|

시장보고서

상품코드

1708143

자동차 벨트 텐셔너 풀리 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Automotive Belt Tensioner Pulleys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

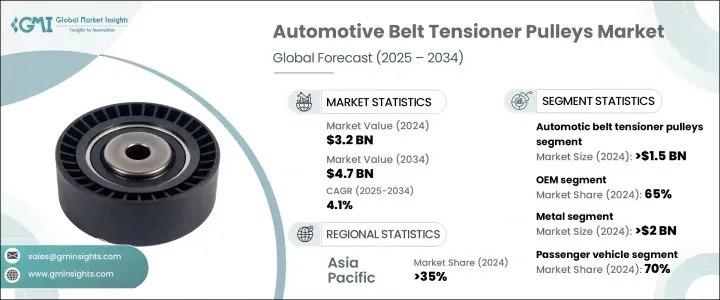

자동차 벨트 텐셔너 풀리 세계 시장은 2024년에는 32억 달러에 달했고, 2025-2034년 4.1%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다.

이 시장은 승용차 및 상용차의 세계 생산 증가에 힘입어 꾸준한 성장을 보이고 있습니다. 자동차 벨트 텐셔너 풀리는 적절한 벨트 장력을 유지하고 마모와 손상을 줄이며 엔진 효율을 최적화하는 데 중요한 역할을 합니다. 자동차 제조업체들이 고성능, 저연비, 내구성이 뛰어난 엔진에 집중함에 따라 이러한 부품에 대한 수요는 계속 증가하고 있습니다.

신흥국을 중심으로 한 자동차 산업의 급속한 확장은 시장 성장을 더욱 촉진하고 있습니다. 배출가스 저감 및 연비 향상을 위한 엄격한 규제 기준은 자동차 제조업체들이 첨단 텐셔닝 솔루션을 통합하도록 유도하고 있습니다. 가볍고 내구성이 뛰어난 소재를 포함한 벨트 구동 시스템의 기술 혁신은 벨트 텐셔너 풀리의 성능을 향상시키고 있습니다. 또한, 전기 및 하이브리드 자동차의 채택이 증가함에 따라 시장 역학이 재편되어 첨단 파워트레인 시스템에 맞는 특수 텐셔닝 솔루션에 대한 기회가 창출되고 있습니다. 지속 가능한 이동성과 모듈식 엔진 설계로의 전환에 따라 제조업체들은 다양한 작동 조건에서 일관된 성능을 보장하는 벨트 텐셔너 풀리 개발에 주력하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 32억 달러 |

| 예상 금액 | 47억 달러 |

| CAGR | 4.1% |

시장은 자동 벨트 텐셔너 풀리와 수동 벨트 텐셔너 풀리의 두 가지 주요 제품 범주로 구분됩니다. 자동 벨트 텐셔너 풀리 부문은 2024년 15억 달러로 평가되며 큰 시장 점유율을 차지했습니다. 이러한 자동 조정 풀리는 수동 개입 없이 최적의 벨트 장력을 유지하여 엔진 수명과 효율성을 향상시키기 때문에 모든 차량 모델에서 선호되고 있습니다. 현대 자동차에서 유지보수가 적고 정밀도가 높은 부품에 대한 수요가 증가함에 따라 이 부문의 성장에 박차를 가하고 있습니다.

자동차 벨트 텐셔너 풀리 시장은 주문자 상표 부착 생산(OEM)과 애프터마켓 판매를 포함한 최종 용도별로 분류되며, 2024년에는 OEM 부문이 시장 점유율의 65%를 차지했으며, 꾸준한 성장이 예상됩니다. 자동차 제조업체들은 엔진 성능을 개선하고, 연비 규제를 충족하고, 내구성을 향상시키기 위해 맞춤형 벨트 텐셔너 풀리를 통합하고 있습니다. 전기 및 하이브리드 자동차의 차세대 엔진 설계와 모듈식 벨트 구동 시스템에 대한 추진은 OEM 분야에서 고급 텐셔너 풀리의 채택을 가속화하고 있습니다.

중국의 자동차 벨트 텐셔너 풀리 시장은 2024년 3억 3,250만 달러에 달했으며, 주요 지역 기업로서 입지를 굳힐 것으로 예측됩니다. 중국은 세계 최대 자동차 생산국 중 하나이며, 자동차 생산량 증가와 연비가 좋은 자동차에 대한 소비자 수요 증가로 인해 첨단 벨트 텐셔너 풀리 시스템의 필요성이 증가하고 있습니다. 물류의 성장과 차량 관리 프로그램에 의해 구동되는 상용차 차량의 확대는 이러한 구성 요소에 대한 수요를 더욱 촉진하고 있습니다. 자동차 산업이 계속 발전함에 따라 벨트 텐셔너 풀리는 다양한 차량 카테고리에서 원활한 엔진 성능을 보장하는 데 필수적인 요소로 남아 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 상황

- 제조업체

- 부품 공급업체

- 서비스 제공업체

- 유통업체

- 최종 용도

- 이익률 분석

- 기술 혁신 상황

- 주요 뉴스와 이니셔티브

- 비용 분석

- 가격 동향

- 재료 성능 비교 분석

- 특허 분석

- 규제 상황

- 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추산 및 예측 : 제품별, 2021년-2034년

- 주요 동향

- 자동 벨트 텐셔너 풀리

- 수동 벨트 텐셔너 풀리

제6장 시장 추산 및 예측 : 차량별, 2021년-2034년

- 주요 동향

- 승용차

- 해치백

- 세단

- SUV

- 상용차

- 소형 상용차(LCV)

- 중형 상용차(MCV)

- 대형 상용차(HCV)

제7장 시장 추산 및 예측 : 재료별, 2021년-2034년

- 주요 동향

- 금속

- 플라스틱

제8장 시장 추산 및 예측 : 용도별, 2021년-2034년

- 주요 동향

- 엔진 타이밍 시스템

- 얼터네이터 시스템

- 파워 스티어링 시스템

- 에어컨 시스템

- 워터 펌프 시스템

- 기타

제9장 시장 추산 및 예측 : 최종 용도별, 2021년-2034년

- 주요 동향

- OEM

- 애프터마켓

제10장 시장 추산 및 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 북유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카공화국

- 사우디아라비아

제11장 기업 개요

- ACDelco

- Bando Chemical Industries

- BorgWarner

- Cloyes Gear &Products

- Continental

- Dayco Products

- Fenner

- Gates

- Goodyear Belts

- Hutchinson

- INA Tensioner

- JTEKT

- Litens Automotive

- Mitsuboshi Belting

- NSK Automation

- NTN

- Pricol Limited

- Schaeffler

- SKF Group

- Tsubakimoto Chain

The Global Automotive Belt Tensioner Pulleys Market was valued at USD 3.2 billion in 2024 and is projected to grow at a CAGR of 4.1% between 2025 and 2034. This market is witnessing steady growth, driven by the increasing production of passenger and commercial vehicles worldwide. Automotive belt tensioner pulleys play a critical role in maintaining proper belt tension, reducing wear and tear, and optimizing engine efficiency. As vehicle manufacturers focus on high-performing, fuel-efficient, and durable engines, the demand for these components continues to rise.

The rapid expansion of the automotive industry, particularly in emerging economies, is further propelling market growth. Stringent regulatory standards aimed at reducing emissions and improving fuel efficiency have prompted automakers to integrate advanced tensioning solutions. Innovations in belt drive systems, including lightweight and high-durability materials, are enhancing the performance of belt tensioner pulleys. Additionally, the rising adoption of electric and hybrid vehicles is reshaping market dynamics, creating opportunities for specialized tensioning solutions tailored for advanced powertrain systems. With a shift towards sustainable mobility and modular engine designs, manufacturers are focusing on developing belt tensioner pulleys that ensure consistent performance under varying operating conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.1% |

The market is segmented into two primary product categories: automatic and manual belt tensioner pulleys. The automatic belt tensioner pulleys segment garnered a valuation of USD 1.5 billion in 2024, holding a significant market share. These self-adjusting pulleys are preferred across vehicle models as they maintain optimal belt tension without manual intervention, enhancing engine longevity and efficiency. The increasing demand for low-maintenance, high-precision components in modern vehicles is fueling the expansion of this segment.

The automotive belt tensioner pulleys market is also categorized by end-use applications, including original equipment manufacturers (OEM) and aftermarket sales. In 2024, the OEM segment accounted for 65% of the market share and is expected to grow steadily. Automakers are integrating custom-engineered belt tensioner pulleys to improve engine performance, meet fuel efficiency regulations, and enhance durability. The push for next-generation engine designs and modular belt drive systems in electric and hybrid vehicles is accelerating the adoption of advanced tensioner pulleys in the OEM sector.

China automotive belt tensioner pulleys market generated USD 332.5 million in 2024, cementing its position as a key regional player. With the country being one of the largest automotive manufacturers globally, rising vehicle production and increasing consumer demand for fuel-efficient automobiles are boosting the need for advanced belt tensioner pulley systems. The expansion of commercial vehicle fleets, driven by logistics growth and fleet management programs, is further driving demand for these components. As the automotive industry continues evolving, belt tensioner pulleys remain indispensable in ensuring seamless engine performance across various vehicle categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Component suppliers

- 3.2.3 Service providers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Cost analysis

- 3.7 Price trend

- 3.8 Comparative analysis of material performance

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Increasing vehicle production and aftermarket demand

- 3.11.1.2 Advancements in belt drive systems

- 3.11.1.3 Growing demand for electric and hybrid vehicles

- 3.11.1.4 Stringent emission and fuel efficiency regulations

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Durability and performance limitations

- 3.11.2.2 Fluctuations in raw material prices

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Automatic belt tensioner pulleys

- 5.3 Manual belt tensioner pulleys

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicle

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Metal

- 7.3 Plastic

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Engine timing system

- 8.3 Alternator system

- 8.4 Power steering system

- 8.5 Air conditioning system

- 8.6 Water pump system

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ACDelco

- 11.2 Bando Chemical Industries

- 11.3 BorgWarner

- 11.4 Cloyes Gear & Products

- 11.5 Continental

- 11.6 Dayco Products

- 11.7 Fenner

- 11.8 Gates

- 11.9 Goodyear Belts

- 11.10 Hutchinson

- 11.11 INA Tensioner

- 11.12 JTEKT

- 11.13 Litens Automotive

- 11.14 Mitsuboshi Belting

- 11.15 NSK Automation

- 11.16 NTN

- 11.17 Pricol Limited

- 11.18 Schaeffler

- 11.19 SKF Group

- 11.20 Tsubakimoto Chain