|

시장보고서

상품코드

1698292

셀리악병 치료 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Celiac Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

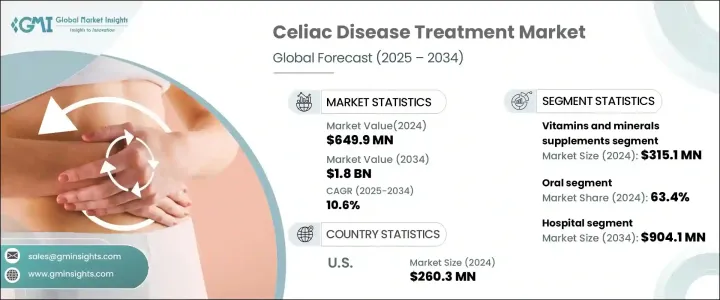

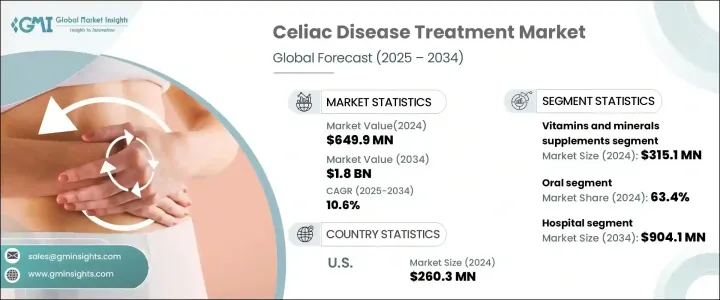

세계 셀리악병 치료 시장은 2024년에 6억 4,990만 달러로 평가되며 2025년부터 2034년까지 연평균 10.6%의 성장률을 보일 것으로 예상됩니다.

셀리악병 유병률의 증가와 고급 진단 도구에 대한 의료 전문가들의 인식이 높아짐에 따라 시장을 주도하고 있습니다. 진단 방법의 개선으로 더 많은 사람들이 진단을 받음에 따라 효과적인 치료에 대한 수요도 계속 증가하고 있습니다. 연구 개발의 발전은 의약품 치료법의 도입을 가속화하여 시장 확대를 더욱 촉진하고 있습니다. 무글루텐 식단을 선호하는 사람들이 급증하고, 혁신적인 비침습적 진단 도구의 채택이 업계 성장을 견인하고 있으며, HLA 타이핑 및 항체 검사의 기술 발전으로 진단 정확도가 향상되고 검사 시간이 단축되어 진단율이 높아지면서 치료 솔루션에 대한 수요가 증가하고 있습니다.

이 시장은 유전적 소인을 가진 사람이 글루텐을 섭취하면 발병하는 자가면역질환인 셀리악병을 관리하고 치료하는 데 초점을 맞추고 있습니다. 이 시장에는 증상 완화, 합병증 예방, 환자의 건강 증진을 목적으로 하는 의약품, 보충제, 치료제가 포함됩니다. 시장은 무글루텐 식단, 비타민/미네랄 보충제, 의료 요법으로 구분됩니다. 셀리악병은 영양 흡수를 방해하기 때문에 건강 유지를 위한 보충제 섭취가 필요합니다. 칼슘과 비타민 D의 섭취는 흡수 장애로 인한 뼈 건강 문제를 해결하기 위해 특히 강조되고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 6억 4,990만 달러 |

| 예상 금액 | 18억 달러 |

| CAGR | 10.6% |

장 건강을 지원하는 특수 보충제를 찾는 소비자가 증가하면서 시장 확대에 박차를 가하고 있습니다. 투여 경로에 따라 시장은 경구 치료와 비경구 치료로 나뉩니다. 경구 부문은 2024년 63.4%로 가장 큰 점유율을 차지했으며, 의료진의 도움 없이도 환자가 자신의 건강 상태를 관리할 수 있는 편의성이 뒷받침되고 있습니다. 효소 보충제 및 면역조절제를 포함한 새로운 경구용 제제의 도입으로 치료 옵션이 확대되고 환자의 순응도가 향상되고 있습니다. 이러한 발전은 약효, 생체이용률, 흡수율을 향상시키고 채택률을 높이고 있습니다. 경구용 치료제는 주사나 정맥주사에 비해 투여가 용이하고, 유연한 치료 솔루션을 필요로 하는 바쁜 라이프스타일을 가진 환자들에게 적합한 치료법으로 여전히 선호되고 있습니다.

최종사용자 시장은 병원, 전문 클리닉, 홈케어 환경, 기타 카테고리로 분류되며, 2024년에는 병원이 가장 큰 부문을 차지하고 2034년에는 9억 4,100만 달러에 달할 것으로 예상됩니다. 치료용 백신과 항염증제의 통합으로 병원 치료가 확대되고 있습니다. 첨단 진단 도구와 다양한 치료 옵션은 환자의 예후를 개선하고 질병 관리를 위한 입원을 증가시키고 있습니다. 병원은 영양 요법, 무글루텐 식단, 생물학적 제제 등 일차 진료에서 반드시 이용할 수 없는 필수적인 치료법을 1차 선택으로 제공합니다. 생물학적 제제 및 효소 요법에 대한 의존도가 잦은 병원 방문을 촉진하여 시장 성장에 기여하고 있습니다.

2024년에는 미국이 2억 6,030만 달러 규모로 북미 시장을 장악했습니다. 셀리악병 환자의 증가로 인해 고급 치료에 대한 수요가 증가하고 있습니다. 미국은 북미 지역 환자의 대부분을 차지하고 있어 환자 기반 확대가 강조되고 있습니다. 혁신적인 치료 접근법, 진단 시스템 강화, 주요 기업들의 전략적 차별화 등 지속적인 연구가 산업의 성장을 촉진하고 있습니다. 의약품의 발전은 가장 시급한 미충족 의료 수요 중 하나인 면역계 반응을 완화하는 것을 목표로 하고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 업계 생태계 분석

- 업계에 대한 영향요인

- 성장 촉진요인

- 셀리악병 유병률 상승

- 치료 선택사항의 기술적 진보

- 무글루텐 제품에 대한 수요 증가

- 셀리악병 진단 기술 증가

- 업계의 잠재적 리스크·과제

- 무글루텐 제품의 고비용

- 엄격한 규제 당국 승인

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- Porters 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 시장 매트릭스 분석

- 주요 시장 기업 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추정과 예측 : 치료별, 2021-2034년

- 주요 동향

- 비타민과 미네랄 보충제

- 무글루텐 식사요법

- 의료 요법

제6장 시장 추정과 예측 : 투여 경로별, 2021-2034년

- 주요 동향

- 경구

- 비경구

제7장 시장 추정과 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 병원

- 전문 클리닉

- 재택의료

- 기타 최종 용도

제8장 시장 추정과 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트

제9장 기업 개요

- ActoBio

- Amgen

- Amneal Pharmaceuticals

- BioLineRx

- Calypso Biotech

- General Mills

- Glenmark Life Sciences

- Hikma Pharmaceuticals

- Innovate Biopharmaceutical

- Novartis

- Takeda Pharmaceutical Company

- Teva Pharmaceutical

- Viatris

- Zydus Pharmaceuticals

The Global Celiac Disease Treatment Market was valued at USD 649.9 million in 2024 and is projected to expand at a CAGR of 10.6% from 2025 to 2034. The increasing prevalence of celiac disease and growing awareness among healthcare professionals regarding advanced diagnostic tools are driving the market. As more people are diagnosed due to improved detection methods, the demand for effective treatment continues to rise. Advancements in research and development are accelerating the introduction of pharmaceutical treatments, further propelling market expansion. The surge in gluten-free dietary preferences beyond the celiac population and the adoption of innovative non-invasive diagnostic tools are strengthening the industry. Technological advancements in HLA typing and antibody testing are enhancing diagnostic accuracy and reducing test duration, thereby increasing diagnosis rates and boosting demand for therapeutic solutions.

The market focuses on the management and treatment of celiac disease, an autoimmune disorder triggered by gluten ingestion in genetically predisposed individuals. It includes pharmaceutical products, supplements, and therapies designed to alleviate symptoms, prevent complications, and enhance patient well-being. The market is segmented into gluten-free diets, vitamin and mineral supplements, and medical therapies. The vitamins and minerals supplements category dominated, contributing USD 315.1 million in 2024, as celiac disease impairs nutrient absorption, necessitating supplementation to maintain health. Calcium and vitamin D intake is particularly emphasized for addressing bone health concerns associated with malabsorption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $649.9 Million |

| Forecast Value | $1.8 Billion |

| CAGR | 10.6% |

Consumers are increasingly seeking specialized supplements that support gut health, fueling market expansion. Based on administration routes, the market is divided into oral and parenteral treatments. The oral segment held a significant share of 63.4% in 2024, favored for its convenience, allowing patients to manage their condition without healthcare provider assistance. The introduction of novel oral formulations, including enzyme supplements and immune modulators, is broadening treatment options and improving patient adherence. These advancements enhance drug efficacy, bioavailability, and absorption, increasing adoption rates. Oral therapies remain preferred due to their ease of administration compared to injections and infusions, accommodating patients with busy lifestyles who require flexible treatment solutions.

The end-user market is classified into hospitals, specialty clinics, homecare settings, and other categories. Hospitals accounted for the largest segment in 2024, with projections reaching USD 904.1 million by 2034. The integration of therapeutic vaccines and anti-inflammatory drugs is expanding hospital-based treatment offerings. Advanced diagnostic tools and a diverse range of therapeutic options improve patient outcomes, increasing hospital admissions for disease management. Hospitals provide essential first-line treatments, including nutrition therapy, gluten-free diets, and biologics, which are not always available in primary care settings. The reliance on biologic agents and enzyme therapies drives frequent hospital visits, contributing to market growth.

In 2024, the United States dominated the North American market with a valuation of USD 260.3 million. Rising celiac disease cases are intensifying the demand for advanced treatments. The U.S. accounts for a significant portion of North American cases, highlighting an expanding patient base. Ongoing research into innovative treatment approaches, enhanced diagnostic systems, and strategic differentiation by key market players is fostering industry growth. Pharmaceutical advancements aim to mitigate immune system reactions, addressing one of the most pressing unmet medical needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of celiac disease

- 3.2.1.2 Technological advancements in therapeutic options

- 3.2.1.3 Increasing demand for gluten-free products

- 3.2.1.4 Increasing diagnostic technologies for celiac disease diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of gluten-free products

- 3.2.2.2 Stringent regulatory approvals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Vitamins and mineral supplements

- 5.3 Gluten-free diet

- 5.4 Medical therapies

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Homecare settings

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ActoBio

- 9.2 Amgen

- 9.3 Amneal Pharmaceuticals

- 9.4 BioLineRx

- 9.5 Calypso Biotech

- 9.6 General Mills

- 9.7 Glenmark Life Sciences

- 9.8 Hikma Pharmaceuticals

- 9.9 Innovate Biopharmaceutical

- 9.10 Novartis

- 9.11 Takeda Pharmaceutical Company

- 9.12 Teva Pharmaceutical

- 9.13 Viatris

- 9.14 Zydus Pharmaceuticals