|

시장보고서

상품코드

1699347

알루미늄 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Aluminum Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

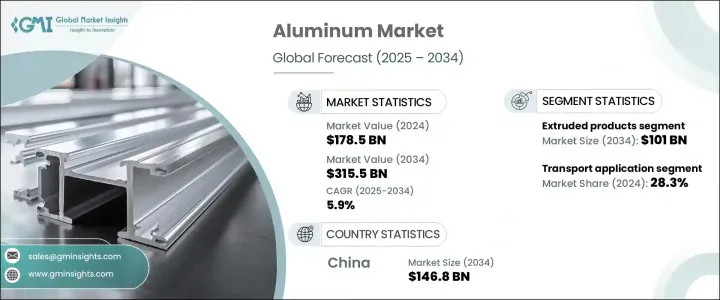

세계의 알루미늄 시장은 2024년에 1,785억 달러로 평가되었으며, 2025년부터 2034년까지 5.9%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

가장 눈에 띄는 제품 중 하나로 알루미늄은 특히 산업 응용 분야에서 강한 수요를보고 있습니다. 1차 알루미늄의 세계 생산량은 2023년에 7,230만 톤에 달하여 꾸준한 확대를 보여주었습니다. 이 시장은 다양한 산업에서의 소비 증가로 혜택을 누리고 경량 소재, 재활용 가능성, 제조 공정의 효율화에 의해 큰 성장을 이루고 있습니다.

제품 유형별로 볼 때 알루미늄 시장은 평판 제품, 단조 제품, 압출 제품, 긴 제품, 주조 제품 등으로 분류됩니다. 압출 제품 부문이 가장 높은 성장을 기록했으며 2024년에는 564억 달러에 이르렀습니다. 평판 제품이 약간 차이가 있어 자동차 산업과 포장 산업에서 중요한 역할을 하기 때문에 2024년에는 491억 달러에 이르렀습니다. 이 제품은 시장을 독점하고 총 매출의 40% 이상을 차지했습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 1,785억 달러 |

| 예측 금액 | 3,155억 달러 |

| CAGR | 5.9% |

압출제품은 특히 건설·운수부문에서 높은 수요를 유지하였습니다. 비용의 약 30%를 차지하고 있으며, 항공우주, 건축 및 건설, 전기산업이 시장 확대의 주요 공헌자로 부상했습니다.

시장은 또한 압연, 압출, 인발, 주조, 단조 등의 가공 방법에 따라 구분됩니다. 무주조는 가공 알루미늄의 20%를 차지했으며, 특히 자동차 및 산업기계에 사용되고 있습니다.

신기술은 생산비용과 환경부하의 저감에 공헌하였습니다.

시장은 용도별로 운송, 건설, 전기 및 전자, 포장, 설비 및 기계, 내구소비재, 호일재, 그 밖에 구분됩니다. 루미늄은 트랜스미션, 회로기판, 열교환기 등에 널리 사용되고 있습니다.

시장 전망은 특히 포장과 운송에서 지속 가능한 알루미늄의 사용을 촉진하는 규제가 진전되고 있음을 강조했습니다.

중국의 알루미늄 시장은 2024년에 809억 달러를 창출했으며, 2034년에는 1,468억 달러에 이를 것으로 예측됩니다. 1차 알루미늄 생산량은 4,200만 톤으로 2023년 생산량을 웃돌았습니다.

목차

제1장 조사 방법과 조사 범위

- 시장 범위와 정의

- 기본 추정과 계산

- 예측 계산

- 데이터 소스

- 1차 조사와 검증

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업체

- 유통업체

- 공급업체의 상황

- 이익률 분석

- 주요 뉴스

- 규제 상황

- 영향요인

- 성장 촉진요인

- 자동차 업계에서 경량 소재 수요 증가

- 저탄소 알루미늄 생산에 대한 노력 확대

- 알루미늄의 재활용과 순환경제에 대한 주목 증가

- 건설 및 인프라 프로젝트의 성장

- 포장 업계로부터의 왕성한 수요

- 알루미늄 가공 기술의 진보

- 지속가능한 금속 생산을 지원하는 정부의 정책

- 업계의 잠재적 위험 및 과제

- 에너지 제한 및 환경 규제

- 원료 가격의 변동

- 세계 공급 체인에 영향을 미치는 무역 마찰

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계·예측 : 제품별(2021-2034년)

- 주요 동향

- 평면 제품

- 압출 제품

- 단조 제품

- 긴 제품

- 주조 제품

- 기타

제6장 시장 추계·예측 : 가공 방법별(2021-2034년)

- 주요 동향

- 압연

- 압출

- 인발

- 주조

- 단조

제7장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 운송

- 건설

- 전기 및 전자

- 포장

- 설비 및 기계

- 내구 소비재

- 호일 재고

- 기타

제8장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제9장 기업 프로파일

- Alcoa

- Aleris Rolled Products

- Arconic

- Emirates Global Aluminum

- Hangzhou Century Aluminium

- Hindalco

- Hongqiao Group

- JW Aluminium

- Logan Aluminium

- Norsk Hydro

- Novelis

- Rio Tinto

- Rusal

- Shandong Xinfa Aluminium Group

- South32

- SPIC

- Vedanta Limited

The Global Aluminum Market was valued at USD 178.5 billion in 2024 and is projected to grow at a 5.9% CAGR from 2025 to 2034. As one of the most prominent commodities, aluminum has seen strong demand, particularly in industrial applications. The global production of primary aluminum reached 72.3 million tons in 2023, demonstrating steady expansion. The market benefits from increasing consumption in various industries, with significant growth driven by lightweight materials, recyclability, and efficiency in manufacturing processes.

Based on product type, the aluminum market is categorized into flat products, forged products, extruded products, long products, cast products, and others. The extruded products segment recorded the highest growth, reaching USD 56.4 billion in 2024. Flat products followed closely, reaching USD 49.1 billion in 2024 due to their significant role in the automotive and packaging industries. These products dominated the market, contributing to over 40% of total sales.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $178.5 Billion |

| Forecast Value | $315.5 Billion |

| CAGR | 5.9% |

Extruded products remained in high demand, especially within the construction and transportation sectors. Meanwhile, flat products gained prominence due to their widespread use in the automotive industry, driven by the push for lightweight vehicles. The automotive sector alone accounted for approximately 30% of total aluminum consumption. Additionally, aerospace, building & construction, and the electrical industry emerged as key contributors to market expansion. Aluminum played a crucial role in power grids, transmission lines, and large-scale infrastructure projects.

The market is further segmented based on processing methods, including rolling, extruding, drawing, casting, and forging. The drawing process is expected to dominate in the coming years, mainly due to its application in high-strength wire manufacturing and aerospace components. Aluminum casting accounted for 20% of processed aluminum, particularly within automotive and industrial machinery. Advanced processing technologies focused on reducing emissions and enhancing energy efficiency, further strengthening the industry's sustainability initiatives.

New technologies helped lower production costs and environmental impact. Despite moderate competitive rivalry, high capital investments acted as entry barriers for new players. The demand for lightweight aluminum alloys created new opportunities, although raw material price fluctuations presented challenges, especially as costs surged significantly post-pandemic.

The market is segmented by application into transport, construction, electrical & electronics, packaging, equipment & machinery, consumer durables, foil stock, and others. The transportation sector led with a 28.3% market share in 2024 and is anticipated to grow at a 4.5% CAGR through 2034. The electrical & electronics segment held a substantial share, with aluminum widely used in power transmission, circuit boards, and heat exchangers. Packaging contributed 15.2% of the market, as aluminum's recyclability made it a preferred material for food and beverage containers. Equipment & machinery, including industrial automation components, also saw significant growth.

The market outlook highlighted evolving regulations promoting sustainable aluminum usage, particularly in packaging and transportation. Supply chain disruptions posed challenges, while the rise in foil stock and consumer durables demand reinforced aluminum's market presence.

The aluminum market in China generated USD 80.9 billion in 2024 and is projected to reach USD 146.8 billion by 2034. The Asia Pacific region dominated due to industrial diversity and strong manufacturing capabilities. China accounted for 55% of aluminum production and nearly 50% of global consumption in 2024, producing 42 million tons of primary aluminum, surpassing its 2023 output. Government policies, abundant bauxite reserves, and energy subsidies contributed to this dominance. Urbanization and infrastructure expansion further fueled aluminum demand in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for lightweight materials in automotive

- 3.6.1.2 Expanding low-carbon aluminium production initiatives

- 3.6.1.3 Increasing aluminium recycling and circular economy focus

- 3.6.1.4 Growth in construction and infrastructure projects

- 3.6.1.5 Strong demand from the packaging industry

- 3.6.1.6 Advancements in aluminium processing technologies

- 3.6.1.7 Government policies supporting sustainable metal production

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Energy restrictions and environmental regulations

- 3.6.2.2 Volatility in raw material prices

- 3.6.2.3 Trade tensions affecting global supply chains

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Carats)

- 5.1 Key trends

- 5.2 Flat products

- 5.3 Extruded products

- 5.4 Forged products

- 5.5 Long products

- 5.6 Cast products

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 – 2034 (USD Billion) (Carats)

- 6.1 Key trends

- 6.2 Rolling

- 6.3 Extruding

- 6.4 Drawn

- 6.5 Casting

- 6.6 Forging

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Carats)

- 7.1 Key trends

- 7.2 Transport

- 7.3 Construction

- 7.4 Electrical & electronics

- 7.5 Packaging

- 7.6 Equipment & machinery

- 7.7 Consumer durables

- 7.8 Foil stock

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Carats)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alcoa

- 9.2 Aleris Rolled Products

- 9.3 Arconic

- 9.4 Emirates Global Aluminum

- 9.5 Hangzhou Century Aluminium

- 9.6 Hindalco

- 9.7 Hongqiao Group

- 9.8 JW Aluminium

- 9.9 Logan Aluminium

- 9.10 Norsk Hydro

- 9.11 Novelis

- 9.12 Rio Tinto

- 9.13 Rusal

- 9.14 Shandong Xinfa Aluminium Group

- 9.15 South32

- 9.16 SPIC

- 9.17 Vedanta Limited