|

시장보고서

상품코드

1667066

수성 폴리우레탄 분산액 시장 : 기회, 성장 촉진요인, 산업 동향 분석(2025-2034년)Waterborne Polyurethane Dispersions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

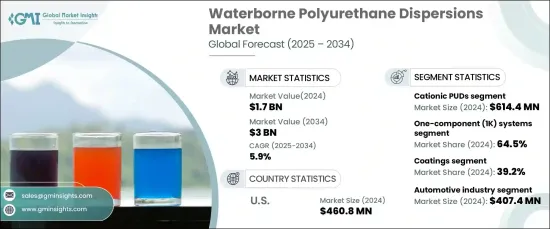

세계의 수성 폴리우레탄 분산액(PUD) 시장은 2024년에 17억 달러로 평가되었고, 2025년부터 2034년에 걸쳐 CAGR 5.9%로 성장할 것으로 전망됩니다.

이러한 견고한 성장은 코팅, 접착제, 페인트, 실란트 등 다양한 응용 분야에서 친환경 및 고성능 소재에 대한 수요가 증가함에 따라 촉진되고 있습니다. 업계에서는 환경에 대한 책임을 다하는 글로벌 변화에 발맞춰 지속 가능한 저-VOC 솔루션을 점점 더 우선시하고 있습니다. 수성 폴리우레탄 분산제는 성능, 다용도성, 친환경성이 탁월하게 결합되어 있어 산업 전반에 걸쳐 매력적인 선택이 되고 있습니다. 또한 폴리머 기술의 발전과 더욱 엄격해진 환경 규제로 인해 이러한 분산제의 채택이 더욱 증가하고 있습니다. 탄소 발자국을 줄이고 엄격한 지속 가능성 기준을 충족하는 것이 강조되면서 수성 PUD는 친환경 기술로 전환하는 산업에서 핵심 솔루션으로 자리매김하고 있습니다.

유형별로 시장은 음이온성, 양이온성, 비이온성, 자가 가교 및 하이브리드 폴리우레탄 분산액으로 세분화됩니다. 2024년에는 양이온성 PUD가 시장을 장악하여 전체 매출에 6억 1,440만 달러를 기여했습니다. 양전하를 띠는 구조로 잘 알려진 양이온성 PUD는 우수한 접착력을 제공하므로 내구성과 신뢰성이 중요한 섬유 및 포장과 같은 응용 분야에서 특히 유용합니다. 이러한 고유한 특성 덕분에 고성능 접착 솔루션을 필요로 하는 분야에서 없어서는 안 될 소재로 자리매김하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 17억 달러 |

| 예측 금액 | 30억 달러 |

| CAGR | 5.9% |

또한 시장은 기능에 따라 1성분(1K)와 2성분(2K) 시스템으로 나뉘어 분류됩니다. 2024년에는 일액형 시스템이 64.5%의 상당한 점유율을 차지했습니다. 이러한 사전 배합 시스템은 추가 경화 성분이 필요하지 않으므로 적용 프로세스가 간소화되고 효율성이 향상됩니다. 사용자 친화적인 특성 덕분에 건설, 자동차, 가구 제조 등 간소화된 운영이 필수적인 산업에서 선호되는 제품입니다.

미국의 수성 폴리우레탄 분산제 시장은 2024년에 4억 6,080만 달러의 매출을 기록했으며, 이는 저-VOC, 친환경 제품에 대한 수요 증가에 힘입은 결과입니다. 자동차, 섬유, 건설과 같은 주요 산업이 시장 성장을 촉진하는 데 중추적인 역할을 했습니다. 친환경 화학 및 지속 가능한 생산에 대한 규제가 강화되면서 미국에서는 수성 PUD의 채택이 계속 증가하고 있습니다. 미국은 폴리머 기술의 발전과 더불어 산업 혁신에 대한 리더십을 바탕으로 수성 PUD의 개발 및 적용을 위한 주요 허브로 자리매김하고 있습니다. 자동차, 포장, 목재 코팅과 같은 분야에서 성능 저하 없이 환경 친화적인 소재를 우선시하는 산업에서 높은 수요가 뚜렷하게 나타나고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 소스

- 1차 데이터

- 2차 데이터

- 유료

- 공적

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혼란

- 장래 전망

- 제조업체

- 유통업체

- 공급자의 상황

- 이익률 분석

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 고성능 제품에 대한 수요 증가

- 환경 규제 및 지속 가능한 제품에 대한 수요 증가

- 업계의 잠재적 위험 및 과제

- 높은 비용

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 규모와 예측 : 유형별(2021-2034년)

- 주요 동향

- 음이온성 PUD

- 양이온 PUD

- 비이온성 PUD

- 자가 가교형 PUD

- 하이브리드 PUD

제6장 시장 규모와 예측 : 기능별(2021-2034년)

- 주요 동향

- 1성분(1K) 시스템

- 2성분(2K) 시스템

제7장 시장 규모와 예측 : 용도별(2021-2034년)

- 주요 동향

- 접착제 및 실란트

- 코팅제

- 합성 피혁 제조

- 연포장

- 기타

제8장 시장 규모와 예측 : 최종 용도 산업별(2021-2034년)

- 주요 동향

- 자동차

- 건설

- 섬유

- 가구

- 포장

- 기타

제9장 시장 규모와 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- BASF

- Cargill

- Covestro

- DIC Corporation

- Dow

- Evonik

- HMG Paints

- Huntsman

- Lanxess

- Nippon Polyurethane

- PPG Industries

- RPM International

- Toyo Kasei

- Wacker Chemie

The Global Waterborne Polyurethane Dispersions Market was valued at USD 1.7 billion in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2034. This robust growth is fueled by the rising demand for eco-friendly and high-performance materials in diverse applications such as coatings, adhesives, paints, and sealants. Industries increasingly prioritize sustainable and low-VOC solutions to align with global shifts toward environmentally responsible practices. Waterborne polyurethane dispersions offer an exceptional combination of performance, versatility, and eco-friendliness, making them an attractive choice across industries. Additionally, advancements in polymer technology and stricter environmental regulations are further driving the adoption of these dispersions. The growing emphasis on reducing carbon footprints and meeting stringent sustainability standards has positioned waterborne PUDs as a key solution for industries transitioning to greener technologies.

By type, the market is segmented into anionic, cationic, nonionic, self-crosslinking, and hybrid polyurethane dispersions. In 2024, cationic PUDs dominated the market, contributing USD 614.4 million to the overall revenue. Known for their positively charged structure, cationic PUDs deliver superior adhesion, making them particularly valuable in applications such as textiles and packaging, where durable and reliable bonding is critical. Their unique properties position them as an indispensable material in sectors that demand high-performance adhesion solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $3 Billion |

| CAGR | 5.9% |

The market is also categorized based on functionality, dividing into one-component (1K) and two-component (2K) systems. In 2024, one-component systems captured a significant share of 64.5%. These pre-formulated systems eliminate the need for additional curing components, simplifying application processes and enhancing efficiency. Their user-friendly nature makes them a preferred choice in industries where streamlined operations are essential, including construction, automotive, and furniture manufacturing.

The U.S. waterborne polyurethane dispersions market generated USD 460.8 million in 2024, driven by the growing demand for low-VOC, eco-conscious products. Key industries, such as automotive, textiles, and construction, have played a pivotal role in boosting market growth. With increasing regulatory emphasis on green chemistry and sustainable production, the adoption of waterborne PUDs in the U.S. continues to rise. The country's leadership in industrial innovation, coupled with advancements in polymer technology, positions it as a major hub for the development and application of waterborne PUDs. High demand is evident in sectors like automotive, packaging, and wood coatings, as industries prioritize environmentally friendly materials without compromising performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing demand for high-performance products

- 3.6.1.2 Increasing environmental regulations & demand for sustainable products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Anionic PUDs

- 5.3 Cationic PUDs

- 5.4 Nonionic PUDs

- 5.5 Self-crosslinking PUDs

- 5.6 Hybrid PUDs

Chapter 6 Market Size and Forecast, By Functionality, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 One-component (1K) systems

- 6.3 Two-component (2K) systems

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Adhesives & sealants

- 7.3 Coatings

- 7.4 Synthetic leather production

- 7.5 Flexible packaging

- 7.6 Others

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Construction

- 8.4 Textile

- 8.5 Furniture

- 8.6 Packaging

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 BASF

- 10.2 Cargill

- 10.3 Covestro

- 10.4 DIC Corporation

- 10.5 Dow

- 10.6 Evonik

- 10.7 HMG Paints

- 10.8 Huntsman

- 10.9 Lanxess

- 10.10 Nippon Polyurethane

- 10.11 PPG Industries

- 10.12 RPM International

- 10.13 Toyo Kasei

- 10.14 Wacker Chemie