|

시장보고서

상품코드

1666638

초저유황연료유(VLSFO) 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Very Low Sulphur Fuel Oil (VLSFO) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

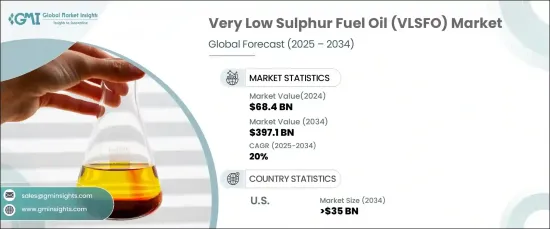

세계의 초저유황연료유(VLSFO) 시장은 2024년에 684억 달러로 평가되었으며, 2025년부터 2034년까지 20%의 연평균 성장률을 기록하며 크게 확대될 것으로 예상됩니다.

이러한 시장의 급증은 2020년부터 국제해사기구(IMO)가 시행한 엄격한 황 배출 규제에 힘입은 바가 큽니다. 이러한 규제에 따라 전 세계 해운 회사는 새로운 황 함유량 기준을 준수하는 청정 해상 연료인 VLSFO로 전환해야 합니다. 이러한 변화는 저유황 연료에 대한 수요를 증가시킬 뿐만 아니라 정유사들이 이러한 진화하는 기준을 충족하기 위해 생산 능력을 강화하도록 유도하여 시장 성장을 더욱 촉진하고 있습니다.

규제 촉진요인 외에도 해양 부문은 빠르게 성장하고 있으며, 환경에 대한 인식이 높아지면서 VLSFO 수요 증가에 기여하고 있습니다. 탄소 배출을 줄이고 해양 생태계를 보호하기 위해 지속 가능한 해운 관행이 그 어느 때보다 중요한 화두로 떠오르고 있습니다. 친환경 연료로의 전환은 이러한 목표에 완벽하게 부합합니다. 유럽과 아시아 태평양과 같은 주요 지역에서 더 많은 벙커링 시설을 이용할 수 있게 되고 선박 교통량이 증가함에 따라 VLSFO 시장은 이 지역 전역에서 광범위하게 채택되고 있습니다. 기업들은 운영 효율성을 최적화하는 동시에 환경 규제를 준수하기 위해 혁신적인 기술에 투자하고 있으며, 이를 통해 지속적인 시장 확대를 보장하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 684억 달러 |

| 예측 금액 | 3,971억 달러 |

| CAGR | 20% |

기존 선박을 저유황 추진 기술로 개조하는 추세로 인해 VLSFO 수요는 더욱 증가하고 있습니다. 해상 여객 수송량이 지속적으로 증가하고 지역 항구가 개발됨에 따라 시장의 전망은 여전히 긍정적입니다. 또한, 특히 항공모함 및 잠수함과 같은 군함을 보유한 방위 부문에서 해군 함대를 확장하기 위한 정부의 투자로 인해 이 부문에서도 VLSFO에 대한 수요가 증가할 것으로 보입니다.

미국의 초저유황 연료유(VLSFO) 시장은 2034년까지 350억 달러에 달할 것으로 예상됩니다. 저유황 연료에 대한 수요 증가는 강화된 황 배출 규제와 새로운 기준을 충족할 수 있는 정유 공장의 근접성에 의해 주도되고 있습니다. 또한 현지 규제로 인해 청정 연료의 채택이 촉진되고 있으며, 해상 활동으로 인한 오염을 줄여야 할 필요성이 VLSFO에 대한 수요를 더욱 높이고 있습니다. 고급스러움과 신뢰성을 갖춘 선박에 대한 수요 증가와 함께 운영 신뢰성에 대한 관심이 높아지면서 시장의 성장세가 지속되고 있습니다. 지속적인 경제 안정과 친환경 운송에 대한 관심이 높아지면서 미국의 VLSFO 시장은 향후 10년 동안 계속 번창할 것으로 예상됩니다.

목차

제1장 조사 방법과 조사 범위

- 시장의 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 출처

- 1차 데이터

- 2차 데이터

- 유상

- 공적

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 전략 대시보드

- 혁신과 지속가능성의 전망

제5장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 스페인

- 러시아

- 영국

- 이탈리아

- 프랑스

- 독일

- 벨기에

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 호주

- 싱가포르

- 중동 및 아프리카

- UAE

- 사우디아라비아

- 터키

- 남아프리카

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

제6장 기업 프로파일

- BP

- Chevron

- Exxon Mobil

- Hindustan Petroleum

- Indian Oil

- Marathon Petroleum

- Mediterranean Fuels

- Phillips 66

- Rosneft

- Saudi Aramco

- Shell

- Sinopec

- TotalEnergies

- Viva Energy

- Vitol

The Global Very Low Sulphur Fuel Oil Market, valued at USD 68.4 billion in 2024, is poised for significant expansion, with an expected CAGR of 20% from 2025 to 2034. This market surge is largely driven by the stringent sulphur emission regulations enforced by the International Maritime Organization (IMO) since 2020. These regulations require shipping companies worldwide to transition to VLSFO, a cleaner marine fuel alternative that complies with the new sulphur content standards. This shift is not only pushing the demand for low-sulphur fuels but also prompting refineries to enhance their production capabilities to meet these evolving standards, further fueling market growth.

Beyond regulatory drivers, the maritime sector is growing rapidly, with rising environmental awareness also contributing to the increased demand for VLSFO. Sustainable shipping practices are now more than ever a central focus, with the aim to reduce carbon emissions and protect marine ecosystems. The shift toward eco-friendly fuels aligns perfectly with these objectives. As more bunkering facilities become available and vessel traffic intensifies in key regions like Europe and Asia-Pacific, the VLSFO market is seeing widespread adoption across these regions. Companies are investing in innovative technologies to optimize operational efficiency while ensuring compliance with environmental regulations, thus ensuring continued market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $68.4 Billion |

| Forecast Value | $397.1 Billion |

| CAGR | 20% |

The trend toward retrofitting existing vessels with low-sulphur propulsion technologies is boosting the VLSFO demand even further. As seaborne passenger traffic continues to grow and regional ports develop, the market's trajectory remains positive. In addition, government investments in expanding naval fleets, particularly in the defense sector with military vessels such as aircraft carriers and submarines, will likely increase the demand for VLSFO in these segments as well.

In the U.S., the Very Low sulphur Fuel Oil (VLSFO) market is projected to reach USD 35 billion by 2034. The increasing demand for low-sulphur fuels is being driven by tighter sulphur emission regulations and the proximity of refineries that can meet the new standards. Additionally, local regulations are fostering the adoption of cleaner fuels, while the need to reduce pollution from seaborne activities is further pushing the demand for VLSFO. The growing focus on operational reliability, in line with the rising demand for vessels that offer luxury and dependability, continues to fuel the market's growth. With ongoing economic stability and a stronger focus on eco-friendly shipping, the U.S. VLSFO market is expected to continue flourishing in the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 North America

- 5.2.1 U.S

- 5.2.2 Canada

- 5.3 Europe

- 5.3.1 Spain

- 5.3.2 Russia

- 5.3.3 UK

- 5.3.4 Italy

- 5.3.5 France

- 5.3.6 Germany

- 5.3.7 Belgium

- 5.3.8 Netherlands

- 5.4 Asia Pacific

- 5.4.1 China

- 5.4.2 Japan

- 5.4.3 South Korea

- 5.4.4 India

- 5.4.5 Australia

- 5.4.6 Singapore

- 5.5 Middle East & Africa

- 5.5.1 UAE

- 5.5.2 Saudi Arabia

- 5.5.3 Turkey

- 5.5.4 South Africa

- 5.6 Latin America

- 5.6.1 Brazil

- 5.6.2 Mexico

- 5.6.3 Argentina

Chapter 6 Company Profiles

- 6.1 BP

- 6.2 Chevron

- 6.3 Exxon Mobil

- 6.4 Hindustan Petroleum

- 6.5 Indian Oil

- 6.6 Marathon Petroleum

- 6.7 Mediterranean Fuels

- 6.8 Phillips 66

- 6.9 Rosneft

- 6.10 Saudi Aramco

- 6.11 Shell

- 6.12 Sinopec

- 6.13 TotalEnergies

- 6.14 Viva Energy

- 6.15 Vitol