|

시장보고서

상품코드

1685214

심전도(ECG) 기기 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Electrocardiogram (ECG) Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

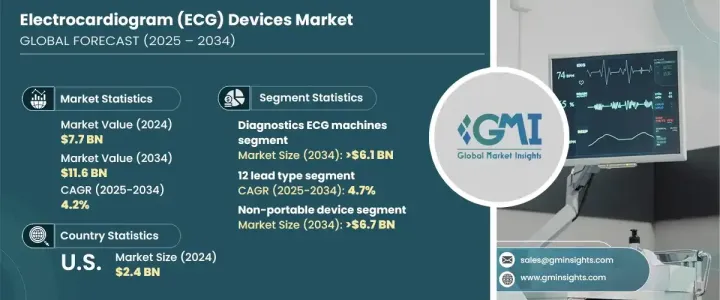

세계의 심전도 기기 시장은 2024년에 77억 달러로 평가되었고, 2025-2034년 CAGR 4.2%로 확대할 전망입니다.

심장 발작, 부정맥, 고혈압을 포함한 심혈관 질환은 세계 건강에 큰 과제이며, 심전도 기기 수요를 견인하고 있습니다. 이러한 질병은 세계 주요 사망 원인 중 하나이며 조기 발견과 지속적인 모니터링의 필요성을 강조합니다. 심장 관련 합병증을 일으키기 쉬운 인구 고령화는 시장 성장을 뒷받침하는 중요한 역할을 수행합니다.

세계 각국의 정부는 심혈관 질환의 조기 발견 및 관리를 우선시하고 있는 한편, 선진 의료 기술의 개발을 지원하기 위해 의료비가 증가하고 있습니다. 또한 심장 건강에 대한 의식이 높아지고 예방 의료와 정기적인 심장 검진으로의 전환이 촉진되고 있습니다. 디지털 연결 강화 및 진단 알고리즘 개선 등 ECG 기기의 끊임없는 진보로 병원, 진단센터, 재택치료 등 다양한 의료 환경에서 ECG 기기에 대한 접근성과 효율성이 높아지고 있습니다. 이러한 폭넓은 가용성과 기능성의 향상이 시장 확대의 주요 요인이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 77억 달러 |

| 예측 금액 | 116억 달러 |

| CAGR | 4.2% |

제품 유형별로, 심전도 기기 시장은 주로 진단용 심전도 기기와 모니터링용 심전도 기기로 나뉩니다. 진단용 ECG 기기 분야는 CAGR 3.7%로 성장할 전망이며, 2034년에는 61억 달러에 이를 전망입니다. 이러한 기기는 심장 이상을 감지하는 데 중요한 역할을 하며, 의료 서비스 제공업체가 심장 활동을 정밀하게 평가할 수 있도록 합니다. 노화와 관련된 만성 질환 유병률 증가는 진단기 수요를 촉진하는 중요한 요인입니다. 동시에 멀티 리드 구성 및 디지털 통합과 같은 지속적인 기술 개선으로 임상 현장에서의 효율성 및 정확성이 향상되고 워크플로우가 간소화되고 환자 결과가 개선되었습니다.

심전도 기기 시장을 리드 유형별로 분류하면 싱글 리드, 3 리드, 6 리드, 12 리드 및 기타 리드 유형으로 분류됩니다. 12 리드 ECG 분야가 두드러지며 CAGR 4.7%로 성장할 전망이고, 2034년에는 53억 달러에 이를 것으로 예측됩니다. 이 부문은 심장 활동을 평가하는 종합적인 능력으로 우세하며 복잡한 심혈관 질환의 진단에 필수적입니다. 헬스케어 전문가들은 심장 리듬의 정확성과 상세한 분석을 위해 특히 응급 및 구명 의료 현장에서 12개 유도 ECG에 크게 의존합니다. 이러한 장비는 광범위한 진단 능력으로 집중 치료실과 심장 모니터링 센터에서 필수적이며 심장의 건강 상태를 정확하게 모니터링합니다.

미국에서 ECG 기기 시장은 2024년 24억 달러로 평가되었으며 2034년까지 연평균 복합 성장률(CAGR) 3.8%로 성장할 것으로 예상됩니다. 심혈관 질환의 유병률이 여전히 높아 심장 질환 관리에는 조기 진단 및 지속적인 모니터링이 필수적이기 때문에 ECG 기기에 대한 수요가 계속 증가하고 있습니다. 미국에서는 만성 심장 질환에 걸리기 쉬운 고령화가 진행되고 있으며 시장 수요를 더욱 촉진하고 있습니다. 견고한 의료 인프라 및 지속적인 기술 진보로 미국은 세계 시장을 선도하는 입장에 있습니다. 혁신적인 ECG 솔루션에 대한 투자가 증가하고 환자 의식이 향상됨에 따라 미국 시장은 향후 몇 년동안 지속적인 성장을 이룰 것으로 보입니다.

목차

제1장 조사 방법 및 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 심혈관 질환 유병률 증가

- ECG 기기의 기술적 진보

- 모바일 및 텔레메트리 심장 모니터 채용 증가

- 심장의 건강에 대한 의식의 고조

- 업계의 잠재적 위험 및 과제

- 고급 ECG 기기의 고비용

- 숙련된 전문가의 부족

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

- 향후 시장 동향

- 발작성 심장 관련 증상을 나타내는 환자에서 웨어러블 심전도 기기에 대한 유용성 개요

- 임상 현장에서 휴대형 심전도 기기의 개발

- 운동 중 심전도 모니터링을 위한 유연한 웨어러블 전극 개발

제4장 경쟁 구도

- 서문

- 기업 매트릭스 분석

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 진단용 심전도 기기

- 휴식시 심전도

- 스트레스 심전도

- 모니터링 심전도 기기

- 홀터 모니터

- 심전도 텔레메트리 모니터 및 이벤트 모니터

- 이식형 심장 모니터

- 기타 모니터링용 심전도 기기

제6장 시장 추계 및 예측 : 리드 유형별(2021-2034년)

- 주요 동향

- 싱글 리드 유형

- 3 리드 유형

- 6 리드 유형

- 12 리드 유형

- 기타 리드 유형

제7장 시장 추계 및 예측 : 휴대성별(2021-2034년)

- 주요 동향

- 비휴대용 장치

- 휴대용 장치

제8장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 병원 및 진료소

- 외래수술센터(ASC)

- 진단센터

- 재택치료 환경

- 기타 최종 사용자

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- ALIVECOR

- Allengers

- biotricity

- bionet

- BIOTRONIK

- Boston Scientific

- BPL Medical Technologies

- CARDIOLINE

- FUKUDA

- GE HealthCare

- Baxter

- PHILIPS

- Medtronic

- mindray

- SPACELABS HEALTHCARE

The Global Electrocardiogram Devices Market, valued at USD 7.7 billion in 2024, is expected to expand at a CAGR of 4.2% from 2025 to 2034. Cardiovascular diseases, including heart attacks, arrhythmias, and hypertension, continue to be major health challenges worldwide, driving the demand for ECG devices. These conditions are among the leading causes of death globally, highlighting the need for early detection and continuous monitoring. The aging population, which is more prone to heart-related complications, plays a significant role in boosting market growth.

Governments worldwide are prioritizing early detection and management of cardiovascular diseases, while healthcare expenditures rise to support the development of advanced medical technologies. There is also growing awareness about heart health, prompting a shift toward preventive care and regular cardiac screenings. Continuous advancements in ECG devices, such as enhanced digital connectivity and improved diagnostic algorithms, are making them increasingly accessible and effective across various healthcare settings, including hospitals, diagnostic centers, and home healthcare. This broader availability and enhanced functionality are key drivers of market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 7.7 Billion |

| Forecast Value | $ 11.6 Billion |

| CAGR | 4.2% |

In terms of product types, the ECG devices market is primarily divided into diagnostic ECG machines and monitoring ECG devices. The diagnostic ECG machines segment is set to grow at a CAGR of 3.7%, reaching USD 6.1 billion by 2034. These machines play a crucial role in detecting cardiac abnormalities, allowing healthcare providers to assess heart activity with high precision. The increasing prevalence of chronic conditions related to aging is a significant factor driving the demand for diagnostic machines. At the same time, continuous technological improvements, such as multi-lead configurations and digital integration, are enhancing their efficiency and accuracy in clinical settings, streamlining workflows and improving patient outcomes.

When broken down by lead type, the ECG devices market is categorized into single-lead, 3-lead, 6-lead, 12-lead, and other lead types. The 12-lead ECG segment stands out, projected to grow at a CAGR of 4.7%, reaching USD 5.3 billion by 2034. This segment dominates due to its comprehensive ability to assess the heart's activity, making it indispensable for diagnosing complex cardiovascular conditions. Healthcare professionals rely heavily on 12-lead ECGs for their accuracy and detailed analysis of heart rhythms, especially in emergency and critical care settings. These devices are vital in intensive care units and cardiac monitoring centers due to their extensive diagnostic capabilities, ensuring precise monitoring of heart health.

In the United States, the ECG devices market was valued at USD 2.4 billion in 2024, with expectations to grow at a CAGR of 3.8% through 2034. The persistent high prevalence of cardiovascular diseases continues to drive the demand for ECG devices, as early diagnosis and continuous monitoring are crucial for managing heart conditions. The U.S. is also witnessing an aging population that is more susceptible to chronic heart diseases, further fueling market demand. With its robust healthcare infrastructure and ongoing technological advancements, the U.S. is well-positioned to lead the global market. As investments in innovative ECG solutions rise and patient awareness improves, the U.S. market is set for continued growth in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of cardiovascular diseases

- 3.2.1.2 Technological advancements in ECG devices

- 3.2.1.3 Increasing adoption of mobile and telemetry cardiac monitors

- 3.2.1.4 Rising awareness about heart health

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced ECG devices

- 3.2.2.2 Lack of skilled professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Overview on usefulness of wearable ECG devices in patients experiencing paroxysmal cardiac-related symptoms

- 3.11 Development of a handheld electrocardiogram device in a clinical setting

- 3.12 Development of flexible wearable electrodes for electrocardiogram monitoring during exercise

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostics ecg machines

- 5.2.1 Resting ecg

- 5.2.2 Stress ecg

- 5.3 Monitoring ecg devices

- 5.3.1 Holter monitoring

- 5.3.2 ECG telemetry monitoring/Event monitoring

- 5.3.3 Implantable cardiac monitors

- 5.3.4 Other monitoring ecg devices

Chapter 6 Market Estimates and Forecast, By Lead Type, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single lead type

- 6.3 3 lead type

- 6.4 6 lead type

- 6.5 12 lead type

- 6.6 Other lead types

Chapter 7 Market Estimates and Forecast, By Portability, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Non-portable device

- 7.3 Portable device

Chapter 8 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Ambulatory surgical centers

- 8.4 Diagnostic centers

- 8.5 Home care settings

- 8.6 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ALIVECOR

- 10.2 Allengers

- 10.3 biotricity

- 10.4 bionet

- 10.5 BIOTRONIK

- 10.6 Boston Scientific

- 10.7 BPL Medical Technologies

- 10.8 CARDIOLINE

- 10.9 FUKUDA

- 10.10 GE HealthCare

- 10.11 Baxter

- 10.12 PHILIPS

- 10.13 Medtronic

- 10.14 mindray

- 10.15 SPACELABS HEALTHCARE