|

시장보고서

상품코드

1666909

자동차 예측 기술 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Automotive Predictive Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

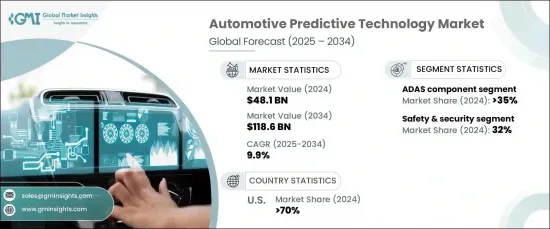

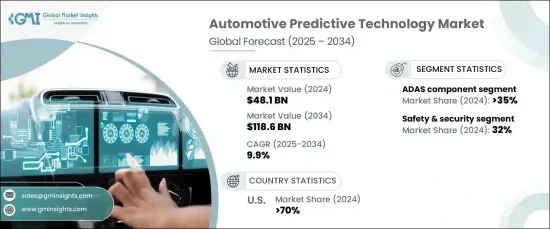

세계 자동차 예측 기술 시장은 2024년에 481억 달러로 평가되었으며, 2025년부터 2034년에 걸쳐 9.9%의 연평균 복합 성장률(CAGR)로 견고한 성장을 이룰 것으로 예상되고 있습니다. 이 성장의 촉진요인은 ADAS(선진 안전 기능)와 운전 지원 시스템에 대한 수요 증가입니다. 자동차 제조업체는 교통 패턴, 운전자 행동, 차량 성능 등 실시간 데이터를 분석하여 차량의 안전성을 높이고 사고를 방지하고 전반적인 운전 체험을 개선하기 위해 가속적으로 예측 기술을 채용하고 있습니다. 또, 예지보전도 큰 지지를 얻고 있어, 잠재적인 문제를 조기에 발견하는 것으로 예기치 않은 고장을 방지해, 차량의 신뢰성을 높이고 있습니다.

시장 확대에 박차를 가하고 있는 주요 요인은 전기차(EV)의 도입이 증가하고 있다는 점입니다. 자동차 산업이 보다 지속 가능한 사회를 목표로 하는 가운데, EV의 성능을 최적화하고 배터리 수명을 연장하기 위해서는 예측 기술이 필수적입니다. 이러한 기술은 첨단 분석을 사용하여 배터리 소모를 예측하고, 충전 습관을 모니터링하고, 에너지 효율을 높임으로써 EV의 최적 성능과 수명을 보장합니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024 |

| 예측연도 | 2025-2034 |

| 시작금액 | 481억 달러 |

| 예측 금액 | 1,186억 달러 |

| CAGR | 9.9% |

시장의 하드웨어 부문에는 ADAS 부품, OBD 장치 및 텔레매틱스 시스템이 포함됩니다. 2024년에는 ADAS 부품이 시장 점유율의 35%를 차지하고 2034년까지 480억 달러를 창출할 것으로 예측됩니다. 자동화 및 보다 안전한 드라이빙 솔루션에 대한 수요가 증가함에 따라 적응형 크루즈 컨트롤, 레인 어시스트, 충돌 감지 등 ADAS 기능이 통합됩니다. 센서, 카메라, 레이더, 인공지능을 활용함으로써 이러한 기술은 차량이 실시간으로 위험을 예측하고 완화할 수 있게 하고 교통 안전을 대폭 강화합니다.

시장은 또한 예지보전, 차량 건강 모니터링, 안전 및 보안, 운전 패턴 분석 등의 용도별로 구분됩니다. 2024년에는 교통사고 사망자 수의 감소에 세계적으로 주목을 받고 있는 것을 배경으로 안전 및 보안 분야가 시장 점유율의 32%를 차지하고 있습니다. 인간의 실수가 교통 사고의 주요 요인이기 때문에 예측 기술은 위험을 예측하고 전반적인 교통 안전을 향상시키는 데 매우 중요합니다.

미국의 자동차 예측 기술 시장은 2024년에 70%의 점유율로 압도적으로 세계 시장을 선도했습니다. 이 나라는 자율주행차(AV)와 선진 예측 시스템의 개발로 리더십을 발휘하고 있으며, 자동차 제조업체와 하이테크 기업으로부터 상당액의 투자를 모으고 있습니다. 예측 기술은 AV에 매우 중요하며 센서와 카메라의 데이터를 처리하여 복잡한 환경을 탐색하고 충돌을 피하고 신속하고 정확한 판단을 내릴 수 있습니다.

목차

제1장 조사 방법과 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 정보

- 데이터 마이닝 소스

- 시장 범위와 정의

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 자동차 OEM

- 기술 공급자

- 데이터 분석 및 클라우드 서비스 제공업체

- 최종 용도

- 공급자의 상황

- 이익률 분석

- 기술 및 혁신 환경

- 특허 분석

- 주요 뉴스와 대처

- 규제 상황

- 사례 연구

- 영향요인

- 성장 촉진요인

- 자동차의 안전성과 효율성에 대한 수요 증가

- 개인 맞춤형 및 연결된 경험에 대한 수요

- 인공지능(AI)과 머신러닝(ML)의 급속한 통합

- 커넥티드카의 채용 증가

- 업계의 잠재적 위험 및 과제

- 데이터 프라이버시와 보안에 대한 우려

- 높은 도입 비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추정 및 예측 : 용도별, 2021년-2034년

- 주요 동향

- 예지보전

- 차량 건강 모니터링

- 안전 및 보안

- 주행 패턴 분석

- 기타

제6장 시장 추정 및 예측 : 전개별, 2021년-2034년

- 주요 동향

- 온프레미스

- 클라우드

제7장 시장 추정 및 예측 : 하드웨어별, 2021년-2034년

- 주요 동향

- ADAS 컴포넌트

- OBD

- 텔레매틱스

제8장 시장 추정 및 예측 : 차종별, 2021년-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV차

- 상용차

- 소형 상용차(LCV)

- 대형 상용차(HCV)

제9장 시장 추정 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제10장 기업 프로파일

- Aisin

- Aptiv

- Bosch

- Continental

- Garrett Motion

- HARMAN

- Honeywell

- Infineon

- Intel

- Lear

- Magna

- Mobileye

- NVIDIA

- NXP

- Qualcomm

- Renesas

- Siemens

- Valeo

- Visteon

- ZF Friedrichshafen

The Global Automotive Predictive Technology Market, valued at USD 48.1 billion in 2024, is expected to experience robust growth at a CAGR of 9.9% from 2025 to 2034. This growth is driven by the increasing demand for advanced safety features and driver assistance systems. Automakers are adopting predictive technologies at an accelerating pace to enhance vehicle safety, prevent accidents, and improve overall driving experiences by analyzing real-time data such as traffic patterns, driver behavior, and vehicle performance. Predictive maintenance has also gained significant traction, allowing for early detection of potential issues to prevent unexpected breakdowns and ensure greater vehicle reliability.

A key factor fueling market expansion is the rise in electric vehicle (EV) adoption. As the automotive industry moves toward greater sustainability, predictive technologies are becoming essential for optimizing EV performance and extending battery life. These technologies use advanced analytics to forecast battery wear, monitor charging habits, and enhance energy efficiency, ensuring optimal performance and longevity of EVs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48.1 Billion |

| Forecast Value | $118.6 Billion |

| CAGR | 9.9% |

The hardware segment of the market includes ADAS components, OBD devices, and telematics systems. In 2024, ADAS components accounted for 35% of the market share and are expected to generate USD 48 billion by 2034. The increasing demand for automation and safer driving solutions has led to the integration of ADAS features such as adaptive cruise control, lane assist, and collision detection. By leveraging sensors, cameras, radar, and artificial intelligence, these technologies enable vehicles to predict and mitigate risks in real-time, significantly enhancing road safety.

The market is also segmented by applications, including predictive maintenance, vehicle health monitoring, safety and security, and driving pattern analysis. In 2024, the safety and security segment held 32% of the market share, driven by the global focus on reducing traffic fatalities. With human error being a major factor in road accidents, predictive technologies have become crucial in anticipating hazards and improving overall road safety.

The U.S. automotive predictive technology market led the global market with a dominant 70% share in 2024. The country's leadership in developing autonomous vehicles (AVs) and advanced predictive systems has attracted significant investments from automakers and tech companies alike. Predictive technology is crucial for AVs, enabling them to process data from sensors and cameras to navigate complex environments, avoid collisions, and make quick, precise decisions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automotive OEMs

- 3.1.2 Technology providers

- 3.1.3 Data analytics & cloud service providers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Case study

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for vehicle safety & efficiency

- 3.9.1.2 Demand for personalized & connected experiences

- 3.9.1.3 Rapid integration of Artificial Intelligence (AI) and Machine Learning (ML)

- 3.9.1.4 Rising adoption of connected cars

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data privacy & security concerns

- 3.9.2.2 High implementation costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

CHAPTER 4 : Competitive Landscape

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Predictive maintenance

- 5.3 Vehicle health monitoring

- 5.4 Safety & security

- 5.5 Driving pattern analysis

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premise

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Hardware, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 ADAS component

- 7.3 OBD

- 7.4 Telematics

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Passenger vehicle

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUVs

- 8.3 Commercial vehicles

- 8.3.1 Light Commercial Vehicles (LCVs)

- 8.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 94.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aisin

- 10.2 Aptiv

- 10.3 Bosch

- 10.4 Continental

- 10.5 Garrett Motion

- 10.6 HARMAN

- 10.7 Honeywell

- 10.8 Infineon

- 10.9 Intel

- 10.10 Lear

- 10.11 Magna

- 10.12 Mobileye

- 10.13 NVIDIA

- 10.14 NXP

- 10.15 Qualcomm

- 10.16 Renesas

- 10.17 Siemens

- 10.18 Valeo

- 10.19 Visteon

- 10.20 ZF Friedrichshafen