|

시장보고서

상품코드

1685064

스파우트 및 비스파우트 액체 파우치 포장 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Spout and Non-Spout Liquid Pouch Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

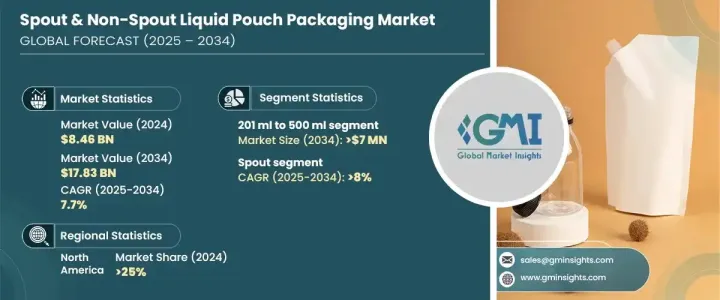

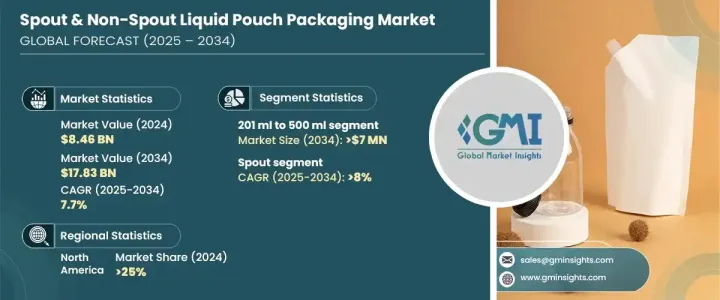

스파우트 및 비스파우트 액체 파우치 포장 세계 시장은 2024년 84억 6,000만 달러로 평가되었으며, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 7.7%로 성장할 것으로 예측됩니다.

유연하고 가볍고 공간 효율적인 패키징 솔루션에 대한 수요가 증가함에 따라 이러한 확장이 뒷받침됩니다. 소비자가 편리하고 운반할 수 있고 재봉 가능한 포장 옵션을 요구하는 가운데, 기업은 경질 용기를 대신하여 비용 효율적이고 효율적인 선택으로 전환하고 있습니다. 지속가능성에 대한 주목이 높아짐에 따라 시장 성장이 더욱 가속화되고 있으며, 제조업체는 진화하는 환경 규제와 소비자의 취향에 맞게 재활용 가능하고 생분해성이 있는 파우치에 투자하고 있습니다.

전자상거래의 상승은 액체 파우치 수요를 높이는 데 중요한 역할을 합니다. 왜냐하면, 액체 파우치는 내구성이 있고, 유출하기 어렵고, 운송 비용을 절감할 수 있기 때문입니다. 이러한 패키징 솔루션은 기능과 편의성이 최우선인 음식, 퍼스널케어, 가정용품 등 업계에 특히 매력적입니다. 또, 사용하기 쉬운 옵션을 요구하는 바쁜 소비자를 위해서, 1회분씩 운반할 수 있는 패키징 형식의 채택이 증가하고 있는 것도, 성장을 뒷받침하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 84억 6,000만 달러 |

| 예측 금액 | 178억 3,000만 달러 |

| CAGR | 7.7% |

기술의 진보가 시장을 변화시키고 있으며, 각 회사는 액체 파우치의 강도, 유연성 및 장벽 특성을 향상시키는 혁신적인 소재 설계에 주력하고 있습니다. QR 코드가 달린 파우치나 감온 라벨 등의 스마트 패키징 솔루션이 보급되어 소비자의 참여와 제품의 안전성이 향상되고 있습니다. 또한 비용 효율적인 제조 기술과 생산 자동화를 통해 액체 파우치 포장은 공급망 최적화를 목표로 하는 기업에게 선호되는 옵션이 되었습니다.

시장은 용량별로 200ml까지, 201ml-500ml, 501ml-1리터, 1리터 이상으로 구분됩니다. 201ml - 500ml 부문은 여러 산업에서 널리 채택되어 있기 때문에 2034년까지 700만 달러를 창출할 것으로 예측되고 있습니다. 이 용량 범위는 휴대성과 실용성의 완벽한 균형을 제공하며 음료, 소스, 퍼스널케어 아이템, 가정용 액체 포장에 이상적입니다. 컴팩트한 크기는 편의성을 요구하는 소비자에게 매력적인 동시에 제조자에게 효율적인 보관과 운송을 보장합니다. 다양한 용도에 대응할 수 있는 것이 시장의 우위성을 높이고 있습니다.

이 시장은 또한 유형별로 스파우트 포장과 비스파우트 포장으로 분류됩니다. 스파우트 부문은 가장 높은 성장을 기록했으며 2025년부터 2034년까지의 CAGR은 8%를 나타낼 전망입니다. 스파우트 파우치는 제어된 디스펜서와 리실러블 기능으로 기능성과 편의성이 향상되어 인기가 높아지고 있습니다. 사용의 용이성을 보장하면서 제품 낭비를 최소화하는 능력은 액체 포장에 매우 바람직합니다. 이 파우치는 음료, 조미료, 퍼스널케어 아이템에 널리 사용되며 특히 유출 방지와 휴대성이 필수적입니다. 일회용으로 여행에도 편리한 패키징에 대한 수요 증가가 이 부문의 확대를 촉진하는 중요한 요인이 되고 있습니다.

2024년 시장 점유율은 북미가 25%를 차지하고 미국에서 수요가 왕성합니다. 환경 친화적이고 편리한 포장에 대한 소비자의 선호도는이 지역의 성장을 계속 견인하고 있습니다. 지속 가능한 소재와 재활용 가능한 포장을 지원하는 규제적 노력이 시장을 더욱 강화하고 있습니다. 벌크 포장의 인기 증가와 전자상거래의 확대는 내구성이 있고 유출이 어려운 액체 파우치 수요를 높이고 있습니다. 비용 효율적인 생산 기술의 혁신으로 액체 파우치 포장은 운송 비용을 줄이면서 업무 효율을 향상시키고자 하는 기업에게 매력적인 선택이 되었습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 소스

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래의 전망

- 제조업체

- 유통업체

- 주요 뉴스와 대처

- 규제 상황

- 영향요인

- 성장 촉진요인

- 편리성이 높은 패키지에 대한 수요 증가

- 지속가능성과 재료 사용량 감소

- 대용량 포장의 혁신

- 전자상거래와 FMCG의 성장

- 비용 효율성 및 사용자 정의

- 업계의 잠재적 위험 및 과제

- 재활용의 복잡성

- 제품 무결성 문제

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추정 및 예측 : 유형별, 2021년-2034년

- 주요 동향

- 스파우트

- 비스파우트

제6장 시장 추정 및 예측 : 용량별, 2021년-2034년

- 주요 동향

- 200mL이하

- 201mL-500mL

- 501mL-1L

- 1L 이상

제7장 시장 추정 및 예측 : 라미네이트별, 2021년-2034년

- 주요 동향

- 2층

- 3층

- 4층

- 기타

제8장 시장 추정 및 예측 : 용도별, 2021년-2034년

- 주요 동향

- 음식

- 주스 및 음료

- 소스 및 조미료

- 유제품

- 공업용 제품

- 오일 및 윤활유

- 화학제품

- 퍼스널케어

- 액체 비누

- 샴푸 & 컨디셔너

- 홈케어

- 세제

- 세정액

- 의약품

- 크림&젤

- 시럽

제9장 시장 추정 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Amcor

- Ampac

- Cellpack Packaging

- Chengde

- Constantia Flexibles

- Glenroy

- Huhtamaki

- Impak Corporation

- Pouch Makers CA

- Smart Pouches

- Smurfit Kappa

- Sonoco

- Swiss Pac

- Tetra Pak

- Uflex

The Global Spout And Non-Spout Liquid Pouch Packaging Market was valued at USD 8.46 billion in 2024 and is expected to grow at a CAGR of 7.7% between 2025 and 2034. The increasing demand for flexible, lightweight, and space-efficient packaging solutions is driving this expansion. As consumers seek convenient, portable, and resealable packaging options, businesses are shifting toward cost-effective and efficient alternatives to rigid containers. The growing focus on sustainability has further accelerated market growth, with manufacturers investing in recyclable and biodegradable pouches to align with evolving environmental regulations and consumer preferences.

The rise of e-commerce has played a crucial role in boosting demand for liquid pouches, as they offer durability, spill resistance, and reduced shipping costs. These packaging solutions are particularly appealing to industries such as food and beverage, personal care, and household products, where functionality and convenience are top priorities. The increasing adoption of single-serve and on-the-go packaging formats has also fueled growth, catering to busy consumers looking for easy-to-use options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.46 Billion |

| Forecast Value | $17.83 Billion |

| CAGR | 7.7% |

Technological advancements are transforming the market, with companies focusing on innovative material designs that enhance the strength, flexibility, and barrier properties of liquid pouches. Smart packaging solutions, such as QR-coded pouches and temperature-sensitive labels, are gaining traction, improving consumer engagement and product safety. Additionally, cost-efficient manufacturing techniques and automation in production are making liquid pouch packaging a preferred choice for businesses looking to optimize their supply chains.

The market is segmented by capacity into up to 200 ml, 201 ml to 500 ml, 501 ml to 1 liter, and above 1 liter. The 201 ml to 500 ml segment is projected to generate USD 7 million by 2034, driven by its widespread adoption across multiple industries. This capacity range provides the perfect balance of portability and practicality, making it ideal for packaging beverages, sauces, personal care items, and household liquids. Its compact size appeals to consumers looking for convenience while ensuring efficient storage and transportation for manufacturers. The ability to cater to various applications strengthens its market prominence.

The market is also categorized by type into spout and non-spout packaging. The spout segment is set to register the highest growth, with a CAGR of 8% between 2025 and 2034. Spout pouches are becoming increasingly popular due to their controlled dispensing and resealable features, offering enhanced functionality and convenience. Their ability to minimize product waste while ensuring ease of use makes them highly desirable for liquid packaging. These pouches are widely utilized for beverages, condiments, and personal care items, especially where spill prevention and portability are essential. The rising demand for single-use and travel-friendly packaging is a significant factor driving the expansion of this segment.

North America accounted for a 25% share of the market in 2024, with strong demand in the United States. Consumer preference for eco-friendly and convenient packaging continues to drive growth in the region. Regulatory initiatives supporting sustainable materials and recyclable packaging further strengthen the market. The increasing popularity of bulk packaging and the expansion of e-commerce have heightened the demand for durable, spill-proof liquid pouches. Innovations in cost-efficient production technologies have made liquid pouch packaging an attractive option for businesses looking to improve operational efficiency while reducing transportation costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand for convenience packaging

- 3.4.1.2 Sustainability and reduced material use

- 3.4.1.3 Innovation in large-capacity packaging

- 3.4.1.4 Growth in e-commerce and FMCG

- 3.4.1.5 Cost efficiency and customization

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 Recycling complexity

- 3.4.2.2 Product integrity issues

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Spout

- 5.3 Non-Spout

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Up to 200 ml

- 6.3 201 ml to 500 ml

- 6.4 501 ml to 1 liter

- 6.5 Above 1 liter

Chapter 7 Market Estimates & Forecast, By Laminates, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Two layers

- 7.3 Three layers

- 7.4 Four layers

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverages

- 8.2.1 Juices & beverages

- 8.2.2 Sauces & condiments

- 8.2.3 Dairy products

- 8.3 Industrial

- 8.3.1 Oils & lubricants

- 8.3.2 Chemicals

- 8.4 Personal care

- 8.4.1 Liquid soaps

- 8.4.2 Shampoos & conditioners

- 8.5 Home care

- 8.5.1 Detergents

- 8.5.2 Cleaning solutions

- 8.6 Pharmaceutical

- 8.6.1 Creams & gels

- 8.6.2 Syrups

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amcor

- 10.2 Ampac

- 10.3 Cellpack Packaging

- 10.4 Chengde

- 10.5 Constantia Flexibles

- 10.6 Glenroy

- 10.7 Huhtamaki

- 10.8 Impak Corporation

- 10.9 Pouch Makers CA

- 10.10 Smart Pouches

- 10.11 Smurfit Kappa

- 10.12 Sonoco

- 10.13 Swiss Pac

- 10.14 Tetra Pak

- 10.15 Uflex