|

시장보고서

상품코드

1766289

동물용 정형외과 임플란트 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Veterinary Orthopedic Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

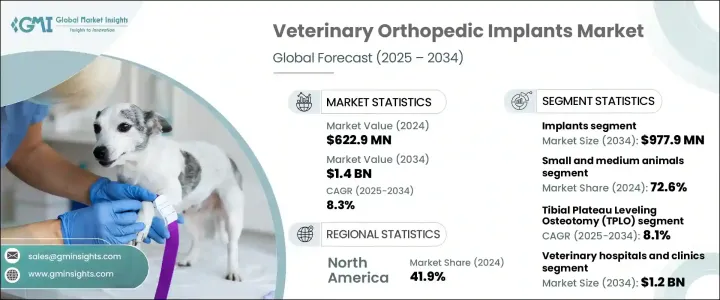

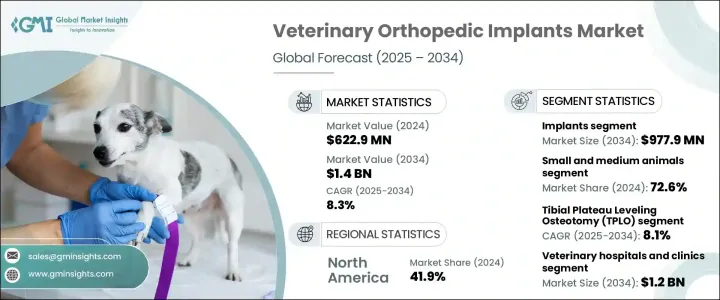

세계의 동물용 정형외과 임플란트 시장은 2024년 6억 2,290만 달러로 평가되었으며, CAGR 8.3%로 성장해 2034년까지 14억 달러에 이를 것으로 추정됩니다.

이 성장은 정형외과 치료나 골 윤곽 형성 등의 고도의 수의학적 서비스에 대한 수요를 계속 촉진하는 세계 반려동물 소유자 수 증가에 따른 영향이 큽니다.

또한 동물의 최신 수술 임플란트의 이점에 대한 인식이 높아지고 업계 참가자들에게 새로운 기회가 탄생했습니다. 또한 현재 진행 중인 R&D 노력은 비용 효율적이고 사용하기 쉬운 임플란트 기술 개발에 중점을 두고 있으며, 선진국 시장과 신흥국 시장 모두에서 채용률이 크게 높아질 것으로 예측됩니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 6억 2,290만 달러 |

| 예측 금액 | 14억 달러 |

| CAGR | 8.3% |

수의학 성형 외과 수술은 동반 동물의 근골격계 질환을 치료하기 위해 특히 수요가 높습니다. 또, 체내에서 자연적으로 용해해, 재수술의 필요성을 없애는 생체 흡수성 임플란트 재료 수요도 높아지고 있습니다. 폴리글리콜산과 같은 폴리머를 사용하여 개발되는 경우가 많은 이들 재료는 안전성, 효율성, 비용면에서 뛰어나기 때문에 인기를 모으고 있습니다.

제품 유형별로 볼 때, 시장은 임플란트와 기구로 분류됩니다. 임플란트 이 분야는 2024년 시장을 리드해 4,200만 달러의 평가 금액에 이르렀으며, 2034년에는 9억 7,790만 달러로 성장할 것으로 예측됩니다.

동물유형별로 보면 시장은 소동물, 중동물, 대동물로 분류됩니다. 이 부문의 성장을 견인한 것은 세계 반려동물 수 증가와 골절과 관절장애 등 정형외과적 문제의 빈도 증가입니다. 또한 외과 치료에 대한 액세스가 향상되어 반려동물의 주인이 질 높은 치료에 투자할 의욕이 높아지고 있는 것도 이 분야의 성장을 더욱 뒷받침하고 있습니다.

용도별로 분석하면 시장에는 경골고원 수평화골절술(TPLO), 경골결절전전술(TTA), 관절치환술, 외상, 기타 용도 등의 수술이 포함됩니다. 이 중 TPLO 수술은 여전히 주요 용도이며 8.1%로 3억 320만 달러로 성장할 것으로 예측되고 있습니다.

최종 용도별로 보면, 시장은 동물 병원 및 진료소와 기타 동물 의료시설로 구분됩니다. 설비가 갖추어진 진료소나 병원이 견조하게 존재해, 종합적인 수의료에 대한 수요가 높아지고 있는 것이, 이 분야를 견인하고 있습니다.

지역적으로는 북미가 2024년 세계 시장을 선도해 41.9%의 점유율을 차지했습니다. 이 지역은 또한 여러 대형 물품 임플란트 제조업체의 존재, 규제의 합리화, 충실한 임상 연구 활동 등의 혜택을 받고 있으며, 이들 모두가이 시장의 지속적인 확대에 기여하고 있습니다.

시장은 적당히 통합되어 있으며, 주요 기업은 경쟁력을 유지하기 위해 인수, 제휴, 제품 혁신, R&D 투자 등의 전략을 채용하고 있습니다. 상위 5개 기업(DePuy Synthes (Johnson & Johnson), Movora (Vimian Group), Veterinary Instrumentation, Arthrex Vet Systems, Rita Leibinger GmbH)는 세계 시장 수익의 약 60%를 차지하고 있으며, 이러한 기업들은 동물용 정형외과 의료에 대한 세계적인 요구에 부응하기 위해 포트폴리오 확충과 신시장 진입에 계속 주력하고 있습니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 업계에 미치는 영향요인

- 성장 촉진요인

- 개 정형외과 질환의 발생률 증가

- 수의 정형외과 기술의 진보

- 반려동물 보험 적용 범위 확대

- 정형외과적 문제에 관한 반려동물 주인의 의식의 고조

- 업계의 잠재적 위험 및 과제

- 정형외과 수술과 임플란트의 고액의 비용

- 숙련된 수의사 정형외과의 부족

- 시장 기회

- 임플란트 제조업체와 동물 병원의 협력과 파트너십 강화

- 신흥 시장의 급속한 도시화와 소득 증가

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 기술의 상황

- 미래 시장 동향

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 매트릭스 분석

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 주요 발전

- 합병인수

- 파트너십 및 협업

- 신제품 발매

- 확장 계획

제5장 시장 추계 및 예측 : 제품별, 2021-2034년

- 주요 동향

- 임플란트

- 플레이트

- TPLO 플레이트

- TTA 플레이트

- 외상 플레이트

- 특제 플레이트

- 기타 플레이트

- 관절 임플란트

- 뼈나사 및 앵커

- 핀과 와이어

- 기타 임플란트

- 플레이트

- 기기

제6장 시장 추계 및 예측 : 동물 유형별, 2021-2034년

- 주요 동향

- 소형 및 중형 동물

- 개

- 고양이

- 기타 소형 및 중형 동물

- 대형 동물

제7장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 경골 고원 수평 골절술(TPLO)

- 경골 결절 전진술(TTA)

- 관절 치환술

- 고관절 치환술

- 무릎 관절 치환술

- 팔꿈치 관절 치환술

- 발목 치환술

- 외상

- 기타 용도

제8장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- 동물 병원 및 진료소

- 기타 최종 용도

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제10장 기업 프로파일

- AmerisourceBergen Corporation(Cencora, Inc.)

- Arthrex Vet Systems

- B. Braun

- BlueSAO

- DePuy Synthes(Johnson & Johnson)

- Fusion Implants

- GerVetUSA

- GPC Medical Ltd.

- Integra LifeSciences

- Movora(Vimian Group)

- Narang Medical Limited

- Ortho Max

- Orthomed

- Rita Leibinger

- Veterinary Instrumentation

The Global Veterinary Orthopedic Implants Market was valued at USD 622.9 million in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 1.4 billion by 2034. This growth is largely influenced by the rising number of pet owners worldwide, which continues to drive demand for advanced veterinary services such as orthopedic procedures and bone contouring. Technological advancements in veterinary surgery-especially minimally invasive techniques like arthroscopy-are also helping to accelerate recovery time, increasing acceptance among pet parents.

Furthermore, greater awareness about the benefits of modern surgical implants in animals has created new opportunities for industry participants. Investments in animal healthcare infrastructure in emerging economies have further reinforced market expansion. Additionally, ongoing R&D efforts are focused on developing cost-effective and user-friendly implant technologies, which are expected to significantly boost adoption rates across both developed and developing markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $622.9 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 8.3% |

Veterinary orthopedic procedures are in particularly high demand for treating musculoskeletal conditions in companion animals. The prevalence of injuries and degenerative diseases in animals, especially those involving joints and ligaments, continues to rise, prompting increased use of surgical implants. Demand is also climbing for bioabsorbable implant materials that dissolve naturally in the body, eliminating the need for follow-up removal surgeries. These materials, often developed using polymers like polylactic acid and polyglycolic acid, are gaining popularity for their safety, efficiency, and cost advantages. Innovations such as smart implants embedded with sensors or drug-releasing coatings are also becoming more prominent. These devices help monitor healing processes and reduce post-operative infections, further enhancing treatment outcomes.

In terms of product type, the market is segmented into implants and instruments. The implants category is further broken down into plates, joint implants, bone screws and anchors, pins and wires, and other related components. This segment led the market in 2024, reaching a valuation of USD 442 million, and is expected to grow to USD 977.9 million by 2034. This dominance can be attributed to growing awareness around orthopedic care in pets and the increasing availability of sophisticated implant technologies.

By animal type, the market is categorized into small and medium animals and large animals. The small and medium animals segment-which includes dogs, cats, and other similarly sized animals-accounted for 72.6% of the market share in 2024 and is projected to expand at a CAGR of 8.5% through 2034. Growth in this segment is driven by the rising global pet population and the increasing frequency of orthopedic issues, such as fractures and joint disorders. Additionally, enhanced accessibility to surgical treatments and a greater willingness among pet owners to invest in high-quality care are further propelling segment growth.

When analyzed by application, the market includes procedures such as Tibial Plateau Leveling Osteotomy (TPLO), Tibial Tuberosity Advancement (TTA), joint replacement, trauma, and other uses. Among these, TPLO surgery remains a primary application, accounting for USD 141.2 million in 2024, and is projected to grow to USD 303.2 million by 2034, with a CAGR of 8.1%. This procedure is particularly known for restoring joint stability and promoting faster recovery in animals suffering from ligament injuries.

On the basis of end use, the market is segmented into veterinary hospitals and clinics and other veterinary care facilities. In 2024, veterinary hospitals and clinics dominated with a market value of USD 537.1 million, expected to reach USD 1.2 billion by 2034 at a CAGR of 8.5%. The robust presence of well-equipped clinics and hospitals, paired with the growing demand for comprehensive veterinary care, has been instrumental in driving this segment forward. Clinics and hospitals also serve as the initial point of consultation for most pet owners, making them key contributors to overall market revenue.

Geographically, North America led the global market in 2024, holding a share of 41.9%. High levels of pet ownership, rising disposable incomes, and strong demand for advanced veterinary care are core factors fueling regional growth. The region also benefits from the presence of several major veterinary implant manufacturers, streamlined regulatory pathways, and substantial clinical research activities, all of which contribute to the continued expansion of this market.

The market is moderately consolidated, with key players adopting strategies such as acquisitions, partnerships, product innovation, and R&D investments to maintain their competitive edge. The top five companies- DePuy Synthes (Johnson & Johnson), Movora (Vimian Group), Veterinary Instrumentation, Arthrex Vet Systems, and Rita Leibinger GmbH-collectively accounted for approximately 60% of global market revenue. These firms continue to focus on expanding their portfolios and entering new markets to address the growing global need for veterinary orthopedic care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Animal type

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing incidence of orthopedic conditions in dogs

- 3.2.1.2 Advancement in veterinary orthopedic technology

- 3.2.1.3 Expansion of pet insurance coverage

- 3.2.1.4 Increasing awareness among pet owners about orthopedic problems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of orthopedic procedures and implants

- 3.2.2.2 Limited availability of skilled veterinary orthopedic surgeons

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing collaboration and partnership between implant manufacturers and veterinary hospitals

- 3.2.3.2 Rapid urbanization and income growth in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implants

- 5.2.1 Plates

- 5.2.1.1 TPLO plates

- 5.2.1.2 TTA plates

- 5.2.1.3 Trauma plates

- 5.2.1.4 Specialty plates

- 5.2.1.5 Other plates

- 5.2.2 Joint implants

- 5.2.3 Bone screws and anchors

- 5.2.4 Pins and Wires

- 5.2.5 Other implants

- 5.2.1 Plates

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Small and medium animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Other small and medium animals

- 6.3 Large animals

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tibial Plateau Leveling Osteotomy (TPLO)

- 7.3 Tibial Tuberosity Advancement (TTA)

- 7.4 Joint replacement

- 7.4.1 Hip replacement

- 7.4.2 Knee replacement

- 7.4.3 Elbow replacement

- 7.4.4 Ankle replacement

- 7.5 Trauma

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AmerisourceBergen Corporation (Cencora, Inc.)

- 10.2 Arthrex Vet Systems

- 10.3 B. Braun

- 10.4 BlueSAO

- 10.5 DePuy Synthes (Johnson & Johnson)

- 10.6 Fusion Implants

- 10.7 GerVetUSA

- 10.8 GPC Medical Ltd.

- 10.9 Integra LifeSciences

- 10.10 Movora (Vimian Group)

- 10.11 Narang Medical Limited

- 10.12 Ortho Max

- 10.13 Orthomed

- 10.14 Rita Leibinger

- 10.15 Veterinary Instrumentation