|

시장보고서

상품코드

1892848

콜드체인 모니터링 시장 기회, 성장요인, 업계 동향 분석 및 예측(2026-2035년)Cold Chain Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

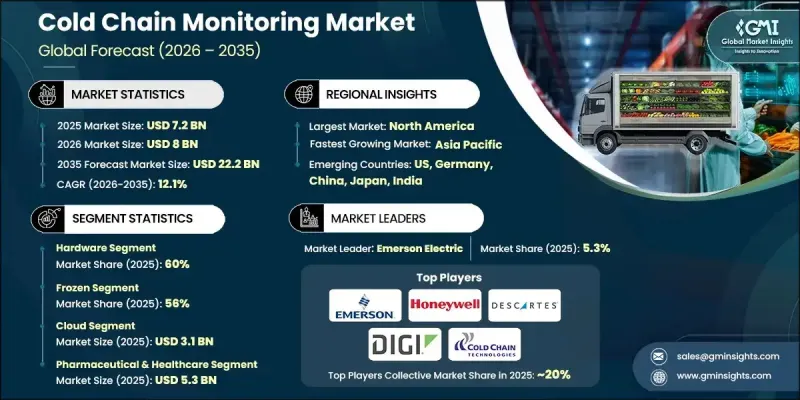

세계의 콜드체인 모니터링 시장은 2025년에 72억 달러로 평가되었고, 2035년까지 연평균 복합 성장률(CAGR) 12.1%로 성장하여 222억 달러에 이를 것으로 예측됩니다.

신선식품, 육류, 해산물, 유제품, 냉동식품, 즉석식품 등 신선식품의 소비가 증가함에 따라 공급망 전반에 걸쳐 정밀한 온도 관리에 대한 수요가 증가하고 있습니다. 배송 주기가 단축되고 유통망이 확대됨에 따라 기업들은 제품 손상 방지와 품질 유지에 대한 압박이 커지고 있습니다. 특히 신선식품의 국제 거래가 확대됨에 따라 모든 운송에 있어 완벽한 추적 가능성과 엄격한 온도 관리가 요구되고 있습니다. 폐기물을 줄이고 신선도를 유지하며, 안전성과 품질 일관성에 대한 기대치가 높아짐에 따라 콜드체인 모니터링은 필수 불가결한 요소가 되었습니다. 정확한 온도 모니터링의 필요성은 생물학적 제제, 백신, 특수 치료제가 엄격하게 통제된 온도 범위에 의존하는 제약 분야에서 더욱 중요해지고 있습니다. 온도에 민감한 치료법의 채택이 증가함에 따라 제조업체와 유통업체는 경보 기능과 감사 대응 데이터를 제공하는 실시간 검증을 거친 모니터링 도구에 크게 의존하고 있습니다. 공중보건 비상사태에 대한 디지털 시스템 도입이 가속화되면서 제약업계는 실시간 콜드체인 모니터링을 최우선 과제로 삼고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2025년 |

| 예측 연도 | 2026-2035년 |

| 개시 연도 시장 규모 | 72억 달러 |

| 예측 금액 | 222억 달러 |

| CAGR | 12.1% |

하드웨어 부문은 2025년에 60%의 점유율을 차지할 것으로 예상되며, 2026년부터 2035년까지 연평균 복합 성장률(CAGR) 12.4%로 성장할 것으로 전망됩니다. 콜드체인 업무는 창고, 냉장 운송 차량, 컨테이너, 라스트 마일 시설에 설치되는 물리적 모니터링 장치, 온도 프로브, GPS 장치, 데이터 로거, 습도 센서, 텔레매틱스 도구, 도어 상태 감지기 등 많은 하드웨어에 의존하고 있습니다. 모든 팔레트, 배송품, 보관 지점에서 지속적인 추적이 필요하기 때문에 하드웨어 수요는 소프트웨어 도입보다 빠르게 증가하여 시장에서의 선도적 지위를 확고히 하고 있습니다.

냉동 부문은 2025년 56%의 점유율을 차지할 것으로 예상되며, 2035년까지 연평균 복합 성장률(CAGR) 12.4%로 성장할 것으로 전망됩니다. 특정 의약품, 생물학적 제제, 온도에 민감한 식품 등 냉동 온도에서 보관되는 제품은 엄격하게 통제된 환경에서 유지되어야 합니다. 작은 온도 변화도 안전성과 효율성을 떨어뜨릴 수 있기 때문에 기업들은 공급망 전반에 걸친 지속적인 모니터링, 고정밀 센서, 신뢰할 수 있는 실시간 보고 시스템에 투자하고 있습니다.

미국의 콜드체인 모니터링 시장은 2025년 23억 달러 규모에 달할 것으로 예측됩니다. 이 나라에 퍼져있는 냉장 보관 시설과 온도 관리 운송 네트워크가 모니터링 시스템의 보급을 촉진하고 있습니다. 신선식품, 가공식품, 냉동식품, 생물학적 제제, 첨단 의약품에 대한 엄격한 요구사항과 더불어 신선식품 유통의 규모가 커지면서 실시간 가시성의 필요성이 더욱 커지고 있습니다. 제품의 다양성, 장거리 운송, 소매 업체의 높은 성능 기준과 함께 정확한 콜드체인 추적 기술에 대한 수요는 지속적으로 증가하고 있습니다.

세계 콜드체인 모니터링 시장에서 활동하는 기업으로는 Teszo, Control Ant, Cold Chain Technologies, Digi International, Sensitec, Zebra Technologies, Cartesian Systems, Emerson Electric, Honeywell International, Oerlikom, RBCom 등이 있습니다. 오알비컴 등이 있습니다. 콜드체인 모니터링 시장에서 경쟁하는 기업들은 하드웨어 포트폴리오의 확장, 센서 정확도 향상, 첨단 연결 기능의 제품 라인 통합을 통해 자신의 입지를 강화하고 있습니다. 많은 기업들이 온도 추적, 위치 정보, 자동 알림을 결합한 실시간 플랫폼 개발에 집중하여 규제 준수를 지원하고 폐기 위험을 줄이기 위해 노력하고 있습니다. 물류 사업자 및 제약사와의 전략적 제휴를 통해 벤더는 모니터링 솔루션을 공급망에 더 깊숙이 통합할 수 있습니다.

자주 묻는 질문

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 상황

- 센서 및 하드웨어 제조업체

- 접속성과 IoT 네트워크 프로바이더

- 소프트웨어/플랫폼 제공 사업자

- 콜드체인 포장·단열 컨테이너

- 냉동기기 제조업체

- 냉장 창고 사업자님 및 창고 인프라

- 비용 구조

- 이익률

- 각 단계별 부가가치

- 공급망에 영향을 미치는 요인

- 디스럽터

- 공급업체 상황

- 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 시장 기회

- 성장 가능성 분석

- 규제 상황

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- Porter's Five Forces 분석

- PESTEL 분석

- 기술 동향과 혁신 에코시스템

- 현행 기술

- 신기술

- 특허 분석

- 가격 동향 분석

- 지역별

- 제품별

- 생산 통계

- 생산 거점

- 소비 거점

- 수출입

- 비용 내역 분석

- 리스크 분석과 관리

- 업무 리스크 평가

- 재무 리스크 평가

- 기술·사이버 보안 리스크

- 리스크 경감 전략

- 지속가능성과 환경 측면

- 지속가능한 대처

- 폐기물 감축 전략

- 생산 에너지 효율

- 친환경 이니셔티브

- 탄소발자국에 관한 고려사항

- 이용 사례

- 베스트 케이스 시나리오

- 투자수익률(ROI)과 비용편익 분석

- 기능과 가격 벤치마크

- 고객 선호도/구매 행동

제4장 경쟁 구도

- 서론

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 인수합병(M&A)

- 제휴 및 협업

- 신제품 발매

- 사업 확대 계획과 자금조달

제5장 시장 추산 및 예측 : 컴포넌트별, 2022-2035

- 주요 동향

- 하드웨어

- 센서

- RFID 디바이스

- 텔레매틱스

- 네트워크 장비

- 기타

- 소프트웨어

- 실시간 모니터링

- 분석 및 보고서

- 서비스

- 전문 서비스

- 매니지드 서비스

제6장 시장 추산 및 예측 : 온도별, 2022-2035

- 주요 동향

- 냉동

- 콜드 스토리지

제7장 시장 추산 및 예측 : 도입 형태별, 2022-2035

- 주요 동향

- 클라우드

- On-Premise

- 하이브리드

제8장 시장 추산 및 예측 : 물류 분야별, 2022-2035

- 주요 동향

- 스토리지

- 운송

제9장 시장 추산 및 예측 : 최종 용도별, 2022-2035

- 주요 동향

- 의약품 및 의료 분야

- 식품 및 음료

- 물류 및 유통

- 화학제품

- 기타

제10장 시장 추산 및 예측 : 지역별, 2022-2035

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 베네룩스

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 태국

- 인도네시아

- 싱가포르

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 콜롬비아

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트(UAE)

제11장 기업 개요

- Global Leaders

- Sensitech(Carrier Global)

- Emerson Electric

- Honeywell International

- Descartes Systems

- Digi International

- Zebra Technologies

- Cold Chain Technologies(CCT)

- ORBCOMM

- Controlant

- Testo

- ELPRO-Buchs

- Regional Champions

- DeltaTrak

- Monnit

- FreshLoc Technologies

- Samsara

- Tive

- Roambee

- Blulog(low-power NFC and wireless data loggers)

- OnAsset Intelligence(air cargo temperature &security tracking)

- Zest Labs

- TagBox

- 신규 기업

- SenseAnywhere

- Rotronic

- TempGenius

- Zhuhai Rayonics Technology

- Blulog

The Global Cold Chain Monitoring Market was valued at USD 7.2 billion in 2025 and is estimated to grow at a CAGR of 12.1% to reach USD 22.2 billion by 2035.

Rising consumption of perishable foods, including fresh produce, meat, seafood, dairy, frozen meals, and ready-to-eat items, has intensified the demand for precise temperature control throughout supply chains. As delivery cycles become shorter and distribution networks broaden, companies face growing pressure to prevent product damage and maintain quality. Every shipment now requires complete traceability and strict temperature adherence, especially as global trade in perishables expands. Cold-chain monitoring has become essential for reducing waste and preserving freshness while meeting heightened expectations for safety and consistency. The need for accurate temperature oversight is even more critical in the pharmaceutical sector, where biologics, vaccines, and specialized therapies depend on tightly regulated temperature ranges. With the increasing adoption of temperature-sensitive treatments, manufacturers and distributors rely heavily on real-time, validated monitoring tools that offer alerts and audit-ready data. The accelerated deployment of digital systems during public health emergencies has further cemented real-time cold-chain oversight as a priority within the pharmaceutical landscape.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.2 Billion |

| Forecast Value | $22.2 Billion |

| CAGR | 12.1% |

The hardware segment held a 60% share in 2025 and is expected to grow at a CAGR of 12.4% from 2026 to 2035. Cold-chain operations depend on large quantities of physical monitoring devices, temperature probes, GPS units, data loggers, humidity sensors, telematics tools, and door-status detectors installed across warehouses, refrigerated transport, containers, and last-mile equipment. Because every pallet, shipment, and storage point requires continuous tracking, hardware demand grows faster than software adoption, ensuring its leading market position.

The frozen segment accounted for a 56% share in 2025 and is projected to grow at a 12.4% CAGR through 2035. Products stored at frozen temperatures, including certain pharmaceuticals, biologics, and temperature-sensitive foods, must remain within tightly controlled environments. Even the smallest deviation can compromise safety or effectiveness, prompting companies to invest in continuous monitoring, high-accuracy sensors, and reliable real-time reporting throughout the supply chain.

U.S. Cold Chain Monitoring Market generated USD 2.3 billion in 2025. The country's extensive network of refrigerated storage facilities and temperature-controlled transportation promotes strong adoption of monitoring systems. The scale of perishable food distribution, alongside strict requirements for fresh produce, packaged foods, frozen items, biologics, and advanced pharmaceuticals, reinforces the need for real-time visibility. High product variety, long transport distances, and retailer performance standards consistently elevate demand for accurate cold-chain tracking technologies.

Companies active in the Global Cold Chain Monitoring Market include Testo, Controlant, Cold Chain Technologies, Digi International, Sensitech, Zebra Technologies, Descartes Systems, Emerson Electric, Honeywell International, and ORBCOMM. Companies competing in the Cold Chain Monitoring Market strengthen their position by expanding hardware portfolios, enhancing sensor accuracy, and integrating advanced connectivity features into their product lines. Many firms focus on developing real-time platforms that combine temperature tracking, geolocation, and automated alerts to support regulatory compliance and reduce spoilage risk. Strategic collaborations with logistics providers and pharmaceutical manufacturers help vendors embed monitoring solutions deeper within supply chains.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Temperature

- 2.2.4 Deployment

- 2.2.5 Logistics

- 2.2.6 End use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Sensor & hardware manufacturers

- 3.1.1.2 Connectivity & IoT network providers

- 3.1.1.3 Software / platform providers

- 3.1.1.4 Cold chain packaging & insulated containers

- 3.1.1.5 Refrigeration equipment manufacturers

- 3.1.1.6 Cold storage operators & warehouse infrastructure

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid growth of cloud computing & hyperscale expansion

- 3.2.1.2 Explosion of AI, machine learning & high-performance computing (HPC)

- 3.2.1.3 Increasing data generation across industries

- 3.2.1.4 Growth of edge computing for low-latency applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Power & cooling constraints limit high-density server deployments

- 3.2.2.2 Rising energy costs pressure TCO and server refresh decisions

- 3.2.2.3 Supply chain volatility and semiconductor shortages delay server shipments

- 3.2.3 Market opportunities

- 3.2.3.1 Accelerated adoption of AI-optimized and GPU-accelerated servers

- 3.2.3.2 Growth of edge computing opens new server deployment footprints

- 3.2.3.3 Transition to liquid cooling creates hardware upgrade cycles

- 3.2.3.4 Rise of ARM-based servers and alternative architectures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology trends & innovation ecosystem

- 3.7.1 Current technologies

- 3.7.1.1 IoT-based sensors & wireless environmental sensors

- 3.7.1.2 Temperature & humidity data loggers

- 3.7.1.3 Telematics integration for refrigerated containers / vehicles

- 3.7.1.4 GPS / location tracking combined with monitoring for refrigerated containers

- 3.7.2 Emerging technologies

- 3.7.2.1 Predictive analytics / AI and ML-driven analytics

- 3.7.2.2 Data-driven decision-making platforms

- 3.7.2.3 Integration with broader supply-chain systems

- 3.7.2.4 Edge computing / local processing & hybrid architectures

- 3.7.1 Current technologies

- 3.8 Patent analysis

- 3.9 Price trend analysis

- 3.9.1 By region

- 3.9.2 By products

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Risk analysis & management

- 3.12.1 Operational risk assessment

- 3.12.2 Financial risk evaluation

- 3.12.3 Technology & cybersecurity risks

- 3.12.4 Risk mitigation strategies

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Use cases

- 3.15 Best case scenario

- 3.16 ROI & Cost-Benefit Analysis

- 3.17 Feature & pricing benchmarking

- 3.18 Customer preference / buying behavior

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 RFID devices

- 5.2.3 Telematics

- 5.2.4 Networking devices

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Real-time monitoring

- 5.3.2 Analytics and reporting

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Temperature, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Frozen

- 6.3 Chilled

Chapter 7 Market Estimates & Forecast, By Deployment, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Logistics, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Storage

- 8.3 Transportation

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Pharmaceutical & healthcare

- 9.3 Food & beverage

- 9.4 Logistics & distribution

- 9.5 Chemical

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Thailand

- 10.4.7 Indonesia

- 10.4.8 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Leaders

- 11.1.1 Sensitech (Carrier Global)

- 11.1.2 Emerson Electric

- 11.1.3 Honeywell International

- 11.1.4 Descartes Systems

- 11.1.5 Digi International

- 11.1.6 Zebra Technologies

- 11.1.7 Cold Chain Technologies (CCT)

- 11.1.8 ORBCOMM

- 11.1.9 Controlant

- 11.1.10 Testo

- 11.1.11 ELPRO-Buchs

- 11.2 Regional Champions

- 11.2.1 DeltaTrak

- 11.2.2 Monnit

- 11.2.3 FreshLoc Technologies

- 11.2.4 Samsara

- 11.2.5 Tive

- 11.2.6 Roambee

- 11.2.7 Blulog (low-power NFC and wireless data loggers)

- 11.2.8 OnAsset Intelligence (air cargo temperature & security tracking)

- 11.2.9 Zest Labs

- 11.2.10 TagBox

- 11.3 Emerging Players

- 11.3.1 SenseAnywhere

- 11.3.2 Rotronic

- 11.3.3 TempGenius

- 11.3.4 Zhuhai Rayonics Technology

- 11.3.5 Blulog