|

시장보고서

상품코드

1684784

온보드 진단(OBD) 애프터마켓 시장 규모 - 제품별, 차량별, 용도별, 컴포넌트별, 성장 예측(2025-2034년)On-Board Diagnostics (OBD) Aftermarket Size - By Product, By Vehicle, By Application, By Component, Growth Forecast, 2025 - 2034 |

||||||

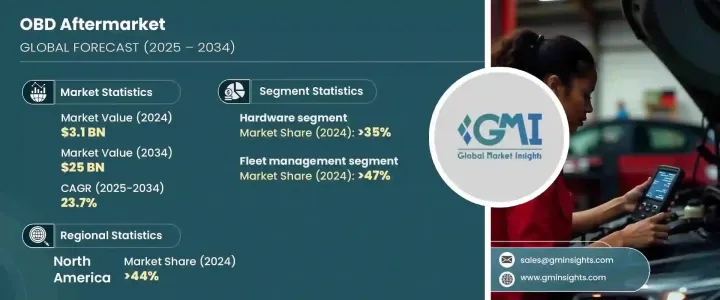

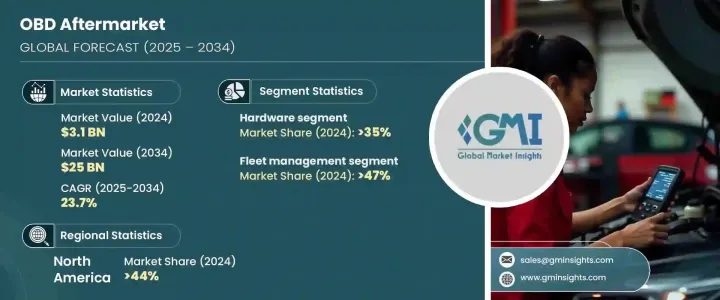

세계 온보드 진단(OBD) 애프터마켓 시장은 2024년에는 31억 달러로 평가되었고 2025년부터 2034년까지의 CAGR은 23.7%를 나타낼 전망입니다.

이러한 급격한 확대는 데이터 구동 기술에 의한 원격 차량 진단 시스템에 대한 의존도가 증가하고 있다는 배경입니다. 이러한 고급 솔루션은 차량의 운전 데이터에 실시간으로 액세스하여 원격 모니터링 및 사전 유지보수를 가능하게 합니다. 차량 성능을 즉시 파악함으로써 OBD 시스템은 안전성을 높이고 예기치 않은 고장을 방지하며 적시에 정비를 실현합니다. 자동차 산업이 디지털 전환을 계속 받아들이는 동안, OBD 애프터마켓 솔루션은 차량의 긴 수명화, 성능 최적화, 엄격한 안전 기준 유지에 중요한 역할을 하고 있습니다.

스마트 자동차 솔루션에 대한 수요 급증, 규제 준수 요건, 강화된 차량 관리 도구에 대한 소비자 선호가 시장 성장의 주요 촉진요인입니다. 예지 보전, 실시간 분석, 최신 연결 프로토콜과의 원활한 통합과 같은 기능을 갖춘 OBD 솔루션은 내연차, 하이브리드 자동차 및 전기자동차의 다양한 요구를 충족시키기 위해 진화하고 있습니다. 이러한 고급 시스템은 진단을 개선하고 원활한 차량 운영을 보장하며 사용자에게 실용적인 통찰력을 제공하는 데 필수적입니다. 최첨단 차량 연결 기술의 채용이 시장을 더욱 밀어 올려 최신 차량 관리의 요점이 되고 있습니다. 자동차 제조업체와 애프터마켓 서비스 제공업체가 혁신에 대한 투자를 계속하는 동안 OBD 솔루션은 자동차 발전의 최전선이 될 것으로 예상됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025년-2034년 |

| 시작 금액 | 31억 달러 |

| 예측 금액 | 250억 달러 |

| CAGR | 23.7% |

2024년 시장 점유율의 35%를 차지한 하드웨어 분야는 2034년까지 30%를 차지할 것으로 예측됩니다. 첨단 진단 도구의 꾸준한 도입이 이 부문을 견인하고 차량 데이터를 분석하고 실시간 통찰력을 제공하는 기능이 향상되었습니다. 이러한 기술 혁신은 자동차 진단에 혁명을 일으켜 사용자가 차량 성능을 더욱 효율적으로 평가할 수 있게 합니다. 기술이 발전함에 따라 차세대 OBD 하드웨어는 더 높은 정확도를 제공할 것이며, 사용자는 문제가 심각해지기 전에 발견하고 해결할 수 있습니다. 이러한 변화는 자동차가 장기간에 걸쳐 최적의 상태를 유지할 수 있도록 하는 예측 및 예방 유지보수에 대한 업계의 중점을 강조합니다.

OBD 애프터마켓은 소비자를 위한 텔레매틱스, 차량 관리, 카셰어링, 이용 기반 보험으로 용도별로 분류됩니다. 2024년에는 차량 관리 분야가 시장 점유율의 47%를 차지하고 우위를 차지하고 있습니다. 차량 운행 관리자는 차량의 움직임을 모니터링하고, 경로를 최적화하고, 운전 행동을 실시간으로 추적하기 위해 OBD 기술을 활용하고 있습니다. OBD를 디지털 맵핑 및 고급 추적 기능과 통합함으로써 플릿 관리자는 차량 사용을 보다 상세하게 관리할 수 있어 효율성 향상과 비용 절감을 도모할 수 있습니다. 또한, OBD 시스템과 운행 관리 플랫폼의 원활한 통합은 운행의 투명성을 높이고, 부정 행위를 줄이고, 다운타임을 최소화하며, 물류 및 운송 산업에 필수적인 도구가 되었습니다.

북미는 확립된 자동차 산업과 차량 진단 기술의 끊임없는 진보에 견인되어 2024년 OBD 애프터마켓에서 44%의 압도적 점유율을 차지했습니다. 이 지역에서는 규제 준수, 예방 보전, 자동차 기술 혁신이 중시되고 OBD 솔루션의 보급이 가속화되고 있습니다. 주요 자동차 제조업체의 견고한 존재감과 성숙한 애프터마켓 생태계를 통해 북미는 세계 시장의 선두 주자로 자리매김하고 있습니다. 커넥티드 차량 기술과 차량 최적화 솔루션에 대한 수요가 증가함에 따라 이 지역의 성장을 더욱 강화하고 있으며, 향후 수년간 지속적인 시장 확대를 보장하고 있습니다.

목차

제1장 조사 방법과 조사 범위

- 조사 디자인

- 조사 접근

- 데이터 수집 방법

- 기본 추정과 계산

- 기준연도의 산출

- 시장추계의 주요 동향

- 예측 모델

- 1차 조사와 검증

- 1차 소스

- 데이터 마이닝 소스

- 시장 범위와 정의

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 부품 공급자

- 기술 제공업체

- 유통업체

- 최종 사용자

- 공급자의 상황

- 이익률 분석

- 기술과 혁신의 전망

- 특허 분석

- 규제 상황

- 영향요인

- 성장 촉진요인

- 원격 진단 기술로의 이동

- 자동차 사물인터넷(IoT) 동향 증가

- 세계 자동차 생산 증가

- 배기 가스 규제에 대한 관심 증가

- 업계의 잠재적 리스크 및 과제

- 사이버 보안 위협과 프라이버시에 대한 우려

- 호환성과 상호 운용성 문제

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추정 및 예측 : 차량별, 2021년-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV차

- 상용차

- 소형 상용차(LCV)

- 대형 상용차(HCV)

제6장 시장 추정 및 예측 : 용도별, 2021년-2034년

- 주요 동향

- 소비자용 텔레매틱스

- 플릿 관리

- 카셰어링

- 이용 기반 보험(UBI)

제7장 시장 추정 및 예측 : 컴포넌트별, 2021년-2034년

- 주요 동향

- 하드웨어

- OBD 스캐너

- OBD 동글

- 소프트웨어

- PC 기반 OBD 스캔 툴

- 앱(OBD 텔레매틱스 플랫폼)

- 서비스

- 트레이닝 및 컨설팅

- 통합 및 관리

- 매니지드 서비스

제8장 시장 추정 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- UAE

- 남아프리카

- 사우디아라비아

제9장 기업 프로파일

- Autel

- Agilis Systems

- AVL DiTEST

- Bridgestone

- CalAmp Corporation

- Continental

- Danlaw

- ERM Electronic Systems LTD(Ituran)

- Geotab

- Hella

- Innova Electronics

- Launch Tech

- Nexar

- Robert Bosch

- ScanTool

- TomTom Telematics

- Verizon Connect

- Xirgo Technologies

- ZF Friedrichshafen

- Zubie

The global on-board diagnostics aftermarket, valued at USD 3.1 billion in 2024, is set to experience remarkable growth, with projections indicating a CAGR of 23.7% from 2025 to 2034. This rapid expansion is fueled by the increasing reliance on remote vehicle diagnostic systems powered by data-driven technologies. These advanced solutions provide real-time access to a vehicle's operational data, enabling remote monitoring and proactive maintenance. By offering instant insights into vehicle performance, OBD systems enhance safety, prevent unexpected breakdowns, and ensure timely servicing. As the automotive industry continues to embrace digital transformation, OBD aftermarket solutions are playing a critical role in vehicle longevity, optimizing performance, and maintaining stringent safety standards.

The Surge In Demand For Smart Automotive Solutions, Regulatory Compliance Requirements, And Consumer Preferences For Enhanced Vehicle Management Tools Are Key Drivers Of Market growth. With features such as predictive maintenance, real-time analytics, and seamless integration with modern connectivity protocols, OBD solutions are evolving to meet the diverse needs of internal combustion, hybrid, and electric vehicles. These advanced systems are essential for improving diagnostics, ensuring smooth vehicle operations, and delivering actionable insights to users. The adoption of cutting-edge vehicle connectivity technologies has further propelled the market, making it a cornerstone of modern vehicle management. As automakers and aftermarket service providers continue investing in innovation, OBD solutions will remain at the forefront of automotive advancements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $25 Billion |

| CAGR | 23.7% |

The hardware segment, which accounted for 35% of the market share in 2024, is expected to hold 30% by 2034. The steady introduction of advanced diagnostic tools is driving this segment, offering enhanced capabilities for analyzing vehicle data and delivering real-time insights. These innovations are revolutionizing automotive diagnostics, enabling users to assess vehicle performance more efficiently. As technology advances, next-generation OBD hardware will provide even greater accuracy, allowing users to detect and address issues before they escalate. This shift underscores the industry's focus on predictive and preventive maintenance, ensuring vehicles remain in optimal condition for extended periods.

The OBD aftermarket is categorized based on application into consumer telematics, fleet management, car sharing, and usage-based insurance. The fleet management segment dominated in 2024, capturing 47% of the market share. Fleet operators are increasingly leveraging OBD technology to monitor vehicle movement, optimize routes, and track driving behavior in real time. By integrating OBD with digital mapping and advanced tracking features, fleet managers gain greater control over vehicle utilization, leading to improved efficiency and cost savings. Additionally, the seamless integration of OBD systems with fleet management platforms enhances operational transparency, reduces unauthorized activities, and minimizes downtime, making it an essential tool for logistics and transportation industries.

North America held a commanding 44% share of the OBD aftermarket in 2024, driven by a well-established automotive industry and continuous advancements in vehicle diagnostics technology. The region's strong emphasis on regulatory compliance, preventive maintenance, and automotive innovation has accelerated the widespread adoption of OBD solutions. With a robust presence of leading automotive manufacturers and a mature aftermarket ecosystem, North America has positioned itself as a leader in the global market. The growing demand for connected vehicle technologies and fleet optimization solutions is further fueling regional growth, ensuring sustained market expansion in the years to come.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component suppliers

- 3.1.2 Technology providers

- 3.1.3 Distributors

- 3.1.4 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Shifting focus toward remote diagnostics technology

- 3.7.1.2 Growing trend of automotive Internet of Things (IoT)

- 3.7.1.3 Increasing global automotive production

- 3.7.1.4 Rising emphasis on emission control standards

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Cybersecurity threats and privacy concerns

- 3.7.2.2 Compatibility and interoperability issues

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCVs)

- 5.3.2 Heavy commercial vehicles (HCVs)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Consumer telematics

- 6.3 Fleet management

- 6.4 Car sharing

- 6.5 Usage-based insurance (UBI)

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Hardware

- 7.2.1 OBD scanners

- 7.2.2 OBD dongles

- 7.3 Software

- 7.3.1 PC-based OBD scanning tools

- 7.3.2 Apps (OBD telematics platforms)

- 7.4 Service

- 7.4.1 Training and consulting

- 7.4.2 Integration and management

- 7.4.3 Managed service

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Autel

- 9.2 Agilis Systems

- 9.3 AVL DiTEST

- 9.4 Bridgestone

- 9.5 CalAmp Corporation

- 9.6 Continental

- 9.7 Danlaw

- 9.8 ERM Electronic Systems LTD (Ituran)

- 9.9 Geotab

- 9.10 Hella

- 9.11 Innova Electronics

- 9.12 Launch Tech

- 9.13 Nexar

- 9.14 Robert Bosch

- 9.15 ScanTool

- 9.16 TomTom Telematics

- 9.17 Verizon Connect

- 9.18 Xirgo Technologies

- 9.19 ZF Friedrichshafen

- 9.20 Zubie