|

시장보고서

상품코드

1699238

벌크 컨테이너 포장 시장 - 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Bulk Container Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

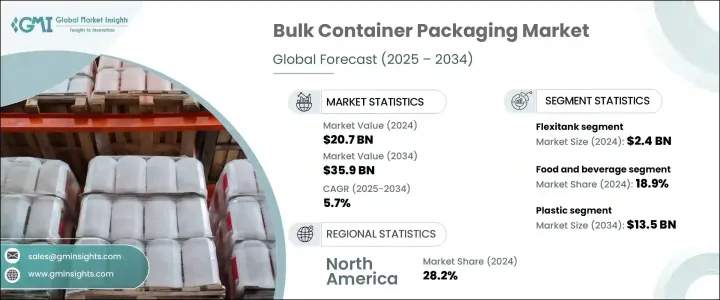

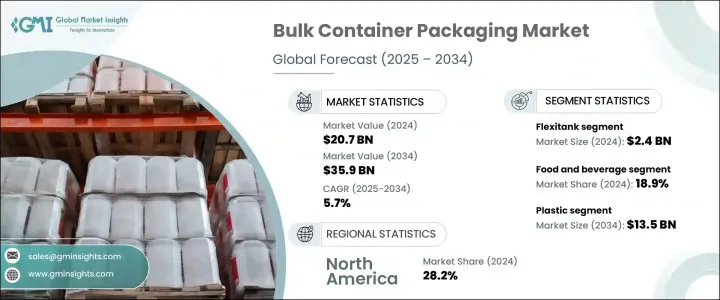

세계 벌크 컨테이너 포장 시장은 2024년에 207억 달러로 평가되었으며, 2025년부터 2034년까지 연평균 복합 성장률(CAGR) 5.7%로 확대될 것으로 예측됩니다.

전자상거래의 급성장과 함께 세계 무역과 산업화의 페이스가 늘어나는 것이 효율적이고 비용 효율적인 벌크 포장 솔루션 수요를 촉진하고 있습니다. 화학, 식음료, 의약품 등을 포함한 다양한 분야의 기업이 물류 효율을 높이고 제품의 무결성을 유지하기 위해 중간 벌크 컨테이너(IBC)와 플렉시 탱크 등의 벌크 컨테이너에 주목하고 있습니다. 장거리에서 비용 효율적인 운송 솔루션에 대한 수요가 시장 확대에 더욱 기여하고 있습니다.

제조업체는 제품의 안전성을 보장하기 위해 위생, 오염이 없는 포장, 규제 준수를 중시하고 있습니다. 무역량의 개발과 기밀성이 높은 상품의 안전 수송의 필요성은 특히 배리어 특성을 강화한 다층 용기의 개발에 있어서, 제조업체에게 새로운 기회를 가져올 것으로 예상됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 207억 달러 |

| 예측 금액 | 359억 달러 |

| CAGR | 5.7% |

시장은 제품별로 플렉시 탱크, 중간 벌크 컨테이너, 벌크 컨테이너 라이너로 구분됩니다. 수요가 발생하고 있습니다. 플렉시 탱크는 단일 사용 솔루션으로 액체화물의 오염 위험을 최소화하고 식품 등급 액체, 산업 화학 및 의약품 원료를 다루는 업계에서 선호되는 옵션입니다.

시장은 최종 용도별로 식품, 화학, 석유 및 가스, 의약품, 페인트, 잉크 및 염료, 기타 산업으로 분류됩니다. 플렉시 탱크, IBC, 라이너 등의 벌크 컨테이너는 곡물, 설탕, 밀가루, 유제품 등의 상품 운송에 널리 사용되고 있습니다.

재료 유형별로 볼 때 시장은 플라스틱, 금속 및 기타로 구분됩니다. 약품, 의약품, 농업 등의 산업은 그 내식성과 취급 용이성으로부터 플라스틱 포장에 의존하고 있습니다. 생분해성 플라스틱이나 재활용 가능한 플라스틱의 진보는 환경 문제에 대한 대응으로서 한층 더 채용을 가속시키고 있습니다.

지역별로는 북미가 2024년에 28.2% 시장 점유율을 차지했으며 왕성한 농업과 화학제품의 수출에 뒷받침되고 있습니다. 미국의 대량 컨테이너 포장 시장은 2024년에 50억 달러를 돌파했고 비용 효율적인 운송 솔루션에 대한 수요가 증가함에 따라 시장 확대에 박차를 가하고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 세계무역과 산업화 확대

- 지속 가능한 포장에 관한 정부의 규제

- 식음료 업계로부터 수요 증가

- 전자상거래 분야 확대

- 신흥국 시장과 인프라 개척

- 업계의 잠재적 위험 및 과제

- 원재료 가격 변동

- 공급망의 혼란과 물류 문제

- 성장 촉진요인

- 잠재성장력의 분석

- 규제 상황

- 기술 동향

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 제품별, 2021-2034년

- 주요 동향

- 플렉시 탱크

- 중간 벌크 컨테이너

- 리지드

- 고정식

- 벌크 컨테이너 라이너

제6장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 화학

- 석유 및 가스

- 음식

- 페인트, 잉크

- 의약품

- 기타

- 농업

- 섬유

제7장 시장 추계 및 예측 : 재료별, 2021-2034년

- 주요 동향

- 플라스틱

- 금속

- 기타

- 목재

- 섬유

제8장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Bulk Lift

- CDF Corporation

- CL Smith

- DENIOS

- DS Smith

- Greif

- Hazmatpac

- Hoover CS

- IDEX Corporation

- ILC Dover

- International Paper

- LC Packaging

- Mauser Packaging Solutions

- Mondi

- Myers Industries

- Pyramid Technoplast

- Schafer Werke

- Schoeller Allibert

- Schutz

- Signode Industrial Group

- Smurfit Kappa

- Snyder Industries

- Time Technoplast

The Global Bulk Container Packaging Market was valued at USD 20.7 billion in 2024 and is projected to expand at a CAGR of 5.7% from 2025 to 2034. The increasing pace of global trade and industrialization, along with the rapid growth of e-commerce, is driving demand for efficient and cost-effective bulk packaging solutions. As industries scale up operations to meet growing demand, the need for reliable transportation and storage of goods continues to rise. Companies across sectors, including chemicals, food and beverages, and pharmaceuticals, are turning to bulk containers such as intermediate bulk containers (IBCs) and flexitanks to enhance logistics efficiency and maintain product integrity. The demand for long-distance and cost-effective transportation solutions further contributes to market expansion. With the increasing consumption of processed food and beverages worldwide, the demand for specialized bulk packaging has grown substantially.

Manufacturers are emphasizing hygiene, contamination-free packaging, and regulatory compliance to ensure product safety. Bulk packaging formats, including flexitanks, drums, bulk bags, and IBCs, play a crucial role in the transportation of edible oils, dairy products, fruit juices, alcoholic beverages, and other liquid food items. Growing global trade volumes and the need for secure transportation of sensitive goods are expected to create new opportunities for manufacturers, particularly in the development of multi-layered containers with enhanced barrier properties. The integration of IoT-enabled tracking and real-time monitoring solutions is anticipated to drive product innovation and differentiation in the competitive landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.7 Billion |

| Forecast Value | $35.9 Billion |

| CAGR | 5.7% |

The market is segmented based on product into flexitanks, intermediate bulk containers, and bulk container liners. The flexitank segment, which reached USD 2.4 billion in 2024, is experiencing strong demand due to its cost advantages over traditional barrels and IBCs. As a single-use solution, flexitanks minimize contamination risks for liquid cargo, making them a preferred choice for industries handling food-grade liquids, industrial chemicals, and pharmaceutical ingredients.

The market is further categorized by end use into food and beverages, chemicals, oil and gas, pharmaceuticals, paints, inks and dyes, and other industries. The food and beverage sector held an 18.9% market share in 2024. The rising demand for safe, hygienic, and cost-efficient bulk transportation solutions is propelling market growth. Bulk containers such as flexitanks, IBCs, and liners are extensively used for transporting commodities like grains, sugar, flour, and dairy products. Growing emphasis on sustainability and food-grade packaging has spurred innovation in reusable and biodegradable bulk containers.

By material type, the market is segmented into plastics, metals, and others. The plastic segment is projected to reach USD 13.5 billion by 2034, driven by its lightweight nature, durability, and cost-effectiveness. Industries such as food and beverage, chemicals, pharmaceuticals, and agriculture rely on plastic packaging due to its corrosion resistance and ease of handling. Advancements in biodegradable and recyclable plastics are further accelerating adoption in response to environmental concerns.

Regionally, North America held a 28.2% market share in 2024, supported by strong agricultural and chemical exports. Government regulations promoting recyclable and biodegradable packaging are fostering the adoption of sustainable bulk container solutions. The US bulk container packaging market surpassed USD 5 billion in 2024, with increasing demand for cost-effective transportation solutions fueling market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Global Trade & Industrialization

- 3.2.1.2 Government Regulation on Sustainable Packaging

- 3.2.1.3 Rising Demand from Food & Beverage Industry

- 3.2.1.4 Expansion of E-Commerce Sector

- 3.2.1.5 Emerging Market and Infrastructure Development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuating Raw Material Prices

- 3.2.2.2 Supply Chain Disruption & Logistics Issue

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Bn & Units)

- 5.1 Key trends

- 5.2 Flexitanks

- 5.3 Intermediate bulk container

- 5.3.1 Rigid

- 5.3.2 Fixed

- 5.4 Bulk container liners

Chapter 6 Market Estimates and Forecast, By End-Use, 2021 – 2034 (USD Bn & Units)

- 6.1 Key trends

- 6.2 Chemicals

- 6.3 Oil & gas

- 6.4 Food and beverages

- 6.5 Paints, inks, and yes

- 6.6 Pharmaceutical

- 6.7 Others

- 6.7.1 Agriculture

- 6.7.2 Textiles

Chapter 7 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Bn & Units)

- 7.1 Key trends

- 7.2 Plastic

- 7.3 Metal

- 7.4 Others

- 7.4.1 Wood

- 7.4.2 Fiber

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bulk Lift

- 9.2 CDF Corporation

- 9.3 CL Smith

- 9.4 DENIOS

- 9.5 DS Smith

- 9.6 Greif

- 9.7 Hazmatpac

- 9.8 Hoover CS

- 9.9 IDEX Corporation

- 9.10 ILC Dover

- 9.11 International Paper

- 9.12 LC Packaging

- 9.13 Mauser Packaging Solutions

- 9.14 Mondi

- 9.15 Myers Industries

- 9.16 Pyramid Technoplast

- 9.17 Schafer Werke

- 9.18 Schoeller Allibert

- 9.19 Schutz

- 9.20 Signode Industrial Group

- 9.21 Smurfit Kappa

- 9.22 Snyder Industries

- 9.23 Time Technoplast