|

시장보고서

상품코드

1667151

에너지용 블록체인 시장 : 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Blockchain in Energy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

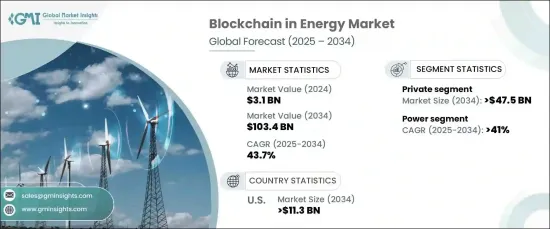

세계의 에너지용 블록체인 시장은 2024년 31억 달러로 평가되었고, 2025-2034년 연평균 복합 성장률(CAGR) 43.7%로 성장할 것으로 예측됩니다.

이 성장은 에너지 시스템의 최적화, 안전 확보, 분산화에 있어서 분산형 대장 기술(DLT)의 적용이 증가하고 있는 것이 배경에 있습니다. 블록체인은 재생 가능 에너지 증서(REC), 탄소 크레딧, 피어 투 피어 에너지 거래, 그리드 관리 등의 에너지 거래를 추적하는 투명하고 변조 방지된 방법을 제공합니다. 이 기술은 운영 효율성을 높이고 중개자에 대한 의존도를 줄이고, 특히 재생 가능 에너지 통합, 에너지 저장 및 분산 에너지 네트워크에서의 혁신을 촉진합니다.

에너지 시스템의 디지털화의 진전과 스마트 미터의 세계의 보급이 함께 블록체인의 보급이 진행될 것으로 예상됩니다. 게다가 에너지 부문의 민영화와 절전을 목적으로 한 정부의 이니셔티브에 뒷받침되는 재생 가능 에너지원(RES)의 확대가 에너지 관리에서의 블록체인 통합을 더욱 강화하고 있습니다. 이러한 개발은 보다 효율적인 에너지 추적, 송전망의 신뢰성 향상, 운영의 합리화를 가능하게 하고, 이 분야에서의 블록체인 도입에 유리한 환경을 갖추고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작금액 | 31억 달러 |

| 예측 금액 | 1,034억 달러 |

| CAGR | 43.7% |

에너지용 블록체인 시장은 퍼블릭 부문와 프라이빗 부문으로 분류됩니다. 프라이빗 부문은 크게 성장할 것으로 예상되며, 2034년까지 544억 달러를 창출할 것으로 예상됩니다. 이러한 성장의 배경에는 보안 강화, 거래 속도 가속화, 데이터 관리 강화에 대한 요구가 있습니다. 기밀 정보에 대한 안전하고 허가된 액세스와 제어를 제공하는 블록체인 솔루션에 대한 수요는 이 부문의 확장에 중요한 요소가 될 것입니다. 게다가, 규제 및 지속가능성 요구사항을 충족하는 투명하고 변조 방지 솔루션으로의 전환이 증가함에 따라 블록체인 시장에 유리한 기회가 생길 것으로 보입니다.

용도 관점에서 에너지의 블록 체인 시장은 전력과 석유 및 가스로 나뉩니다. 전력 부문은 거래 비용 절감과 네트워크 투명성 향상이 원동력이 되어 2034년까지 연평균 복합 성장률(CAGR) 43%로 성장할 것으로 예상되고 있습니다. 소비자와 생산자들이 중개업자를 통하지 않고 직접 에너지를 교환할 수 있는 피어 투 피어(P2P) 에너지 거래 플랫폼에 대한 수요는 특히 서비스가 어려운 지역에서 비용 절감과 에너지 접근 확대에 기여합니다. 전력 부문의 지속적인 디지털화는 블록체인 채택을 촉진하여 송전망 운영 및 에너지 시장과 관련된 기밀 데이터의 보안을 보장합니다.

미국 에너지용 블록체인 시장은 2034년까지 130억 달러를 창출할 것으로 예상됩니다. 태양광 발전, 풍력 발전, 축전지 등의 분산형 에너지 자원(DER)의 도입이 진행됨에 따라 이러한 자산을 관리하기 위한 안전한 분산형 플랫폼에 대한 수요가 높아지고 있습니다. 캘리포니아 및 뉴욕과 같은 지역에서 재생 가능 에너지로의 전환은 블록체인 통합을 더욱 촉진하고, 거래 비용을 절감하며, 소비자와 생산자 간의 직접적인 에너지 교환을 촉진합니다.

목차

제1장 조사 방법과 조사 범위

- 시장의 정의

- 기본 추정과 계산

- 예측 계산

- 1차 조사와 검증

- 1차 소스

- 데이터 마이닝 소스

- 시장의 정의

제2장 주요 요약

제3장 업계 인사이트

- 업계 에코시스템

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 전략 대시보드

- 혁신과 기술의 전망

제5장 시장 규모와 예측 : 카테고리별, 2021-2034년

- 주요 동향

- 퍼블릭

- 프라이빗

제6장 시장 규모와 예측 : 용도별, 2021-2034년

- 주요 동향

- 전력

- 그리드 거래

- 피어 투 피어 거래

- 에너지 파이낸스

- 지속가능성 어트리뷰션

- 전기자동차 충전

- 기타

- 석유 및 가스

- 공급망

- 오퍼레이션

- 트레이딩

- 보안

제7장 시장 규모와 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 네덜란드

- 프랑스

- 스페인

- 아시아태평양

- 중국

- 일본

- 싱가포르

- 호주

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 라틴아메리카

- 브라질

- 중국

제8장 기업 프로파일

- Accenture

- Electron

- Greeneum

- IBM

- Infosys Limited

- Kaleido

- LO3 Energy

- Oracle

- Power Ledger

- SAP

- Sun Exchange

- WePower

The Global Blockchain In Energy Market was valued at USD 3.1 billion in 2024 and is projected to grow at a CAGR of 43.7% from 2025 to 2034. This growth is driven by the increasing application of distributed ledger technology (DLT) in optimizing, securing, and decentralizing energy systems. Blockchain offers a transparent, tamper-proof method for tracking energy transactions, including renewable energy certificates (RECs), carbon credits, peer-to-peer energy trading, and grid management. This technology enhances operational efficiency, reduces reliance on intermediaries, and fosters innovation, particularly in renewable energy integration, energy storage, and decentralized energy networks.

The increasing digitization of energy systems, combined with the global rise in smart meter adoption, is expected to drive widespread blockchain implementation. Additionally, the expansion of renewable energy sources (RES), supported by energy sector privatization and government initiatives aimed at conserving electricity, will further encourage blockchain integration in energy management. These developments enable more efficient energy tracking, improved grid reliability, and streamlined operations, creating a favorable environment for blockchain adoption in the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $103.4 Billion |

| CAGR | 43.7% |

The blockchain in energy market is categorized into public and private segments. The private segment is anticipated to experience substantial growth, generating USD 54.4 billion by 2034. This growth is driven by the need for heightened security, faster transaction speeds, and greater control over data. The demand for blockchain solutions that provide secure, authorized access and control over sensitive information will be a key factor in this segment's expansion. Additionally, the growing shift toward transparent, tamper-proof solutions that meet regulatory and sustainability requirements will create lucrative opportunities for the blockchain market.

In terms of application, the blockchain in energy market is divided into power and oil & gas. The power sector is expected to grow at a CAGR of 43% by 2034, driven by lower transaction costs and improved network transparency. The demand for peer-to-peer (P2P) energy trading platforms, which allow consumers and producers to exchange energy directly without intermediaries, will help reduce costs and increase energy access, especially in underserved areas. The continued digitalization of the power sector will also drive blockchain adoption, ensuring the security of sensitive data related to grid operations and energy markets.

U.S. blockchain in energy market is expected to generate USD 13 billion by 2034. The growing adoption of distributed energy resources (DERs), such as solar, wind, and battery storage, will increase the demand for secure, decentralized platforms to manage these assets. The shift towards renewable energy in regions like California and New York will further promote blockchain integration, reducing transaction costs and facilitating direct energy exchanges between consumers and producers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Category, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Public

- 5.3 Private

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Power

- 6.2.1 Grid transactions

- 6.2.2 Peer to peer transactions

- 6.2.3 Energy financing

- 6.2.4 Sustainability attribution

- 6.2.5 Electric vehicle charging

- 6.2.6 Other

- 6.3 Oil & gas

- 6.3.1 Supply chain

- 6.3.2 Operations

- 6.3.3 Trading

- 6.3.4 Security

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Netherlands

- 7.3.4 France

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 Singapore

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chie

Chapter 8 Company Profiles

- 8.1 Accenture

- 8.2 Electron

- 8.3 Greeneum

- 8.4 IBM

- 8.5 Infosys Limited

- 8.6 Kaleido

- 8.7 LO3 Energy

- 8.8 Oracle

- 8.9 Power Ledger

- 8.10 SAP

- 8.11 Sun Exchange

- 8.12 WePower