|

시장보고서

상품코드

1708222

고차단성 포장 필름 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)High Barrier Packaging Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

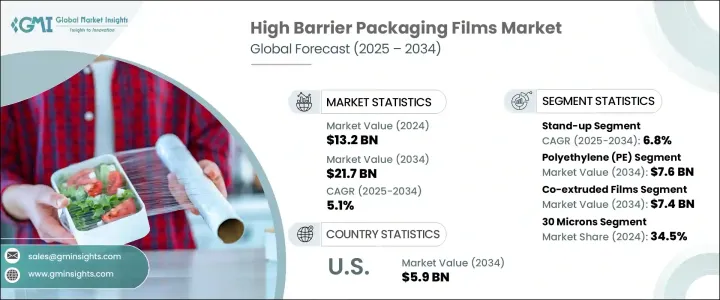

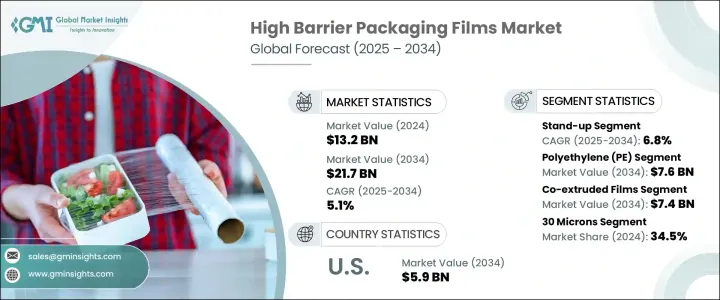

세계의 고차단성 포장 필름 시장은 2024년에 132억 달러를 창출하며, 의약품 분야의 급성장, E-Commerce의 확대, 온라인 식품 택배 서비스의 인기 증대에 의해 촉진되며, 2025-2034년에 CAGR 5.1%로 성장할 것으로 예상되고 있습니다.

제약회사가 혁신과 확장을 거듭하는 가운데, 민감한 제품을 보호하는 첨단 포장 솔루션의 필요성이 더욱 중요해지고 있습니다. 포장용 하이배리어 필름은 의약품의 유통기한을 연장하는 동시에 습기, 산소 및 기타 오염물질에 대한 최적의 보호를 보장합니다. 또한 급성장하는 E-Commerce 산업과 온라인 식품 배송 서비스의 급격한 증가는 운송 및 보관 중에도 제품의 무결성을 유지하는 고성능 포장에 대한 수요를 더욱 부추기고 있습니다. 안전하고 위생적이며 지속가능한 포장에 대한 소비자의 기대치가 높아진 것도 시장 성장에 기여하고 있습니다. 또한 환경 보호에 대한 인식이 높아짐에 따라 재활용 가능하고 생분해성 및 장벽이 높은 소재에 대한 투자가 증가하면서 순환 경제의 목표에 부합하도록 제조업체의 투자를 촉진하고 있습니다.

이 시장에는 스탠드업 파우치, 플랫 파우치, 가방 및 자루, 물집 및 클램쉘, 랩 및 리딩 필름, 향 주머니 및 스틱 팩 등 다양한 포장 형태가 포함됩니다. 이 중 스탠드업 파우치는 2034년까지 6.8%의 연평균 복합 성장률(CAGR)로 가장 높은 성장률을 보일 것으로 예측됩니다. 이러한 성장은 특히 스낵 및 조리된 식품과 같이 가볍고 장벽이 높은 연포장에 대한 소비자의 선호도가 높아졌기 때문으로 분석됩니다. 제조업체들은 편의성과 지속가능성에 대한 소비자의 요구에 부응하기 위해 고품질의 재활용 가능한 소재를 채택하고 고급 리실러블 기능을 통합하고 있습니다. 플라스틱 폐기물에 대한 환경적 우려가 커지면서 업계는 제품의 안전성과 신선도를 유지하면서 환경에 미치는 영향을 줄일 수 있는 포장 솔루션을 개발하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 시작 금액 | 132억 달러 |

| 예상 금액 | 217억 달러 |

| CAGR | 5.1% |

고차단성 포장 필름 시장은 폴리에틸렌(PE), 폴리프로필렌(PP), 폴리에틸렌 테레프탈레이트(PET), 폴리염화비닐리덴(PVDC), 에틸렌비닐알코올(EVOH), 폴리아미드(나일론), 기타로 분류됩니다. 폴리에틸렌(PE)이 이 부문을 지배하고 있으며, 2034년까지 76억 달러에 달할 것으로 예측됩니다. 규제 요건과 고객의 기대에 부응하기 위해 기업이 지속가능한 관행을 중시함에 따라 재활용 가능한 바이오 PE 소재로의 전환이 눈에 띄게 진행되고 있습니다. 각 제조업체는 우수한 산소 차단 및 수분 차단 기능을 갖춘 혁신적인 모노매트리얼 PE 필름을 개발하여 지속가능성을 촉진하면서 제품을 보호하고 있습니다. 이러한 PE 소재의 첨단 포장은 이 부문의 성장을 가속하고 친환경 포장에 대한 수요 증가에 부응하고 있습니다.

북미 고차단성 포장 필름 시장은 2024년 38.4%의 점유율을 차지할 것으로 예상되며, 간편식 및 조리식품에 대한 수요 증가에 힘입어 성장세를 이어갈 것으로 전망됩니다. 유통기한이 길고 신선도가 오래 지속되는 포장 식품에 대한 소비자 선호도가 높아짐에 따라 고배리어 포장 솔루션에 대한 수요는 지속적으로 증가하고 있습니다. 이 지역에서는 포장된 냉동식품, 스낵, 식품 트레이의 소비가 눈에 띄게 증가하고 있으며, 이는 고차단성 포장 필름의 채택을 더욱 촉진하고 있습니다. 또한 이 지역은 기술 혁신에 중점을 두고 있으며, 지속가능하고 친환경적인 포장 솔루션에 대한 요구가 증가함에 따라 북미 시장 지배적 지위를 유지할 것으로 예측됩니다.

목차

제1장 조사 방법과 조사 범위

제2장 개요

제3장 업계 인사이트

- 에코시스템 분석

- 업계에 대한 영향요인

- 촉진요인

- E-Commerce와 온라인 식품 딜리버리의 성장

- 제약 산업의 확대

- 진공포장과 가스치환포장(MAP)의 수요 증가

- 유제품·육류 포장 업계의 확대

- 급속한 도시화와 라이프스타일의 변화가 포장 상품을 촉진

- 업계의 잠재적 리스크 & 과제

- 첨단 배리어 필름의 높은 제조 비용

- 원료 공급에 영향을 미치는 석유화학제품 가격의 변동

- 촉진요인

- 성장 가능성 분석

- 규제 상황

- 기술 상황

- 향후 시장 동향

- 갭 분석

- Porter의 산업 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추산·예측 : 재료 유형별, 2021-2034년

- 주요 동향

- 폴리에틸렌(PE)

- 폴리프로필렌(PP)

- 폴리에틸렌 테레프탈레이트(PET)

- 폴리 염화 비닐리덴(PVDC)

- 에틸렌 비닐 알코올(EVOH)

- 폴리아미드(나일론)

- 기타

제6장 시장 추산·예측 : 포장 형태별, 2021-2034년

- 주요 동향

- 스탠딩 파우치

- 플랫 파우치

- 백 & 자루

- 블리스터 & 클램쉘

- 랩·리딩 필름

- 사쉐·스틱 팩

제7장 시장 추산·예측 : 기술별, 2021-2034년

- 주요 동향

- 공압출 필름

- 메탈라이즈드 필름

- 스퍼터링 필름

- 원자층 증착(ALD) 필름

- 라미네이트 필름

제8장 시장 추산·예측 : 막후별, 2021-2034년

- 주요 동향

- 30미크론 미만

- 30-50미크론

- 50-70미크론

- 70미크론 이상

제9장 시장 추산·예측 : 용도 유형별, 2021-2034년

- 주요 동향

- 신선식품 포장

- 가공식품 포장

- 음료 포장

- 헬스케어 제품

- 퍼스널케어와 화장품

- 산업용 부품

- 농산물

제10장 시장 추산·예측 : 최종 용도 산업별, 2021-2034년

- 주요 동향

- 식품 및 음료

- 의약품·의료

- 전자·반도체

- 산업용

- 기타

제11장 시장 추산·예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 아랍에미리트

제12장 기업 개요

- 3M

- ACG

- Amcor

- Bemis Manufacturing

- Berry Global

- Celplast Metallized Products

- Cosmo Films

- Innovia Films

- Jindal Poly Films

- Klockner Pentaplast

- Mitsubishi Chemical Advanced Materials

- Mondi

- Oike

- Perlen Packaging

- Sealed Air

- Sigma Plastics Group

- Sonoco Products

- Toppan

- Toray Plastics

- Uflex

- Winpak

The Global High Barrier Packaging Films Market generated USD 13.2 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2034, driven by the rapid growth of the pharmaceutical sector, the expansion of e-commerce, and the increasing popularity of online food delivery services. As pharmaceutical companies continue to innovate and expand, the need for advanced packaging solutions that protect sensitive products becomes more critical. High barrier packaging films ensure optimal protection against moisture, oxygen, and other contaminants while extending the shelf life of pharmaceuticals. Moreover, the booming e-commerce industry and the surge in online food delivery services have further fueled the demand for high-performance packaging that maintains product integrity during shipping and storage. Rising consumer expectations for secure, hygienic, and sustainable packaging have also contributed to market growth. Additionally, increasing environmental awareness is driving manufacturers to invest in recyclable, biodegradable, and high-barrier materials to align with circular economy goals.

The market encompasses a variety of packaging formats, including stand-up pouches, flat pouches, bags and sacks, blisters and clamshells, wraps and lidding films, and sachets and stick packs. Among these, stand-up pouches are projected to experience the highest growth, with a CAGR of 6.8% through 2034. This growth is largely attributed to the rising consumer preference for lightweight, high-barrier flexible packaging, particularly for snacks and ready-to-eat meals. Manufacturers are increasingly adopting high-quality recyclable materials and integrating advanced resealable features to meet consumer demands for convenience and sustainability. As environmental concerns about plastic waste intensify, industry players are developing packaging solutions that reduce environmental impact while maintaining product safety and freshness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.2 Billion |

| Forecast Value | $21.7 Billion |

| CAGR | 5.1% |

In terms of material type, the high barrier packaging films market is segmented into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinylidene chloride (PVDC), ethylene vinyl alcohol (EVOH), polyamide (nylon), and others. Polyethylene (PE) is expected to dominate the segment, reaching USD 7.6 billion by 2034. A notable shift is underway towards recyclable and bio-based PE materials as companies emphasize sustainable practices to meet regulatory requirements and customer expectations. Manufacturers are developing innovative mono-material PE films that offer superior oxygen and moisture barriers, ensuring product protection while promoting sustainability. These advancements in PE materials are driving the growth of this segment and catering to the rising demand for environmentally responsible packaging.

North America High Barrier Packaging Films Market held a 38.4% share in 2024, propelled by increasing demand for convenience foods and ready-to-eat meals. As consumer preferences shift towards packaged foods that provide extended shelf life and freshness, the demand for high-barrier packaging solutions continues to grow. The region is witnessing a notable rise in the consumption of prepackaged frozen meals, snacks, and food trays, which further boosts the adoption of high barrier packaging films. Additionally, the region's strong emphasis on innovation, combined with the growing need for sustainable and eco-friendly packaging solutions, is expected to maintain North America's dominant position in the market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in e-commerce and online food delivery

- 3.2.1.2 Expansion of pharmaceutical industry

- 3.2.1.3 Rising demand for vacuum and modified atmosphere packaging (MAP)

- 3.2.1.4 Expansion of the dairy and meat packaging industry

- 3.2.1.5 Rapid urbanization and changing lifestyles driving packaged goods

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs of advanced barrier films

- 3.2.2.2 Volatility in petrochemical prices affecting raw material supply

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Polyethylene (PE)

- 5.3 Polypropylene (PP)

- 5.4 Polyethylene Terephthalate (PET)

- 5.5 Polyvinylidene Chloride (PVDC)

- 5.6 Ethylene Vinyl Alcohol (EVOH)

- 5.7 Polyamide (Nylon)

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Packaging Format, 2021 - 2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Stand-up pouches

- 6.3 Flat pouches

- 6.4 Bags & sacks

- 6.5 Blisters & clamshells

- 6.6 Wraps & lidding films

- 6.7 Sachets & stick packs

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Co-extruded films

- 7.3 Metallized films

- 7.4 Sputtered films

- 7.5 Atomic Layer Deposition (ALD) Films

- 7.6 Laminated films

Chapter 8 Market Estimates & Forecast, By Film Thickness, 2021 - 2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Up to 30 microns

- 8.3 30-50 microns

- 8.4 50-70 microns

- 8.5 Above 70 microns

Chapter 9 Market Estimates & Forecast, By Application Type, 2021 - 2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 Fresh food packaging

- 9.3 Processed food packaging

- 9.4 Beverage packaging

- 9.5 Healthcare products

- 9.6 Personal care & cosmetics

- 9.7 Industrial components

- 9.8 Agricultural products

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion & Kilo Tons)

- 10.1 Key trends

- 10.2 Food & beverages

- 10.3 Pharmaceuticals & medical

- 10.4 Electronics & semiconductor

- 10.5 Industrial

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 3M

- 12.2 ACG

- 12.3 Amcor

- 12.4 Bemis Manufacturing

- 12.5 Berry Global

- 12.6 Celplast Metallized Products

- 12.7 Cosmo Films

- 12.8 Innovia Films

- 12.9 Jindal Poly Films

- 12.10 Klockner Pentaplast

- 12.11 Mitsubishi Chemical Advanced Materials

- 12.12 Mondi

- 12.13 Oike

- 12.14 Perlen Packaging

- 12.15 Sealed Air

- 12.16 Sigma Plastics Group

- 12.17 Sonoco Products

- 12.18 Toppan

- 12.19 Toray Plastics

- 12.20 Uflex

- 12.21 Winpak