in next-generation mobility solutions are accelerating the integration of modern, scalable E-E systems across the region.

Major players such as Robert Bosch GmbH, Continental AG, Aptiv PLC, ZF Friedrichshafen AG, and Denso Corporation are actively investing in RandD, forming strategic partnerships, and developing modular, software-defined E-E platforms to stay competitive. The focus on enhancing cybersecurity, scalability, and energy management is set to define the next generation of automotive electrical and electronic architectures worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 E-E architecture providers

- 3.2.2 Component providers

- 3.2.3 Distributors

- 3.2.4 End Use

- 3.3 Impact of trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (selling price)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Pricing analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing demand for electric vehicles (EVs)

- 3.10.1.2 Increasing focus on vehicle safety and regulatory standards

- 3.10.1.3 Rising adoption of Advanced Driver Assistance Systems (ADAS)

- 3.10.1.4 Demand for connected cars and vehicle-to-everything (V2X) communication

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High complexity and cost of developing advanced E/E architectures

- 3.10.2.2 Cybersecurity risks associated with increasing vehicle connectivity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Distributed E/E architecture

- 5.3 Domain E/E architecture

- 5.4 Zonal architecture

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric vehicles

- 7.3.1 Battery Electric Vehicles (BEV)

- 7.3.2 Plug-in Hybrid Electric Vehicles (PHEV)

- 7.3.3 Hybrid Electric Vehicles (HEV)

Chapter 8 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Electronic Control Units (ECUs)

- 8.3 Power distribution boxes

- 8.4 Actuators and sensors

- 8.5 Communication interfaces

- 8.6 Wiring harnesses

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv

- 10.2 Continental

- 10.3 Denso

- 10.4 Faurecia

- 10.5 Harman International

- 10.6 Hitachi Astemo

- 10.7 Hyundai Mobis

- 10.8 Infineon Technologies

- 10.9 Lear

- 10.10 Magna International

- 10.11 Marelli

- 10.12 NXP Semiconductors

- 10.13 Panasonic

- 10.14 Renesas Electronics

- 10.15 Robert Bosch

- 10.16 STMicroelectronics

- 10.17 Texas Instruments

- 10.18 Valeo

- 10.19 Visteon

- 10.20 ZF Friedrichshafen