|

시장보고서

상품코드

1913412

자동차용 하이퍼바이저 시장 : 기회, 성장 요인, 산업 동향 분석 및 예측(2026-2035년)Automotive Hypervisor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

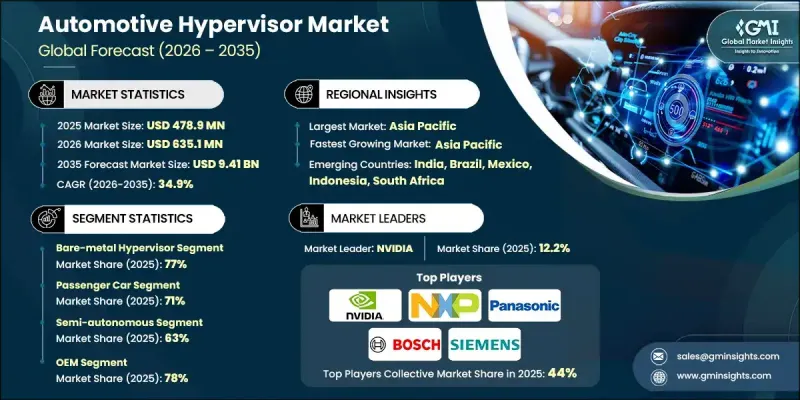

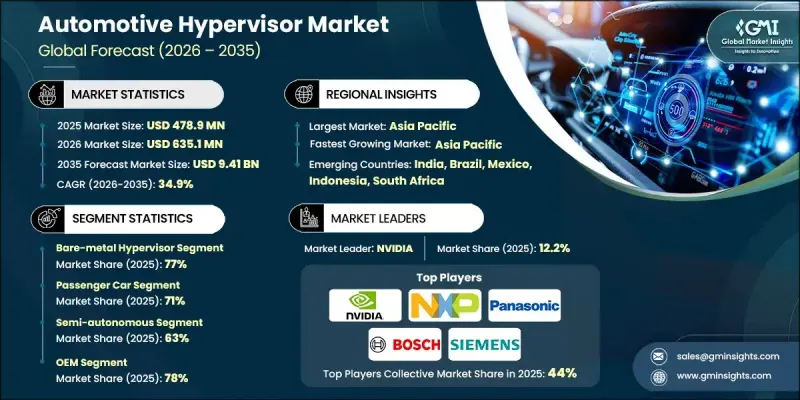

세계의 자동차 하이퍼바이저 시장은 2025년 4억 7,890만 달러로 평가되었으며, 2035년까지 연평균 복합 성장률(CAGR) 34.9%로 성장해 94억 1,000만 달러에 이를 것으로 예측됩니다.

시장 확대의 배경은 자동차 산업이 하드웨어 중심의 차량 아키텍처에서 중앙 집중식 컴퓨팅 플랫폼을 기반으로 소프트웨어 정의 차량으로 구조 전환하는 것을 포함합니다. 자동차 제조업체는 공유 컴퓨팅 환경에서 여러 운영 체제 및 용도를 지원하므로 자동차용 하이퍼바이저에 대한 의존도를 높이고 있습니다. 이 마이그레이션은 소프트웨어 배포 사이클을 가속화하고 확장성을 향상시키고 여러 차량 플랫폼에 기능을 도입할 때 유연성을 확대합니다. 중앙 집중식 컴퓨팅으로의 전환은 시스템 설계의 단순화, 복잡성 감소, 소프트웨어 라이프사이클 관리의 효율화를 지원합니다. 차량이 연결성이 뛰어나고 지능적이고 소프트웨어 중심이 됨에 따라 하이퍼바이저는 안전한 워크로드 관리, 성능 최적화 및 미래를 기대하는 차량 아키텍처를 지원하는 기반 기술로 부상하고 있습니다. 디지털 차량 플랫폼과 차세대 모빌리티 솔루션에 대한 투자 확대가 도입을 더욱 가속화하고 있으며, 자동차 하이퍼바이저는 현대 자동차 혁신을 가능하게 하는 중요한 요소로 자리매김하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2025년 |

| 예측 연도 | 2026-2035년 |

| 시작 규모 | 4억 7,890만 달러 |

| 예측 금액 | 94억 1,000만 달러 |

| CAGR | 34.9% |

ADAS(첨단 운전자 보조 시스템)의 복잡화와 자율 이동으로 진전함에 따라 안전상 중요한 용도와 그렇지 않은 용도가 엄격히 분리될 필요성이 높아지고 있습니다. 자동차용 하이퍼바이저 플랫폼은 워크로드의 안전한 분리를 가능하게 하고 기능 안전 요구사항을 충족하면서 예측 가능한 시스템 작동을 보장한다고 합니다. 제조업체는 차량 아키텍처를 간소화하고, 배선 복잡성을 줄이고, 에너지 소비를 줄이고, 전체 시스템을 효율적으로 개선하기 위해 여러 전자 제어 장치를 소수의 도메인 컨트롤러와 중앙 컨트롤러에 통합합니다.

베어메탈 하이퍼바이저 부문은 2025년에 77%의 점유율을 차지했고, 2026년부터 2035년까지 CAGR 34.3%를 보일 것으로 예측됩니다. 이 부문은 차량 하드웨어와 직접 연동할 수 있는 능력을 통해 응답 지연을 최소화하고 안전 중심 자동차 용도에 필수적인 실시간 시스템 성능을 지원하기 위해 주목을 받고 있습니다.

승용차 부문은 2025년에 71%의 점유율을 차지했으며 2035년까지 연평균 복합 성장률(CAGR) 35.5%를 보일 것으로 예측됩니다. 커넥티드 서비스 및 가상화된 인포테인먼트 환경에 대한 수요 증가는 통합된 차량 컴퓨팅 시스템 내에서 여러 용도를 실행하는 하이퍼바이저 기반 플랫폼의 도입을 촉진하고 있습니다.

미국의 자동차용 하이퍼바이저 시장은 2025년 1억 980만 달러에 달했습니다. 이 나라에서의 성장은 커넥티드카, 자율주행, 소프트웨어 정의 차량의 개발에 주력하는 자동차 제조업체 및 기술 제공업체로부터의 강력한 투자에 의해 지원되고 있습니다.

자주 묻는 질문

목차

제1장 조사 방법

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 이익률

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 요인

- 소프트웨어 정의 차량(SDV)으로의 전환

- ADAS 및 자율주행기능 통합의 진전

- ECU 통합 및 비용 최적화

- 기능 안전과 사이버 보안에 대한 주목의 향상

- 업계의 잠재적 위험 및 과제

- 고집적화와 검증의 복잡성

- 한정적인 애프터마켓에서의 채용

- 시장 기회

- 집중형 및 존별 차량 아키텍처 확대

- 전기차 및 자율주행차의 성장

- OTA 및 커넥티드 서비스 통합

- 상용차 및 플릿 차량으로부터의 새로운 수요

- 성장 요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 미국 교통부(DOT) 기준

- 직업안전보건국(OSHA) 가이드라인

- 미국 환경보호청(EPA)

- 유럽

- EN ISO 컨테이너 표준

- 유럽연합의 관세 및 안전규제

- BS EN/CEN 규격

- 국가 규격(UNE, DIN 등)

- 아시아태평양

- 중국국가표준(GB)

- 일본 JIS 규격 요건

- 한국 KS 인증

- 인도 BIS 규격

- 태국공업규격협회(TISI)

- 라틴아메리카

- INMETRO(국립 계량 연구소)

- INTI(국립공업기술연구소) 인증

- NOM(Norma Oficial Mexicana) 규격

- 중동 및 아프리카

- ESMA/에미레이트 호환성 평가 체계(ECAS)

- GCC 기술규제

- SABS 인증

- 북미

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신의 전망

- 현재의 기술 동향

- 신흥기술

- 가격 분석

- 제품별 가격 설정

- 지역별 가격 설정

- 비용 내역 분석

- 특허 분석

- 지속가능성과 환경면

- 지속가능한 실천

- 폐기물 감축 전략

- 생산에서의 에너지 효율

- 환경에 배려한 대처

- 탄소발자국에 관한 고려 사항

- 이용 사례

- 하이퍼바이저 아키텍처와 배포 모델

- 1유형 vs 2유형 vs 혼합 중요도 아키텍처

- 집중형 vs 구역별 ECU 배치

- 멀티 도메인 통합 전략(ADAS+IVI+바디)

- 성능, 대기 시간, 결정성의 트레이드 오프

- SoC 호환성과 하드웨어 공동 설계

- 오픈소스 vs 독점 하이퍼바이저 전략

- 기능 안전과 혼합 중요도 관리

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 인수합병

- 제휴 및 협업

- 신제품 발매

- 사업 확대 계획과 자금 조달

제5장 시장 추계 및 예측 : 하이퍼바이저별, 2022-2035년

- 베어메탈 하이퍼바이저

- 호스팅 하이퍼바이저

제6장 시장 추계 및 예측 : 자율성 수준별, 2022-2035년

- 준자율형

- 완전 자율형

제7장 시장 추계 및 예측 : 차량별, 2022-2035년

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제8장 시장 추계 및 예측 : 용도별, 2022-2035년

- ADAS(첨단 운전자 보조 시스템)

- 인포테인먼트 및 텔레매틱스

- 파워트레인 및 섀시 제어 시스템

- Vehicle-to-Everything(V2X)

- 자율주행 시스템

제9장 시장 추계 및 예측 : 판매 채널별, 2022-2035년

- OEM

- 애프터마켓

제10장 시장 추계 및 예측 : 지역별, 2022-2035년

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 러시아

- 폴란드

- 루마니아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ANZ

- 베트남

- 인도네시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 프로파일

- 글로벌 기업

- BlackBerry QNX

- Continental

- Green Hills Software

- NVIDIA

- NXP Semiconductors

- Panasonic

- Renesas Electronics

- Robert Bosch

- Siemens(Mentor Graphics)

- Wind River Systems

- 지역 기업

- Aptiv

- Infineon Technologies

- OpenSynergy

- Sasken Technologies

- STMicroelectronics

- Synopsys

- SYSGO

- Texas Instruments

- Vector Informatik

- VMware

- 신흥기업

- Apex.AI

- Lynx Software Technologies

- OpenSynergy Ecosystem Partners

- SafeRide Technologies

- Virtual Open Systems

The Global Automotive Hypervisor Market was valued at USD 478.9 million in 2025 and is estimated to grow at a CAGR of 34.9% to reach USD 9.41 billion by 2035.

Market expansion is driven by the automotive industry's structural transition from hardware-focused vehicle architectures to software-defined vehicles built around centralized computing platforms. Vehicle manufacturers are increasingly relying on automotive hypervisors to support multiple operating systems and applications on a shared computing environment. This shift is enabling faster software deployment cycles, improved scalability, and greater flexibility in introducing features across multiple vehicle platforms. The move toward centralized computing is also supporting simplified system design, reduced complexity, and more efficient software lifecycle management. As vehicles become more connected, intelligent, and software-driven, hypervisors are emerging as a foundational technology that supports secure workload management, performance optimization, and future-ready vehicle architectures. Growing investment in digital vehicle platforms and next-generation mobility solutions is further accelerating adoption, positioning automotive hypervisors as a critical enabler of modern automotive innovation.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $478.9 Million |

| Forecast Value | $9.41 Billion |

| CAGR | 34.9% |

The increasing complexity of advanced driver assistance systems and the progression toward autonomous mobility have heightened the need for strict separation between safety-critical and non-critical applications. Automotive hypervisor platforms are described as enabling secure isolation of workloads, ensuring predictable system behavior while meeting functional safety requirements. Manufacturers are consolidating multiple electronic control units into fewer domain and central controllers to streamline vehicle architecture, reduce wiring complexity, lower energy consumption, and improve overall system efficiency.

The bare-metal hypervisor segment held 77% share in 2025 and is expected to grow at a CAGR of 34.3% from 2026 to 2035. This segment is gaining traction due to its ability to interact directly with vehicle hardware, minimizing response latency and supporting real-time system performance, which is essential for safety-focused automotive applications.

The passenger car segment accounted for 71% share in 2025 and is forecast to grow at a CAGR of 35.5% through 2035. Rising demand for connected services and virtualized infotainment environments is driving adoption of hypervisor-based platforms that allow multiple applications to operate within a unified vehicle computing system.

U.S. Automotive Hypervisor Market reached USD 109.8 million in 2025. Growth in the country is supported by strong investment from automakers and technology providers focused on connected, autonomous, and software-defined vehicle development.

Key companies active in the Global Automotive Hypervisor Market include NVIDIA, BlackBerry, Wind River Systems, NXP Semiconductors, Green Hills Software, Robert Bosch, Continental, Renesas Electronics, Siemens, and Panasonic. Companies operating in the Global Automotive Hypervisor Market are strengthening their competitive position through continuous innovation, ecosystem partnerships, and alignment with software-defined vehicle strategies. Many players are investing heavily in safety-certified hypervisor platforms that support mixed-critical workloads and centralized vehicle architectures. Strategic collaborations with automakers, semiconductor vendors, and software developers are accelerating integration into next-generation vehicle platforms. Firms are also focusing on scalability, cybersecurity, and compliance with functional safety standards to meet evolving regulatory and industry requirements.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.3 GMI AI policy & data integrity commitment

- 1.4 Research trail & confidence scoring

- 1.4.1 Research trail components

- 1.4.2 Scoring components

- 1.5 Data collection

- 1.5.1 Partial list of primary sources

- 1.6 Data mining sources

- 1.6.1 Paid sources

- 1.7 Base estimates and calculations

- 1.7.1 Base year calculation

- 1.8 Forecast model

- 1.9 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Hypervisor

- 2.2.3 Vehicle

- 2.2.4 Level of autonomy

- 2.2.5 Sales channel

- 2.2.6 Application

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift toward software-defined vehicles (SDVs)

- 3.2.1.2 Rising ADAS and autonomous feature integration

- 3.2.1.3 ECU consolidation and cost optimization

- 3.2.1.4 Growing focus on functional safety and cybersecurity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High integration and validation complexity

- 3.2.2.2 Limited aftermarket adoption

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of centralized and zonal vehicle architectures

- 3.2.3.2 Growth of electric and autonomous vehicles

- 3.2.3.3 Integration of OTA and connected services

- 3.2.3.4 Emerging demand from commercial and fleet vehicles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. Department of Transportation (DOT) Standards

- 3.4.1.2 Occupational Safety and Health Administration (OSHA) Guidelines

- 3.4.1.3 U.S. Environmental Protection Agency (EPA)

- 3.4.2 Europe

- 3.4.2.1 EN ISO Container Standards

- 3.4.2.2 European Union Customs and Safety Regulations

- 3.4.2.3 BS EN / CEN Standards

- 3.4.2.4 National Standards (UNE, DIN, etc.)

- 3.4.3 Asia Pacific

- 3.4.3.1 China GB (Guobiao) Standards

- 3.4.3.2 Japan JIS Requirements

- 3.4.3.3 Korea KS Certification

- 3.4.3.4 Indian BIS Standards

- 3.4.3.5 Thai Industrial Standards Institute (TISI)

- 3.4.4 Latin America

- 3.4.4.1 INMETRO (National Institute of Metrology)

- 3.4.4.2 INTI certification (Instituto Nacional de Tecnologia Industrial)

- 3.4.4.3 NOM standards (Norma Official Mexicana)

- 3.4.5 Middle East & Africa

- 3.4.5.1 ESMA / Emirates Conformity Assessment Scheme (ECAS)

- 3.4.5.2 GCC technical regulations

- 3.4.5.3 SABS certification

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1.1 Pricing by product

- 3.8.1.2 Pricing by region

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use cases

- 3.13 Hypervisor architecture & deployment models

- 3.13.1 Type-1 vs Type-2 vs mixed-criticality architecture

- 3.13.2 Centralized vs zonal ECU deployment

- 3.13.3 Multi-domain consolidation strategies (ADAS + IVI + body)

- 3.13.4 Performance, latency & determinism trade-offs

- 3.14 SoC compatibility and hardware co-design

- 3.15 Open-source vs proprietary hypervisor strategies

- 3.16 Functional safety and mixed-criticality management

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Hypervisor, 2022 - 2035 ($Mn)

- 5.1 Key trends

- 5.2 Bare-metal hypervisor

- 5.3 Hosted hypervisor

Chapter 6 Market Estimates & Forecast, By Level of Autonomy, 2022 - 2035 ($Mn)

- 6.1 Key trends

- 6.2 Semi-autonomous

- 6.3 Fully autonomous

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicle

- 7.3.1 LCV (Light commercial vehicle)

- 7.3.2 MCV (Medium commercial vehicle)

- 7.3.3 HCV (Heavy commercial vehicle)

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Mn)

- 8.1 Key trends

- 8.2 ADAS (Advanced Driver Assistance Systems)

- 8.3 Infotainment & telematics

- 8.4 Powertrain & chassis control systems

- 8.5 Vehicle-to-everything (V2X) communication

- 8.6 Autonomous Driving Systems

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.3.9 Romania

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 BlackBerry QNX

- 11.1.2 Continental

- 11.1.3 Green Hills Software

- 11.1.4 NVIDIA

- 11.1.5 NXP Semiconductors

- 11.1.6 Panasonic

- 11.1.7 Renesas Electronics

- 11.1.8 Robert Bosch

- 11.1.9 Siemens (Mentor Graphics)

- 11.1.10 Wind River Systems

- 11.2 Regional players

- 11.2.1 Aptiv

- 11.2.2 Infineon Technologies

- 11.2.3 OpenSynergy

- 11.2.4 Sasken Technologies

- 11.2.5 STMicroelectronics

- 11.2.6 Synopsys

- 11.2.7 SYSGO

- 11.2.8 Texas Instruments

- 11.2.9 Vector Informatik

- 11.2.10 VMware

- 11.3 Emerging players

- 11.3.1 Apex.AI

- 11.3.2 Lynx Software Technologies

- 11.3.3 OpenSynergy Ecosystem Partners

- 11.3.4 SafeRide Technologies

- 11.3.5 Virtual Open Systems