|

시장보고서

상품코드

1698291

맥주캔 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Beer Cans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

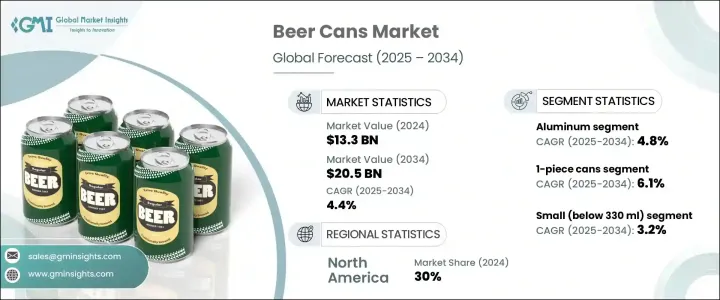

세계의 맥주캔 시장은 꾸준한 성장을 이루고 있으며, 2024년에는 133억 달러에 이르렀으며, 2025년부터 2034년까지의 CAGR은 4.4%를 나타낼 것으로 예측되고 있습니다.

특히 크래프트 맥주와 프리미엄 맥주의 소비 증가는 시장 확대의 주요 요인입니다., 지속가능성, 제품 보존, 비용 효율성을 선호하기 위해 알루미늄 포장으로 이동하고 있습니다.

시장 관계자는 또한 지속 가능한 포장 솔루션에 주력함으로써 소비자의 선호도 변화에 대응하고 있습니다. 이 부문은 맥주 품질에 영향을 미칠 수 있는 외부 요소에 대한 탁월한 보호 기능을 제공함으로써 예측 기간 동안 4.8%의 연평균 성장률(CAGR)로 성장할 것으로 예상됩니다. 운송 비용의 삭감과 제품의 저장 수명의 연장에 의해 알루미늄은 대규모·소규모의 맥주 양조장 양쪽 모두에게 선호되는 소재가 되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 133억 달러 |

| 예측 금액 | 205억 달러 |

| CAGR | 4.4% |

시장은 제품 유형에 따라 구분되며 1피스 캔, 2피스 캔, 3피스 캔이 있습니다. 1피스 캔 부문은 강력한 성장을 이루고 있으며 예측 기간 동안 CAGR 6.1%를 나타낼 것으로 예측됩니다. 이 깡통은 이음새가 없는 구조로, 누설 방지와 내구성이 강화되어 인기를 끌고 있습니다. 가압 맥주와 질소 주입 맥주는이 형식의 혜택을 누리며 프리미엄 맥주와 스페셜 티 맥주에 선호되는 옵션이되었습니다. 맥주 제조업체가 하이엔드 상품의 제공에 주력하는 가운데, 1피스캔 수요는 가속하고 있습니다.

맥주캔 시장에서는 북미가 큰 점유율을 차지하고 있으며, 2024년에는 총 매출의 30%를 차지했습니다. 특히 크래프트 맥주와 프리미엄 부문에서 높은 맥주 소비가이 지역 수요를 계속 촉진하고 있습니다. 미국은 2024년에 32억 달러의 매출을 기록했고, 크래프트 맥주 인기 증가와 E-Commerce 채널의 확대가 시장 확대를 지지했습니다. 알루미늄 사이클의 생태계가 발달하고 지속 가능한 포장에 대한 소비자의 의식이 높아짐에 따라 맥주 회사는 경량이고 친환경 캔으로의 전환을 촉진하고 있습니다. 소비자의 취향이 다양한 맥주 맛과 포장 효율의 개선으로 옮겨가는 가운데 제조업체는 진화하는 업계 수요에 부응하기 위해 생산 전략을 최적화하고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 맥주 소비량 증가

- 크래프트 맥주와 프리미엄 부문의 성장

- 지속가능성을 위한 유리병에서 알루미늄캔으로의 이동

- 비알코올·저알코올 맥주 성장

- 비용 효율성과 제조 진보

- 업계의 잠재적 위험 및 과제

- 주류 포장에 대한 규제 과제 및 제한 사항

- 대체 포장재와의 경쟁

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 재료별(2021-2034년)

- 주요 동향

- 알루미늄

- 강철

제6장 시장 추계·예측 : 제품 유형별(2021-2034년)

- 주요 동향

- 1피스 캔

- 2피스 캔

- 3피스 캔

제7장 시장 추계·예측 : 용량별(2021-2034년)

- 주요 동향

- 소용량(330ml 이하)

- 중용량(330ml-500ml)

- 대용량(500ml 이상)

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 아시아태평양

- 중국

- 인도

- 일본

- 뉴질랜드

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Ardagh Group

- Asahi Group

- Baixicans

- Ball

- Canpack

- Ceylon Beverage Can

- Crown

- Daiwa Can

- Erjin Packaging

- G3 Enterprises

- Hainan Zhenxi

- Nampak

- Orora Packaging

- Scan Holdings

- Shining Aluminum

- Thai Beverage Can

- Toyo Seikan

- Visy

The Global Beer Cans Market is witnessing steady growth, reaching USD 13.3 billion in 2024, with projections indicating a CAGR of 4.4% between 2025 and 2034. Rising beer consumption, particularly in the craft and premium segments, is a key driver of market expansion. Consumers are increasingly gravitating toward canned beer for its ability to maintain freshness, block light and oxygen exposure, and enhance portability. Breweries, on the other hand, are shifting toward aluminum packaging as they prioritize sustainability, product preservation, and cost efficiency. With the craft beer industry continuing to thrive, demand for high-quality packaging that preserves unique flavors and carbonation is surging.

Market players are also responding to changing consumer preferences by focusing on sustainable packaging solutions. Aluminum cans, known for their lightweight nature and recyclability, are emerging as the dominant packaging choice. This segment is projected to grow at a CAGR of 4.8% during the forecast period, driven by its ability to provide superior protection against external elements that can impact beer quality. Reduced transportation costs and extended product shelf life make aluminum the preferred material for both large and small-scale breweries. The increasing emphasis on environmental responsibility is further reinforcing this trend, prompting beer manufacturers to integrate eco-friendly packaging into their production strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.3 Billion |

| Forecast Value | $20.5 Billion |

| CAGR | 4.4% |

The market is also segmented by product type, with 1-piece, 2-piece, and 3-piece cans available. The 1-piece can segment is experiencing robust growth, projected to register a CAGR of 6.1% over the forecast timeline. These cans are gaining popularity due to their seamless structure, which offers enhanced leak protection and durability. Pressurized and nitrogen-infused beers benefit from this format, making it a preferred choice for premium and specialty beer varieties. With breweries focusing on delivering high-end offerings, the demand for 1-piece cans is accelerating.

North America holds a significant share of the beer cans market, accounting for 30% of the total revenue in 2024. High beer consumption, particularly in craft and premium segments, continues to fuel regional demand. The United States alone generated USD 3.2 billion in 2024, with rising craft beer popularity and expanding e-commerce channels supporting market expansion. A well-developed aluminum recycling ecosystem and growing consumer awareness of sustainable packaging are prompting breweries to transition to lightweight, eco-friendly cans. As consumer preferences shift toward diverse beer flavors and improved packaging efficiency, manufacturers are optimizing their production strategies to meet evolving industry demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising beer consumption

- 3.2.1.2 Growth of craft beer and premium segments

- 3.2.1.3 Shift from glass bottles to aluminum cans for sustainability

- 3.2.1.4 Growth of non-alcoholic & low-alcohol beer

- 3.2.1.5 Cost efficiency & manufacturing advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and restrictions on alcohol packaging

- 3.2.2.2 Competition from alternative packaging materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 1-piece cans

- 6.3 2-piece cans

- 6.4 3-piece cans

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 – 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Small (Below 330 ml)

- 7.3 Medium (330 ml – 500 ml)

- 7.4 Large (Above 500 ml)

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ardagh Group

- 9.2 Asahi Group

- 9.3 Baixicans

- 9.4 Ball

- 9.5 Canpack

- 9.6 Ceylon Beverage Can

- 9.7 Crown

- 9.8 Daiwa Can

- 9.9 Erjin Packaging

- 9.10 G3 Enterprises

- 9.11 Hainan Zhenxi

- 9.12 Nampak

- 9.13 Orora Packaging

- 9.14 Scan Holdings

- 9.15 Shining Aluminum

- 9.16 Thai Beverage Can

- 9.17 Toyo Seikan

- 9.18 Visy