|

시장보고서

상품코드

1698333

스마트 약물전달 시스템(DDS) 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Smart Drug Delivery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

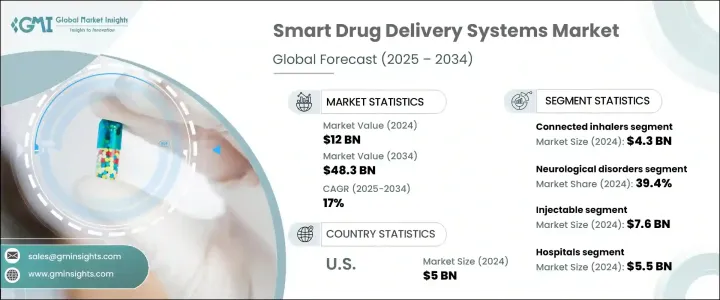

세계의 스마트 약물전달 시스템(DDS) 시장은 2024년에 120억 달러로 평가되었으며 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 17%를 나타낼 것으로 예측됩니다.

이러한 첨단 시스템은 치료제를 정확하게 전달하고 부작용을 줄이고 환자의 결과를 개선하여 약효를 높입니다. 수요에 박차를 가하고 있습니다.헬스 케어는 디지털 헬스 기술이나 환자 중심의 케어로 변화하고 있어 이러한 지능적인 약물전달 시스템의 채용이 증가하고 있습니다.

시장은 제품별로 분류되며, 연결 흡입기는 2024년 43억 달러의 매출을 올렸으며 CAGR 16.8%를 나타낼 전망입니다. 천식과 만성 호흡기 질환의 이환율 상승은 실시간 데이터 추적 및 사용 상황 모니터링을 제공하고 치료 어드밴스를 향상시키는 이러한 장치 수요를 촉진하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 120억 달러 |

| 예측 금액 | 483억 달러 |

| CAGR | 17% |

용도별로는 신경질환 분야가 39.4%의 매출 점유율을 차지했으며, 2024년에는 47억 달러에 달했습니다. 이러한 기술은 약물 투여의 정확성을 높이고, 치료 성과를 최적화하며, 치료와 관련된 과제를 완화합니다.

시장은 투여 경로별로 주사제, 흡입제, 경구 약물전달로 구분됩니다. 기술 혁신은 약물전달, 모니터링, 커스터마이징을 강화하고 정확한 투여 및 치료 결과 개선을 보장합니다.

병원은 최대의 최종 용도 부문을 차지하며 2024년에는 55억 달러의 수익을 창출했습니다. 치료의 어드히어런스가 향상되어 환자의 치료가 최적화되고 있습니다.

지역별로는 북미가 스마트 약물전달 시스템(DDS) 시장을 선도하고, 2024년에는 55억 달러에 달했고, 2034년에는 222억 달러에 이를 것으로 예측되고 있습니다. 미국은 2024년 50억 달러의 수익을 올리고 지역 시장을 독점했습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 만성 질환 증가

- 디지털 헬스 기술의 채용 확대

- 환자 중심 재택치료로의 변화

- 약물전달의 기술 진보

- 업계의 잠재적 위험 및 과제

- 디바이스 개발 및 생산에 따른 고비용

- 표준화의 부족

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술적 전망

- 향후 시장 동향

- 갭 분석

- 특허 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계·예측 : 제품별(2021-2034년)

- 주요 동향

- 커넥티드 흡입기

- 커넥티드 오토인젝터

- 커넥티드 펜 인젝터

- 커넥티드 웨어러블 인젝터

- 애드온 센서

- 기타 제품

제6장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 대사 장애

- 신경 장애

- 호흡기 장애

- 호르몬 장애

- 기타 용도

제7장 시장 추계·예측 : 투여 경로별(2021-2034년)

- 주요 동향

- 주사제

- 흡입제

- 경구제

제8장 시장 추계·예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 병원

- 진료소

- 재택치료

- 외래의료

- 기타 최종 사용자

제9장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Amiko Digital Health

- Becton, Dickinson and Company

- Biocorp

- Elcam Medical

- Johnson &Johnson

- Medtronic

- Merck

- Nemera

- Novo Nordisk

- Pfizer

- Phillips-Medisize

- Portal Instruments

- Teva Pharmaceutical Industries

- West Pharmaceutical Services

- Ypsomed

The Global Smart Drug Delivery Systems Market was valued at USD 12 billion in 2024 and is projected to grow at a CAGR of 17% from 2025 to 2034. These advanced systems enhance drug efficacy by delivering therapeutic agents with precision, reducing side effects, and improving patient outcomes. Smart drug delivery integrates nanotechnology, microsensors, and controlled-release mechanisms to optimize medication administration. The rising prevalence of chronic diseases, including diabetes, cancer, and cardiovascular conditions, is fueling the demand for targeted drug delivery solutions. With healthcare shifting towards digital health technologies and patient-centric care, the adoption of these intelligent drug delivery systems is increasing. Technological advancements in nanotechnology, biomaterials, and sensors are refining the accuracy and efficiency of these systems, driving market expansion.

The market is categorized by product, with connected inhalers generating USD 4.3 billion in revenue in 2024 and set to grow at a CAGR of 16.8%. The rising incidence of asthma and chronic respiratory diseases is driving demand for these devices, which offer real-time data tracking and usage monitoring, improving treatment adherence. The integration of sensors and digital applications enhances patient engagement and symptom management, further propelling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12 Billion |

| Forecast Value | $48.3 Billion |

| CAGR | 17% |

By application, the neurological disorders segment held a 39.4% revenue share, reaching USD 4.7 billion in 2024. The increasing occurrence of Alzheimer's disease, Parkinson's disease, epilepsy, and multiple sclerosis is generating demand for advanced drug delivery solutions that enhance treatment efficacy. These technologies improve drug administration accuracy, optimizing therapeutic outcomes and reducing treatment-related challenges. The ability to deliver targeted therapies for complex neurological conditions contributes significantly to segment growth.

The market is segmented by route of administration into injectables, inhalation, and oral drug delivery. The injectable segment led with USD 7.6 billion in revenue in 2024, driven by advancements in materials science, nanotechnology, and smart sensors. These innovations enhance drug delivery, monitoring, and customization, ensuring precise dosing and improved treatment outcomes. Regulatory approvals from agencies like the U.S. FDA are supporting the commercialization of these solutions, accelerating market growth.

Hospitals represent the largest end-use segment, generating USD 5.5 billion in revenue in 2024. The increasing adoption of smart drug delivery technologies in hospitals is improving medication management, ensuring better treatment adherence, and optimizing patient care. Growing hospitalization rates, advancements in healthcare infrastructure, and investments in smart medical devices are driving segment expansion.

Regionally, North America led the smart drug delivery systems market, reaching USD 5.5 billion in 2024, with projections to hit USD 22.2 billion by 2034. The U.S. dominated the regional market with USD 5 billion in revenue in 2024. Strong collaborations between pharmaceutical and medical device companies, along with regulatory support for innovative medical technologies, are propelling market growth in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Growing adoption of digital health technologies

- 3.2.1.3 Shift towards patient-centric and home-based care

- 3.2.1.4 Technological advancements in drug delivery

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with device development and production

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Connected inhalers

- 5.3 Connected autoinjectors

- 5.4 Connected pen injectors

- 5.5 Connected wearable injectors

- 5.6 Add-on sensors

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Metabolic disorders

- 6.3 Neurological disorders

- 6.4 Respiratory disorders

- 6.5 Hormonal disorders

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Injectable

- 7.3 Inhalation

- 7.4 Oral

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Clinics

- 8.4 Home care

- 8.5 Ambulatory care settings

- 8.6 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amiko Digital Health

- 10.2 Becton, Dickinson and Company

- 10.3 Biocorp

- 10.4 Elcam Medical

- 10.5 Johnson & Johnson

- 10.6 Medtronic

- 10.7 Merck

- 10.8 Nemera

- 10.9 Novo Nordisk

- 10.10 Pfizer

- 10.11 Phillips-Medisize

- 10.12 Portal Instruments

- 10.13 Teva Pharmaceutical Industries

- 10.14 West Pharmaceutical Services

- 10.15 Ypsomed