|

시장보고서

상품코드

1708140

재제조 자동차 부품 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Remanufactured Automotive Parts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

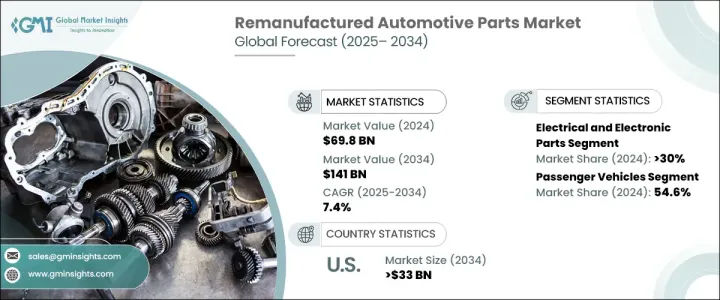

세계 재제조 자동차 부품 시장은 2024년 698억 달러에 달했고, 2025-2034년 연평균 7.4%의 성장률을 보일 것으로 전망됩니다.

재제조 자동차 부품에 대한 수요는 기술 발전, 환경적 이점, 비용 효율성 등으로 인해 급증하고 있습니다. 지속가능성에 대한 관심과 순환 경제 원칙에 대한 관심이 높아짐에 따라 재생 부품은 새로운 부품의 대안으로 떠오르고 있습니다. 이러한 부품은 엄격한 재생 공정을 거쳐 OEM 표준을 충족하거나 초과하는 동시에 재료 폐기물과 에너지 소비를 줄입니다. 그 결과, 자동차 제조업체와 소비자 모두 재생 자동차 부품의 이점을 인식하여 시장이 크게 확대되고 있습니다.

자동화, 디지털화 및 재료 과학 혁신의 급속한 통합은 재제조 공정에 혁명을 일으켜 제품의 품질과 신뢰성을 향상시켰습니다. 최신 기술을 통해 재제조 업체는 중고 부품을 효율적으로 신품에 가까운 상태로 복원하여 최적의 성능과 수명을 보장할 수 있습니다. 이러한 추세는 전기자동차(EV)와 하이브리드 자동차의 보급이 증가하면서 더 많은 첨단 부품에 의존하게 되면서 더욱 강화되고 있습니다. 또한, 배출가스 및 지속가능성에 대한 정부의 엄격한 규제는 자동차 제조업체들이 재제조 솔루션에 투자하도록 유도하여 시장 성장을 가속하고 있습니다. 고품질의 재생 부품을 경쟁력 있는 가격에 이용할 수 있게 됨에 따라, 자동차 소유주들은 새 부품에 대한 비용 효율적이고 친환경적인 대안을 찾고 있으며, 이는 소비자의 구매 의사 결정에 영향을 미치고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 698억 달러 |

| 예상 금액 | 1,410억 달러 |

| CAGR | 7.4% |

재제조 자동차 부품 시장은 전기 및 전자 부품, 엔진, 변속기, 휠, 브레이크 등 주요 부품 카테고리로 구분되며, 2024년에는 전기 및 전자 부품 부문이 가장 높은 30%의 시장 점유율을 차지할 것으로 예측됩니다. 센서, 전기 구동계, 인포테인먼트 시스템 등 첨단 자동차 기술에 대한 의존도가 높아짐에 따라 전기 및 전자 부품의 재생산 수요가 증가하고 있습니다. 이러한 부품은 수리 및 교체 비용을 낮추면서 차량 시스템의 수명을 연장할 수 있는 지속 가능한 방법을 제공합니다. 재생 전자 부품의 통합은 자동차의 효율성을 높일 뿐만 아니라 전자 폐기물을 크게 줄여 시장을 더욱 발전시킬 수 있습니다.

차종별로는 재제조 자동차 부품 시장에는 승용차와 상용차가 포함됩니다. 승용차 부문은 2024년 54.6%의 점유율을 차지하며 시장을 주도했습니다. 이러한 성장은 자동차 부품의 수명을 연장하고 자동차 생산의 이산화탄소 배출량을 줄이려는 노력에 힘입은 바 큽니다. 재제조 스타터, 발전기, 고전압 배터리의 채택 증가는 부품의 재사용 및 개조를 통해 환경에 미치는 영향을 최소화하고 귀중한 자원을 절약하는 순환 경제로의 전환과 일치합니다. 자동차 제조업체들이 지속 가능한 생산 및 수리 솔루션을 우선시함에 따라 승용차 부문의 재생 부품에 대한 수요는 가속화될 것으로 예측됩니다.

북미는 2024년 재제조 자동차 부품 시장에서 35%의 큰 점유율을 차지했으며, 미국이 압도적인 기여 국가로 부상하고 있습니다. 예측에 따르면, 미국 시장은 2034년까지 330억 달러에 달할 것으로 예상되며, 이는 지속가능성, 비용 효율성, OEM 지원 재제조 프로그램에 대한 관심이 높아진 것이 주요 요인으로 작용할 것으로 보입니다. 주요 자동차 제조업체들은 재제조 이니셔티브를 확대하고 수요 증가에 대응하기 위해 다양한 재제조 부품을 제공합니다. 엄격한 환경 정책, 강력한 애프터마켓 산업, 높아진 소비자 인식으로 인해 북미는 여전히 자동차 재제조 부품 시장의 세계 확장을 주도하는 주요 지역으로 남아 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 자동차 제조업체

- 써드파티 재제조업체

- 역물류 프로바이더

- 최종 용도

- 공급업체 상황

- 이익률 분석

- 기술 혁신 상황

- 특허 분석

- 주요 뉴스와 이니셔티브

- 비용 내역

- 가격 동향

- 규제 상황

- 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추산 및 예측 : 부품별, 2021년-2034년

- 주요 동향

- 전기 및 전자부품

- 엔진

- 변속기

- 휠과 브레이크

- 기타

제6장 시장 추산 및 예측 : 차량별, 2021년-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV 차량

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제7장 시장 추산 및 예측 : 공급별, 2021년-2034년

- 주요 동향

- OEM

- 애프터마켓

제8장 시장 추산 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카공화국

- 사우디아라비아

제9장 기업 개요

- Andre Niermann

- BBB Industries

- BorgWarner

- Bosch

- Cardone

- Carwood

- Caterpillar

- Denso

- Detroit Diesel

- Eaton

- Jasper Engines &Transmissions

- Lucas Electrical

- Marelli

- Maval

- Motorcar Parts of America

- NAPA

- Stellantis

- Teamec

- Valeo

- ZF

The Global Remanufactured Automotive Parts Market reached USD 69.8 billion in 2024 and is projected to grow at a CAGR of 7.4% between 2025 and 2034. The demand for remanufactured automotive parts is surging due to a combination of technological advancements, environmental benefits, and cost-efficiency. As sustainability concerns and circular economy principles gain momentum, remanufactured components are emerging as a preferred alternative to new parts. These components undergo rigorous refurbishment processes, ensuring they meet or exceed original equipment manufacturer (OEM) standards while reducing material waste and energy consumption. As a result, automakers and consumers alike are recognizing the advantages of remanufactured automotive parts, driving substantial market expansion.

The rapid integration of automation, digitalization, and material science innovations has revolutionized the remanufacturing process, enhancing product quality and reliability. With modern technology, remanufacturers can efficiently restore used parts to near-new condition, ensuring optimal performance and longevity. This trend is further bolstered by the rising adoption of electric vehicles (EVs) and hybrid models, which rely on a greater number of sophisticated components. Additionally, stringent government regulations on emissions and sustainability initiatives are pushing automakers to invest in remanufacturing solutions, reinforcing market growth. The increasing availability of high-quality remanufactured parts at competitive prices is influencing consumer purchasing decisions as more vehicle owners seek cost-effective and environmentally friendly alternatives to new components.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.8 Billion |

| Forecast Value | $141 Billion |

| CAGR | 7.4% |

The remanufactured automotive parts market is segmented into key component categories, including electrical and electronic parts, engines, transmissions, wheels, and brakes. In 2024, the electrical and electronic parts segment held the largest market share, accounting for 30%. The growing reliance on advanced vehicle technologies, such as sensors, electric drivetrains, and infotainment systems, has amplified the demand for remanufactured electrical and electronic components. These components offer a sustainable way to extend the lifespan of vehicle systems while lowering repair and replacement costs. The integration of remanufactured electronics not only enhances vehicle efficiency but also significantly reduces electronic waste, further driving the market forward.

By vehicle type, the remanufactured automotive parts market includes passenger and commercial vehicles. The passenger vehicle segment dominated the market in 2024, securing a 54.6% share. This growth is largely driven by efforts to extend the longevity of automotive components and reduce the carbon footprint of vehicle production. The increasing adoption of remanufactured starters, alternators, and high-voltage batteries aligns with the industry's transition toward a circular economy, where reusing and refurbishing parts minimizes environmental impact and conserves valuable resources. With automakers prioritizing sustainable production and repair solutions, the demand for remanufactured parts in the passenger vehicle sector is expected to accelerate.

North America held a significant 35% share of the remanufactured automotive parts market in 2024, with the U.S. emerging as the dominant contributor. Projections indicate that the U.S. market will reach USD 33 billion by 2034, fueled by an increasing focus on sustainability, cost-effectiveness, and OEM-backed remanufacturing programs. Major automotive manufacturers are expanding their remanufacturing initiatives, offering a diverse range of remanufactured components to cater to rising demand. With stringent environmental policies, a strong aftermarket industry, and growing consumer awareness, North America remains a key region driving the global expansion of the remanufactured automotive parts market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Automakers

- 3.1.2 Third-party remanufacturers

- 3.1.3 Reverse logistics providers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost breakdown

- 3.8 Price trend

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Improving remanufacturing processes

- 3.10.1.2 Stricter environmental policies

- 3.10.1.3 Growing emphasis on reducing waste

- 3.10.1.4 Increasing cost savings by using remanufactured parts

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Negative consumer perception

- 3.10.2.2 Supply chain complexity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 – 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Electrical and electronic parts

- 5.3 Engine

- 5.4 Transmission

- 5.5 Wheels and brakes

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Supply, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Andre Niermann

- 9.2 BBB Industries

- 9.3 BorgWarner

- 9.4 Bosch

- 9.5 Cardone

- 9.6 Carwood

- 9.7 Caterpillar

- 9.8 Denso

- 9.9 Detroit Diesel

- 9.10 Eaton

- 9.11 Jasper Engines & Transmissions

- 9.12 Lucas Electrical

- 9.13 Marelli

- 9.14 Maval

- 9.15 Motorcar Parts of America

- 9.16 NAPA

- 9.17 Stellantis

- 9.18 Teamec

- 9.19 Valeo

- 9.20 ZF