|

시장보고서

상품코드

1913354

차량내 결제 서비스 시장 : 시장 기회, 성장 요인, 산업 동향 분석 및 예측(2026-2035년)In-Vehicle Payment Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

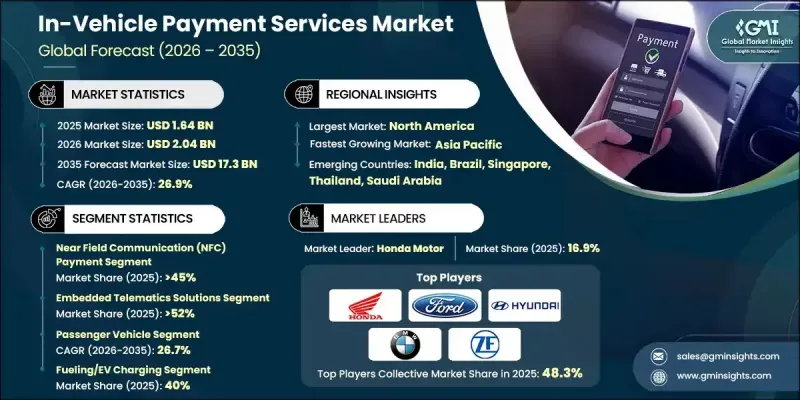

세계의 차량내 결제 서비스 시장은 2025년 16억 4,000만 달러로 평가되었고, 2035년까지 연평균 복합 성장률(CAGR) 26.9%로 성장할 전망이며, 173억 달러에 이를 것으로 예측됩니다.

시장 기세는 이동성 관련 활동에서 원활하고 비접촉식 디지털 거래에 대한 선호도가 높아짐에 따라 자동차 제조업체와 이동성 서비스 제공업체가 안전한 결제 기능을 차량에 직접 통합할 수 있도록 돕고 있습니다. 고급 인포테인먼트 및 텔레매틱스 아키텍처를 갖춘 커넥티드 자동차 플랫폼의 급속한 확장은 통합 결제 기능과 실시간 거래 처리를 위한 견고한 기반을 구축하고 있습니다. 소비자의 디지털 지갑과 무현금 결제 솔루션에 대한 의존도가 높아짐에 따라 차량 시스템과 광범위한 금융 생태계 간의 호환성이 더욱 가속화되고 있습니다. 자동차 제조업체는 개발 사이클의 효율화, 규제 요건에 대한 대응, 커넥티드 서비스로부터의 새로운 수익 기회 창출을 목적으로 금융기관, 결제 처리업자, 기술 기업과의 제휴를 적극적으로 진행하고 있습니다. 병행하여 IoT, AI, 고속 연결 등의 첨단 기술의 통합으로 차량, 결제 인프라, 서비스 플랫폼 간의 통신이 강화되어 차량용 상거래 솔루션의 확장성 및 신뢰성이 향상되었습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2025년 |

| 예측 연도 | 2026-2035년 |

| 시작 시 가치 | 16억 4,000만 달러 |

| 예측 금액 | 173억 달러 |

| CAGR | 26.9% |

2025년 근거리 무선통신(NFC) 결제 부문은 45%의 점유율을 차지하며, 2035년까지 87억 달러에 달할 것으로 예측됩니다. 비접촉식 결제 방법의 광범위한 보급과 차량 하드웨어 에코시스템 내에서의 통합의 진전이 채용을 뒷받침하고 있습니다.

임베디드 텔레매틱스 솔루션 부문은 2025년 52%의 점유율을 차지했으며, 8억 5,290만 달러의 수익을 창출했습니다. 이러한 솔루션은 안전한 네이티브 결제 기능을 제공하는 동시에 데이터 소유권 강화, 시스템 안정성 향상 및 장기 서비스 수익화를 가능하게 하는 점에서 높게 평가되고 있습니다.

미국의 차량내 결제 서비스 시장은 2025년에 6억 5,310만 달러에 이르렀으며, 2035년까지 견조한 성장이 전망되고 있습니다. 시장 확대는 커넥티드카의 높은 보급률 및 편리성을 중시한 디지털 결제 체험에 대한 강한 수요에 의해 지원되고 있습니다.

자주 묻는 질문

목차

제1장 조사 방법

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률 분석

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 비접촉 결제 수요 증가

- 커넥티드카 보급률의 성장

- 디지털 월렛 및 에코시스템의 확대

- OEM과 핀테크의 파트너십

- 전기자동차의 보급 확대 및 충전 인프라의 확충

- 업계의 잠재적 위험 및 과제

- 사이버 보안 및 데이터 프라이버시에 대한 우려 사항

- 높은 시스템 통합 비용 및 컴플라이언스 비용

- 시장 기회

- EV 충전 결제 통합 확대

- 함대 및 상용 차량에서 결제 자동화의 성장

- 개인화된 차량용 상거래 서비스 개발

- 생체 인증 및 음성 대응 결제 인증의 도입

- 성장 가능성 분석

- 규제 상황

- 북미

- 미국 : 안전한 차량 탑재 결제 처리를 위한 PCI DSS(Payment Card 산업 데이터 보안 기준)

- 캐나다 : PIPEDA(개인정보보호 및 전자문서법)에 의한 결제 및 사용자 데이터 보호 규제

- 유럽

- 영국 : 차량내 디지털 결제에 있어서 영국 GDPR(EU 개인정보보호규정) 및 PCI DSS 준거

- 독일 : 임베디드 결제 시스템용 GDPR(EU 개인정보보호규정) 및 ISO/IEC 27001 정보 보안 관리

- 프랑스 : 안전한 전자 결제 및 차량내 결제를 위한 PSD2(개정 결제 서비스 지령)

- 이탈리아 : 디지털 및 임베디드 결제 플랫폼을 위한 PSD2 및 GDPR(EU 개인정보보호규정) 컴플라이언스 프레임워크

- 스페인 : 차량내 결제 데이터 보안의 GDPR(EU 개인정보보호규정) 및 PCI DSS 요구 사항

- 아시아태평양

- 중국 : PIPL(개인정보보호법)에 의한 커넥티드카 및 차량내 결제 데이터의 규제

- 일본 : 자동차 결제 데이터 보안에 있어서의 개인 정보 보호법(APPI)

- 인도 : 차량내 결제 서비스에 적용되는 RBI 디지털 결제 보안 가이드라인

- 라틴아메리카

- 브라질 : 차량내 및 커넥티드 결제 시스템에서 LGPD(일반 데이터 보호법)

- 멕시코 : 자동차 디지털 결제를 규정하는 개인정보보호법(LFPDPPP)

- 아르헨티나 : 차량내 결제 플랫폼과 관련된 개인 정보 보호법(법률 제25,326호)

- 중동 및 아프리카

- 아랍에미리트(UAE) : UAE 데이터 보호 규정 및 임베디드 결제 서비스용 PCI DSS

- 남아프리카 : 커넥티드카 결제 데이터에 관한 POPIA(개인정보보호법)

- 사우디아라비아 : 차량내 결제 시스템용 사우디 데이터 및 AI청(SDAIA) 데이터 보호 규제

- 북미

- Porter's Five Forces 분석

- PESTEL 분석

- 기술 및 혁신 동향

- 현재 기술 동향

- 신흥 기술

- 비용 내역 분석

- 개발 비용 구조

- 연구개발 비용 분석

- 마케팅 및 판매 비용

- 특허 분석

- 지속가능성 및 환경면

- 지속가능한 실천

- 폐기물 감축 전략

- 생산에 있어서의 에너지 효율화

- 환경에 배려한 대처

- 장래 시장 전망 및 기회

- OEM 수익화 및 비즈니스 모델 분석

- 직접 거래 수익 모델(수익 분배, MDR 기반)

- 구독형 차재 상거래 모델

- 플랫폼 및 생태계 수익화(앱 스토어, 마켓플레이스)

- 데이터 구동형 수익화의 기회(이용 상황, 행동 분석)

- OEM 대 핀텍 대 결제 네트워크의 수익 소유권

- OEM 통합 및 도입 프레임워크

- 에코시스템의 역학 및 전략적 컨트롤 포인트

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병 및 인수

- 제휴 및 협업

- 신제품 발매

- 사업 확대 계획 및 자금 조달

제5장 시장 추계 및 예측 : 지불 방법별(2022-2035년)

- 근거리 무선 통신(NFC) 결제

- QR 코드 베이스의 결제

- 내장형 지갑

- 기타

제6장 시장 추계 및 예측 : 기술별(2022-2035년)

- 임베디드 텔레매틱스 솔루션

- 모바일 애플리케이션 기반 통합

- 클라우드 기반 결제 플랫폼

제7장 시장 추계 및 예측 : 차량별(2022-2035년)

- 승용차

- SUV

- 세단

- 해치백

- 상용차

- 경상용차(LCV)

- MCV

- 대형 상용차(HCV)

제8장 시장 추계 및 예측 : 용도별(2022-2035년)

- 연료 보급 및 전기자동차 충전

- 스마트 주차

- 자동 요금 수수 시스템

- 전자상거래

- 기타

제9장 시장 추계 및 예측 : 지역별(2022-2035년)

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 포르투갈

- 크로아티아

- 베네룩스

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 싱가포르

- 태국

- 인도네시아

- 베트남

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 콜롬비아

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

제10장 기업 프로파일

- 세계 기업

- Amazon Web Services

- Ford Motor Company

- Hyundai Motor Company

- IBM

- Mastercard

- PayPal

- Shell

- Visa

- Volkswagen

- BMW

- Jaguar Land Rover Automotive

- ParkMobile

- ZF

- 지역 기업

- General Motors Company

- Honda Motor

- Daimler/Mercedes-Benz

- Toyota Motor

- Telenav

- Parkopedia

- CarPay Diem/Kwalyo

- SiriusXM Connected Vehicle

- Gentex

- Thales

- 신흥 기업 및 디스럽터 기업

- Car IQ Pay

- Cerence

- PayByCar

- Verra Mobility

- Apple

- Samsung Electronics

- Parkwhiz

- Xevo

The Global In-Vehicle Payment Services Market was valued at USD 1.64 billion in 2025 and is estimated to grow at a CAGR of 26.9% to reach USD 17.3 billion by 2035.

Market momentum is driven by the growing preference for seamless and contactless digital transactions across mobility-related activities, encouraging automakers and mobility service providers to embed secure payment functionality directly into vehicles. The rapid expansion of connected vehicle platforms equipped with sophisticated infotainment and telematics architectures is creating a robust base for integrated payment capabilities and real-time transaction processing. Increasing consumer reliance on digital wallets and cashless payment solutions is further accelerating compatibility between vehicle systems and broader financial ecosystems. Automakers are actively partnering with financial institutions, payment processors, and technology firms to streamline development cycles, address regulatory requirements, and unlock new revenue opportunities from connected services. In parallel, the integration of advanced technologies such as IoT, AI, and high-speed connectivity is enhancing communication between vehicles, payment infrastructure, and service platforms, reinforcing the scalability and reliability of in-vehicle commerce solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.64 Billion |

| Forecast Value | $17.3 Billion |

| CAGR | 26.9% |

In 2025, the near field communication payment segment held 45% share and is forecast to reach USD 8.7 billion by 2035. Adoption is supported by widespread acceptance of contactless payment methods and increasing integration within vehicle hardware ecosystems.

The embedded telematics solutions segment held 52% share in 2025 and generated USD 852.9 million. These solutions are favored for enabling secure, native payment functionality while improving data ownership, system reliability, and long-term service monetization.

U.S. In-Vehicle Payment Services Market reached USD 653.1 million in 2025 and is expected to record strong growth through 2035. Market expansion is supported by high penetration of connected vehicles and strong demand for convenience-oriented digital payment experiences.

Key companies operating in the Global In-Vehicle Payment Services Market include Volkswagen, PayPal, BMW, ZF, Ford Motor Company, Shell, Hyundai Motor, Jaguar Land Rover Automotive, Honda Motor, and ParkMobile. Companies in the In-Vehicle Payment Services Market are focusing on strategic partnerships to strengthen ecosystem integration and accelerate solution deployment. Collaboration with financial institutions, fintech providers, and mobility service platforms allows players to ensure regulatory compliance while expanding transaction coverage. Many firms are investing in cybersecurity, tokenization, and data encryption to enhance trust and protect user information. Continuous software innovation and over-the-air update capabilities are being leveraged to improve functionality and scalability. Market participants are also prioritizing user-centric interface design to improve adoption and engagement.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Payment mode

- 2.2.3 Technology

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising demand for contactless payments

- 3.2.1.3 Growth of connected vehicle penetration

- 3.2.1.4 Expansion of digital wallet ecosystems

- 3.2.1.5 OEM-fintech partnerships

- 3.2.1.6 Increase in EV adoption and charging infrastructures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cybersecurity and data privacy concerns

- 3.2.2.2 High system integration and compliance costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of EV charging payment integration

- 3.2.3.2 Growth of fleet and commercial vehicle payment automation

- 3.2.3.3 Development of personalized in-car commerce services

- 3.2.3.4 Adoption of biometric and voice-enabled payment authentication

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: PCI DSS (Payment Card Industry Data Security Standard) for secure in-vehicle payment processing

- 3.4.1.2 Canada: PIPEDA (Personal Information Protection and Electronic Documents Act) governing payment and user data protection

- 3.4.2 Europe

- 3.4.2.1 United Kingdom: UK GDPR and PCI DSS compliance for in-vehicle digital payments

- 3.4.2.2 Germany: GDPR and ISO/IEC 27001 information security management for embedded payment systems

- 3.4.2.3 France: PSD2 (Revised Payment Services Directive) for secure electronic and in-vehicle payments

- 3.4.2.4 Italy: PSD2 and GDPR compliance framework for digital and embedded payment platforms

- 3.4.2.5 Spain: GDPR and PCI DSS requirements for in-vehicle payment data security

- 3.4.3 Asia Pacific

- 3.4.3.1 China: PIPL (Personal Information Protection Law) regulating connected vehicle and in-vehicle payment data

- 3.4.3.2 Japan: APPI (Act on the Protection of Personal Information) for automotive payment data security

- 3.4.3.3 India: RBI digital payment security guidelines applicable to in-vehicle payment services

- 3.4.4 Latin America

- 3.4.4.1 Brazil: LGPD (Lei Geral de Protecao de Dados) for in-vehicle and connected payment systems

- 3.4.4.2 Mexico: Federal Law on Protection of Personal Data (LFPDPPP) governing automotive digital payments

- 3.4.4.3 Argentina: Personal Data Protection Law (Law No. 25,326) relevant to in-vehicle payment platforms

- 3.4.5 Middle East & Africa

- 3.4.5.1 United Arab Emirates: UAE data protection regulations and PCI DSS for embedded payment services

- 3.4.5.2 South Africa: POPIA (Protection of Personal Information Act) for connected vehicle payment data

- 3.4.5.3 Saudi Arabia: Saudi Data and AI Authority (SDAIA) data protection regulations for in-vehicle payment systems

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Development cost structure

- 3.8.2 R&D cost analysis

- 3.8.3 Marketing & sales costs

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Future market outlook & opportunities

- 3.12 OEM Monetization & Business Model Analysis

- 3.12.1 Direct transaction revenue models (revenue share, MDR-based)

- 3.12.2 Subscription-based in-vehicle commerce models

- 3.12.3 Platform and ecosystem monetization (app stores, marketplaces)

- 3.12.4 Data-driven monetization opportunities (usage, behavioral insights)

- 3.12.5 OEM vs fintech vs payment network revenue ownership

- 3.13 OEM Integration & Deployment Framework

- 3.14 Ecosystem Power Dynamics & Strategic Control Points

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Payment mode, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Near Field Communication (NFC) Payments

- 5.3 QR Code-Based Payments

- 5.4 Embedded Wallets

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Embedded Telematics Solutions

- 6.3 Mobile Application-Based Integration

- 6.4 Cloud-Based Payment Platforms

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 SUV

- 7.2.2 Sedan

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Fueling/EV Charging

- 8.3 Smart Parking

- 8.4 Automated Toll Payments

- 8.5 E-commerce

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.3.10 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Amazon Web Services

- 10.1.2 Ford Motor Company

- 10.1.3 Hyundai Motor Company

- 10.1.4 IBM

- 10.1.5 Mastercard

- 10.1.6 PayPal

- 10.1.7 Shell

- 10.1.8 Visa

- 10.1.9 Volkswagen

- 10.1.10 BMW

- 10.1.11 Jaguar Land Rover Automotive

- 10.1.12 ParkMobile

- 10.1.13 ZF

- 10.2 Regional Players

- 10.2.1 General Motors Company

- 10.2.2 Honda Motor

- 10.2.3 Daimler / Mercedes-Benz

- 10.2.4 Toyota Motor

- 10.2.5 Telenav

- 10.2.6 Parkopedia

- 10.2.7 CarPay Diem / Kwalyo

- 10.2.8 SiriusXM Connected Vehicle

- 10.2.9 Gentex

- 10.2.10 Thales

- 10.3 Emerging / Disruptor Players

- 10.3.1 Car IQ Pay

- 10.3.2 Cerence

- 10.3.3 PayByCar

- 10.3.4 Verra Mobility

- 10.3.5 Apple

- 10.3.6 Samsung Electronics

- 10.3.7 Parkwhiz

- 10.3.8 Xevo