|

시장보고서

상품코드

1665227

위성 케이블 및 어셈블리 시장 : 기회와 촉진요인, 산업 동향 분석, 예측(2025-2034년)Satellite Cables and Assemblies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

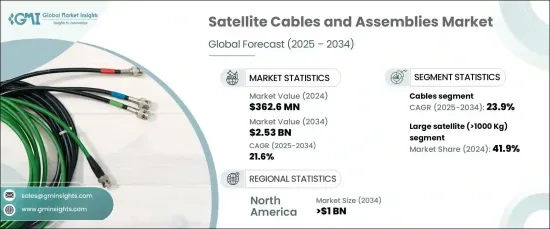

세계 위성 케이블 및 어셈블리 시장은 2024년 3억 6,260만 달러로 평가되었으며, 2025-2034년까지 추정 CAGR 21.6%로 현저한 성장을 이루려고 합니다.

이러한 급성장의 배경은 위성 광대역 서비스의 확대로 인해 원격지나 서비스가 잘 되지 않는 지역에서 신뢰할 수 있는 고속 인터넷에 대한 수요가 높아질 수 있습니다. 통신, 미디어, 방어와 같은 주요 산업은 선진 위성 통신 네트워크에 대한 의존도를 높이고 있으며, 선진 케이블 및 조립 부품이 필요합니다. 특히 지역의 위성 기반 인터넷 서비스의 상승은 고속 데이터 전송을 지원할 수 있는 견고한 케이블 및 커넥터의 중요한 필요성을 강조합니다.

시장은 위성 유형에 따라 소형 위성(500kg까지), 중형 위성(501-1,000kg), 대형 위성(1,000kg 이상)으로 구분됩니다. 2024년에는 대형 위성이 41.9%의 점유율로 시장을 독점했습니다. 무게가 1,000kg 이상인 이 위성은 복잡한 통신, 지구관측, 과학 연구 임무에 필수적입니다. 이러한 위성은 배전, 데이터 전송 및 통신 서브시스템을 관리하기 위해 고성능 케이블 및 어셈블리가 필요합니다. 대형 위성의 배치가 진행됨에 따라 우주의 가혹한 조건을 견딜 수 있도록 설계된 튼튼한 경량 케이블에 대한 수요가 증가하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 3억 6,260만 달러 |

| 예측 금액 | 25억 3,000만 달러 |

| CAGR | 21.6% |

위성 케이블 및 조립 시장은 부품별로 케이블, 커넥터 및 기타로 분류됩니다. 예측 기간 동안 CAGR은 23.9%로 케이블 부문이 가장 빠르게 성장할 것으로 예상됩니다. 케이블은 위성 시스템에서 신뢰할 수 있는 전력과 데이터 전송을 보장하는 데 매우 중요한 역할을 합니다. 산업은 방사선, 극단적인 온도, 기계적 스트레스에 대한 내성 등 엄격한 성능 기준을 충족하는 제품 개발에 주력하고 있습니다. 위성 기술의 발전으로 우주 운영의 무결성을 유지하면서 고속 데이터 전송을 지원할 수 있는 유연하고 가볍고 내구성 있는 케이블이 필요합니다.

북미 위성 케이블 및 조립 시장은 2034년까지 10억 달러에 이를 것으로 예상되며, 미국이 이 성장의 최전선에 있습니다. 우주통신, 탐사, 위성 기반 서비스에 대한 투자 증가는 고성능 위성 네트워크를 지원하는 첨단 케이블 시스템 수요를 촉진하고 있습니다. 미국 정부의 이니셔티브와 민간 기업의 위성 발사에 참여하는 것은 혁신적인 위성 기술 개발을 뒷받침하고 있습니다. 위성 별자리와 광대역 구상의 확대는 이 역동적이고 빠르게 진화하는 시장에서 안정적이고 효율적이며 내구성 있는 케이블의 필요성을 더욱 강조하고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 소스

- 1차 데이터

- 2차 자료

- 유료 정보원

- 공적 정보원

제2장 주요 요약

제3장 산업 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 변혁

- 미래의 전망

- 제조업체

- 유통업체

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 위성 광대역 및 통신 시스템에 대한 수요 증가

- 위성 발사 활동과 우주 개발 이니셔티브 증가

- 위성의 소형화와 비용 절감 기술의 진보

- 고성능이며 경량인 위성 케이블 및 어셈블리 요구 증가

- IoT나 AI 용도에 있어서의 위성 시스템의 이용 확대

- 산업의 잠재적 리스크 및 과제

- 첨단 케이블 및 어셈블리 재료와 관련된 높은 비용

- 가혹한 환경 조건 하에서의 품질 기준 유지의 과제

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추정·예측 : 위성 유형별, 2021-2034년

- 주요 동향

- 소형 위성(500Kg 이하)

- 중형 위성(501-1,000Kg)

- 대형 위성(1,000Kg 이상)

제6장 시장 추정·예측 : 도체 재료별, 2021-2034년

- 주요 동향

- 금속 합금

- 섬유

제7장 시장 추정·예측 : 부품별, 2021-2034년

- 주요 동향

- 케이블

- 라운드 케이블

- 플랫/리본 케이블

- 커넥터

- 기타

제8장 시장 추정·예측 : 단열 유형별, 2021-2034년

- 주요 동향

- 열경화성

- 열가소성

제9장 시장 추정·예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Amphenol Corporation

- Axon'Cable SAS

- Cicoil Flat Cables

- Cinch Connectivity Solutions

- Eaton Corporation

- Huber Suhner

- Meggitt PLC

- Nexans SA

- Prysmian Group

- Smiths Group PLC

- TE Connectivity

- WL Gore & Associates, Inc.

The Global Satellite Cables And Assemblies Market, valued at USD 362.6 million in 2024, is poised for remarkable growth with an estimated CAGR of 21.6% from 2025 to 2034. This surge is driven by the growing demand for reliable, high-speed internet in remote and underserved regions, fueled by the expansion of satellite broadband services. Key industries such as telecommunications, media, and defense increasingly rely on advanced satellite communication networks, necessitating sophisticated cable and assembly components. The rise of satellite-based internet services, particularly in rural areas, underscores the critical need for robust cables and connectors capable of supporting high data transfer speeds.

The market is segmented by satellite type into small satellites (up to 500 kg), medium satellites (501-1000 kg), and large satellites (over 1000 kg). In 2024, large satellites dominated the market with a 41.9% share. These satellites, often weighing over 1,000 kg, are vital for complex communication, Earth observation, and scientific research missions. They require high-performance cables and assemblies to manage power distribution, data transmission, and communication subsystems. The increasing deployment of large satellites drives demand for durable, lightweight cables engineered to withstand the harsh conditions of space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $362.6 Million |

| Forecast Value | $2.53 Billion |

| CAGR | 21.6% |

By component, the satellite cables and assemblies market is categorized into cables, connectors, and others. The cables segment is projected to be the fastest-growing, with an impressive CAGR of 23.9% during the forecast period. Cables play a pivotal role in ensuring reliable power and data transmission within satellite systems. The industry is focused on developing products that meet stringent performance standards, including resistance to radiation, temperature extremes, and mechanical stress. Advances in satellite technology have amplified the need for flexible, lightweight, and durable cables capable of supporting high-speed data transfer while maintaining operational integrity in space.

North America satellite cables and assemblies market is expected to reach USD 1 billion by 2034, with the United States at the forefront of this growth. Increased investments in space communication, exploration, and satellite-based services are driving demand for advanced cable systems that support high-performance satellite networks. U.S. government initiatives and private sector participation in satellite launches are boosting the development of innovative satellite technologies. The expansion of satellite constellations and broadband initiatives further underscores the need for reliable, efficient, and durable cables in this dynamic and rapidly evolving market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for satellite broadband and communication systems

- 3.6.1.2 Increasing satellite launch activities and space exploration initiatives

- 3.6.1.3 Advancements in satellite miniaturization and cost reduction technologies

- 3.6.1.4 Growing need for high-performance, lightweight satellite cables and assemblies

- 3.6.1.5 Expanding use of satellite systems in IoT and AI applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs associated with advanced cable and assembly materials

- 3.6.2.2 Challenges in maintaining quality standards under extreme environmental conditions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Satellite Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Small satellite (<500 Kg)

- 5.3 Medium satellite (501-1000 Kg)

- 5.4 Large satellite (>1000 Kg)

Chapter 6 Market Estimates & Forecast, By Conductor Material, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Metal alloys

- 6.3 Fibers

Chapter 7 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Cables

- 7.2.1 Round cables

- 7.2.2 Flat/ ribbon cables

- 7.3 Connectors

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Insulation Type, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Thermosetting

- 8.3 Thermoplastic

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amphenol Corporation

- 10.2 Axon' Cable SAS

- 10.3 Cicoil Flat Cables

- 10.4 Cinch Connectivity Solutions

- 10.5 Eaton Corporation

- 10.6 Huber+Suhner

- 10.7 Meggitt PLC

- 10.8 Nexans SA

- 10.9 Prysmian Group

- 10.10 Smiths Group PLC

- 10.11 TE Connectivity

- 10.12 W.L. Gore & Associates, Inc.