|

시장보고서

상품코드

1665183

강압제 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Antihypertensive Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

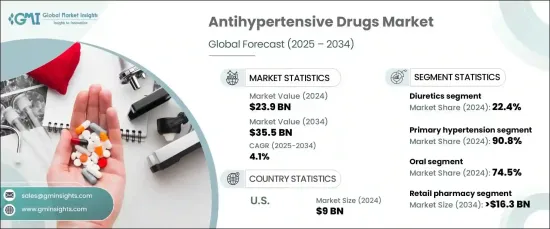

세계 강압제 시장은 2024년에 239억 달러로 평가되었으며 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 4.1%로 확대될 전망입니다.

이 성장은 세계 고혈압의 유병률 증가로 인한 것입니다. 고혈압은 무증상이며 심각한 건강 위험이 있기 때문에 종종 "침묵의 살인자"라고합니다.

인구의 고령화와 식생활의 혼란, 스트레스, 운동 부족 등 생활 습관의 악화가 진행됨에 따라 고혈압률은 계속 상승하고 효과적인 치료법에 대한 수요가 높아지고 있습니다. 약물 제형의 끊임없는 진보는 원격 모니터링 및 개별화된 투약 계획과 같은 디지털 건강 기술의 통합과 함께 치료 풍경을 재구성하고 있습니다. 또한 심장병과 뇌졸중과 같은 통제되지 않은 고혈압과 관련된 합병증에 대한 의식이 높아짐에 따라 조기 진단과 적극적인 치료의 도입을 촉진하고 혈압 억제제의 지속적인 수요를 확보하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 239억 달러 |

| 예측 금액 | 355억 달러 |

| CAGR | 4.1% |

시장은 치료 유형별로 이뇨제, ACE 억제제, 안지오텐신 수용체 차단제, 베타 차단제, 칼슘 채널 차단제, 레닌 억제제, 알파 차단제, 혈관 확장제 및 기타 치료법으로 분류됩니다. 2024년에는 혈압을 낮추는 효과가 인정된 티아지드계 이뇨제가 널리 사용되어 이뇨제 부문이 22.4%로 최대 점유율을 차지했습니다. 이 부문에는 루프 이뇨제와 칼륨 보전 이뇨제도 포함되어 다양한 치료 요구를 충족합니다. 또 다른 주요 카테고리인 베타 차단제는 베타 1 선택성과 내인성 교감 신경 자극성으로 구분되며 개별 환자의 요구에 따라 개별화 솔루션을 제공합니다.

약 유형별로 보면, 시장은 1차성 고혈압 치료제와 2차성 고혈압 치료제로 나뉩니다. 1차성 고혈압 치료는 이 질병의 높은 유병률을 반영하여 2024년 시장 점유율에서 90.8%를 차지했습니다. 1차성 고혈압은 라이프스타일과 유전적 요인과 관련이 많으며 효과적이고 장기적인 치료 옵션에 대한 필요성이 증가하고 있습니다.

미국은 강압제 시장에서 지배적인 지위를 유지하고 있으며, 2024년에는 90억 달러의 매출을 기록했습니다. 이 리더십은 높은 혈압 이환율, 견고한 건강 관리 인프라 및 R&D에 대한 많은 투자로 인한 것입니다. 혁신적인 치료법에 대한 규제 당국의 승인으로 환자는 최첨단 약물을 사용할 수 있게 되어 시장 성장을 더욱 촉진하고 있습니다. 또한 조기진단 캠페인과 첨단 치료 프로토콜에 주력함으로써 국가 전체의 보급률도 가속화되고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 정보

- 데이터 마이닝 소스

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 고혈압 유병률 증가

- 고혈압 치료제 개발과 제제의 진보

- 고혈압의 리스크에 대한 의식의 고조

- 치료 전략에 있어서의 디지털 헬스 솔루션의 통합

- 업계의 잠재적 위험 및 과제

- 강압 치료 중의 복약 준수의 저하

- 엄격한 규제의 존재

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술적 전망

- 특허 분석

- 갭 분석

- 미래 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망

제5장 시장 추계·예측 : 치료법별, 2021-2034년

- 주요 동향

- 이뇨제

- 티아지드계 이뇨제

- 루프 이뇨제

- 칼륨 보전 이뇨제

- ACE 억제제

- 안지오텐신 수용체 차단제

- 베타 차단제

- 베타1 선택적

- 내인성 교감 신경 자극제

- 칼슘 채널 차단제

- 레닌 억제제

- 알파 차단제

- 혈관확장제

- 기타 치료제

제6장 시장 추계·예측 : 약제 유형별, 2021-2034년

- 주요 동향

- 1차성 고혈압

- 2차성 고혈압

제7장 시장 추계·예측 : 투여 경로별, 2021-2034년

- 주요 동향

- 경구제

- 주사제

- 기타 투여 경로

제8장 시장 추계·예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 소매 약국

- 병원 약국

- 온라인 약국

제9장 시장 추계·예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- AbbVie

- AstraZeneca

- Bayer AG

- Boehringer Ingelheim International GmbH

- Daiichi Sankyo Company

- Johnson & Johnson Services

- Lupin

- Merck & Co

- Noden Pharma DAC

- Novartis AG

- Pfizer

- Sanofi

- Sun Pharmaceutical Industries

- Takeda Pharmaceutical

- Torrent Pharmaceuticals

The Global Antihypertensive Drugs Market, valued at USD 23.9 billion in 2024, is set to expand at a compound annual growth rate (CAGR) of 4.1% from 2025 to 2034. This growth is largely driven by the increasing prevalence of hypertension worldwide, a condition often referred to as the "silent killer" due to its asymptomatic nature and severe health risks.

As populations age and lifestyle factors such as poor diet, stress, and lack of exercise persist, hypertension rates continue to rise, fueling the demand for effective treatments. Continuous advancements in drug formulations, coupled with the integration of digital health technologies like remote monitoring and personalized medication plans, are reshaping treatment landscapes. Furthermore, heightened awareness of the complications associated with unmanaged hypertension, such as heart disease and stroke, is encouraging early diagnosis and proactive treatment adoption, ensuring a sustained demand for antihypertensive drugs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.9 Billion |

| Forecast Value | $35.5 Billion |

| CAGR | 4.1% |

The market is categorized by therapy type into diuretics, ACE inhibitors, angiotensin receptor blockers, beta blockers, calcium channel blockers, renin inhibitors, alpha-blockers, vasodilators, and other treatments. In 2024, the diuretics segment commanded the largest share at 22.4%, thanks to the widespread use of thiazide diuretics, which are recognized for their effectiveness in reducing blood pressure. This segment also includes loop and potassium-sparing diuretics, catering to diverse treatment requirements. Beta blockers, another key category, are further segmented into beta-1 selective and intrinsic sympathomimetic variants, offering personalized solutions based on individual patient needs.

By drug type, the market divides into treatments for primary and secondary hypertension. Primary hypertension treatments dominated with a commanding 90.8% market share in 2024, reflecting the high global prevalence of this condition. Primary hypertension, often linked to lifestyle and genetic factors, underscores the growing need for effective, long-term treatment options.

The United States remains a dominant player in the antihypertensive drugs market, generating USD 9 billion in revenue in 2024. This leadership is attributed to the high incidence of hypertension, coupled with robust healthcare infrastructure and significant investment in research and development. Regulatory approvals for innovative therapies are enabling patients to access cutting-edge medications, further driving market growth. The focus on early diagnosis campaigns and advanced treatment protocols is also accelerating adoption rates across the country.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of hypertension

- 3.2.1.2 Advances in hypertensive drug development and formulations

- 3.2.1.3 Growing awareness about the risks of hypertension

- 3.2.1.4 Integration of digital health solutions in treatment strategies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Poor medication adherence during antihypertensive treatments

- 3.2.2.2 Presence of stringent regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Patent analysis

- 3.7 Gap analysis

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Therapy, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diuretics

- 5.2.1 Thiazide diuretics

- 5.2.2 Loop diuretics

- 5.2.3 Potassium-sparing diuretics

- 5.3 ACE inhibitors

- 5.4 Angiotensin receptor blockers

- 5.5 Beta blockers

- 5.5.1 Beta-1 selective

- 5.5.2 Intrinsic sympathomimetic

- 5.6 Calcium channel blockers

- 5.7 Renin inhibitors

- 5.8 Alpha-blockers

- 5.9 Vasodilators

- 5.10 Other therapies

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Primary hypertension

- 6.3 Secondary hypertension

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacy

- 8.3 Hospital pharmacy

- 8.4 Online pharmacy

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 AstraZeneca

- 10.3 Bayer AG

- 10.4 Boehringer Ingelheim International GmbH

- 10.5 Daiichi Sankyo Company

- 10.6 Johnson & Johnson Services

- 10.7 Lupin

- 10.8 Merck & Co

- 10.9 Noden Pharma DAC

- 10.10 Novartis AG

- 10.11 Pfizer

- 10.12 Sanofi

- 10.13 Sun Pharmaceutical Industries

- 10.14 Takeda Pharmaceutical

- 10.15 Torrent Pharmaceuticals