|

시장보고서

상품코드

1698246

가정용 수면 스크리닝 기기 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Home Sleep Screening Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

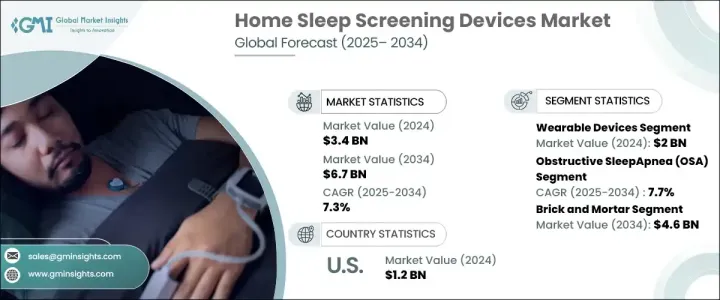

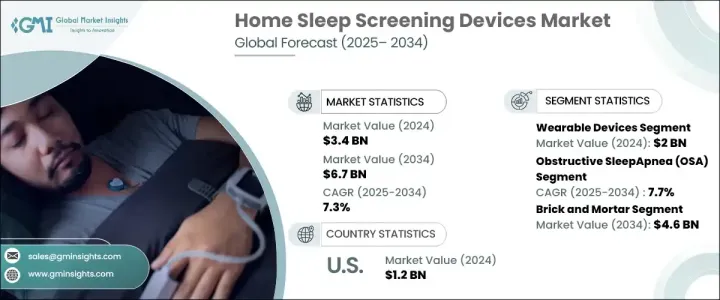

세계의 가정용 수면 스크리닝 기기 시장은 2024년 34억 달러로 평가되었으며, 2025-2034년 연평균 복합 성장률(CAGR) 7.3%로 성장할 것으로 예측됩니다.

웨어러블 기술 및 휴대용 기술의 진보, 비용 효율적인 수면 솔루션에 대한 요구의 고조, 진단율 향상, 고령화 등이 확대의 주요 요인입니다. 불면증, 레스트리스 레그 증후군, 폐쇄성 수면무호흡증 등의 수면장애 유병률 상승이 가정용 수면 모니터링 솔루션의 수요를 촉진하고 있습니다.

가정용 수면 스크리닝 기기는 수면 패턴을 모니터링하고 분석하며 장애를 감지합니다. 이러한 도구에는 스마트워치 및 피트니스 트래커와 같은 웨어러블 옵션과 휴대용 수면 폴리그래프나 수면 무호흡 모니터와 같은 비웨어러블 시스템이 포함됩니다. 2024년에는 웨어러블 디바이스가 시장을 견인하였으며, 2021년 17억 달러에서 20억 달러로 증가했습니다. 이러한 경량 디바이스를 통해 사용자는 자신의 수면 패턴을 편리하게 추적할 수 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 34억 달러 |

| 예측 금액 | 67억 달러 |

| CAGR | 7.3% |

웨어러블 기술의 세계 출하액은 2022년에 5억 3,430만 달러에 달하였으며, 스마트 워치나 피트니스트 래커에 대한 기호가 높아지고 있습니다. 웨어러블 수면 모니터링 장치 시장은 수면 건강에 대한 소비자 인식이 높아지면서 크게 확대되고 있습니다. 보고서에 따르면 성인의 수면 부족률은 꾸준히 상승하고 있으며 웨어러블 수면 트래킹 솔루션 채택을 독려하는 개인이 늘고 있습니다.

시장은 용도별로 폐쇄성 수면 무호흡 증후군, 불면증, 레스트레스 레그 증후군, 일일 리듬 장애, 기타 질환으로 구분됩니다. 폐쇄성 수면 무호흡증 부문은 2024년에 16억 달러를 차지하였고, 2034년까지 CAGR 7.7%로 성장할 것으로 예측되고 있습니다. 폐쇄성 수면 무호흡증은 심혈관질환이나 낮 동안의 졸음 등의 위험에 대한 인식이 높아지면서 건강상 큰 우려 사항으로 널리 인식되고 있습니다. 수면장애 진단과 평가를 위한 소개 증가가 재택형 수면검사 솔루션의 수요를 증대시키고 있습니다.

수면 장애의 인지를 촉진하는 공중위생상의 대처가 시장 성장에 중요한 역할을 하고 있습니다. 수면 무호흡증 증상의 인식과 관리에 초점을 맞춘 교육 프로그램이 현저히 증가하고 있습니다. 게다가 가정용 수면 스크리닝 기기의 채용이 급증하고 있어, 과거 몇 년간 그 사용이 큰폭으로 증가하고 있습니다.

유통 채널을 기반으로 시장은 실제 매장과 전자상거래 플랫폼으로 나뉘어져 있습니다. 약국, 의료용품점, 수면 클리닉을 포함한 실점포가 2024년에는 압도적인 점유율을 차지했으며, 2034년에는 46억 달러에 이를 것으로 예측되고 있습니다. 점포에서의 구입은 건강 관련 제품을 찾는 대부분의 소비자에게 여전히 바람직한 선택지입니다. 이러한 점포에서는, 전문가에 의한 지도나 실제로 제품을 체험할 수 있어, 고객의 신뢰와 만족도를 높이고 있습니다.

2024년 미국 가정용 수면 스크리닝 기기 시장은 12억 달러를 창출했으며, 2034년까지 연평균 복합 성장률(CAGR) 6.4%로 확대될 것으로 예상됩니다. 재택 수면 검사는 기존의 실험실 기반 수면 폴리그래프 검사를 대체하는 비용 효율적인 옵션을 제공하며, 소비자에게 보다 이용하기 쉬운 것으로 되었습니다. 비용 저하 및 보험 적용 범위의 확대는, 예방 헬스케어 대책에 대한 폭넓은 지지와 함께, 시장 침투의 원동력이 되고 있습니다. 합리적인 가격 및 편의성 향상으로 재택 수면 모니터링 솔루션으로의 전환이 가속화되고 있으며, 이 시장은 향후 몇 년간 지속적인 성장이 예상됩니다.

목차

제1장 조사 방법 및 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 수면장애의 세계적 유병률 증가

- 재택 건강 관리 솔루션에 대한 수요 증가

- 수면 모니터링 기술의 진보

- 디지털 헬스 및 웨어러블 기술 통합에 대한 요구의 급증

- 업계의 잠재적 위험 및 과제

- 첨단 기기의 높은 초기 비용

- 데이터 프라이버시 및 보안에 대한 우려

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 미국

- 유럽

- 기술 전망

- 상환 시나리오

- Porter's Five Forces 분석

- PESTEL 분석

- 갭 분석

- 밸류체인 분석

제4장 경쟁 구도

- 서문

- 기업 매트릭스 분석

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 웨어러블 디바이스

- 스마트 워치

- 피트니스 트래커

- 기타 웨어러블 디바이스

- 비웨어러블 디바이스

제6장 시장 추계 및 예측 : 용도별(2021-2034년)

- 주요 동향

- 폐쇄성 수면 무호흡증후군(OSA)

- 불면증

- 레스트레스 레그 증후군

- 개일 리듬 장애

- 기타 용도

제7장 시장 추계 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 실제 점포

- 전자상거래

제8장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제9장 기업 프로파일

- ApneaMed

- BMC

- BRAEBON

- CleveMed

- GARMIN

- HUAWEI

- natus

- NovaSom

- PHILIPS

- ResMed

- SleepWorks

- SOMNOmedics

- VIRTUOX

- ZEPP

- ZOLL itamar

The Global Home Sleep Screening Devices Market was valued at USD 3.4 billion in 2024 and is expected to grow at a CAGR of 7.3% from 2025 to 2034. Advances in wearable and portable technology, the increasing need for cost-effective sleep solutions, higher diagnosis rates, and an aging population are key factors driving expansion. The rising prevalence of sleep disorders such as insomnia, restless leg syndrome, and obstructive sleep apnea is fueling demand for home-based sleep monitoring solutions.

Home sleep screening devices monitor and analyze sleep patterns and detect disorders. These tools include wearable options like smartwatches and fitness trackers and non-wearable systems like portable polysomnography and sleep apnea monitors. In 2024, wearable devices led the market, generating USD 2 billion, an increase from USD 1.7 billion in 2021. These lightweight devices allow users to track their sleep patterns conveniently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.7 Billion |

| CAGR | 7.3% |

Global shipments of wearable technology reached USD 534.3 million in 2022, with a growing preference for smartwatches and fitness trackers. The market for wearable sleep monitoring devices has expanded significantly, driven by increasing consumer awareness of sleep health. Reports indicate that sleep deprivation rates among adults have risen steadily, encouraging more individuals to adopt wearable sleep-tracking solutions.

By application, the market is segmented into obstructive sleep apnea, insomnia, restless leg syndrome, circadian rhythm disorders, and other conditions. The obstructive sleep apnea segment accounted for USD 1.6 billion in 2024 and is projected to grow at a CAGR of 7.7% through 2034. The condition is widely recognized as a major health concern, with rising awareness about its risks, including cardiovascular disease and daytime drowsiness. Increased diagnoses and referrals for sleep disorder evaluations have amplified the demand for home-based sleep testing solutions.

Public health initiatives promoting awareness of sleep disorders are playing a significant role in market growth. There has been a noticeable rise in educational programs focused on recognizing and managing sleep apnea symptoms. Additionally, the adoption of home sleep screening devices has surged, with a significant increase in their use over the past few years.

Based on distribution channels, the market is divided into brick-and-mortar stores and e-commerce platforms. Physical retail outlets, including pharmacies, medical supply stores, and sleep clinics, held the dominant share in 2024 and are projected to reach USD 4.6 billion by 2034. In-store purchases remain the preferred option for most consumers seeking health-related products. These locations offer expert guidance and hands-on product experience, enhancing customer confidence and satisfaction.

In 2024, the U.S. home sleep screening devices market generated USD 1.2 billion and is expected to expand at a CAGR of 6.4% through 2034. Home sleep tests offer a cost-effective alternative to traditional lab-based polysomnography, making them more accessible for consumers. Lower costs and expanding insurance coverage are driving market penetration, alongside a broader push toward preventive healthcare measures. Greater affordability and convenience are accelerating the shift toward at-home sleep monitoring solutions, positioning the market for sustained growth in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global prevalence of sleep disorders

- 3.2.1.2 Growing demand for home healthcare solutions

- 3.2.1.3 Advancements in sleep monitoring technologies

- 3.2.1.4 Surging need for integrated digital health and wearable technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs for advanced devices

- 3.2.2.2 Data privacy and security concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearable devices

- 5.2.1 Smartwatches

- 5.2.2 Fitness trackers

- 5.2.3 Other wearable devices

- 5.3 Non-wearable devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Obstructive sleep apnea (OSA)

- 6.3 Insomnia

- 6.4 Restless leg syndrome

- 6.5 Circadian rhythm disorders

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ApneaMed

- 9.2 BMC

- 9.3 BRAEBON

- 9.4 CleveMed

- 9.5 GARMIN

- 9.6 HUAWEI

- 9.7 natus

- 9.8 NovaSom

- 9.9 PHILIPS

- 9.10 ResMed

- 9.11 SleepWorks

- 9.12 SOMNOmedics

- 9.13 VIRTUOX

- 9.14 ZEPP

- 9.15 ZOLL itamar