|

시장보고서

상품코드

1685233

재처리 의료기기 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Reprocessed Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

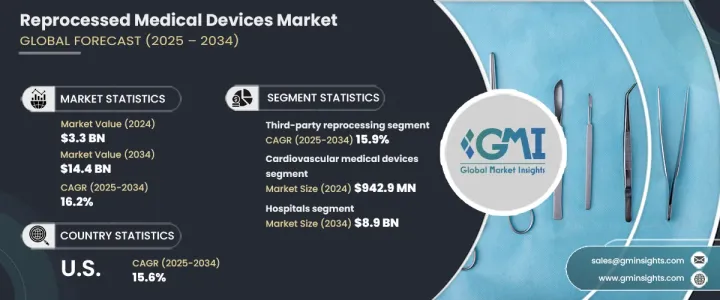

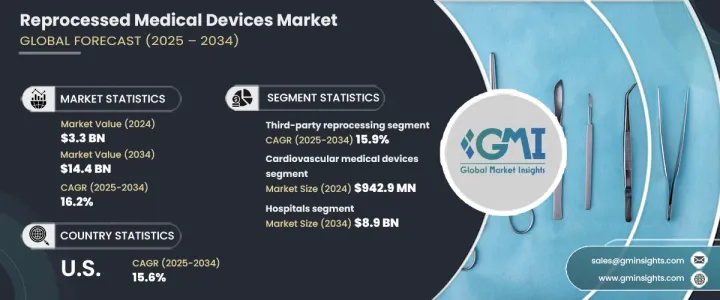

세계의 재처리 의료기기 시장은 2024년 33억 달러로 평가되었고, 2025-2034년 연평균 복합 성장률(CAGR) 16.2%로 확대될 전망입니다.

이러한 성장의 원동력은 재처리 기술의 발전, 단일 사용 디바이스의 재처리 수요 증가, 감염 관리에 대한 강한 관심입니다. 신흥국 시장에서의 헬스케어 서비스의 확대도 시장 성장에 중요한 역할을 하고 있습니다. 재처리 장치의 안전성, 효율성 및 환경적 이점을 강조하는 교육 프로그램은 의료 제공업체와 환자 간의 수용 확대로 이어져 시장 확대를 더욱 강화하고 있습니다.

환경 문제에 대한 관심도 시장에 영향을 미치는 중요한 요소 중 하나입니다. 의료 폐기물을 줄일 필요성이 증가하고 있으며, 의료 서비스 제공업체는 지속 가능한 관행을 채택하도록 촉구되고 있습니다. 의료기기의 재처리는 폐기물을 최소화하고, 세계의 지속가능성에 대한 노력에 부합하며, 엄격한 환경 규제 준수를 보장합니다. 이러한 요인은 세계의 재처리 디바이스에 대한 수요를 계속 견인하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 33억 달러 |

| 예측 금액 | 144억 달러 |

| CAGR | 16.2% |

재처리 의료기기는 원래 단독 사용을 위해 설계되었지만 재사용 전에 높은 안전성과 성능 기준을 충족하기 위해 철저한 세척, 소독, 멸균 및 테스트가 수행됩니다. 시장은 제품 유형별로 구분되며, 2024년에는 순환기계 의료기기가 9억 4,290만 달러로 가장 높은 매출을 올렸습니다.

시장은 또한 제3자 재처리 및 사내 재처리를 포함한 재처리 유형별로 분류됩니다. 제3자 재처리는 2024년 27억 달러를 차지했으며, 2034년까지 연평균 복합 성장률(CAGR) 15.9%로 예측됩니다. 이러한 전문 서비스는 병원 및 의료 센터에 상당한 비용 절감을 제공하여 장치가 엄격한 안전 및 규제 요구 사항을 충족하는지 확인합니다. 제3자 재처리업체의 전문 지식은 의료 시설이 운영 비용을 절감하면서 컴플라이언스를 유지하는 데 도움이 됩니다.

최종 사용자의 관점에서 병원은 압도적인 시장 부문을 차지하고 있으며, 2034년까지 89억 달러에 이를 것으로 예측됩니다. 의료 산업의 비용 압력은 계속 상승하고 있으며, 재처리된 의료기기가 새로운 장비의 매력적인 대안이 되고 있습니다. 병원은 환자의 안전을 손상시키지 않고 장비를 재사용하여 예산을 최적화할 수 있습니다. 또한 헬스케어 부서가 지속가능성을 추구함으로써 재처리 장비의 채용이 증가하고 일회용 플라스틱 수요를 줄이고 환경에 미치는 영향을 줄입니다.

미국의 재처리 의료기기 시장은 2024년 14억 달러로 평가되었으며, 2034년까지 15.6%의 연평균 복합 성장률(CAGR)로 성장할 것으로 예상됩니다. 헬스케어 비용이 증가함에 따라 병원과 의료 센터는 비용 효율적인 솔루션을 찾고 있습니다. FDA가 정한 명확한 규제 가이드라인이 존재함으로써 재처리 기기가 엄격한 안전성과 성능 기준을 충족하는 것이 보장되고, 의료 종사자의 신뢰가 양성되어 국가 전체에서의 도입이 촉진되고 있습니다.

목차

제1장 조사 방법 및 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 지속 가능한 폐기물 처리 방법에 관한 유리한 규제 상황

- 신흥국에서의 유통업체망 강화와 함께 저렴한 비용

- 수많은 심장 수술 및 혈압 모니터링에 있어서 재처리 제품 사용 확대

- 업계의 잠재적 위험 및 과제

- 수술 부위 감염의 위험

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 상환 시나리오

- Porter's Five Forces 분석

- PESTEL 분석

- 갭 분석

- 의료기기 재처리 스텝

- 밸류체인 분석

제4장 경쟁 구도

- 서문

- 기업 매트릭스 분석

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품별(2021-2034년)

- 주요 동향

- 심혈관 의료기기

- 혈압 커프 및 지혈 커프

- 전기 생리학 진단용 카테터

- 전기 생리학용 케이블

- 심장 안정화 및 위치 결정 기구

- 심부정맥압박 슬리브(DVT)

- 기타 심장혈관용 의료기기

- 복강경

- 내시경용 트로커 및 컴포넌트

- 하모닉 여성

- 정형외과 및 관절경

- 소화기 및 비뇨기

- 소화기 생검 기기

- 비뇨기 생검 기기

- 일반 외과용 기기

- 주입 가방

- 풍선 팽창 장치

- 기타 제품

제6장 시장 추계 및 예측 : 유형별(2021-2034년)

- 주요 동향

- 제3자 재처리

- 사내 재처리

제7장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 병원

- 외래수술센터(ASC)

- 기타 최종 사용자

제8장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Arjo

- Boston Scientific

- Cardinal Health

- GE Healthcare

- Halomedicals Systems

- INNOVATIVE HEALTH

- Johnson &Johnson

- MEDLINE

- Medtronic

- SOMA TECH

- STERIS

- Stryker

- SURETECH MEDICAL

- Teleflex

- VANGUARD

The Global Reprocessed Medical Devices Market reached USD 3.3 billion in 2024 and is set to expand at a CAGR of 16.2% from 2025 to 2034. This growth is driven by advancements in reprocessing technology, rising demand for single-use device reprocessing, and a strong focus on infection control. The expansion of healthcare services in developing regions also plays a crucial role in market growth. Educational programs highlighting the safety, efficiency, and environmental benefits of reprocessed devices have led to greater acceptance among healthcare providers and patients, further boosting market expansion.

Environmental concerns are another key factor influencing the market. The need to reduce medical waste is increasing, prompting healthcare providers to adopt sustainable practices. Reprocessing medical devices minimizes waste, aligns with global sustainability efforts, and ensures compliance with strict environmental regulations. These factors continue to drive the demand for reprocessed devices worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $14.4 Billion |

| CAGR | 16.2% |

Reprocessed medical devices, originally designed for single use, undergo thorough cleaning, disinfection, sterilization, and testing to meet high safety and performance standards before reuse. The market is segmented by product type, with cardiovascular medical devices generating the highest revenue of USD 942.9 million in 2024.

The market is also categorized by reprocessing type, which includes third-party reprocessing and in-house reprocessing. Third-party reprocessing accounted for USD 2.7 billion in 2024 and is projected to grow at a CAGR of 15.9% through 2034. These specialized services provide significant cost savings for hospitals and medical centers, ensuring devices meet rigorous safety and regulatory requirements. The expertise of third-party reprocessors helps healthcare facilities maintain compliance while reducing operational costs.

In terms of end users, hospitals represent the dominant market segment, expected to reach USD 8.9 billion by 2034. Cost pressures in the healthcare industry continue to rise, making reprocessed medical devices an attractive alternative to new equipment. Hospitals can optimize budgets by reusing devices without compromising patient safety. Additionally, the healthcare sector's push for sustainability is increasing the adoption of reprocessed devices, reducing the demand for single-use plastics, and lowering the environmental impact.

The U.S. reprocessed medical devices market was valued at USD 1.4 billion in 2024 and is expected to grow at a CAGR of 15.6% through 2034. Rising healthcare costs have led hospitals and medical centers to seek cost-effective solutions. The presence of clear regulatory guidelines set by the FDA ensures that reprocessed devices meet strict safety and performance standards, fostering confidence among healthcare providers and driving adoption across the country.

.Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Favorable regulatory landscape regarding sustainable waste disposal methods

- 3.2.1.2 Affordable costs coupled with the strengthening network of distributors in emerging economies

- 3.2.1.3 Growing use of reprocessed products in numerous cardiac surgeries and blood pressure monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of surgical site infections

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Steps involved in medical device reprocessing

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiovascular medical devices

- 5.2.1 Blood pressure cuffs/tourniquet cuffs

- 5.2.2 Diagnostic electrophysiology catheters

- 5.2.3 Electrophysiology cables

- 5.2.4 Cardiac stabilization and positioning devices

- 5.2.5 Deep vein compression sleeves (DVT)

- 5.2.6 Other cardiovascular medical devices

- 5.3 Laparoscopic

- 5.3.1 Endoscopic trocars and components

- 5.3.2 Harmonic scalpels

- 5.4 Orthopedic/arthroscopic

- 5.5 Gastroenterology and urology

- 5.5.1 Gastroenterology biopsy devices

- 5.5.2 Urology biopsy devices

- 5.6 General surgery equipment

- 5.6.1 Infusion pressure bags

- 5.6.2 Balloon inflation devices

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Type, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Third-party reprocessing

- 6.3 In-house reprocessing

Chapter 7 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arjo

- 9.2 Boston Scientific

- 9.3 Cardinal Health

- 9.4 GE Healthcare

- 9.5 Halomedicals Systems

- 9.6 INNOVATIVE HEALTH

- 9.7 Johnson & Johnson

- 9.8 MEDLINE

- 9.9 Medtronic

- 9.10 SOMA TECH

- 9.11 STERIS

- 9.12 Stryker

- 9.13 SURETECH MEDICAL

- 9.14 Teleflex

- 9.15 VANGUARD