|

시장보고서

상품코드

1708240

경구 항당뇨병제 시장 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)Oral Antidiabetic Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

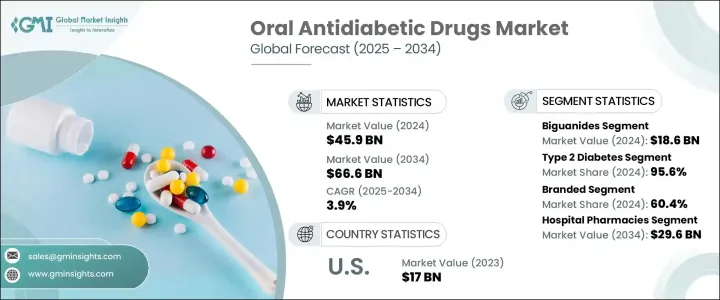

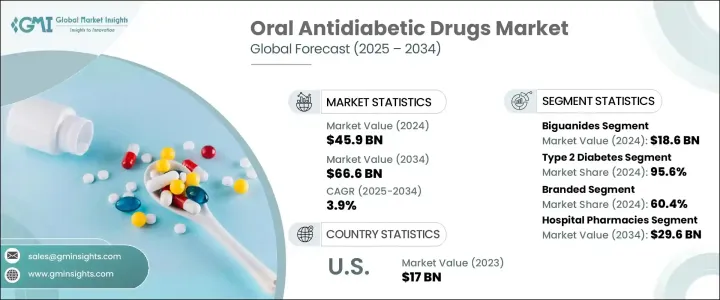

경구용 항당뇨병제 세계 시장은 2024년 459억 달러 규모에 달했으며, 2025년부터 2034년까지 연평균 3.9%의 성장률을 보일 것으로 전망됩니다. 이 시장의 성장은 당뇨병, 특히 제2형 당뇨병(T2DM)의 전 세계 유병률 증가가 큰 원동력이 되고 있습니다. 특히 개발도상국에서 T2DM 진단을 받는 사람이 증가하고 있는데, 이는 앉아서 생활하는 생활습관과 식습관 장애가 원인입니다. 인슐린 저항성의 주요 원인인 비만은 혈당 조절을 위한 경구용 약물에 대한 수요를 더욱 증가시키고 있습니다. 나트륨-포도당 수송 단백질-2(SGLT-2) 억제제, 디펩티딜 펩티데이즈-4(DPP-4) 억제제 등의 약물이 인기를 끌고 있습니다. 이들 약물은 혈당을 효과적으로 조절하는 것 외에도 체중 조절이라는 또 다른 이점이 있어 환자들에게 종합적인 솔루션을 제공합니다.

이 시장은 약물 종류별로 비구아나이드, SGLT-2 억제제, DPP-4 억제제, 설포닐우레아, 티아졸리딘계 약물, 메글리티니드, α-글루코시다아제 억제제, 기타 카테고리로 분류되며, 2024년 비구아나이드 약물 부문은 186억 달러의 매출을 기록할 것으로 예상됩니다. 가장 널리 처방되는 비구아나이드 계열 약물인 메트포르민은 T2DM의 1차 선택 약물로서 우위를 유지하고 있습니다. 메트포르민은 간에서 포도당 생성을 감소시키고 인슐린 감수성을 높여 혈당 수치를 낮추는 효과가 있어 시장에서의 입지를 확고히 하고 있습니다. 또한, 비구아나이드 계열 약물은 여전히 의료진의 1차 선택 약물로 시장 안정에 큰 기여를 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 459억 달러 |

| 예상 금액 | 666억 달러 |

| CAGR | 3.9% |

질병 유형별로 살펴보면, 2024년에는 제2형 당뇨병 부문이 95.6%의 압도적인 점유율을 차지했습니다. 이는 전 세계적으로 T2DM의 유병률이 증가하고 있는 것과 직접적인 관련이 있습니다. 특히 인구가 많은 국가에서는 도시화, 건강에 해로운 식습관, 운동 부족이 T2DM의 조기 발병의 주요 요인으로 작용하고 있습니다. 이에 따라 간편하고 장기적인 경구용 치료제에 대한 수요가 증가하고 있으며, 당뇨병 관리에서 경구용 항당뇨병제의 역할이 커지고 있습니다.

북미의 경구용 항당뇨병제 시장은 2024년 41.1%의 점유율을 차지했습니다. 이 지역의 높은 당뇨병 유병률은 약물의 발전과 환자들의 인식 개선과 함께 시장 성장을 견인할 것으로 예상됩니다. 고령화, 좌식 생활습관, 식습관 장애 등의 요인이 이 지역의 당뇨병 유병률 증가에 기여하고 있습니다. 또한, 원격의료 및 디지털 헬스 툴과 같은 헬스케어 기술 혁신은 환자의 질병 관리를 용이하게 하고 경구용 항당뇨병제 채택을 더욱 촉진하고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 산업 생태계 분석

- 업계에 대한 영향요인

- 성장 촉진요인

- 2형 당뇨병 유병률 상승

- 경구제에 대한 선호 상승

- 온라인 약국과 E-Commerce 확대

- 병용요법 동향 상승

- 업계의 잠재적 리스크·과제

- 신약 클래스의 고비용

- 부작용과 안전성에 대한 우려

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 파이프라인 분석

- 당뇨병 상황

- 세계의 당뇨병 환자 수(지역별), 2024년

- 당뇨병 환자 수가 많은 국가, 2024년

- 세계의 당뇨병 사망자 수, 지역별, 2024년

- 세계의 당뇨병 환자 수가 가장 많을 것으로 예측되는 국가, 2045년

- 향후 시장 동향

- Porters 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업 시장 매트릭스 분석

- 주요 시장 기업 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추정과 예측 : 약물 종류별, 2021-2034년

- 주요 동향

- 비구아나이드 약

- 디펩티딜 펩티다아제 4(DPP-4) 억제제

- Sitagliptin

- Linagliptin

- Vildagliptin

- Saxagliptin

- Alogliptin

- 기타 DPP-4 억제제

- 나트륨-글루코스 수송 단백질-2(SGLT-2) 억제제

- Dapagliflozin

- Empagliflozin

- Canagliflozin

- 설포닐우레아

- Glimepiride

- Glipizide

- Glyburide

- 티아졸리딘디온

- 메글리티니드

- Repaglinide

- Nateglinide

- α-글루코시다아제 억제제

- 기타 약물 종류별

제6장 시장 추정과 예측 : 질환 유형별, 2021-2034년

- 주요 동향

- 2형 당뇨병

- 1형 당뇨병

제7장 시장 추정과 예측 : 치료제 유형별, 2021-2034년

- 주요 동향

- 브랜드 의약품

- 제네릭 의약품

제8장 시장 추정과 예측 : 유통 채널별, 2021-2034년

- 주요 동향

- 병원 약국

- 소매 약국

- 온라인 약국

제9장 시장 추정과 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 남아프리카공화국

- 사우디아라비아

- 아랍에미리트

제10장 기업 개요

- Astellas Pharma

- AstraZeneca

- Bayer

- Boehringer Ingelheim

- Bristol Myers Squibb

- Eli Lilly and Company

- Glenmark Pharmaceuticals

- Johnson & Johnson(Janssen Pharmaceuticals)

- Merck

- Novartis

- Novo Nordisk

- Pfizer

- Sanofi

- Takeda Pharmaceuticals

The Global Oral Antidiabetic Drugs Market generated USD 45.9 billion in 2024 and is projected to expand at a CAGR of 3.9% from 2025 to 2034. The growth of this market is largely driven by the rising global prevalence of diabetes, particularly Type 2 diabetes (T2DM). The increasing number of people diagnosed with T2DM, especially in developing nations, can be traced back to the widespread adoption of sedentary lifestyles and poor dietary habits. Obesity, a major contributor to insulin resistance, has further intensified the demand for oral medications designed to regulate blood sugar levels. Medications such as sodium-glucose transport protein-2 (SGLT-2) inhibitors and dipeptidyl peptidase-4 (DPP-4) inhibitors are becoming more popular. These drugs offer the added benefit of weight management in addition to effectively controlling blood glucose levels, giving patients a comprehensive solution to their condition.

This market is segmented by drug class into biguanides, SGLT-2 inhibitors, DPP-4 inhibitors, sulfonylureas, thiazolidinediones, meglitinides, alpha-glucosidase inhibitors, and other categories. In 2024, the biguanides segment generated USD 18.6 billion, with Metformin, the most widely prescribed biguanide, maintaining its dominance as the first-line treatment for T2DM. Its ability to reduce blood glucose levels by lowering hepatic glucose production and increasing insulin sensitivity has solidified its position in the market. Furthermore, biguanides continue to be a primary choice for healthcare providers, contributing significantly to market stability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.9 Billion |

| Forecast Value | $66.6 Billion |

| CAGR | 3.9% |

When considering disease type, the Type 2 diabetes segment accounted for a dominant 95.6% share in 2024. This is directly linked to the increasing prevalence of T2DM worldwide. Urbanization, unhealthy eating habits, and a lack of physical activity are key contributors to the early onset of T2DM, particularly in large-population countries. Consequently, there is a rising demand for convenient, long-term oral treatment options, reinforcing the growing role of oral antidiabetic drugs in managing diabetes.

In North America, the oral antidiabetic drugs market held a 41.1% share in 2024. The region's high prevalence of diabetes, combined with ongoing advancements in drug formulations and increased patient awareness, is expected to continue driving market growth. Factors such as aging populations, sedentary lifestyles, and poor dietary habits are contributing to the rising incidence of diabetes in the region. Additionally, innovations in healthcare, such as telemedicine and digital health tools, have made it easier for patients to manage their condition, further boosting the adoption of oral antidiabetic drugs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of type 2 diabetes

- 3.2.1.2 Increased preference for oral medications

- 3.2.1.3 Expansion of online pharmacies and e-commerce

- 3.2.1.4 Growing trend for combination therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of newer drug classes

- 3.2.2.2 Side effects and safety concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Diabetes landscape

- 3.6.1 Number of diabetics worldwide, by region, 2024

- 3.6.2 Countries with the highest number of diabetics, 2024

- 3.6.3 Number of diabetes deaths worldwide, by region, 2024

- 3.6.4 Countries with the highest projected number of diabetics worldwide in 2045

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biguanides

- 5.3 Dipeptidyl peptidase - 4 (DPP-4) inhibitors

- 5.3.1 Sitagliptin

- 5.3.2 Linagliptin

- 5.3.3 Vildagliptin

- 5.3.4 Saxagliptin

- 5.3.5 Alogliptin

- 5.3.6 Other DPP-4 inhibitors

- 5.4 Sodium-glucose transport protein-2 (SGLT-2) inhibitors

- 5.4.1 Dapagliflozin

- 5.4.2 Empagliflozin

- 5.4.3 Canagliflozin

- 5.5 Sulfonylureas

- 5.5.1 Glimepiride

- 5.5.2 Glipizide

- 5.5.3 Glyburide

- 5.6 Thiazolidinediones

- 5.7 Meglitinides

- 5.7.1 Repaglinide

- 5.7.2 Nateglinide

- 5.8 Alpha-glucosidase inhibitors

- 5.9 Other drug classes

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 2 diabetes

- 6.3 Type 1 diabetes

Chapter 7 Market Estimates and Forecast, By Medication Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generic

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Astellas Pharma

- 10.2 AstraZeneca

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Bristol Myers Squibb

- 10.6 Eli Lilly and Company

- 10.7 Glenmark Pharmaceuticals

- 10.8 Johnson & Johnson (Janssen Pharmaceuticals)

- 10.9 Merck

- 10.10 Novartis

- 10.11 Novo Nordisk

- 10.12 Pfizer

- 10.13 Sanofi

- 10.14 Takeda Pharmaceuticals