|

시장보고서

상품코드

1716464

가스 절연 개폐 장치 시장 기회, 성장 촉진 요인, 산업 동향 분석, 예측(2025-2034년)Gas Insulated Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

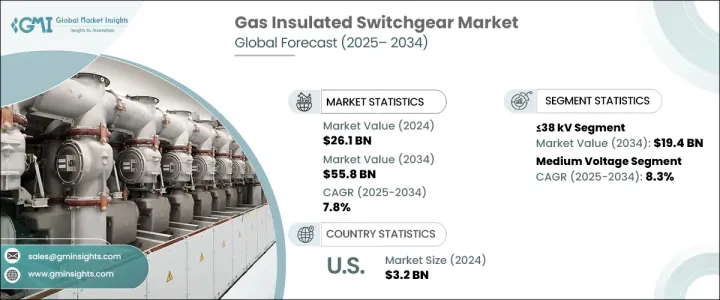

가스 절연 개폐 장치 세계 시장은 2024년에 261억 달러에 이르렀고, 2025년부터 2034년에 걸쳐 CAGR 7.8%로 성장할 것으로 예측됩니다.

세계 전력 수요 증가, 급속한 도시화, 송배전망의 지속적인 확대가 시장 성장의 원동력이 되고 있습니다. GIS는 기존의 공기절연 개폐장치(AIS)보다 우위를 차지하고 있습니다. GIS는 높은 내구성과 중단 없는 성능을 제공하기 때문에 밀집한 도시환경, 대규모 산업시설, 극단적인 기상조건의 지역 전력시스템을 관리하는데 필수적입니다.

이 시장에서는 전력망을 현대화하고 에너지 효율을 확보하기 위해 정부와 민간 기업 모두의 투자가 증가하고 있습니다. GIS는 이 전환을 촉진하는데 있어 매우 중요한 역할을 하고 있으며, 지속가능성의 목표에 따른 컴팩트하고 고성능의 솔루션을 제공합니다. GIS의 효율성은 향상되었으며 차세대 전력 인프라로 선호되는 옵션입니다. 스마트 그리드 솔루션과 지능형 전력 분배 시스템에 대한 수요는 특히 전송 손실을 줄이고 그리드 안정성을 개선하는 데 중점을 둔 지역에서 GIS 배포를 더욱 가속화하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 261억 달러 |

| 예측 금액 | 558억 달러 |

| CAGR | 7.8% |

고전압 부문은 여전히 시장을 독점하고 있으며, 정격 150kV 이상의 GIS 시스템이 큰 점유율을 차지하고 있습니다. 컴팩트한 설계로 고위험 환경에서도 확실하게 기능하기 때문에 공간이 제한되고 운용 효율이 최우선으로 되는 용도에 최적입니다.

중전압 GIS 분야는 2034년까지 연평균 복합 성장률(CAGR)이 8.3%로 예상되어 큰 성장이 예상되고 있습니다. 부문의 근대화 노력은 재생 가능 에너지 통합에 대한 관심이 높아짐에 따라 중전압 GIS의 채용에 박차를 가하고 있습니다. 지속가능성과 자동화를 우선하는 산업은 업무 효율을 높이고 정전을 최소화하기 위해 GIS 기술로 전환하고 있습니다.

북미 가스 절연 개폐 장치 시장은 2024년에 32억 달러를 창출해 미국이 송전의 업그레이드 투자를 주도하고 있습니다. 국가가 증가하는 전력 수요를 충족하기 위해 노후화된 전력망 인프라를 현대화함에 따라, GIS는 차세대 전력 분배 시스템을 지원하는 데 중요한 역할을 하고 있습니다. 스마트 그리드와 고급 전력 관리 솔루션이 중시되고 있으며, GIS의 도입은 더욱 진행되고 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 규제 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 업계의 잠재적 위험 및 과제

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 전략 대시보드

- 혁신과 지속가능성의 전망

제5장 시장 규모와 예측 : 용량별, 2021년-2034년

- 주요 동향

- 38 kV 이하

- 38 kV-72 kV 미만

- 72 kV-150 kV 미만

- 150 kV 초과

제6장 시장 규모와 예측 : 전압 레벨별, 2021년-2034년

- 주요 동향

- 중전압

- 1차 배전

- 2차 배전

- 고전압

제7장 시장 규모와 예측 : 용도별, 2021년-2034년

- 주요 동향

- 송배전

- 제조 및 가공

- 인프라 및 수송

- 발전

- 기타

제8장 시장 규모와 예측 : 지역별, 2021년-2034년

- 주요 동향

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 프랑스

- 독일

- 이탈리아

- 러시아

- 스페인

- 아시아태평양

- 중국

- 호주

- 인도

- 일본

- 한국

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 남아프리카

- 이집트

- 라틴아메리카

- 브라질

- 아르헨티나

제9장 기업 프로파일

- ABB

- Bharat Heavy Electricals

- CHINT Group

- CG Power and Industrial Solutions

- Eaton

- Fuji Electric

- General Electric

- HD Hyundai Electric

- Hitachi

- Hyosung Heavy Industries

- Lucy Group

- Mitsubishi Electric

- Ormazabal

- Schneider Electric

- Siemens

- Skema

- Toshiba

The Global Gas Insulated Switchgear Market reached USD 26.1 billion in 2024 and is projected to grow at a CAGR of 7.8% between 2025 and 2034. The rising global demand for electricity, rapid urbanization, and the continuous expansion of power transmission and distribution networks are fueling market growth. As countries move toward upgrading their power infrastructure, GIS technology is increasingly being adopted across industrial, commercial, and utility sectors. Its superior performance in terms of space efficiency, reliability, and low maintenance costs gives it an edge over traditional air-insulated switchgear (AIS). GIS is becoming essential for managing power systems in dense urban environments, large-scale industrial setups, and regions with extreme weather conditions, as it offers high durability and uninterrupted performance.

The market is witnessing increased investments from both government and private players to modernize power grids and ensure energy efficiency. As the energy transition gains momentum, integrating renewable sources into existing grids is becoming a priority. GIS plays a pivotal role in facilitating this shift, providing compact and high-performance solutions that align with sustainability goals. Additionally, advancements in insulation technologies and digital monitoring capabilities are enhancing GIS efficiency, making it a preferred choice for next-generation power infrastructure. The demand for smart grid solutions and intelligent power distribution systems is further accelerating GIS deployment, particularly in regions focusing on reducing transmission losses and improving grid stability. With rising concerns over environmental sustainability, many market players are also exploring eco-friendly gas alternatives to minimize the carbon footprint of GIS systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.1 Billion |

| Forecast Value | $55.8 Billion |

| CAGR | 7.8% |

The high-voltage segment remains the dominant force in the market, with GIS systems rated above 150 kV holding a substantial share. These high-capacity switchgear solutions are widely deployed in power plants, heavy manufacturing industries, and large-scale utility projects to ensure stable and efficient electricity distribution. Their compact designs and ability to function reliably in high-risk environments make them ideal for applications where space is limited and operational efficiency is paramount. Industries such as oil and gas, mining, and transportation are increasingly integrating GIS technology to meet stringent safety and performance requirements while optimizing power management systems.

The medium-voltage GIS segment is projected to experience significant growth, with an expected CAGR of 8.3% through 2034. The rapid expansion of urban infrastructure, alongside the rise of smart cities, is driving the demand for efficient and reliable power distribution solutions. Modernization initiatives in commercial and residential sectors, coupled with the growing focus on renewable energy integration, are fueling the adoption of medium-voltage GIS. Industries prioritizing sustainability and automation are shifting toward GIS technology to enhance operational efficiency and minimize power outages.

North America Gas Insulated Switchgear Market generated USD 3.2 billion in 2024, with the United States leading investments in power transmission upgrades. As the country modernizes its aging grid infrastructure to meet increasing electricity demand, GIS is playing a crucial role in supporting next-generation power distribution systems. The growing emphasis on smart grids and advanced power management solutions is further strengthening GIS adoption. With investments in renewable energy and digitalized grid networks on the rise, GIS is set to become a cornerstone of North America's power sector transformation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 ≤ 38 kV

- 5.3 > 38 kV to ≤ 72 kV

- 5.4 > 72 kV to ≤ 150 kV

- 5.5 > 150 kV

Chapter 6 Market Size and Forecast, By Voltage Level 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Medium voltage

- 6.2.1 Primary distribution

- 6.2.2 Secondary distribution

- 6.3 High voltage

Chapter 7 Market Size and Forecast, By Application 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 Transmission & distribution

- 7.3 Manufacturing & processing

- 7.4 Infrastructure & transportation

- 7.5 Power generation

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Bharat Heavy Electricals

- 9.3 CHINT Group

- 9.4 CG Power and Industrial Solutions

- 9.5 Eaton

- 9.6 Fuji Electric

- 9.7 General Electric

- 9.8 HD Hyundai Electric

- 9.9 Hitachi

- 9.10 Hyosung Heavy Industries

- 9.11 Lucy Group

- 9.12 Mitsubishi Electric

- 9.13 Ormazabal

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Skema

- 9.17 Toshiba