|

시장보고서

상품코드

1698594

X선 검출기 시장 - 기회, 성장 촉진요인, 산업 동향 분석 예측(2025-2034년)X-ray Detectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

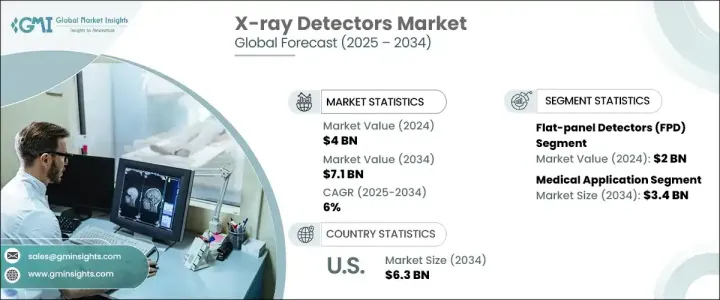

세계의 X선 검출기 시장은 2024년 40억 달러로 평가되었으며, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 6%로 확대될 것으로 예측됩니다.

X선 방사선을 전자 신호 및 시각 신호로 변환하는 이러한 검출기는 특히 의료 및 치과 분야 등 다양한 화상처리 용도에서 중요한 역할을 하고 있습니다. 암은 여전히 세계의 주요 사인 중 하나이며 고급 스크리닝 및 진단 솔루션의 필요성이 높아지고 있습니다.

기술의 진보에 의해 X선 검출의 효율은 대폭 향상되어, 화질의 향상과 진단의 신속화에 연결되어 있습니다. 직접 디지털 X선 촬영(DR) 시스템이 보급되고 있습니다. 경량이며 무선인 검출기의 통합에 의해 공간 분해능의 향상과 방사선 피폭의 저감을 실현해, 시장은 진화를 계속하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 40억 달러 |

| 예측 금액 | 71억 달러 |

| CAGR | 6% |

검출기 유형별로는 플랫 패널 검출기(FPD), 컴퓨티드 라디오그래피(CR) 검출기, 전하 결합 소자 검출기 등이 있습니다. FPD는 고화질, 고속 처리, 필름 기반 이미징을 배제하는 능력으로 지지되어 의료시설의 효율을 향상시키고 있습니다. 디지털 X선 촬영이나 투시 용도으로의 채용이 증가하고 있어 시장 성장을 가속하고 있습니다.

시장은 의료용, 치과용, 기타 용도로 분류되며, 2024년 매출 점유율은 의료용이 46.9%를 차지했습니다. 뼈와 관절에 영향을 미치는 질병 증가로 인해 정확한 진단 및 치료 계획을 위해 X선 영상 진단에 대한 의존도가 높아지고 있으며 호흡기 질환은 빈번한 촬영이 필요하므로 첨단 X선 검출기 솔루션에 대한 수요가 높아지고 있습니다.

병원은 여전히 주요 최종 사용자이며 2024년 판매 점유율은 34.5%입니다. 디지털 X선 촬영 시스템의 통합은 워크플로우의 효율성을 높이고 X선 검출기의 보급을 지지하고 있습니다.

미국에서 2023년 시장 수익은 15억 3,000만 달러였고, 2034년에는 63억 달러에 이를 것으로 예측되고 있습니다. 만성질환의 유병률 증가와 고액 헬스케어 지출이 의료시설에 있어서의 X선 검출기의 광범위한 채용을 지지하고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 질병의 조기 진단에 대한 수요 증가

- 기술의 진보

- X선 기술의 장점에 대한 의식의 고조

- 유리한 상환 시나리오

- 업계의 잠재적 위험 및 과제

- X선 검출기의 고비용

- 엄격한 규제 시나리오

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술적 전망

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 검출기 유형별, 2021-2034년

- 주요 동향

- 플랫 패널 검출기(FPD)

- 컴퓨티드 라디오그래피(CR) 검출기

- 전하 결합 소자 검출기

- 기타 검출기 유형

제6장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 의료 용도

- 치과 용도

- 기타 용도

제7장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 병원

- 진단 실험실

- 기타 최종 용도

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Agfa-Gevaert Group

- Canon Medical Systems

- Carestream Health

- Fujifilm

- General Electric Company

- Konica Minolta

- Koninklijke Philips

- PerkinElmer

- Siemens Healthineers

- Teledyne Technologies

- Thales Group

- Toshiba

- Varex Imaging

The Global X-Ray Detectors Market was valued at USD 4 billion in 2024 and is projected to expand at a CAGR of 6% from 2025 to 2034. These detectors, which convert X-ray radiation into electronic or visual signals, play a critical role in various imaging applications, particularly in the medical and dental fields. The rising demand for early disease detection, driven by the growing prevalence of chronic illnesses, is fueling market expansion. Cancer remains one of the leading causes of death worldwide, increasing the need for advanced screening and diagnostic solutions. The adoption of X-ray detectors is expected to rise as healthcare systems emphasize early diagnosis and improved imaging accuracy.

Technological advancements have significantly enhanced the efficiency of X-ray detection, leading to improved image quality and faster diagnosis. The transition from film-based to digital X-ray detectors has accelerated, enabling quicker image capture and streamlined workflow in medical settings. Direct digital radiography (DR) systems, known for their speed and accuracy, are gaining traction. The market continues to evolve with the integration of lightweight and wireless detectors, offering better spatial resolution and reduced radiation exposure. Innovations in detector technology are expected to drive industry growth in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 6% |

By detector type, the market includes flat-panel detectors (FPD), computed radiography (CR) detectors, and charge-coupled device detectors, among others. In 2023, market revenue stood at USD 3.8 billion, with the FPD segment dominating, contributing USD 2 billion in 2024. FPDs are favored for their high image quality, rapid processing speed, and ability to eliminate film-based imaging, improving efficiency in healthcare facilities. Their increasing adoption in digital radiography and fluoroscopy applications is accelerating market growth. Continuous enhancements in direct conversion and wireless connectivity further strengthen their position in the industry, making them the preferred choice for medical imaging professionals.

The market is categorized into medical, dental, and other applications, with the medical segment accounting for 46.9% of revenue share in 2024. This segment is expected to generate USD 3.4 billion by 2034, driven by the increasing prevalence of musculoskeletal disorders and chronic respiratory diseases. A rise in conditions affecting bones and joints has led to greater reliance on X-ray imaging for accurate diagnosis and treatment planning. Additionally, respiratory illnesses necessitate frequent imaging, reinforcing the demand for advanced X-ray detector solutions.

Hospitals remain the leading end users, capturing a 34.5% revenue share in 2024. The high patient volume and sophisticated imaging infrastructure in hospitals contribute to their dominant market position. The integration of digital radiography systems enhances workflow efficiency, supporting the widespread adoption of X-ray detectors. Increased government investment in advanced imaging technologies further propels market growth, as hospitals continue to expand radiology departments to meet the growing demand for diagnostic imaging.

In the U.S., market revenue was USD 1.53 billion in 2023 and is projected to reach USD 6.3 billion by 2034. The rising incidence of chronic diseases and high healthcare expenditure support the extensive adoption of X-ray detectors across medical facilities. Increased awareness of early diagnosis continues to drive demand, positioning the U.S. as a key contributor to global market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.3 Methodology and Scope

- 1.3.1 Research approach

- 1.3.2 Data collection methods

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Forecast model

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.6.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for early disease diagnosis

- 3.2.1.2 Technological advancement

- 3.2.1.3 Increased awareness about the benefits of X-ray technology

- 3.2.1.4 Favorable reimbursement scenario

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with X-ray detectors

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Detector Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Flat-panel detectors (FPD)

- 5.3 Computed radiography (CR) detectors

- 5.4 Charge coupled device detectors

- 5.5 Other detector types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Medical application

- 6.3 Dental application

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agfa-Gevaert Group

- 9.2 Canon Medical Systems

- 9.3 Carestream Health

- 9.4 Fujifilm

- 9.5 General Electric Company

- 9.6 Konica Minolta

- 9.7 Koninklijke Philips

- 9.8 PerkinElmer

- 9.9 Siemens Healthineers

- 9.10 Teledyne Technologies

- 9.11 Thales Group

- 9.12 Toshiba

- 9.13 Varex Imaging