|

시장보고서

상품코드

1716644

베이커리 포장기 시장 기회, 성장 촉진요인, 산업 동향 분석 및 예측(2025-2034년)Bakery Packaging Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

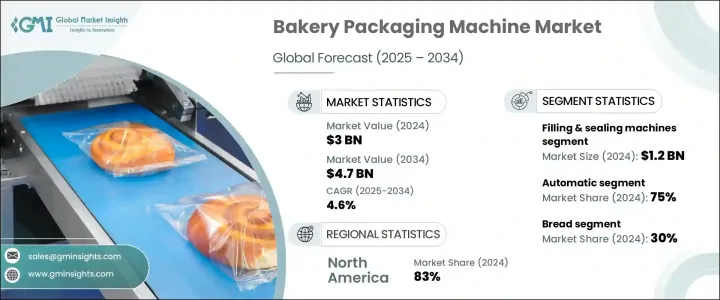

세계의 베이커리 포장기 시장은 2024년에 30억 달러로 평가되었고 2025년부터 2034년에 걸쳐 CAGR 4.6%를 나타낼 것으로 예측됩니다.

이 성장에는 포장된 베이커리 제품에 대한 수요 증가와 세계 소매점과 베이커리 체인의 존재감 증가가 기여하고 있습니다. - 페이스트리 등 RTE 베이커리 제품에 대한 지향이 높아지고 있습니다. 또한 전자상거래와 소비자 직송 서비스 증가에 따라 베이커리 브랜드는 소비자의 요구 변화에 대응하기 위해 고품질의 포장 기계에 투자 경쟁이 치열해지는 시장에서 차별화를 도모하는 베이커리 브랜드가 늘어남에 따라 브랜드 아이덴티티를 높여 운송 중 제품의 무결성을 확보하는 포장 솔루션이 중시되고 있습니다.

베이커리 포장기 시장은 충전·씰 기계, 라벨링 기계, 스트랩 기계, 테이프 기계 등 다양한 유형으로 분류됩니다. 제조업체는 독특한 형상, 크기, 맞춤형 브랜딩에 대응할 수 있는 유연한 포장 솔루션에 주력하고 있어 혼잡한 선반으로 제품이 눈에 띄게 하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 30억 달러 |

| 예측 금액 | 47억 달러 |

| CAGR | 4.6% |

자동화의 관점에서 시장은 자동기와 반자동기로 나뉘어져 있습니다. 2024년 시장 점유율은 자동기가 75%를 차지했습니다. 대량 생산 베이커리에 특히 중요합니다. 이 시스템은 생산 공정을 간소화하고 제조업체가 오류 및 가동 중단 시간을 최소화하면서 운영을 확장 할 수있게합니다.

북미의 베이커리 포장기 시장은 세계 시장의 83%를 차지하고 2024년에는 8억 8,000만 달러를 창출했습니다. 증가와 미국과 캐나다 전역에서 베이커리 점포 수가 증가하고 있기 때문에. 스마트 포장 혁신과 자동화는 이러한 수요에 부응하기 위해 매우 중요한 역할을 하고 있으며, 베이커리는 제품의 신선도와 매력을 유지하면서 포장 프로세스를 강화할 수 있습니다.

목차

제1장 조사 방법과 조사 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 밸류체인에 영향을 주는 요인

- 이익률 분석

- 파괴적 혁신

- 향후 전망

- 제조업자

- 유통업체

- 공급자의 상황

- 기술적 전망

- 주요 뉴스 및 이니셔티브

- 규제 상황

- 영향요인

- 성장 촉진요인

- 포장 베이커리 제품에 대한 수요 증가

- 베이커리 체인과 소매점 확대

- 업계의 잠재적 위험 및 과제

- 높은 초기 투자 비용

- 엄격한 식품 안전 규정 준수

- 성장 촉진요인

- 성장 가능성 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 서론

- 기업 점유율 분석

- 경쟁 포지셔닝 매트릭스

- 전략 전망 매트릭스

제5장 시장 추계·예측 : 유형별(2021-2034년)

- 주요 동향

- 충전 및 포장기

- 라벨링 머신

- 스트래핑 기계

- 테이프 기계

- 기타(cartooning 등)

제6장 시장 추계·예측 : 자동화 그레이드별(2021-2034년)

- 주요 동향

- 자동

- 반자동

제7장 시장 추계·예측 : 출력 용량별(2021-2034년)

- 주요 동향

- 50개/분 미만

- 50-100개/분

- 100-200개/분

- 200개/분 이상

제8장 시장 추계·예측 : 용도별(2021-2034년)

- 주요 동향

- 빵

- 케이크

- 쿠키

- 페이스트리

- 베이글

- 기타(크로와상 등)

제9장 시장 추계·예측 : 유통 채널별(2021-2034년)

- 주요 동향

- 직접 판매

- 간접 판매

제10장 시장 추계·예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 라틴아메리카

- 브라질

- 멕시코

- 중동 및 아프리카

- UAE

- 사우디아라비아

- 남아프리카

제11장 기업 프로파일

- Arpac

- Bosch Packaging Technology

- Buhler

- Filpack

- Hopak Machinery

- Ishida

- Joiepack Industrial

- Multivac

- PAC Machinery

- Rademaker

- Rianta

- SOMIC Packaging

- Syntegon Technology

- Middleby

- Viking Masek

The Global Bakery Packaging Machine Market was valued at USD 3 billion in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2034. This growth is fueled by the increasing demand for packaged bakery products and the rising presence of retail outlets and bakery chains worldwide. As consumer lifestyles become more hectic, there is a growing inclination toward ready-to-eat bakery items such as bread, cakes, cookies, and pastries. This shift has created a strong demand for innovative, efficient, and visually appealing packaging solutions that not only protect the quality of these products but also extend their shelf life. Moreover, with the rise in e-commerce and direct-to-consumer delivery services, bakery brands are investing in high-quality packaging machinery to meet the changing needs of consumers. As more bakery brands look to differentiate themselves in an increasingly competitive market, there is a growing emphasis on packaging solutions that enhance brand identity and ensure product integrity during transit.

The market for bakery packaging machines is categorized into various types, including filling and sealing machines, labeling machines, strapping machines, tape machines, and others. Among these, the filling and sealing machines segment generated USD 1.2 billion in 2024 and is expected to maintain a strong growth trajectory. This growth is attributed to the increasing need for machines that can handle diverse bakery products in different forms and sizes, catering to bulk production requirements. Manufacturers are focusing on flexible packaging solutions that can accommodate unique shapes, sizes, and custom branding, ensuring that their products stand out on crowded shelves. Additionally, filling and sealing machines that can handle multiple packaging formats have become essential for bakeries aiming to meet changing consumer preferences efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.6% |

In terms of automation, the market is divided into automatic and semi-automatic machines. Automatic machines dominated the market in 2024, holding a 75% share. The rising demand for automation is driven by the need to improve operational efficiency, reduce labor costs, and ensure consistency in packaging. Automatic packaging machines are particularly crucial for high-volume bakeries, where speed and uniformity are essential for maintaining product quality. These systems streamline production processes, enabling manufacturers to scale their operations while minimizing errors and operational downtime. As the bakery industry continues to grow, automatic machines are becoming indispensable in maintaining high standards of efficiency and quality.

The North America bakery packaging machine market accounted for 83% of the global market and generated USD 880 million in 2024. The region's dominance is driven by a growing appetite for bakery products, especially bread, and an increasing number of bakery outlets across the United States and Canada. As consumers continue to seek convenience in their food choices, the demand for advanced packaging technologies has surged. Smart packaging innovations and automation play a pivotal role in meeting these demands, allowing bakeries to enhance their packaging processes while maintaining product freshness and appeal. With the continuous expansion of the bakery sector, the adoption of cutting-edge packaging technologies is expected to drive sustained growth in the North American market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for packaged bakery products

- 3.6.1.2 Expansion of bakery chains and retail outlets

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment costs

- 3.6.2.2 Strict food safety compliance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling & sealing machines

- 5.3 Labelling machines

- 5.4 Strapping machines

- 5.5 Tape machines

- 5.6 Others (cartooning etc.)

Chapter 6 Market Estimates & Forecast, By Automation Grade, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

Chapter 7 Market Estimates & Forecast, By Output Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 50/min

- 7.3 50 to 100/min

- 7.4 100 to 200/min

- 7.5 Above 200/min

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Bread

- 8.3 Cakes

- 8.4 Cookies

- 8.5 Pastry

- 8.6 Bagels

- 8.7 Others (croissants etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Arpac

- 11.2 Bosch Packaging Technology

- 11.3 Buhler

- 11.4 Filpack

- 11.5 Hopak Machinery

- 11.6 Ishida

- 11.7 Joiepack Industrial

- 11.8 Multivac

- 11.9 PAC Machinery

- 11.10 Rademaker

- 11.11 Rianta

- 11.12 SOMIC Packaging

- 11.13 Syntegon Technology

- 11.14 Middleby

- 11.15 Viking Masek