|

시장보고서

상품코드

1885822

HIL(Hardware in the Loop) 시험 시장 : 시장 기회, 성장 요인, 업계 동향 분석 및 예측(2025-2034년)Hardware-in-the-Loop (HIL) Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

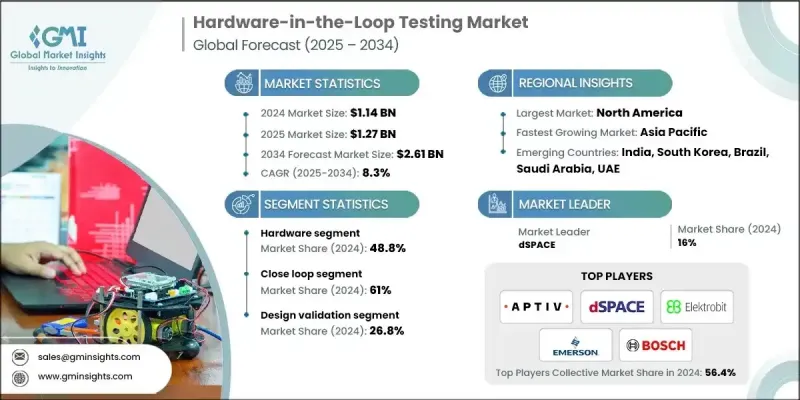

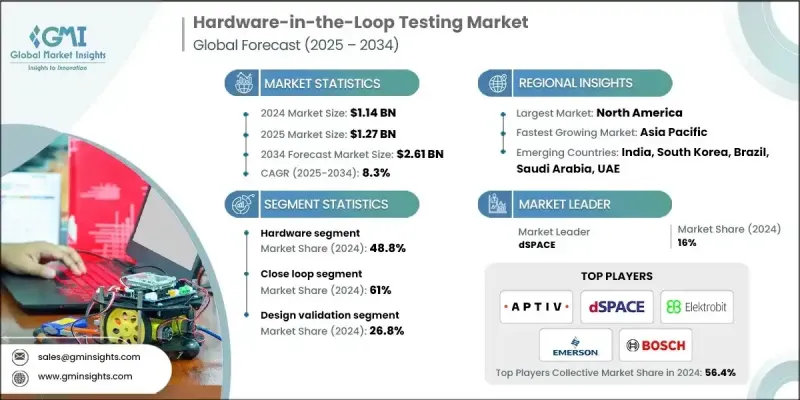

세계의 HIL(Hardware in the Loop) 시험 시장은 2024년에 11억 4,000만 달러로 평가되었고, 2034년까지 연평균 복합 성장률(CAGR) 8.3%로 성장할 전망이며, 26억 1,000만 달러에 이를 것으로 예측됩니다.

고급 제어 아키텍처로의 급속한 전환과 보다 신속한 제품 검증을 추진함으로써 고도로 복잡한 시스템 동작을 재현할 수 있는 실시간 시뮬레이션 환경에 대한 필요성이 증가하고 있습니다. HIL 플랫폼은 지속적인 소프트웨어 검증, 광범위한 멀티도메인 테스트 및 운영 장애의 조기 감지를 지원하며 현대 엔지니어링 워크플로우에서 필수적인 요소가 되었습니다. 개발 사이클이 가속화됨에 따라 솔루션 제공업체는 기술 역량 강화, 실시간 컴퓨팅 리소스 확장, 고밀도 I/O 보드 추가, 소프트웨어 툴체인과의 연계 강화를 추진하고 있습니다. 이러한 강화 방법은 전동 이동성, 항공 연구, 차세대 에너지 시스템 수요 증가에 대응합니다. 기업은 고전압 아키텍처, 추진 유닛 및 계통 연계 장비를 실제 장치를 위험에 빠뜨리지 않고 열적, 노후화 및 변동 부하 조건 하에서 평가하기 위해 HIL 시험에 대한 의존도를 높이고 있습니다. 이 진화로 HIL 기술은 여러 산업 분야에 걸친 첨단 검증 기법의 핵심 추진력으로 자리매김하고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 시 가치 | 11억 4,000만 달러 |

| 예측 금액 | 26억 1,000만 달러 |

| CAGR | 8.3% |

하드웨어 부문은 2024년에 48.8%의 점유율을 차지했으며, 2034년까지 연평균 복합 성장률(CAGR)7.1%로 성장할 것으로 예측됩니다. 그 중요성은 실시간 컴퓨팅 유닛, 높은 채널 수 인터페이스 모듈, 프로그래머블 프로세서, 전용 부하 유닛, 전력 특화형 리그 등 고성능 물리 컴포넌트의 필요성으로 인해 발생합니다. 이 시스템은 중요한 프로덕션 환경에서 사용되는 제어 장치 및 임베디드 로직을 검증하는 데 필요한 마이크로초 수준의 정밀한 성능을 제공합니다. 운송, 방위, 에너지 등의 산업은 전기 추진 시스템, 안전 중심 제어 장치, 진보된 보호 기술의 실제 세계에서의 작동을 검증하기 위해 이러한 하드웨어 플랫폼에 의존합니다.

클로즈드 루프 방식은 2024년에 61%의 점유율을 차지하였고, 2025-2034년 8%의 성장이 전망되고 있습니다. 이 기법이 주류를 유지하는 이유는 물리적 컴포넌트 및 가상 모델 간의 원활한 상호작용을 가능하게 하고 동작 거동을 반영하는 동적 테스트 사이클을 구축할 수 있다는 점입니다. 엔지니어는 폐쇄 루프 구성을 활용하여 물리적 프로토타입을 작동 위험에 노출시키지 않고도 매우 현실적인 조건 하에서 제어 장치, 전동 시스템, 지능형 기능의 성능을 안전하게 검증합니다.

북미의 HIL(Hardware in the Loop) 시험 시장은 2024년 3억 5,530만 달러 규모에 이르렀습니다. 이 지역의 성장은 자동화 기술의 지속적인 발전, 전기 이동성 개발 및 고도로 모듈화된 차량 아키텍처의 보급 확대에 의해 지원됩니다. 미국 기업은 안전성, 컴플라이언스, 디지털 시스템 무결성의 진화하는 기준을 충족하기 위해 검증 프로그램을 확대하고 있습니다. 배터리 개발, 전동화 플랫폼, 차세대 구동 시스템의 현저한 발전은 물리적 프로토타이핑과 관련된 비용 절감과 엔지니어링 기간 단축을 위한 HIL 환경의 도입 가속화에 기여하고 있습니다.

자주 묻는 질문

목차

제1장 조사 방법

- 시장 범위 및 정의

- 조사 설계

- 조사 접근

- 데이터 수집 방법

- 데이터 마이닝 소스

- 세계

- 지역별 및 국가별

- 기본 추정치 및 계산

- 기준 연도 계산

- 시장 추정에서의 주요 동향

- 1차 조사 및 검증

- 1차 정보

- 예측 모델

- 조사의 전제조건 및 제한 사항

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 공급자의 상황

- 실리콘 및 코어 기술 공급자

- 플랫폼 및 시스템 공급업체

- 소프트웨어 및 모델 제공업체

- 시스템 통합자 및 전문 서비스

- 이익률 분석

- 실리콘 및 코어 기술 공급자

- 플랫폼 및 시스템 공급업체

- 소프트웨어 및 모델 제공업체

- 시스템 통합자 및 서비스

- 비용 구조

- 각 단계에서의 부가가치

- 밸류체인에 영향을 주는 요인

- 에코시스템으로의 변혁

- 공급자의 상황

- 업계에 미치는 영향요인

- 성장 촉진요인

- 전기자동차의 보급 및 배터리 시스템 검증 요건의 분석

- ADAS/자동 운전차의 복잡성 및 소프트웨어 정의 차량 아키텍처

- 규제 요건 및 기능 안전 표준(ISO 26262, IEC 61508, DO-178C)

- 파워 일렉트로닉스 및 재생에너지의 그리드 통합

- 비용 절감의 필요성 및 가상 검증에 의한 입증된 ROI

- 업계의 잠재적 위험 및 과제

- 중소기업에서 고액의 자본 투자 및 장기간의 회수 기간

- 숙련 노동력의 부족 및 지식 이전 과제

- 모델 충실도 및 검증상 과제

- 시장 기회

- 클라우드 기반 HIL 및 하드웨어 인 루프 아즈 서비스(HILaaS)

- AI/머신러닝에 의한 테스트 자동화 및 시나리오 생성

- 디지털 트윈 통합 및 라이프사이클 검증

- 아시아태평양 시장에서의 확대 및 현지화

- 성장 촉진요인

- 성장 가능성 분석

- 규제 상황

- 북미의 규제 상황

- 미국 : 연방 및 주수준 요건

- 캐나다 : 미국 기준과의 조화

- 유럽의 규제 상황

- 유럽 연합 : 종합적인 형식 승인 및 사이버 보안 요건

- 영국 : 브렉짓 후 규제의 차이

- 아시아태평양의 규제 상황

- 중국 : 국내 기준 및 데이터 현지화

- 일본 : 품질 기준 및 자동차 기술의 우수성

- 인도 : 규제가 급속히 진화하는 신흥 시장

- 한국 : 선진 기술 및 수출 중시

- 라틴아메리카의 규제 상황

- 브라질 : 지역 리더이며, 현지화 요건을 가지고 있습니다

- 멕시코 : USMCA 통합 및 자동차 제조 거점

- 중동 및 아프리카의 규제 상황

- 아랍에미리트(UAE)(UAE) 및 사우디아라비아 : 의욕적인 기술 도입

- 남아프리카 : 지역 제조 거점

- 지역 횡단적인 규제 동향 및 전략적 시사

- 북미의 규제 상황

- Porter's Five Forces 분석

- PESTEL 분석

- 기술 및 혁신 동향

- 현재의 기술 동향

- FPGA 가속 실시간 시뮬레이션 플랫폼

- 모델 기반 설계(MBD) 및 시뮬레이션 툴체인

- 모듈형 PXI/EtherCAT 기반 HIL 아키텍처

- 인증된 안전 및 컴플라이언스 툴체인

- 신흥 기술

- 클라우드 네이티브 HIL 플랫폼 및 HIL-as-a-Service(HILaaS)

- AI/머신러닝 구동의 테스트 자동화 및 시나리오 생성

- 라이프 사이클 검증을 위한 디지털 트윈 통합

- 사이버 보안 검증 및 보안 OTA 갱신 테스트

- 현재의 기술 동향

- 특허 분석

- 비용 내역 분석

- 무역 흐름 분석

- 수입 시장 시장 역학

- 세계적인 수입 패턴

- 무역 장벽 및 현지화

- 수출 시장 구조

- 수출 장벽 및 인센티브

- 무역 흐름의 동향 및 전략적 시사

- 수입 시장 시장 역학

- 지속가능성 및 환경면

- 지속 가능한 실천의 도입

- 폐기물 감축의 혁신

- 에너지 효율 최적화

- 환경 이니셔티브의 영향

- 이용 사례

- 아이언버드 시험

- 미사일 개발

- 자율형 드론의 시험 운용

- ADAS 및 자율주행

- 전동화 및 전기 구동 시스템

- 전력 계통

- 차량 다이나믹스

- 가상 차량

- 테스트 벤치

- 실제 주행 배출량(RDE)

- 베스트 케이스 시나리오

- 라이프사이클 전체에 걸친 디지털 트윈과 HIL의 통합

- 세계 협업을 위한 클라우드 네이티브 HILaaS

- AI/머신러닝 구동형 자율 검증

- 신재생에너지 통합을 위한 PHIL

- 모듈식으로 업그레이드 가능한 순환형 HIL 아키텍처

- HIL 시장의 주요 경쟁이 채택한 FPGA 시스템

- 성능 및 적용 적합성

- 확장성, 모듈성, 수명 주기 비용

- 규제 및 인증에 있어서의 우위성

- 에코시스템 및 통합

- 지역별 및 규제별 차이화

제4장 경쟁 구도

- 서문

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략적 전망 매트릭스

- 주요 발전

- 합병 및 인수

- 제휴 및 협업

- 신제품 발매

- 사업 확대 계획 및 자금 조달

제5장 시장 추계 및 예측 : 컴포넌트별(2021-2034년)

- 주요 동향

- 하드웨어

- 입출력 인터페이스

- PCIe 기반 I/O 인터페이스

- 표준 PCIe 카드

- 고속 데이터 수집 모듈

- 커스텀 FPGA 통합 PCIe 솔루션

- FPGA 기반 I/O 솔루션

- 인텔(알테라) Arria 기반 인터페이스 모듈

- 자일링스 Zynq 기반 인터페이스 모듈

- FPGA I/O 확장 보드

- 실시간 논리 제어 및 신호 조정 인터페이스

- 이더넷 기반 및 EtherCAT 인터페이스

- 산업용 이더넷(기가비트 이더넷, 10기가비트 이더넷, TSN 대응)

- EtherCAT 마스터 및 슬레이브 모듈

- EtherCAT 탑재 분산 I/O 노드

- 시간동기 통신 모듈

- PCIe 기반 I/O 인터페이스

- 프로세서

- 실시간 시뮬레이터

- 데이터 수집 시스템

- 기타

- 입출력 인터페이스

- 소프트웨어

- 서비스

- 전문 서비스

- 매니지드 서비스

제6장 시장 추계 및 예측 : 제공별(2021-2034년)

- 주요 동향

- 오픈 루프

- 폐쇄 루프

제7장 시장 추계 및 예측 : 시험 단계별(2021-2034년)

- 주요 동향

- 설계 검증

- 통합 테스트

- 수입 시험

- 제조 시험

- 성능 테스트

- 기타

제8장 시장 추계 및 예측 : 최종 용도별(2021-2034년)

- 주요 동향

- 항공우주 산업

- 방위 분야

- 철도

- 파워 일렉트로닉스

- 자동차

- 의료기기

- 재생에너지 시스템

- 통신 및 네트워크

- 기타

제9장 시장 추계 및 예측 : 지역별(2021-2034년)

- 주요 동향

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ANZ

- 동남아시아

- 라틴아메리카

- 브라질

- 멕시코

- 아르헨티나

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

제10장 기업 프로파일

- 세계 기업

- MathWorks

- National Instruments

- dSPACE

- Vector Informatik

- Spirent Communications

- Wind River

- Robert Bosch

- Emerson

- 지역 기업

- ADVANTECH

- APTIV

- Wabtec

- ETAS

- Hinduja Tech

- Elektrobit

- 틈새 및 신흥 기업

- ADD2

- Concurrent Real-Time

- IPG Automotive

- Lynx Software Technologies

- Opal-RT Technologies

- Plexim

- RealTime Wave

- Speedgoat

- Typhoon HIL

The Global Hardware-in-the-Loop (HIL) Testing Market was valued at USD 1.14 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 2.61 billion by 2034.

The rapid shift toward advanced control architectures and the push for faster product validation have amplified the need for real-time simulation environments that can mirror highly complex system behaviors. HIL platforms support continuous software verification, broad multi-domain testing, and earlier detection of operational faults, making them an essential part of modern engineering workflows. With development cycles accelerating, solution providers are broadening their technical capabilities, scaling real-time computing resources, adding higher-density I/O boards, and deepening cooperation with software toolchains. These enhancements cater to rising demand in electric mobility, aviation research, and next-generation energy systems. Companies are increasingly relying on HIL testing to evaluate high-voltage architectures, propulsion units, and grid-connected equipment under thermal, aging, and fluctuating load conditions without placing actual devices at risk. This evolution positions HIL technology as a core enabler for advanced verification practices across multiple industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.14 Billion |

| Forecast Value | $2.61 Billion |

| CAGR | 8.3% |

The hardware segment held 48.8% share in 2024 and is projected to grow at a 7.1% CAGR through 2034. Its prominence stems from the need for high-performance physical components, including real-time computing units, channel-rich interface modules, programmable processors, specialized load units, and power-focused rigs. These systems deliver precise, microsecond-level performance needed to validate controllers and embedded logic used in critical operational environments. Industries such as transportation, defense, and energy rely on these hardware platforms to examine real-world behavior of electric propulsion systems, safety-driven controllers, and advanced protection technologies.

The closed-loop category held a 61% share in 2024 and is projected to grow at 8% from 2025 to 2034. This approach remains dominant because it enables seamless interaction between physical components and virtual models, creating a dynamic test cycle that mirrors operational behavior. Engineers use closed-loop setups to safely examine the performance of control units, electrified systems, and intelligent functions under highly realistic conditions without exposing physical prototypes to operational hazards.

North America Hardware-in-the-Loop (HIL) Testing Market generated USD 355.3 million in 2024. The country's growth is supported by continued progress in automated technologies, electric mobility development, and the wider adoption of highly modular vehicle architectures. Companies in the US are expanding validation programs to meet evolving standards in safety, compliance, and digital system integrity. Significant advancements in battery development, electrified platforms, and next-generation drivetrain systems are helping accelerate the adoption of HIL environments to reduce costs tied to physical prototyping and to shorten engineering timelines.

Prominent participants in the Hardware-in-the-Loop (HIL) Testing Market include Aptiv, dSPACE, Elektrobit, Emerson, IPG Automotive, Lynx Software Technologies, MathWorks, Robert Bosch, Typhoon HIL, and Vector Informatik. Key strategies used by companies in the hardware-in-the-loop testing market focus on expanding technological depth and strengthening collaborative development. Providers are investing in enhanced real-time computing clusters, higher-capacity interface boards, and advanced processing architectures to support increasingly complex simulations. Many organizations are forming alliances with software platforms to ensure seamless integration across modeling, testing, and automation workflows. Firms are also scaling production capabilities, broadening service portfolios, and introducing modular HIL systems that accommodate evolving design demands.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Offering

- 2.2.4 Testing phase

- 2.2.5 End use

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Silicon & Core Technology Providers

- 3.1.1.2 Platform & System Suppliers

- 3.1.1.3 Software & Model Providers

- 3.1.1.4 System Integrators & Professional Services

- 3.1.2 Profit margin analysis

- 3.1.2.1 Silicon & Core Technology Providers

- 3.1.2.2 Platform & System Suppliers

- 3.1.2.3 Software & Model Providers

- 3.1.2.4 System Integrators & Services

- 3.1.3 Cost Structure

- 3.1.4 Value Addition at Each Stage

- 3.1.5 Factors Affecting the Value Chain

- 3.1.6 Ecosystem Disruptions

- 3.1.1 Supplier landscape

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 electric vehicle proliferation and battery system validation requirements analysis

- 3.2.1.2 ADAS/autonomous vehicle complexity and software-defined vehicle architecture

- 3.2.1.3 regulatory mandates and functional safety standards (ISO 26262, IEC 61508, DO-178C)

- 3.2.1.4 power electronics and renewable energy grid integration

- 3.2.1.5 cost reduction imperative and demonstrated ROI from virtual validation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment and extended payback periods for SMEs

- 3.2.2.2 Skilled workforce shortage and knowledge transfer challenges

- 3.2.2.3 Model fidelity and validation challenges

- 3.2.3 Market Opportunities

- 3.2.3.1 Cloud-based HIL and hardware-in-the-loop-as-a-service (HILaaS)

- 3.2.3.2 AI/ML-driven test automation and scenario generation

- 3.2.3.3 Digital twin integration and lifecycle validation

- 3.2.3.4 Asia-pacific market expansion and localization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America Regulatory Landscape

- 3.4.1.1 United States: Federal and State-Level Requirements

- 3.4.1.2 Canada: Harmonization with U.S. Standards

- 3.4.2 Europe Regulatory Landscape

- 3.4.2.1 European Union: comprehensive type approval and cybersecurity mandates

- 3.4.2.2 United Kingdom: post-brexit regulatory divergence

- 3.4.3 Asia Pacific Regulatory Landscape

- 3.4.3.1 China: domestic standards and data localization

- 3.4.3.2 Japan: quality standards and automotive excellence

- 3.4.3.3 India: emerging market with rapid regulatory evolution

- 3.4.3.4 South korea: advanced technology and export focus

- 3.4.4 Latin America Regulatory Landscape

- 3.4.4.1 Brazil: regional leader with localization requirements

- 3.4.4.2 Mexico: USMCA integration and automotive manufacturing hub

- 3.4.5 Middle East & Africa Regulatory Landscape

- 3.4.5.1 UAE & Saudi Arabia: ambitious technology adoption

- 3.4.5.2 South Africa: regional manufacturing hub

- 3.4.6 Cross-regional regulatory trends and strategic implications

- 3.4.1 North America Regulatory Landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 FPGA-accelerated real-time simulation platforms

- 3.7.1.2 Model-based design (MBD) & simulation toolchains

- 3.7.1.3 Modular PXI/EtherCAT-based HIL architectures

- 3.7.1.4 Certified safety & compliance toolchains

- 3.7.2 Emerging technologies

- 3.7.2.1 Cloud-native HIL platforms & hil-as-a-service (HILaaS)

- 3.7.2.2 AI/ML-driven test automation & scenario generation

- 3.7.2.3 Digital twin integration for lifecycle validation

- 3.7.2.4 Cybersecurity validation & secure OTA update testing

- 3.7.1 Current technological trends

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Trade flow analysis

- 3.10.1 Import market dynamics

- 3.10.1.1 Global import patterns

- 3.10.1.2 Trade barriers and localization

- 3.10.2 Export market structure

- 3.10.3 Export barriers and incentives

- 3.10.4 Trade flow trends & strategic implications

- 3.10.1 Import market dynamics

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practice adoption

- 3.11.2 Waste reduction innovation

- 3.11.3 Energy efficiency optimization

- 3.11.4 Environmental initiative impact

- 3.12 Use cases

- 3.12.1 Iron bird testing

- 3.12.2 Missile development

- 3.12.3 Autonomous drone testing

- 3.12.4 ADAS and autonomous driving

- 3.12.5 Electromobility and electric drives

- 3.12.6 Power grids

- 3.12.7 Vehicle dynamics

- 3.12.8 Virtual vehicle

- 3.12.9 Test benches

- 3.12.10 Real driving emissions (RDE)

- 3.13 Best case scenarios

- 3.13.1 Full lifecycle digital twin-HIL integration

- 3.13.2 Cloud-native HILaaS for global collaboration

- 3.13.3 AI/ML-driven autonomous validation

- 3.13.4 PHIL for renewable grid integration

- 3.13.5 Modular, upgradable, circular HIL architectures

- 3.14 FPGA systems used by major competitors in HIL market

- 3.14.1 Performance & application fit

- 3.14.2 Scalability, modularity & lifecycle cost

- 3.14.3 Regulatory & certification advantage

- 3.14.4 Ecosystem & integration

- 3.14.5 Regional & regulatory differentiation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 I/O interfaces

- 5.2.1.1 PCIe-based I/O interfaces

- 5.2.1.1.1 Standard PCIe cards

- 5.2.1.1.2 High-speed DAQ modules

- 5.2.1.1.3 Custom FPGA-integrated PCIe solutions

- 5.2.1.2 FPGA-based I/O solutions

- 5.2.1.2.1 Intel (Altera) Arria-based interface modules

- 5.2.1.2.2 Xilinx Zynq-based interface modules

- 5.2.1.2.3 FPGA I/O expansion boards

- 5.2.1.2.4 Real-time logic control & signal conditioning interfaces

- 5.2.1.3 Ethernet-based and EtherCAT interfaces

- 5.2.1.3.1 Industrial ethernet (GigE, 10GigE, TSN-enabled)

- 5.2.1.3.2 EtherCAT master/slave modules

- 5.2.1.3.3 Distributed I/O nodes with EtherCAT

- 5.2.1.3.4 Time-synchronized communication modules

- 5.2.1.1 PCIe-based I/O interfaces

- 5.2.2 Processors

- 5.2.3 Real-time simulators

- 5.2.4 Data acquisition systems

- 5.2.5 Others

- 5.2.1 I/O interfaces

- 5.3 Software

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.1.1 Open loop

- 6.1.2 Close loop

Chapter 7 Market Estimates & Forecast, By Testing phase, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Design validation

- 7.3 Integration testing

- 7.4 Acceptance testing

- 7.5 Manufacturing testing

- 7.6 Performance testing

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Aerospace

- 8.3 Defence

- 8.4 Railway

- 8.5 Power electronics

- 8.6 Automotive

- 8.7 Medical devices

- 8.8 Renewable energy systems

- 8.9 Telecom and networking

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 MathWorks

- 10.1.2 National Instruments

- 10.1.3 dSPACE

- 10.1.4 Vector Informatik

- 10.1.5 Spirent Communications

- 10.1.6 Wind River

- 10.1.7 Robert Bosch

- 10.1.8 Emerson

- 10.2 Regional players

- 10.2.1 ADVANTECH

- 10.2.2 APTIV

- 10.2.3 Wabtec

- 10.2.4 ETAS

- 10.2.5 Hinduja Tech

- 10.2.6 Elektrobit

- 10.3 Niche/emerging players

- 10.3.1 ADD2

- 10.3.2 Concurrent Real-Time

- 10.3.3 IPG Automotive

- 10.3.4 Lynx Software Technologies

- 10.3.5 Opal-RT Technologies

- 10.3.6 Plexim

- 10.3.7 RealTime Wave

- 10.3.8 Speedgoat

- 10.3.9 Typhoon HIL