|

시장보고서

상품코드

1708186

금속화 배리어 필름 포장 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Metalized Barrier Film Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

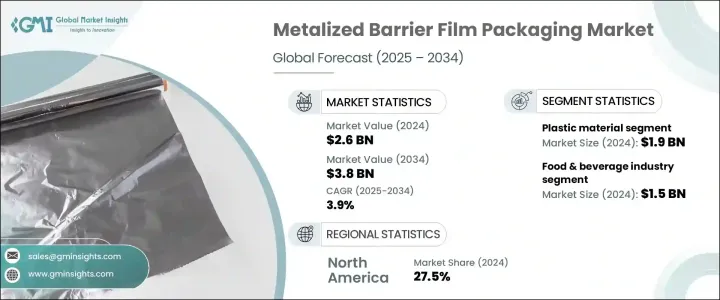

금속화 배리어 필름 포장 세계 시장은 2024년에 26억 달러로 평가되었고, 2025년부터 2034년까지 연평균 3.9% 성장할 것으로 예측됩니다.

이러한 성장의 주요 요인은 제약업계 수요 증가와 다양한 분야에서 유통기한 연장에 대한 요구가 증가하고 있기 때문입니다. 금속화 배리어 필름은 환경적 요인으로부터 높은 보호 기능을 제공하여 포장된 제품의 신선도, 맛, 영양 품질을 유지합니다. 세계화가 진행되고 포장 식품 및 가공 식품에 대한 소비자의 선호도가 높아짐에 따라 제조업체는 운송 시간이 길어지더라도 제품의 무결성을 보장할 수 있는 이러한 필름에 주목하고 있습니다. 특히, 제약 분야에서는 물집 팩과 의료용 파우치에서 이러한 필름의 혜택을 누리고 있으며, 민감한 의약품을 확실하게 보호하고 있습니다. 높은 장벽 솔루션과 규제 표준 준수에 중점을 둔 제조업체들은 이 분야에서 더 많은 채택을 할 것으로 예측됩니다.

유통기한 연장에 대한 수요도 시장 확대를 촉진하는 중요한 요소입니다. 이 필름은 포장된 식품, 의약품, 화장품을 효과적으로 보호하고 부패를 방지하며 장기간 품질을 유지합니다. 소비자의 라이프 스타일이 빠르게 변화함에 따라 조리된 식품과 가공식품에 대한 선호도가 높아짐에 따라 고급 포장 솔루션에 대한 수요가 증가하고 있습니다. 또한 전자상거래와 국제 무역 증가로 인해 운송 및 보관 중에 제품을 보호하는 견고한 배리어 필름에 대한 수요가 증가하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 26억 달러 |

| 예상 금액 | 38억 달러 |

| CAGR | 3.9% |

시장은 재료별로 분류되며, 플라스틱이 이 분야를 지배하고 2024년 19억 달러를 차지했습니다. 플라스틱 기반 금속화 필름은 경량성, 비용 효율성 및 유연성으로 인해 선호되고 있습니다. 소비자들이 휴대 가능하고 편리한 포장을 선택함에 따라 연질 플라스틱 필름은 점점 더 많은 견인력을 얻고 있습니다. 제품의 신선도를 유지하면서 방부제의 필요성을 줄일 수 있어 대량 생산 용도에 적합합니다. 이러한 추세는 품질 유지를 위해 우수한 포장을 필요로 하는 조리된 식품 및 음료의 인기가 높아짐에 따라 더욱 가속화되고 있습니다.

최종 사용 산업별로는 음료 및 식품 부문이 2024년 15억 달러로 가장 큰 기여를 했습니다. 이 부문의 성장은 급속한 도시화와 소비자 습관의 변화로 인해 포장된 즉시 먹을 수 있는 제품을 선호하기 때문입니다. 금속화 배리어 필름은 스낵, 커피, 유제품 및 기타 포장 식품에 널리 사용되어 화학 방부제에 의존하지 않고 신선도를 유지하고 부패를 방지합니다. 지속 가능한 포장에 대한 규제 강화와 친환경 솔루션에 대한 소비자의 요구는 이 부문의 채택을 더욱 촉진하고 있습니다.

북미는 2024년 세계 시장 점유율의 27.5%를 차지했으며, 배리어성 포장에 대한 수요 증가와 전자상거래 부문의 급격한 성장이 그 원동력이 되고 있습니다. 지속 가능한 포장재 채택에 대한 정부의 지원과 소비자의 선호도 변화는 금속화 배리어 필름 포장의 채택을 촉진하고 있습니다. 미국은 2024년 5억 2,390만 달러로 이 지역 시장을 주도했습니다. 운송 중 제품의 무결성을 유지하기 위해 고성능 포장을 필요로 하는 포장 식품에 대한 수요 증가가 그 이유입니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 업계에 대한 영향요인

- 성장 촉진요인

- 업계의 잠재적 리스크&과제

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 향후 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 주요 시장 기업 - 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추산 및 예측 : 재료별, 2021년-2034년

- 주요 동향

- 플라스틱

- 폴리프로필렌(PP)

- 폴리에틸렌 테레프탈레이트(PET)

- 폴리아미드(PA)

- 폴리에틸렌(PE)

- 나일론

- 기타

- 금속

제6장 시장 추산 및 예측 : 최종 이용 산업별, 2021년-2034년

- 주요 동향

- 식품 및 음료

- 의약품

- 일렉트로닉스

- 퍼스널케어 및 화장품

- 기타

제7장 시장 추산 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 아랍에미리트(UAE)

제8장 기업 개요

- Aerolam Group

- Amcor

- Cosmo Films

- Dunmore

- Ester Industries

- Finfoil

- Flex Films

- Jindal Films

- Kolon Industries

- Nahar PolyFilms

- PC Laminations

- SRF

- Sumilon Group

- Taghleef Industries

- Toray

- Zhejiang Changyu New Materials

The Global Metalized Barrier Film Packaging Market, valued at USD 2.6 billion in 2024, is expected to grow at a CAGR of 3.9% from 2025 to 2034. This growth is primarily driven by rising demand from the pharmaceutical industry and the increasing need for extended shelf life across various sectors. Metalized barrier films provide high protection against environmental factors, preserving the freshness, flavor, and nutritional quality of packaged goods. As globalization and consumer preferences for packaged and processed foods increase, manufacturers are turning to these films to ensure product integrity during extended transit times. The pharmaceutical sector, in particular, benefits from these films in blister packs and medical pouches, ensuring the protection of sensitive drugs. Manufacturers focusing on high-barrier solutions and adherence to regulatory standards will see increased adoption in this sector.

The need for longer shelf life is another significant factor fueling market expansion. These films effectively safeguard packaged foods, pharmaceuticals, and cosmetics, preventing spoilage and maintaining quality over time. As consumer lifestyles become more fast-paced, there is a greater inclination toward ready-to-eat and processed food products, driving demand for advanced packaging solutions. In addition, the rise in e-commerce and global trade has heightened the need for robust barrier films to protect products during transportation and storage.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 3.9% |

The market is segmented by material, with plastic dominating this space, accounting for USD 1.9 billion in 2024. Plastic-based metalized films are preferred due to their lightweight nature, cost-efficiency, and flexibility. As consumers increasingly opt for portable and convenient packaging, flexible plastic films gain traction. Their ability to reduce the need for preservatives while maintaining product freshness makes them ideal for high-volume applications. This trend is further supported by the growing popularity of ready-to-eat foods and beverages, which require superior packaging to retain their quality.

By end-use industry, the food and beverage segment is the largest contributor, with a valuation of USD 1.5 billion in 2024. The segment's growth is attributed to rapid urbanization and changing consumer habits, which favor packaged and ready-to-eat products. Metalized barrier films are widely used in snacks, coffee, dairy, and other packaged foods, preserving freshness and preventing spoilage without relying on chemical preservatives. Increasing regulatory emphasis on sustainable packaging and consumer demand for eco-friendly solutions further boost adoption in this segment.

North America held 27.5% of the global market share in 2024, driven by the rising need for high-barrier packaging and the rapid growth of the e-commerce sector. Government support for adopting sustainable packaging materials, combined with changing consumer preferences, is promoting the adoption of metalized barrier film packaging. The United States led the regional market, accounting for USD 523.9 million in 2024, fueled by the growing demand for packaged foods that require high-performance packaging to maintain product integrity during transportation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for extended shelf life

- 3.2.1.2 Advancements in sustainable barrier coatings

- 3.2.1.3 Booming e-commerce & food delivery services

- 3.2.1.4 Rapid urbanization and busy lifestyles

- 3.2.1.5 Growing demand in pharmaceutical packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited recycling & sustainability issues

- 3.2.2.2 Competition from biodegradable alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastics

- 5.2.1 Polypropylene (PP)

- 5.2.2 Polyethylene Terephthalate (PET)

- 5.2.3 Polyamide (PA)

- 5.2.4 Polyethylene (PE)

- 5.2.5 Nylon

- 5.2.6 Others

- 5.3 Metals

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Pharmaceuticals

- 6.4 Electronics

- 6.5 Personal care and cosmetics

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Aerolam Group

- 8.2 Amcor

- 8.3 Cosmo Films

- 8.4 Dunmore

- 8.5 Ester Industries

- 8.6 Finfoil

- 8.7 Flex Films

- 8.8 Jindal Films

- 8.9 Kolon Industries

- 8.10 Nahar PolyFilms

- 8.11 PC Laminations

- 8.12 SRF

- 8.13 Sumilon Group

- 8.14 Taghleef Industries

- 8.15 Toray

- 8.16 Zhejiang Changyu New Materials