|

시장보고서

상품코드

1666528

자동 라벨링 머신 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Automated Labeling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

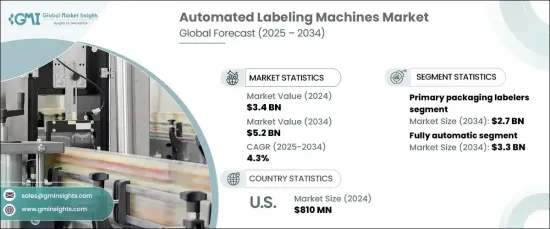

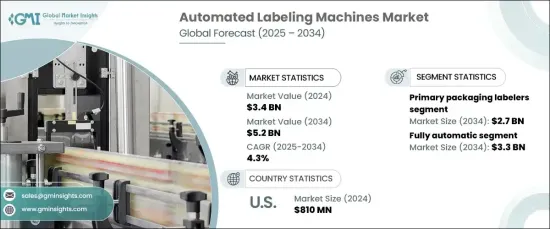

세계의 자동 라벨링 머신 시장은 2024년 34억 달러로 평가되었으며, 2025년과 2034년 사이에 4.3%의 안정적인 CAGR로 성장할 것으로 예상됩니다.

효율적이고 빠르고 정밀한 라벨링 솔루션에 대한 산업계 수요가 시장을 진전시키고 있습니다. 이 기계는 정확성과 일관성이 필수적인 의약품, 음식, 화장품, 소비재 등의 분야에서 널리 사용됩니다. 전자상거래의 성장과 생산 라인 최적화의 필요성은 자동 라벨링 시스템의 채택을 더욱 강화하고 있습니다.

로봇 공학, AI, 머신 비전 등의 기술 진보로 이러한 기계의 기능이 크게 향상되었습니다. 이러한 기술 혁신을 통해 기계는 다양한 라벨 유형 및 포장 형식을 보다 빠르고 정확하게 처리할 수 있어 높은 처리 능력이 필요한 환경에 이상적입니다. 게다가 지속가능성 추진은 생분해성 소재나 재활용 가능한 소재 등 환경친화적인 라벨링 옵션의 개발에 제조업체에 영향을 주어 시장을 재구축하고 있습니다. 기업이 업무 효율성을 높이고 인건비를 절감하며 엄격한 규제에 대응하기 위해 자동 라벨링 머신에 대한 수요가 계속 증가하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 34억 달러 |

| 예측 금액 | 52억 달러 |

| CAGR | 4.3% |

시장은 1차, 2차, 3차 포장 라벨러로 분류됩니다. 1차 포장 라벨러는 병이나 상자와 같은 제품 용기에 라벨링을 담당하며 시장을 독점하고 있습니다. 2차 포장 라벨러는 카톤이나 번들과 같은 외부 포장을 다루고, 3차 라벨러는 팔레트와 같은 대형 유닛에 초점을 맞추었습니다. 각 제품 유형은 생산성 향상, 휴먼 오류 감소, 공급망 전반의 규정 준수 보장에 중요한 역할을 합니다.

또한 시장은 반자동 기계와 전자동 기계를 구별합니다. 전자동 라벨링 머신은 최대 점유율을 차지하며 운영자의 참여를 최소화하면서 빠르고 고정밀 라벨링을 제공합니다. 이러한 기계는 일관되고 신속한 라벨링이 요구되는 대규모 생산 환경에서 선호됩니다. 대조적으로 반자동 시스템은 소규모 작업을 지원하며 다소 수동 입력이 필요하지만 기존 방법보다 훨씬 효율적인 개선이 가능합니다.

북미에서는 미국이 자동 라벨링 머신의 주요 시장이 되고 있으며, 2024년 시장 규모는 8억 1,000만 달러였습니다. 이 나라의 견고한 제조 인프라, 자동화 기술의 보급, 엄격한 규제 기준이 이 시장을 견인하는 주요 요인입니다. AI 통합 및 머신 비전과 같은 기술 혁신은 라벨링 프로세스를 변화시켜 품질 관리 및 유지보수를 강화하고 있습니다. 또한 지속 가능하고 친환경적인 라벨링 솔루션에 대한 수요가 업계를 보다 친환경적인 선택으로 끌어올리고 있습니다. 이러한 동향이 계속되고 있는 가운데, 자동 라벨링 머신의 미국 시장은 안정된 성장을 유지할 것으로 보입니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 소스

- 1차 데이터

- 2차 데이터

- 유료 소스

- 공개 소스

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 방해

- 향후 전망

- 제조업체

- 유통업체

- 공급자의 상황

- 이익률 분석

- 주요 뉴스

- 규제 상황

- 영향요인

- 성장 촉진요인

- 산업 전반에서 효율적이로 빠르며 정확한 라벨 제작 솔루션에 대한 수요 증가

- 제조·포장 업무의 자동화 추세 증가

- 업계의 잠재적 위험 및 과제

- 자동 라벨링 기계와 관련된 높은 비용

- 자동 라벨링 기계와 관련된 상호 운용성 문제

- 성장 촉진요인

- 성장 가능성 분석

- 기술 개요

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 자동 라벨링 머신 시장 추계·예측 : 유형별(2021-2034년), 10억 달러

- 주요 동향

- 1차 포장 라벨러

- 2차 포장 라벨러

- 3차 포장 라벨러

제6장 자동 라벨링 머신 시장 추계·예측 : 라벨링 방식별(2021-2034년), 10억 달러

- 주요 동향

- 접착식/감압식 라벨링

- 슬리브 라벨링

- 접착제 기반

- 기타

제7장 자동 라벨링 머신 시장 추계·예측 : 머신 유형별(2021-2034년), 10억 달러

- 주요 동향

- 반자동

- 전자동

제8장 자동 라벨링 머신 시장 추계·예측 : 용량별(2021-2034년), 10억 달러

- 주요 동향

- 200개/분까지

- 200-500개/분

- 500-1000개/분

- 1000개/분 이상

제9장 자동 라벨링 머신 시장 추계·예측 : 라벨링 유형별(2021-2034년), 10억 달러

- 주요 동향

- 탑 라벨링

- 하단 라벨링

- 탑 및 하단 라벨링

제10장 자동 라벨링 머신 시장 추계·예측 : 최종 이용 산업별(2021-2034년), 10억 달러

- 주요 동향

- 화학

- 소비재

- 일렉트로닉스

- 음식

- 의약품

- 소비재

- 기타(물류·해운 등)

제11장 자동 라벨링 머신 시장 추계·예측 : 유통 채널별(2021-2034년), 10억 달러

- 주요 동향

- 직접 판매

- 간접 판매

제12장 자동 라벨링 머신 시장 추계·예측 : 지역별(2021-2034년), 10억 달러

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제13장 기업 프로파일

- Accutek

- BB Automations

- BellatRx

- Brady

- CTM Labeling Systems

- FoxJet

- Herma

- KHS

- Krones

- Marchesini Group

- PE Labellers

- ProMach

- Sacmi Imola

- SaintyCo

- Sidel Group

The Global Automated Labeling Machines Market, valued at USD 3.4 billion in 2024, is projected to grow at a steady CAGR of 4.3% between 2025 and 2034. The demand for efficient, high-speed, and precise labeling solutions across industries is propelling the market forward. These machines are widely used in sectors such as pharmaceuticals, food and beverages, cosmetics, and consumer goods, where accuracy and consistency are vital. The growth of e-commerce and the need for optimized production lines are further boosting the adoption of automated labeling systems.

Technological advancements, including robotics, AI, and machine vision, have significantly improved the functionality of these machines. These innovations enable machines to handle diverse label types and packaging formats with enhanced speed and precision, making them ideal for environments requiring high throughput. Additionally, the push for sustainability is influencing manufacturers to develop eco-friendly labeling options, such as biodegradable and recyclable materials, which is reshaping the market. As businesses aim to boost operational efficiency, cut labor costs, and meet strict regulations, the demand for automated labeling machines continues to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 4.3% |

The market is categorized into primary, secondary, and tertiary packaging labelers. Primary packaging labelers, responsible for labeling product containers like bottles or boxes, dominate the market. Secondary packaging labelers handle outer packaging like cartons and bundles, while tertiary labelers focus on larger units like pallets. Each type plays a crucial role in improving productivity, reducing human error, and ensuring regulatory compliance across the supply chain.

The market also distinguishes between semi-automatic and fully automatic machines. Fully automatic labeling machines hold the largest share, offering high-speed, precision labeling with minimal operator involvement. These machines are favored in large-scale production environments that demand consistent and rapid labeling. In contrast, semi-automatic systems cater to smaller operations, requiring some manual input but still offering significant efficiency improvements over traditional methods.

In North America, the U.S. stands as the leading market for automated labeling machines, valued at USD 810 million in 2024. The country's robust manufacturing infrastructure, widespread use of automation technologies, and stringent regulatory standards are key factors driving this market. Technological innovations, such as AI integration and machine vision, are transforming labeling processes, thus enhancing quality control and maintenance. Furthermore, the demand for sustainable, eco-friendly labeling solutions is pushing the industry toward greener alternatives. As these trends continue, the U.S. market for automated labeling machines is set to maintain steady growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for efficient, high-speed, and accurate labeling solutions across industries

- 3.6.1.2 Growing trend of automation in manufacturing and packaging operations

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost associated with the automated labeling machines

- 3.6.2.2 Interoperability issues associated with the automated labeling machines

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technological overview

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Automated Labeling Machines Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Primary packaging labelers

- 5.3 Secondary packaging labelers

- 5.4 Tertiary packaging labelers

Chapter 6 Automated Labeling Machines Market Estimates & Forecast, By Labeling Method, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Self-adhesive/pressure-sensitive labeling

- 6.3 Sleeve labeling

- 6.4 Glue-based

- 6.5 Others

Chapter 7 Automated Labeling Machines Market Estimates & Forecast, By Machine Type 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Semi-automatic

- 7.3 Fully automatic

Chapter 8 Automated Labeling Machines Market Estimates & Forecast, By Capacity 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Up to 200 products/min

- 8.3 200 to 500 products/min

- 8.4 500 to 1000 products/min

- 8.5 Above 1000 products/min

Chapter 9 Automated Labeling Machines Market Estimates & Forecast, By Labeling Type 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Top labeling

- 9.3 Bottom labeling

- 9.4 Top & bottom labeling

Chapter 10 Automated Labeling Machines Market Estimates & Forecast, By End Use Industry 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Chemicals

- 10.3 Consumer goods

- 10.4 Electronics

- 10.5 Food & beverages

- 10.6 Pharmaceutical

- 10.7 Consumer goods

- 10.8 Others (logistics and shipping etc.)

Chapter 11 Automated Labeling Machines Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Automated Labeling Machines Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 United States

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Unites kingdom

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 Middle East & Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 United Arab Emirates

Chapter 13 Company Profiles

- 13.1 Accutek

- 13.2 B + B Automations

- 13.3 BellatRx

- 13.4 Brady

- 13.5 CTM Labeling Systems

- 13.6 FoxJet

- 13.7 Herma

- 13.8 KHS

- 13.9 Krones

- 13.10 Marchesini Group

- 13.11 P.E. Labellers

- 13.12 ProMach

- 13.13 Sacmi Imola

- 13.14 SaintyCo

- 13.15 Sidel Group