|

시장보고서

상품코드

1685178

경장 영양 장치 시장 : 기회, 성장 촉진요인, 산업 동향 분석(2025-2034년)Enteral Feeding Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

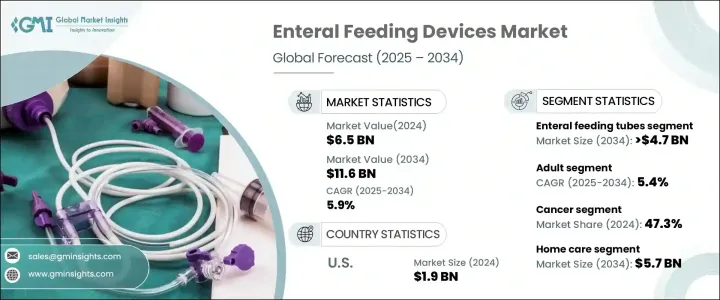

세계의 경장 영양 장치 시장은 2024년에는 65억 달러로 평가되었으며, 2025년부터 2034년까지 연평균 성장률(CAGR) 5.9%로 성장할 것으로 예측됩니다.

이 분야의 성장은 만성 질환의 유병률 증가, 신생아 및 조산아 수유에 대한 수요 증가, 가정 간호 환경에서 경장 영양 솔루션의 채택 확대에 의해 주도되고 있습니다. 자연적으로 음식을 섭취하는 데 장애가 있는 사람들이 늘어나면서 경장 영양 장치에 대한 수요도 계속 증가하고 있습니다. 경장 영양 공급은 의학적 질환으로 인해 경구 섭취가 불가능한 사람들에게 필수 영양소를 전달하는 데 중요한 역할을 합니다. 씹거나 삼키는 능력에 영향을 미치는 치료를 받는 환자들은 적절한 영양을 유지하기 위해 이러한 장치에 의존합니다. 가정 기반 치료는 비용 효율성과 편의성으로 인해 크게 성장하고 있습니다. 의료 서비스 제공자는 단기 및 장기 영양 요구 사항을 모두 관리하기 위해 경장 영양 공급 솔루션을 점점 더 많이 권장하고 있습니다.

경장 영양 장치 시장은 경장 영양 공급 튜브, 펌프, 주사기, 영양 공급 세트 및 액세서리 등 제품 유형에 따라 분류됩니다. 경장 공급 튜브는 5.6%의 연평균 성장률로 2034년까지 47억 달러 이상에 달할 것으로 예상되는 시장 확대를 주도할 것으로 예상됩니다. 이 튜브는 다양한 건강 상태를 가진 개인에게 목표 영양을 전달하는 데 필수적입니다. 급성 및 만성 치료 환경에서의 역할로 인해 적절한 영양 공급을 보장하는 데 선호되는 솔루션입니다. 다양한 유형의 영양 공급 튜브를 사용할 수 있으므로 의료 전문가는 환자 개개인의 필요에 따라 맞춤형 치료를 제공할 수 있습니다. 병원, 클리닉, 홈케어 시설에서 광범위하게 채택되고 있는 경장 영양 공급 튜브는 여전히 시장 성장의 주요 원동력입니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 65억 달러 |

| 예측 금액 | 116억 달러 |

| CAGR | 5.9% |

이 시장은 또한 성인과 소아와 같은 환자 그룹을 기반으로 분류됩니다. 성인 카테고리는 가장 큰 점유율을 차지하고 있으며 2025년부터 2034년까지 5.4%의 연평균 성장률(CAGR)로 성장할 것으로 예상됩니다. 경장 영양을 필요로 하는 성인의 수가 증가함에 따라 이러한 기기에 대한 수요가 지속적으로 증가하고 있습니다. 장기 질환을 앓고 있는 많은 성인들은 건강을 유지하고 합병증을 예방하기 위해 장기간 경장 영양 공급을 필요로 합니다. 완화 치료에서 이러한 솔루션의 채택이 증가함에 따라 전통적인 수유가 불가능한 경우에 필수적인 영양 지원을 제공하기 때문에 수요가 더욱 증가하고 있습니다.

용도별로, 경장 영양 장치는 암, 신경 장애, 위장 질환 등 다양한 의학적 질환에서 널리 사용되고 있습니다. 암 부문은 2024년 시장 점유율의 47.3%를 차지했습니다. 많은 치료로 인해 음식 섭취에 어려움을 겪기 때문에 적절한 영양을 유지하기 위해 경장 영양 공급이 필요합니다. 장기 치료가 필요한 개인에게 이러한 장치는 에너지 수준을 안정적으로 유지하면서 추가 합병증을 예방하는 데 필수적인 역할을 합니다.

또한 시장은 홈 케어, 병원 및 기타 시설 등 최종 사용처에 따라 나뉩니다. 홈 케어 부문은 2024년 시장을 주도했으며 2034년에는 57억 달러에 달할 것으로 예상됩니다. 인구 고령화는 개인이 독립성을 유지하면서 필요한 영양 지원을 받을 수 있는 가정 기반 경장 영양 공급에 대한 수요를 증가시키고 있습니다. 장기 입원에 비해 가정 기반 치료의 경제성은 많은 환자에게 선호되는 선택입니다. 접근성이 높아지면 특히 본인 부담 의료비가 높은 지역에서 더 많은 개인이 이러한 솔루션의 혜택을 누릴 수 있습니다.

미국 경장 영양 장치 시장은 2024년 19억 달러 규모로 평가되었으며, 2034년까지 5.2%의 연평균 성장률을 보일 것으로 예상됩니다. 노인 인구의 증가와 홈 헬스케어 서비스의 채택 증가가 시장 확대를 뒷받침하고 있습니다. 선도 기업들의 연구 개발 노력은 혁신과 제품 가용성에 기여하고 있습니다. 우호적인 환급 정책과 영양 요법을 장려하는 정부 지원 이니셔티브는 시장 성장을 더욱 강화합니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 만성 질환의 유병률 증가

- 신생아 및 조산아 경장 영양에 대한 수요 증가

- 가정 간호 환경에서 경장 영양에 대한 선호도 급증

- 경장 장치의 기술 발전

- 업계의 잠재적 위험 및 과제

- 경장 영양 튜브와 관련된 합병증

- 엄격한 정부 규정 및 규정 준수 요구 사항

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 상환 시나리오

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 향후 시장 동향

제4장 경쟁 구도

- 소개

- 기업 매트릭스 분석

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 경장 영양 튜브

- 비강 삽입/비강 경장 영양 튜브

- 비위관(Nasogastric tube)

- 비공장관 (Nasojejunal tube)

- 복부 삽입형/장루형 경장영양 튜브

- 위루관(Gastrostomy tube)

- 공장루관 / 공장 삽입 튜브(Jejunostomy/jejunal tube)

- 위공장관 (Gastrojejunal, GJ 튜브) 또는 경공장관 (Transjejunal tube)

- 비강 삽입/비강 경장 영양 튜브

- 경장 영양 펌프

- 경장 영양 주사기

- 경장 영양 공급세트

- 부속품/액세서리

제6장 시장 추계 및 예측 : 환자별(2021-2034년)

- 주요 동향

- 성인

- 소아

제7장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 암

- 두경부암

- 소화기 암

- 기타 암

- 중추신경계(CNS) 및 정신 건강

- 비악성 위장(GI) 장애

- 기타 용도

제8장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 재택치료

- 병원

- 기타 최종 용도

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- ALCOR SCIENTIFIC

- Abbott

- AMSINO

- AMT

- -Braun

- Baxter

- Becton Dickinson

- Boston Scientific

- Cardinal Health

- CONMED

- Cook Medical

- DANONE

- FRESENIUS KABI

- HALYARD

- MOOG

- VYGON

The Global Enteral Feeding Devices Market was valued at USD 6.5 billion in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2034. Growth in this sector is driven by the increasing prevalence of chronic illnesses, rising demand for neonatal and preterm feeding, and the expanding adoption of enteral feeding solutions in home care settings. As more individuals face conditions that impair their ability to consume food naturally, the demand for these devices continues to climb. Enteral feeding plays a crucial role in delivering essential nutrients to individuals who cannot eat orally due to medical conditions. Patients undergoing treatments that impact their ability to chew or swallow rely on these devices to maintain adequate nutrition. Home-based care is seeing significant growth due to its cost-effectiveness and convenience. Healthcare providers increasingly recommend enteral feeding solutions for managing both short-term and long-term nutritional needs.

The enteral feeding devices market is categorized based on product type, including enteral feeding tubes, pumps, syringes, giving sets, and accessories. Enteral feeding tubes are expected to lead market expansion with a projected CAGR of 5.6%, reaching over USD 4.7 billion by 2034. These tubes are essential for delivering targeted nutrition to individuals dealing with various health conditions. Their role in acute and chronic care settings makes them a preferred solution for ensuring proper nourishment. The availability of different types of feeding tubes enables healthcare professionals to customize treatments based on individual patient needs. With broad adoption across hospitals, clinics, and home care facilities, enteral feeding tubes remain a primary driver of market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 5.9% |

The market is also segmented based on patient groups, including adult and pediatric populations. The adult category holds the largest share and is expected to grow at a CAGR of 5.4% from 2025 to 2034. A rising number of adults requiring enteral nutrition contributes to sustained demand for these devices. Many adults with long-term conditions need enteral feeding for extended periods to maintain health and prevent complications. The increasing adoption of these solutions in palliative care further boosts demand, as they provide vital nutritional support in cases where traditional feeding is not an option.

In terms of application, enteral feeding devices are widely used across various medical conditions, including cancer, neurological disorders, and gastrointestinal diseases. The cancer segment accounted for 47.3% of the market share in 2024. Many treatments lead to difficulties in consuming food, making enteral feeding necessary to maintain adequate nutrition. For individuals requiring long-term care, these devices play an essential role in ensuring energy levels remain stable while preventing further complications.

The market is also divided by end-use, including home care, hospitals, and other facilities. The home care sector led the market in 2024 and is expected to reach USD 5.7 billion by 2034. An aging population drives demand for home-based enteral feeding, allowing individuals to receive necessary nutritional support while maintaining independence. The affordability of home-based care, compared to extended hospital stays, makes it a preferred choice for many patients. With increased accessibility, more individuals can benefit from these solutions, particularly in regions with high out-of-pocket healthcare expenses.

The U.S. enteral feeding devices market was valued at USD 1.9 billion in 2024 and is projected to grow at a CAGR of 5.2% through 2034. A growing elderly population and increasing adoption of home healthcare services support market expansion. Research and development efforts by leading companies contribute to innovation and product availability. Favorable reimbursement policies and government-backed initiatives promoting nutritional therapies further strengthen market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Increase in demand for neonatal and preterm enteral feeding

- 3.2.1.3 Surging preference for enteral feeding at home care settings

- 3.2.1.4 Technological advancements in enteral feeding devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications associated with enteral feeding tubes

- 3.2.2.2 Stringent government regulations and compliance requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Enteral feeding tubes

- 5.2.1 Nasoenteric/nasal feeding tube

- 5.2.1.1 Nasogastric tube

- 5.2.1.2 Nasojejunal tube

- 5.2.2 Abdominal/ostotomy feeding tube

- 5.2.2.1 Gastrostomy tube

- 5.2.2.2 Jejunostomy/jejunal tube

- 5.2.2.3 Gastrojejunal (GJ) or transjejunal tube

- 5.2.1 Nasoenteric/nasal feeding tube

- 5.3 Enteral feeding pumps

- 5.4 Enteral syringes

- 5.5 Giving sets

- 5.6 Accessories

Chapter 6 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cancer

- 7.2.1 Head and neck cancer

- 7.2.2 Gastrointestinal cancer

- 7.2.3 Other cancer types

- 7.3 Central nervous system (CNS) and mental health

- 7.4 Non-malignant gastrointestinal (GI) disorders

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Home care

- 8.3 Hospitals

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ALCOR SCIENTIFIC

- 10.2 Abbott

- 10.3 AMSINO

- 10.4 AMT

- 10.5 - Braun

- 10.6 Baxter

- 10.7 Becton Dickinson

- 10.8 Boston Scientific

- 10.9 Cardinal Health

- 10.10 CONMED

- 10.11 Cook Medical

- 10.12 DANONE

- 10.13 FRESENIUS KABI

- 10.14 HALYARD

- 10.15 MOOG

- 10.16 VYGON