|

시장보고서

상품코드

1913474

상용차 ADAS 시장 예측 : 기회, 성장 요인, 업계 동향 분석(2026-2035년)Commercial Vehicle ADAS Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

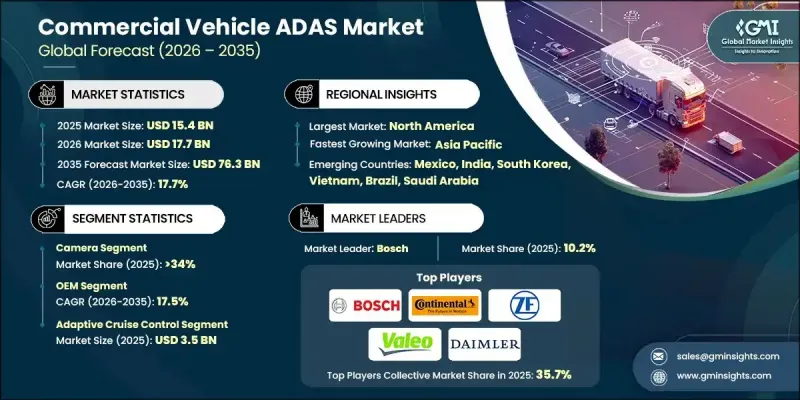

세계 상용차 ADAS 시장은 2025년 154억 달러로 평가되었으며, 2035년까지 연평균 복합 성장률(CAGR) 17.7%로 성장해 763억 달러에 이를 것으로 예측됩니다.

이 강한 성장세는 도로안전에 대한 규제당국의 주목도가 높아지고, 상용차의 사고 관련 비용 절감에 중시가 증대됨에 따라 견인되고 있습니다. 차량 소유자와 운영자는 ADAS(첨단 운전 지원 시스템)를 운영상의 안전성과 효율성을 향상시키는 데 필요한 도구로 점점 인식하고 있습니다. 이 시스템은 운전자 인식 향상, 차량 제어 개선, 수동 작동 의존도 감소를 통해 운전자를 지원합니다. 운송 회사가 위험 완화와 안전 요건 준수를 우선시함에 따라 도입이 가속화되고 있습니다. 기술 진보가 수요를 더욱 강화하고 있으며, 인공지능과 머신러닝에 의해 데이터 처리의 고속화와 실시간 의사결정의 정밀도 향상이 실현되고 있습니다. 이러한 혁신은 차량의 응답성을 높이고 전체 시스템의 신뢰성을 향상시킵니다. 세계 상용 운송 활동이 증가함에 따라 ADAS 통합은 현대 차량 설계 및 차량 관리 전략의 핵심 요소로 계속 주목을 받고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2025년 |

| 예측 연도 | 2026-2035년 |

| 시작 금액 | 154억 달러 |

| 예측 금액 | 763억 달러 |

| CAGR | 17.7% |

OEM 채널 부문은 2026년부터 2035년까지 연평균 복합 성장률(CAGR) 17.5%로 성장할 전망입니다. 자동차 제조업체는 생산 공정에서 ADAS를 직접 통합하므로 고급 안전 기능을 표준 장비 또는 맞춤형 옵션으로 제공할 수 있습니다. 이 접근법은 시스템 호환성과 성능을 향상시키고 일관된 품질 기준을 보장하므로 유통 구조에서 OEM의 견고한 지위를 설명합니다.

어댑티브 크루즈 컨트롤(ACC) 부문은 2025년 35억 달러에 달했습니다. 이 부문은 교통 흐름에 따라 속도를 자동으로 조절하여 장시간 운전 조건 하에서 운전자의 편안함을 지원하고 차량의 안정적인 운전을 유지할 수 있기 때문에 주도적 지위를 유지합니다.

미국 상용차 ADAS 시장은 2025년 39억 달러에 달했습니다. 사고 위험과 운용 비용 증가를 다루기 위해 차량 사업자가 선진 안전 기술을 요구하고 수요가 증가했습니다. 인적 요인으로 인한 운전 실수 감소에 대한 주력은 국내 상용차 차량 전체에서 ADAS 도입의 중요성을 지속적으로 강화하고 있습니다.

자주 묻는 질문

목차

제1장 조사 방법

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급업체 현황

- 수익률

- 비용 구조

- 단계별 부가가치

- 밸류체인에 영향을 주는 요인

- 혁신

- 업계에 미치는 영향요인

- 성장 촉진요인

- 상용차에 대한 정부의 엄격한 안전규제

- 대형 및 상용 차량 관련 교통 사고 증가

- 플릿 안전 대책 및 텔레매틱스 솔루션 도입 확대

- 전자상거래와 라스트마일 배송 차량의 급속한 성장

- 업계의 잠재적 위험 및 과제

- 가혹한 기상 조건 및 도로 상황에서의 신뢰성 과제

- 기존 차량에 ADAS 개설의 복잡성

- 시장 기회

- 전기 상용차에서 ADAS 수요 증가

- 신흥 시장 및 개발도상 경제권에서의 성장 가능성

- ADAS와 V2X 통신 시스템의 통합

- 노후화된 차량을 위한 ADAS 개조 솔루션 확장

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미

- 연방 자동차 안전 기준(FMVSS)

- IIHS 상용차 안전 평가 프로그램

- SAE 인터내셔널 첨단운전지원시스템(ADAS) 및 자동운전기준

- 캐나다 운수성 자동차 안전 규제

- 유럽

- EU 일반안전규제(EU)

- 유엔 유럽 경제위원회(UNECE) 차량 규제

- 유로 NCAP 상용차 안전 평가 프로토콜

- EU 도로 안전 정책의 틀

- 아시아태평양

- 일본의 국토교통성에 의한 ADAS 안전규제

- 지능형 및 커넥티드 차량을 위한 중국 GB 표준

- 중국 신차 평가 프로그램(C-NCAP) ADAS 평가 가이드라인

- 인도 상용차 안전 기준(AIS)

- 라틴아메리카

- 라틴 NCAP 안전 평가 프로토콜

- 브라질 국가 도로 교통국(CONTRAN) 차량 안전 결의

- 아르헨티나 국가교통안전규제

- 멕시코 NOM 차량 안전 기준

- 중동 및 아프리카

- 아랍에미리트(UAE) 연방 교통 안전 규정

- 남아프리카공화국 도로 교통법 차량 기준

- 북미

- Porter's Five Forces 분석

- PESTEL 분석

- 기술과 혁신 동향

- 현재의 기술 동향

- 신규 기술

- 가격 동향

- 지역별

- 제품별

- 코스트 내역 분석

- 지속가능성과 환경영향

- 환경 영향 평가

- 사회적 영향과 지역사회에의 공헌

- 거버넌스와 기업의 사회적 책임

- 지속 가능한 금융과 투자 동향

- 리스크 평가

- 시장 위험

- 기술적 위험

- 규제 및 규정 준수 위험

- 사이버 보안 및 데이터 프라이버시 위험

- 리스크 경감 전략

- 사례 연구

- 전망과 기회

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병 및 인수

- 제휴 및 협업

- 신제품 발매

- 사업 확대 계획과 자금 조달

제5장 시장 추정 및 예측 : 시스템별, 2022-2035

- 적응형 크루즈 컨트롤(ACC)

- 사각지대감지 시스템

- 차선 일탈 경보 시스템

- 자동 긴급 브레이크(AEM)

- 전방 충돌 경보

- 야간 주행 보조 시스템

- 운전자 모니터링 시스템

- 타이어 공압 감시 시스템

- 헤드업 디스플레이

- 주차 지원 시스템

- 기타

제6장 시장 추정 및 예측 : 센서별, 2022-2035

- 레이더

- 라이더

- 초음파

- 카메라

- 기타

제7장 시장 추정 및 예측 : 차종별, 2022-2035

- LCV

- MCV

- 대형 상용차(HCV)

제8장 시장추정 및 예측 : 레벨별, 2022-2035

- 레벨 1

- 레벨 2

- 레벨 3

- 레벨 4

제9장 시장추정 및 예측 : 추진력별, 2022-2035

- 내연기관(ICE)

- 전기자동차(EV)

- 하이브리드

제10장 시장추정 및 예측 : 유통채널별, 2022-2035

- OEM

- 애프터마켓

제11장 시장추정 및 예측 : 지역별, 2022-2035

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 베네룩스

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ANZ

- 싱가포르

- 말레이시아

- 인도네시아

- 베트남

- 태국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 콜롬비아

- 중동 및 아프리카(MEA)

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제12장 기업 프로파일

- 세계기업

- Bosch

- Continental

- ZF Friedrichshafen

- Valeo

- Denso

- Mobileye

- Magna

- Autoliv

- Hyundai Mobis

- Aptiv

- Knorr-Bremse

- Forvia(Hella)

- Daimler

- Volvo

- Ford

- 지역 기업

- Stoneridge

- Brigade Electronics

- Seeing Machines

- MAN Truck & Bus

- Iveco

- Gauzy

- Renault

- 신규기업

- Huawei

- Horizon Robotics

- Black Sesame

- Applied Intuition

The Global Commercial Vehicle ADAS Market was valued at USD 15.4 billion in 2025 and is estimated to grow at a CAGR of 17.7% to reach USD 76.3 billion by 2035.

Strong momentum is driven by increasing regulatory focus on road safety and the growing emphasis on reducing accident-related costs within commercial fleets. Fleet owners and operators increasingly view advanced driver assistance technologies as essential tools for improving operational safety and efficiency. These systems support drivers by enhancing awareness, improving vehicle control, and reducing dependence on manual intervention. Adoption has accelerated as transportation companies prioritize risk mitigation and compliance with safety requirements. Technological progress has further strengthened demand, with artificial intelligence and machine learning enabling faster data processing and more accurate real-time decision-making. These innovations enhance vehicle responsiveness and improve overall system reliability. As commercial transport activity increases worldwide, the integration of ADAS continues to gain traction as a critical component of modern vehicle design and fleet management strategies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $15.4 Billion |

| Forecast Value | $76.3 Billion |

| CAGR | 17.7% |

The OEM channel segment will grow at a CAGR of 17.5% from 2026 to 2035. Vehicle manufacturers integrate ADAS directly during production, allowing advanced safety features to be offered as built-in or configurable options. This approach improves system compatibility and performance while ensuring consistent quality standards, which explains the strong position of OEMs within the distribution landscape.

The adaptive cruise control segment reached USD 3.5 billion in 2025. This segment maintained its leadership due to its ability to support driver comfort and maintain consistent vehicle operation during extended driving conditions by automatically regulating speed based on traffic flow.

U.S. Commercial Vehicle ADAS Market reached USD 3.9 billion in 2025. Demand increased as fleet operators sought advanced safety technologies to address accident risks and rising operational expenses. The focus on reducing human-related driving errors continued to reinforce the importance of ADAS adoption across commercial fleets in the country.

Key companies operating in the Global Commercial Vehicle ADAS Market include Continental, Bosch, Magna, Mobileye, ZF Friedrichshafen, Denso, Volvo, Valeo, Ford, and Daimler. Companies active in the Global Commercial Vehicle ADAS Market strengthen their market position through continuous innovation, strategic partnerships, and large-scale production capabilities. Manufacturers invest heavily in research and development to enhance system accuracy, reliability, and real-time processing capabilities. Collaboration with vehicle manufacturers enables seamless integration of ADAS at the production stage. Firms also focus on expanding product portfolios to address diverse vehicle categories and fleet requirements. Cost optimization and scalable manufacturing help companies remain competitive while meeting growing demand.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Sensor

- 2.2.4 Vehicle Category

- 2.2.5 Level

- 2.2.6 Propulsion

- 2.2.7 Distribution Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent government safety regulations for commercial vehicles

- 3.2.1.2 Rising road accidents involving heavy and commercial vehicles

- 3.2.1.3 Growing adoption of fleet safety and telematics solutions

- 3.2.1.4 Rapid growth of e-commerce and last-mile delivery fleets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Reliability issues in harsh weather and road conditions

- 3.2.2.2 Complexity in retrofitting ADAS in existing vehicles

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing demand for ADAS in electric commercial vehicles

- 3.2.3.2 Growth potential in emerging markets and developing economies

- 3.2.3.3 Integration of ADAS with V2X communication systems

- 3.2.3.4 Expansion of ADAS retrofitting solutions for aging fleets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 Federal Motor Vehicle Safety Standards (FMVSS)

- 3.4.1.2 IIHS Commercial Vehicle Safety Evaluation Programs

- 3.4.1.3 SAE International ADAS and Automated Driving Standards

- 3.4.1.4 Transport Canada Motor Vehicle Safety Regulations

- 3.4.2 Europe

- 3.4.2.1 EU General Safety Regulation (EU)

- 3.4.2.2 UNECE Vehicle Regulations

- 3.4.2.3 Euro NCAP Commercial Vehicle Safety Rating Protocols

- 3.4.2.4 EU Road Safety Policy Framework

- 3.4.3 Asia Pacific

- 3.4.3.1 Japan MLIT Safety Regulations for ADAS

- 3.4.3.2 China GB Standards for Intelligent and Connected Vehicles

- 3.4.3.3 China NCAP (C-NCAP) ADAS Evaluation Guidelines

- 3.4.3.4 India AIS Standards for Commercial Vehicle Safety

- 3.4.4 Latin America

- 3.4.4.1 Latin NCAP Safety Assessment Protocols

- 3.4.4.2 Brazil CONTRAN Vehicle Safety Resolutions

- 3.4.4.3 Argentina National Traffic Safety Regulations

- 3.4.4.4 Mexico NOM Vehicle Safety Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Federal Traffic Safety Regulations

- 3.4.5.2 South Africa National Road Traffic Act Vehicle Standards

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Sustainability and environmental impact

- 3.10.1 Environmental impact assessment

- 3.10.2 Social impact & community benefits

- 3.10.3 Governance & corporate responsibility

- 3.10.4 Sustainable finance & investment trends

- 3.11 Risk Assessment

- 3.11.1 Market risks

- 3.11.2 Technological risks

- 3.11.3 Regulatory and compliance risks

- 3.11.4 Cybersecurity and data privacy risks

- 3.11.5 Risk mitigation strategies

- 3.12 Case studies

- 3.13 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2022 - 2035 ($Bn, units)

- 5.1 Key trends

- 5.2 Adaptive cruise control

- 5.3 Blind spot detection

- 5.4 Lane departure warning system

- 5.5 Automatic emergency braking (AEM)

- 5.6 Forward collision warning

- 5.7 Night vision system

- 5.8 Driver monitoring

- 5.9 Tire pressure monitoring system

- 5.10 Head-up display

- 5.11 Park assist system

- 5.12 Others

Chapter 6 Market Estimates & Forecast, By Sensor, 2022 - 2035 ($Bn, units)

- 6.1 Key trends

- 6.2 Radar

- 6.3 Lidar

- 6.4 Ultrasonic

- 6.5 Camera

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Vehicle Category, 2022 - 2035 ($Bn, units)

- 7.1 Key trends

- 7.2 LCV

- 7.3 MCV

- 7.4 HCV

Chapter 8 Market Estimates & Forecast, By Level, 2022 - 2035 ($Bn, units)

- 8.1 Key trends

- 8.2 Level-1

- 8.3 Level-2

- 8.4 Level-3

- 8.5 Level-4

Chapter 9 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, units)

- 9.1 Key trends

- 9.2 ICE

- 9.3 EV

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($Bn, units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Singapore

- 11.4.7 Malaysia

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.4.10 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 Bosch

- 12.1.2 Continental

- 12.1.3 ZF Friedrichshafen

- 12.1.4 Valeo

- 12.1.5 Denso

- 12.1.6 Mobileye

- 12.1.7 Magna

- 12.1.8 Autoliv

- 12.1.9 Hyundai Mobis

- 12.1.10 Aptiv

- 12.1.11 Knorr-Bremse

- 12.1.12 Forvia (Hella)

- 12.1.13 Daimler

- 12.1.14 Volvo

- 12.1.15 Ford

- 12.2 Regional companies

- 12.2.1 Stoneridge

- 12.2.2 Brigade Electronics

- 12.2.3 Seeing Machines

- 12.2.4 MAN Truck & Bus

- 12.2.5 Iveco

- 12.2.6 Gauzy

- 12.2.7 Renault

- 12.3 Emerging companies

- 12.3.1 Huawei

- 12.3.2 Horizon Robotics

- 12.3.3 Black Sesame

- 12.3.4 Applied Intuition