|

시장보고서

상품코드

1666569

차량 추적 장치 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Vehicle Tracking Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

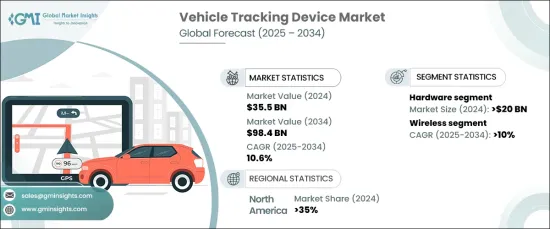

세계의 차량 추적 장치 시장은 2024년 355억 달러에 달했으며, 2025년부터 2034년까지 연평균 성장률(CAGR) 10.6%로 성장할 것으로 예측됩니다.

이러한 급속한 성장은 차량 관리에서 실시간 추적 솔루션에 대한 수요 증가, 차량 도난에 대한 우려 증가, 다양한 산업 분야에서 첨단 텔레매틱스 기술 채택 증가에 힘입은 바가 큽니다. 기업이 운영 효율성, 보안, 비용 관리를 우선시함에 따라 차량 추적 장치는 자산 모니터링, 경로 최적화, 차량 및 물품의 안전 보장에 필수적인 도구가 되었습니다. 실제로 이러한 장치의 기능을 강화하기 위한 전략적 파트너십이 등장하고 있습니다. 예를 들어, 2024년 3월, HERE Technologies는 호주 상용차용 자산 관리 및 내비게이션 서비스를 개선하기 위해 Netstar와 제휴했습니다.

이러한 솔루션에 대한 관심이 높아지는 이유는 기업이 실시간 데이터를 수집하고 분석하여 더 나은 정보에 기반한 의사 결정을 내릴 수 있게 해주는 커넥티드 디바이스와 사물인터넷(IoT)의 급증에 기인합니다. 이러한 추세는 특히 추적 시스템이 상품의 적시 배송을 보장하는 데 필수적인 역할을 하는 물류와 대중교통 시스템과 같은 산업에서 두드러집니다. 소비자와 기업 모두 운영 효율성 향상, 보안, 적시 배송 등 차량 추적의 수많은 이점을 인식하고 있기 때문에 이 시장은 크게 성장할 것으로 예상됩니다. 특히 GPS 추적 장치는 2032년까지 약 90억 달러의 매출과 연간 성장률이 12%를 넘어설 것으로 예상되는 등 시장을 견인할 것으로 전망됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 355억 달러 |

| 예측 금액 | 984억 달러 |

| CAGR | 10.6% |

차량 추적 장치 시장은 하드웨어와 소프트웨어 구성 요소로 나뉩니다. 2024년 하드웨어 부문은 200억 달러 이상의 가치를 차지했으며 계속해서 빠르게 확장되고 있습니다. 기업들이 자산 관리를 위한 안정적이고 효율적인 솔루션을 찾으면서 고품질 텔레매틱스 시스템과 GPS 장치에 대한 수요가 증가함에 따라 이러한 성장을 주도하고 있습니다. 특히 2024년 6월 모니모토가 출시한 모니모토 9와 같은 GPS 추적 기술의 발전은 혁신에 대한 업계의 노력을 보여줍니다. 이 새로운 버전은 오토바이, 보트, 트레일러 등 다양한 자산에 대한 보호 기능을 강화했습니다.

또한 시장은 연결성별로 분류되며, 무선 추적 장치는 2025년부터 2034년까지 10% 이상의 연평균 성장률을 기록할 것으로 예상됩니다. 무선 부문의 성장은 주로 설치의 용이성, 확장성 및 실시간 데이터 기능에 기인합니다. 또한 IoT 애플리케이션의 지속적인 개발은 기업이 고급 추적 기능을 활용하고 더 나은 데이터 분석과 원격 모니터링을 통해 운영을 최적화할 수 있도록 하는 원동력이 되고 있습니다.

북미 지역은 2024년 전 세계 차량 추적 장치 시장의 35% 이상을 차지할 것으로 예상됩니다. 이러한 우위는 주로 엄격한 규제와 잘 정립된 물류 부문에 기인합니다. 북미 지역은 차량 관리를 위한 실시간 추적 솔루션에 대한 의존도가 높기 때문에 기업들이 규제 요건을 충족하고 안전 기준을 강화하기 위해 텔레매틱스 시스템을 통합하면서 시장 수요를 지속적으로 촉진하고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 출처

- 데이터 마이닝 출처

- 시장 범위와 정의

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 공급자의 상황

- 컴포넌트 제공업체

- 서비스 제공업체

- 제조업체

- 유통업체

- 최종 용도

- 이익률 분석

- 기술과 혁신의 전망

- 특허 분석

- 규제 상황

- 비용 분석

- 사례 연구

- 영향요인

- 성장 촉진요인

- 차량 안전에 대한 우려 증가

- 차량 도난 건수 급증

- AI를 활용한 사고 감지 증가

- 차량 관리 필요성 증가

- 업계의 잠재적 위험 및 과제

- 데이터 및 개인 정보 보호 문제

- 높은 초기 비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계 및 예측 : 컴포넌트별(2021-2034년)

- 주요 동향

- 하드웨어

- OBD 장치 / 추적기 및 사전 추적기

- 독립형 추적기

- 소프트웨어

- 차량 관리 플랫폼

- 데이터 분석 도구

- 매핑 및 네비게이션 시스템

- 실시간 추적 소프트웨어

- 기타

제6장 시장 추계 및 예측 : 접속성별(2021-2034년)

- 주요 동향

- 유선

- 무선

제7장 시장 추계 및 예측 : 통신 추적기별(2021-2034년)

- 주요 동향

- 셀룰러 네트워크

- 위성

- 듀얼

제8장 시장 추계 및 예측 : 차량별(2021-2034년)

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV차

- 상용차

- 소형 상용차(LCV)

- 대형 상용차(HCV)

제9장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 운송 및 물류

- 건설

- 석유 및 가스

- 광업

- 긴급 서비스

- 기타

제10장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제11장 기업 프로파일

- AT&T Intelligence

- ATrack Technology

- CalAmp

- Concox Information Technology

- Continental

- Garmin

- Geotab

- Laipac Technology

- Laird

- Meitrack

- Queclink Wireless Solutions

- Sensata

- Starcom Systems

- Suntech International

- Teletrac Navman

- Teltonika

- TomTom International

- Trackimo

- Vamosys

- Verizon Communications

The Global Vehicle Tracking Device Market was valued at USD 35.5 billion in 2024 and is projected to grow at a CAGR of 10.6% from 2025 to 2034. This rapid expansion is largely driven by the increasing demand for real-time tracking solutions in fleet management, heightened concerns about vehicle theft, and the rising adoption of advanced telematics technologies across a variety of industries. As businesses continue to prioritize operational efficiency, security, and cost management, vehicle tracking devices have become indispensable tools for monitoring assets, optimizing routes, and ensuring the safety of vehicles and goods. In fact, strategic partnerships are emerging to boost the capabilities of these devices. For example, in March 2024, HERE Technologies teamed up with Netstar to improve asset management and navigation services for commercial vehicles in Australia.

The growing interest in these solutions can be attributed to the surge in connected devices and the Internet of Things (IoT), which enable businesses to capture and analyze real-time data to make better-informed decisions. This trend is particularly significant in industries like logistics, where tracking systems play an essential role in ensuring the timely delivery of goods, as well as in public transport systems. With consumers and businesses alike recognizing the numerous advantages of vehicle tracking, such as enhanced operational efficiency, security, and timely deliveries, the market is poised for substantial growth. In particular, GPS tracking devices are expected to fuel the market, with a projected revenue of around USD 9 billion by 2032 and an annual growth rate surpassing 12%.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.5 Billion |

| Forecast Value | $98.4 Billion |

| CAGR | 10.6% |

The vehicle tracking device market is segmented into hardware and software components. In 2024, the hardware segment accounted for over USD 20 billion in value and continues to expand rapidly. The increasing demand for high-quality telematics systems and GPS devices is driving this growth as businesses seek reliable, efficient solutions for managing their assets. Notably, advancements in GPS tracking technology, such as Monimoto's release of the Monimoto 9 in June 2024, illustrate the industry's commitment to innovation. This new version provides enhanced protection for various assets, including motorcycles, boats, and trailers.

Additionally, the market is categorized by connectivity, with wireless tracking devices projected to experience a CAGR of over 10% from 2025 to 2034. The wireless segment's growth is mainly due to the ease of installation, scalability, and the real-time data capabilities it offers. The continuous development of IoT applications is also a driving force, enabling businesses to harness advanced tracking functionalities and optimize their operations through better data analytics and remote monitoring.

North America accounted for more than 35% of the global vehicle tracking device market in 2024. This dominance is primarily attributed to stringent regulations and a well-established logistics sector. The region's heavy reliance on real-time tracking solutions for fleet management continues to fuel market demand, with companies integrating telematics systems to meet regulatory requirements and enhance safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Service providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Cost analysis

- 3.8 Case study

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing concerns over vehicle safety

- 3.9.1.2 Surge in number of vehicle thefts

- 3.9.1.3 Rising integration of AI-based accident detection

- 3.9.1.4 Increasing need for fleet management

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data and privacy concerns

- 3.9.2.2 High initial cost

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 OBD device/ tracker and advance tracker

- 5.2.2 Standalone tracker

- 5.3 Software

- 5.3.1 Fleet management platforms

- 5.3.2 Data analytics tools

- 5.3.3 Mapping and navigation systems

- 5.3.4 Real-time tracking software

- 5.3.5 Others

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Wired

- 6.3 Wireless

Chapter 7 Market Estimates & Forecast, By Communication Tracker, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Cellular networks

- 7.3 Satellite

- 7.4 Dual mode

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCV)

- 8.3.2 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Transportation & logistics

- 9.3 Construction

- 9.4 Oil & gas

- 9.5 Mining

- 9.6 Emergency services

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AT&T Intelligence

- 11.2 ATrack Technology

- 11.3 CalAmp

- 11.4 Concox Information Technology

- 11.5 Continental

- 11.6 Garmin

- 11.7 Geotab

- 11.8 Laipac Technology

- 11.9 Laird

- 11.10 Meitrack

- 11.11 Queclink Wireless Solutions

- 11.12 Sensata

- 11.13 Starcom Systems

- 11.14 Suntech International

- 11.15 Teletrac Navman

- 11.16 Teltonika

- 11.17 TomTom International

- 11.18 Trackimo

- 11.19 Vamosys

- 11.20 Verizon Communications