|

시장보고서

상품코드

1766369

간질 치료제 시장 : 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Epilepsy Treatment Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

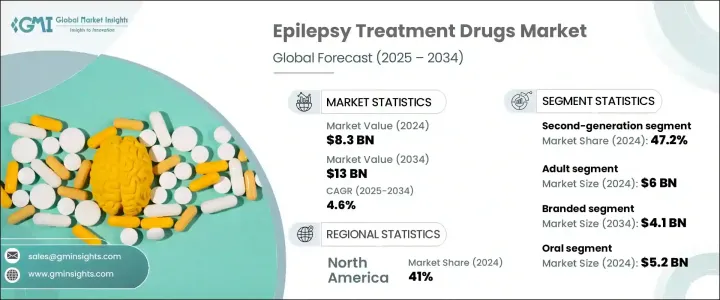

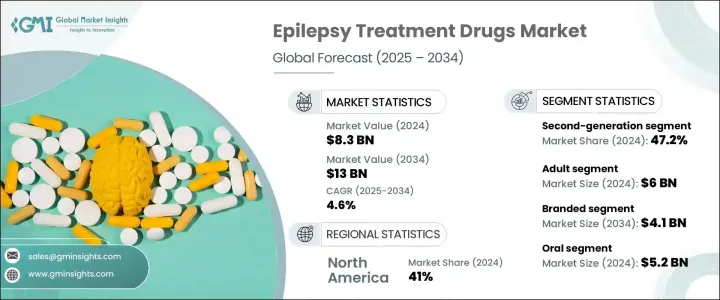

세계의 간질 치료제 시장 규모는 2024년에는 83억 달러로 평가되었고, CAGR 4.6%로 성장할 전망이며, 2034년에는 130억 달러에 이를 것으로 추정됩니다.

간질의 진단 건수가 세계적으로 꾸준히 증가하고 있는 것이, 보다 효과적이고 이용하기 쉬운 치료 옵션에 대한 수요를 촉진하고 있는 주된 요인의 하나입니다. 의약품의 기술 혁신, 부작용이 적은 신시대의 항간질제 개발, 치료 애드히어런스의 향상 등이 이러한 증가 추세를 뒷받침하고 있습니다. 신경학 관련 연구에 대한 정부 및 민간 투자 증가, 인지도 향상, 검진율 상승도 시장 확대에 기여하고 있습니다.

또한 신경질환에 보다 취약한 세계의 고령화 인구 증가도 간질 치료제 수요를 더욱 높일 것으로 예측됩니다. 의약품 개발 기업은, 보다 뛰어난 인용성, 서방성, 환자의 컴플리언스 향상을 실현하는 치료약을 우선시하고 있습니다. 이 시프트는, 신흥국에서 헬스케어 인프라의 개선 및 주요 시장에서의 규제 합리화와 맞물려, 혁신 및 제품 채용에 유리한 환경을 만들어 내고 있습니다. 게다가 특히 약제 내성 간질에 대한 개별화 의료 전략으로의 이행은, 치료 성적을 향상시켜, 장기적인 시장 성장의 원동력이 되고 있습니다.

| 시장 규모 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 83억 달러 |

| 예측 금액 | 130억 달러 |

| CAGR | 4.6% |

항간질제(AED)는 항경련제라고도 불리며, 뇌내의 불규칙한 전기 신호를 안정시킴으로써 발작을 예방하고 간질의 증상 전반을 개선합니다. 약제 클래스별로 시장은 1세대, 2세대, 3세대로 나뉩니다. 2024년에는 2세대 AED가 세계 시장의 47.2%를 차지했으며, 최대 매출 점유율을 차지했습니다. 이 부문은 2025-2034년 CAGR 4.6%로 확대될 것으로 예측되고 있습니다. AED가 널리 받아들여지고 있는 배경에는 구세대 치료약에 비해 약물 상호작용의 발생률이 낮다는 점, 부작용 프로파일이 개선되고 있다는 점, 환자의 건강 관리가 향상되고 있다는 점 등이 있습니다.

제품 유형별로 시장은 브랜드 의약품 및 제네릭 의약품으로 분류됩니다. 브랜드 의약품은 2024년에 26억 달러를 창출했고, 2034년에는 41억 달러에 이를 것으로 예측되고 있습니다. 제약 회사들은 약물 동태가 개선되고 부작용이 적으며 치료 효과가 높은 브랜드 치료제 제조에 점점 주력하게 되고 있습니다. 특히 기존 치료에 반응하지 않는 환자들 사이에서 신규 치료에 대한 요구가 높아지고 있는 점도 브랜드 항간질제의 수요를 끌어올리고 있습니다.

투여 경로를 분석하면 2024년 경구제가 52억 달러를 차지하며 최대 점유율을 차지했습니다. 이 부문은 예측 기간 동안 CAGR 4.9%로 성장할 것으로 예측되고 있습니다. 경구제는 그 편리성, 사용의 용이성, 투여 스케줄 및 환자의 복약 애드히어런스를 향상시키는 서방성 제제의 도입 등으로 인해 선호되고 있습니다. 또, 다양한 경구 제제를 입수 가능한 것도, 선진국 시장과 신흥국 시장 양쪽 모두에서의 채용을 가속시키고 있습니다.

시장은 환자의 속성에 따라 성인 집단과 소아 집단으로 구분됩니다. 2024년 시장 규모는 60억 달러로 성인이 앞섰으며, 2034년까지 CAGR 4.5%로 확대될 것으로 예측됩니다. 성인의 간질 발병률 증가는 뇌졸중, 뇌손상, 변성질환 등의 노화와 관련된 신경질환과 관련이 있습니다. 그 결과, 신뢰성이 높고 과녁을 좁힌 치료 접근법에 대한 수요가 높아지고 있으며, 발작 제어를 개선하기 위한 다제 병용 레지멘이나 장기 요법이 중시되고 있습니다.

발작 유형에 따라 시장은 초점 발작, 전반 발작, 복합 발작으로 구분됩니다. 전반 발작 분야는 2024년에 25억 달러를 창출하였고, 2034년에는 40억 달러에 이를 것으로 추정되고 있습니다. 강직간대발작과 결신발작을 포함한 전반적인 발작의 사례 수가 증가하고 있어 보다 견고한 치료 솔루션의 필요성이 높아지고 있습니다. 이 동향은 신경학적 연구를 위한 정부 자금 확대, 보험 적용 범위 확대, 간질 치료에 대한 접근성 강화를 목적으로 한 정책 이니셔티브에 의해 뒷받침되고 있습니다.

판매 채널에서 병원 약국, 소매 약국 및 온라인 약국이 주요 부문입니다. 소매 약국은 2024년에 23억 달러의 수익을 얻었고 예측 기간 동안 CAGR 4.9%를 기록할 것으로 예상됩니다. 특히 중저소득 국가에서 비용 대비 효과가 높은 제네릭 의약품을 소매장에서 사용할 수 있게 되면서 간질 환자들이 보다 저렴한 가격으로 간질을 관리할 수 있게 되었습니다. 게다가 보험 적용이나 보조금 제도에 의해, 환자가 소매점을 통해서 필요한 의약품을 입수하기 쉽게 되어 있습니다.

지역별로 북미는 2024년 점유율 41%로 세계 간질 치료제 시장을 견인했습니다. 미국은, 높은 인지도, 정비된 헬스케어 시스템, 고도의 신경학적 치료에 대한 환자 액세스를 개선하기 위한 일관된 대처에 의해, 같은 해의 매상고에 31억 달러를 공헌했습니다. 미국 시장은 전년 대비 꾸준한 성장세를 보이며 2021년 28억 달러에서 2023년 30억 달러, 2024년 31억 달러에 이르렀습니다. 이 지역에서 간질의 유병률 증가는, 유리한 규제 조건이나 세계의 제약 기업의 존재와 맞물려, 시장 개척을 계속 지지하고 있습니다.

업계의 대기업은 환자의 결과를 개선하고 헬스케어 시스템에서 간질의 전반적인 부담을 줄이기 위해 첨단 제형과 병용 요법에 적극적으로 투자하고 있습니다.

목차

제1장 조사 방법 및 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 미치는 영향요인

- 성장 촉진요인

- 간질의 유병률 상승

- 연구개발 활동에 대한 투자 증가

- 간질의 새로운 치료에 대한 수요 증가

- 의식의 고조 및 조기 진단

- 업계의 잠재적 위험 및 과제

- 항간질제에 따른 부작용

- 특허 유효기간

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 미국 (식품의약품국(FDA))

- 캐나다(캐나다 보건성 규제)

- 유럽

- 아시아태평양

- 일본(PMDA)

- 중국(NMPA)

- 인도(CDSCO)

- 호주(TGA)

- 북미

- 파이프라인 분석

- 장래 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 기업 매트릭스 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 약제 클래스별(2021-2034년)

- 주요 동향

- 제1세대

- 제2세대

- 제3세대

제6장 시장 추계 및 예측 : 유형별(2021-2034년)

- 주요 동향

- 브랜드

- 제네릭 의약품

제7장 시장 추계 및 예측 : 투여 경로별(2021-2034년)

- 주요 동향

- 경구

- 비강

- 주사

- 직장

제8장 시장 추계 및 예측 : 연령별(2021-2034년)

- 주요 동향

- 소아

- 성인

제9장 시장 추계 및 예측 : 발작 유형별(2021-2034년)

- 주요 동향

- 국소 발작

- 전신 발작

- 복합 발작

제10장 시장 추계 및 예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 병원 약국

- 소매 약국

- 온라인 약국

제11장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제12장 기업 프로파일

- AbbVie

- Bausch Health Companies

- Dr. Reddy's Laboratories

- Eisai

- GSK

- Jazz Pharmaceuticals

- Lupin Pharmaceuticals

- Neurelis

- Novartis

- Pfizer

- Sanofi

- SK Biopharmaceuticals

- Sumitomo Pharma

- Sun Pharmaceutical Industries

- UCB

The Global Epilepsy Treatment Drugs Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 13 billion by 2034. The steady rise in epilepsy diagnoses globally is one of the key factors driving demand for more effective and accessible treatment options. Pharmaceutical innovations, the development of new-age anti-epileptic drugs with fewer side effects, and enhanced treatment adherence are all supporting this upward trend. Growing government and private investments in neurology-related research, alongside increasing awareness and screening rates, are contributing to the expanding market.

The rising global aging population-more vulnerable to neurological disorders-is also expected to further elevate the demand for epilepsy medications. Drug developers are prioritizing therapies that offer better tolerability, sustained release, and improved patient compliance. This shift, paired with improved healthcare infrastructure in developing nations and streamlined regulatory pathways in key markets, is creating a favorable environment for innovation and product adoption. Moreover, the transition toward more personalized medicine strategies, particularly for drug-resistant epilepsy, is improving treatment outcomes and driving long-term market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $13 Billion |

| CAGR | 4.6% |

Anti-epileptic drugs (AEDs), also referred to as anticonvulsants, work by stabilizing irregular electrical signals in the brain, helping to prevent seizures and manage the overall symptoms of epilepsy. Based on drug class, the market is divided into first-generation, second-generation, and third-generation drugs. In 2024, second-generation AEDs accounted for the largest revenue share, contributing 47.2% to the global market. This segment is forecasted to expand at a CAGR of 4.6% from 2025 to 2034. Their broader acceptance is attributed to lower incidences of drug interactions, improved side effect profiles, and better patient adherence compared to older-generation therapies.

In terms of product type, the market is categorized into branded and generic drugs. Branded drugs generated USD 2.6 billion in 2024 and are projected to reach USD 4.1 billion by 2034. Pharmaceutical firms are increasingly focusing on producing branded treatments with improved pharmacokinetics, fewer adverse reactions, and greater therapeutic benefits. The rising need for novel treatments, especially among individuals who do not respond to conventional therapies, is also driving the demand for branded anti-epileptic medications.

When analyzing the route of administration, oral formulations held the largest share in 2024, accounting for USD 5.2 billion. This segment is projected to grow at a CAGR of 4.9% over the forecast period. Oral medications are preferred due to their convenience, ease of use, and the introduction of extended-release versions that improve dosage scheduling and patient adherence. The availability of diverse oral formulations is also accelerating adoption in both developed and emerging markets.

Based on patient demographics, the market is segmented into adult and pediatric populations. The adult segment led with a market value of USD 6 billion in 2024 and is expected to expand at a CAGR of 4.5% through 2034. The increasing incidence of epilepsy among adults is linked to age-related neurological conditions such as strokes, brain injuries, and degenerative disorders. As a result, the demand for reliable and targeted treatment approaches is rising, with a growing emphasis on multi-drug regimens and long-term therapy for improved seizure control.

According to seizure type, the market is segmented into focal seizures, generalized seizures, and combined seizures. The generalized seizure segment generated USD 2.5 billion in 2024 and is estimated to reach USD 4 billion by 2034. A rising number of generalized seizure cases, including tonic-clonic and absence seizures, is prompting the need for more robust therapeutic solutions. This trend is being supported by greater government funding for neurological research, insurance coverage expansions, and policy initiatives aimed at enhancing access to epilepsy care.

In terms of distribution channels, hospital pharmacies, retail pharmacies, and online pharmacies are the major segments. Retail pharmacies captured USD 2.3 billion in revenue in 2024 and are expected to register a CAGR of 4.9% during the forecast period. The growing availability of cost-effective generic drugs in retail settings, especially in low- and middle-income countries, is helping patients manage epilepsy more affordably. Additionally, insurance coverage and subsidy programs are making it easier for patients to access essential medications via retail outlets.

Regionally, North America led the global epilepsy treatment drugs market with a 41% share in 2024. The U.S. alone contributed USD 3.1 billion in revenue that year, driven by high awareness, well-developed healthcare systems, and consistent efforts to improve patient access to advanced neurological treatments. The U.S. market has shown steady year-on-year growth, moving from USD 2.8 billion in 2021 to USD 3 billion in 2023 and reaching USD 3.1 billion in 2024. The increasing prevalence of epilepsy in the region, coupled with favorable regulatory conditions and the presence of global pharmaceutical leaders, continues to push market development.

Major industry players are actively investing in advanced formulations and combination therapies, aiming to enhance patient outcomes and reduce the overall burden of epilepsy on healthcare systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Drug class

- 2.2.2 Type

- 2.2.3 Route of administration

- 2.2.4 Age group

- 2.2.5 Seizure type

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of epilepsy

- 3.2.1.2 Increasing investments in research and development activities

- 3.2.1.3 Increasing demand for novel treatment for epilepsy

- 3.2.1.4 Growing awareness and early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects associated with the antiepileptic drugs

- 3.2.2.2 Patent expiration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. [Food and Drug Administration (FDA)]

- 3.4.1.2 Canada (Health Canada Regulation)

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.3.1 Japan (PMDA)

- 3.4.3.2 China (NMPA)

- 3.4.3.3 India (CDSCO)

- 3.4.3.4 Australia (TGA)

- 3.4.1 North America

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 First-generation

- 5.3 Second-generation

- 5.4 Third-generation

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Branded

- 6.3 Generics

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Nasal

- 7.4 Injectable

- 7.5 Rectal

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatric

- 8.3 Adult

Chapter 9 Market Estimates and Forecast, By Seizure Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Focal seizure

- 9.3 Generalized seizure

- 9.4 Combined seizure

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Bausch Health Companies

- 12.3 Dr. Reddy’s Laboratories

- 12.4 Eisai

- 12.5 GSK

- 12.6 Jazz Pharmaceuticals

- 12.7 Lupin Pharmaceuticals

- 12.8 Neurelis

- 12.9 Novartis

- 12.10 Pfizer

- 12.11 Sanofi

- 12.12 SK Biopharmaceuticals

- 12.13 Sumitomo Pharma

- 12.14 Sun Pharmaceutical Industries

- 12.15 UCB