|

시장보고서

상품코드

1685219

말토덱스트린 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Maltodextrin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

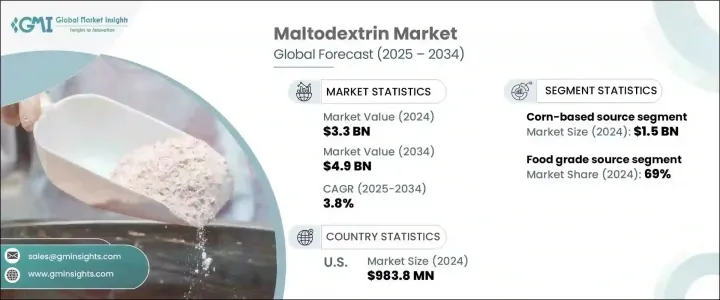

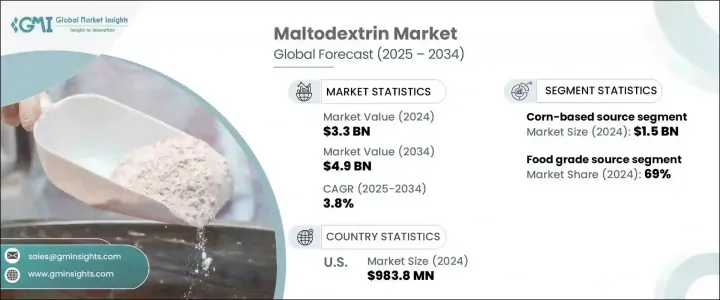

세계의 말토덱스트린 시장은 2024년에 33억 달러로 평가되었고, 2025-2034년 CAGR 3.8%로 강력한 성장을 이룰 전망입니다.

말토덱스트린 수요가 급증하고 있는 이유는 음식, 의약품, 화장품 등 다양한 산업에 걸쳐 광범위하고 다재다능한 용도 때문입니다. 특히, 말토덱스트린은 가공식품의 충전제, 증점제, 안정제로서 널리 사용되고 있기 때문에 식음료 산업은 여전히 시장 확대의 주요 요인이 되고 있습니다. 편의 식품 및 기능성 소재에 대한 소비자 선호도가 높아짐에 따라 말토덱스트린 수요가 꾸준히 증가할 것으로 예상됩니다. 이러한 성장은 보다 건강하고 휴대하기 편리한 옵션과 같은, 진화하는 소비자 요구에 대응하는 제품 개발의 혁신에 의해 더욱 촉진됩니다. 세계의 말토덱스트린 시장이 제품 라인업의 다양화를 계속하고 있는 가운데, 각 산업은 그 비용 효과 및 기능적 이점을 활용하고 있어 향후 10년에 걸쳐 지속적인 성장을 확실히 하고 있습니다.

말토덱스트린 시장은 옥수수, 감자, 카사바, 밀 등 다양한 원료로 분류됩니다. 주요 부문인 옥수수 베이스 말토덱스트린은 2024년에 15억 달러를 창출하였고, 2034년에는 21억 달러에 이를 것으로 예측됩니다. 옥수수 베이스 말토덱스트린은 널리 사용 가능하고 가격도 저렴하며 다기능이기 때문에 식음료 제조업체에게 가장 적합한 선택입니다. 한편, 밀 베이스 말토덱스트린도 시장에서 큰 점유율을 유지하고 있으며, 그 기능적 품질과 많은 산업에 대한 적응성이 특이합니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 33억 달러 |

| 예측 금액 | 49억 달러 |

| CAGR | 3.8% |

제품 등급의 관점에서 말토덱스트린 시장은 의약품 등급, 식품 등급, 산업 등급으로 구분됩니다. 식품 등급의 말토덱스트린은 2024년에 69%의 점유율을 차지하고 시장을 독점하였으며, 이는 주로 다양한 식품의 증점, 안정화, 증량에 있어서의 역할에 기인합니다. 말토덱스트린은 식감을 개선하고 보존성을 높이는 능력이 있기 때문에 가공식품에 필수적입니다. 의약품 등급의 말토덱스트린은 부문으로는 작은 것, 의료용 정제 및 캡슐 제조에서 충전제 및 바인더로 매우 중요하며 시장의 꾸준한 성장에 기여하고 있습니다.

미국의 말토덱스트린 시장 규모는 2024년에 9억 8,380만 달러가 되었으며 여전히 세계 주요 기업입니다. 이 나라의 활발한 식품 가공 산업과 다기능 첨가제로서 말토덱스트린의 광범위한 사용으로 미국은 여전히 우세한 시장을 유지하고 있습니다. 게다가 미국 제약업계는 지속적으로 안정적인 수요를 견인하고 있으며 성장을 더욱 촉진하고 있습니다. 말토덱스트린 제형의 기술 진보 및 혁신은 기능적이고 편리한 건강 지향 식품에 대한 소비자 수요 증가에 대응하고 이 지역 시장을 더욱 밀어올릴 것으로 예상됩니다.

목차

제1장 조사 방법 및 조사 범위

- 시장 범위 및 정의

- 기본 추정 및 계산

- 예측 계산

- 데이터 소스

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 혁신

- 장래 전망

- 제조업체

- 유통업체

- 공급자의 상황

- 이익률 분석

- 주요 뉴스

- 규제 상황

- 영향요인

- 성장 촉진요인

- 식음료 업계 수요 증가

- 건강 지향 증가

- 의약품 및 화장품에 대한 용도 확대

- 업계의 잠재적 위험 및 과제

- 건강에 대한 우려 및 인식

- 원료 가격의 변동

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 규모 및 예측 : 원료별(2021-2034년)

- 주요 동향

- 옥수수 베이스

- 밀 베이스

- 감자 베이스

- 카사바 베이스

- 기타

제6장 시장 규모 및 예측 : 등급별(2021-2034년)

- 주요 동향

- 식품 등급

- 의약품 등급

- 공업용 등급

제7장 시장 규모 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 음식

- 구운 과자

- 과자류

- 유제품

- 음료

- 편의점 식품

- 기타

- 의약품

- 의약품 제제의 부형제

- 영양보조식품

- 화장품 및 퍼스널케어

- 스킨 케어 제품

- 헤어 케어 제품

- 공업용도

- 접착제

- 바인더

- 코팅 및 캡슐화

- 기타

- 동물 사료

- 발효 공정

제8장 시장 규모 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- AGRANA Group

- Archer Daniels Midland

- Avebe

- Cargill

- Golden Grain Group

- Grain Processing Corporation

- Gulshan Polyols

- Ingredion

- Matsutani America

- Mengzhou Tailijie

- Roquette Freres

- Tate &Lyle

- Zhucheng Dongxiao Biotechnology

The Global Maltodextrin Market, valued at USD 3.3 billion in 2024, is set to experience robust growth at a CAGR of 3.8% from 2025 to 2034. The demand for maltodextrin is surging due to its broad and versatile applications across various industries, such as food and beverage, pharmaceuticals, and cosmetics. In particular, the food and beverage industry remains the primary driver of market expansion, as maltodextrin is widely used as a filler, thickener, and stabilizer in processed foods. With the increasing consumer preference for convenience foods and functional ingredients, the demand for maltodextrin is expected to rise steadily. This growth is further fueled by the innovation in product development to meet evolving consumer needs, including healthier, on-the-go options. As the global maltodextrin market continues to diversify its product offerings, industries are capitalizing on its cost-effectiveness and functional benefits, ensuring sustained growth well into the next decade.

The maltodextrin market is divided into various sources, including corn, potato, cassava, wheat, and others. Corn-based maltodextrin, the leading segment, generated USD 1.5 billion in 2024 and is projected to reach USD 2.1 billion by 2034. The widespread availability, affordability, and multifunctionality of corn-based maltodextrin make it the go-to choice for food and beverage manufacturers. Meanwhile, wheat-based maltodextrin also maintains a significant share in the market, prized for its functional qualities and adaptability across numerous industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 3.8% |

In terms of product grade, the maltodextrin market is segmented into pharmaceutical grade, food grade, and industrial grade. Food-grade maltodextrin dominates the market with a 69% share in 2024, largely due to its role in thickening, stabilizing, and bulking various food products. Its ability to improve texture and enhance shelf life makes it indispensable in processed foods. Pharmaceutical-grade maltodextrin, while a smaller segment, is crucial as a filler and binder in the production of medical tablets and capsules, contributing to the market's steady growth.

The U.S. maltodextrin market, valued at USD 983.8 million in 2024, remains a major player in the global landscape. The country's thriving food processing industry, coupled with the widespread use of maltodextrin as a multifunctional additive, ensures the U.S. remains a dominant market. Additionally, the pharmaceutical industry in the U.S. continues to drive consistent demand, further fueling growth. Technological advancements and innovations in maltodextrin formulations are expected to meet the growing consumer demand for functional, convenient, and health-conscious food products, boosting the regional market even further.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand in food and beverage industry

- 3.6.1.2 Rising health consciousness

- 3.6.1.3 Expanding applications in pharmaceuticals and cosmetics

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Health concerns and perception

- 3.6.2.2 Fluctuating raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Corn-based

- 5.3 Wheat-based

- 5.4 Potato-based

- 5.5 Cassava-based

- 5.6 Others

Chapter 6 Market Size and Forecast, By Grade, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food grade

- 6.3 Pharmaceutical grade

- 6.4 Industrial grade

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.2.1 Baked goods

- 7.2.2 Confectionery

- 7.2.3 Dairy products

- 7.2.4 Beverages

- 7.2.5 Convenience foods

- 7.2.6 Others

- 7.3 Pharmaceuticals

- 7.3.1 Excipient in drug formulations

- 7.3.2 Nutritional supplements

- 7.4 Cosmetics and personal care

- 7.4.1 Skincare products

- 7.4.2 Haircare products

- 7.5 Industrial applications

- 7.5.1 Adhesives

- 7.5.2 Binders

- 7.5.3 Coating and encapsulation

- 7.6 Others

- 7.6.1 Animal feed

- 7.6.2 Fermentation processes

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AGRANA Group

- 9.2 Archer Daniels Midland

- 9.3 Avebe

- 9.4 Cargill

- 9.5 Golden Grain Group

- 9.6 Grain Processing Corporation

- 9.7 Gulshan Polyols

- 9.8 Ingredion

- 9.9 Matsutani America

- 9.10 Mengzhou Tailijie

- 9.11 Roquette Frères

- 9.12 Tate & Lyle

- 9.13 Zhucheng Dongxiao Biotechnology